Mexico Construction Materials Market Size, Share, Trends and Forecast by Material Type, End User, and Region, 2025-2033

Mexico Construction Materials Market Overview:

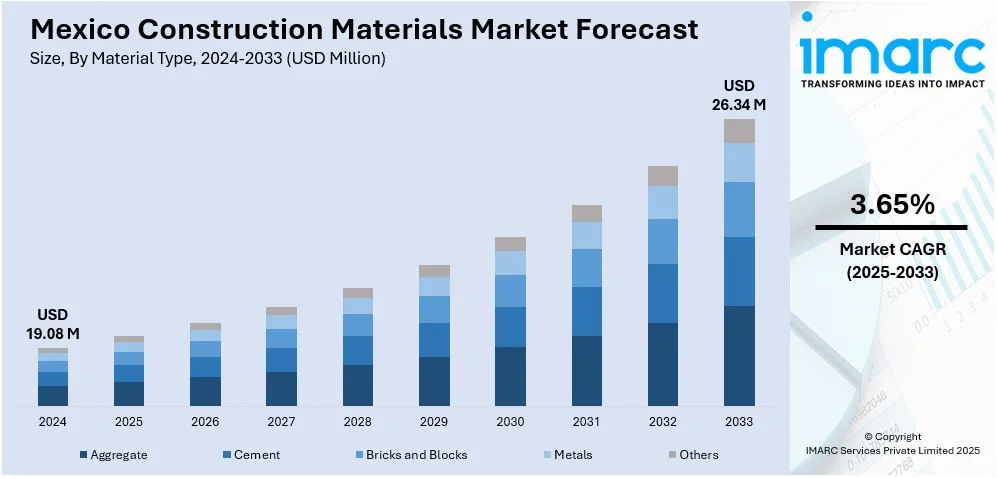

The Mexico construction materials market size reached USD 19.08 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 26.34 Million by 2033, exhibiting a growth rate (CAGR) of 3.65% during 2025-2033. The market is driven due to accelerating demand for eco-friendly and high-performance materials that enhance building durability and environmental efficiency. The growth of infrastructure development, such as roads, bridges, and waste management initiatives, also boosts material usage in residential and commercial markets. Developments in recycled aggregates, high-tech cement composites, and modular parts are determining the future of the industry. These developments together boost Mexico construction materials market share, which constitutes a sizable portion in Latin America's regional construction industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 19.08 Million |

| Market Forecast in 2033 | USD 26.34 Million |

| Market Growth Rate 2025-2033 | 3.65% |

Mexico Construction Materials Market Analysis:

- Major Market Drivers: Increasing infrastructure growth fuels high demand for key construction materials. Government spending on transportation systems, urban development initiatives, and renewable energy infrastructure triggers steady material usage trends. Rising urbanization and industrial growth needs underpin long-term market resilience and material demand in residential and commercial segments.

- Key Market Trends: Stepping up use of green building materials demonstrates environmental awareness and regulatory adherence. High-tech material production with advanced technology integration improves performance specifications and standards of durability. Digitalization via Building Information Modelling (BIM) and intelligent technologies maximizes resource usage and building efficiency throughout Mexico's building industry.

- Competitive Landscape: Market consolidation of major material suppliers reinforces distribution networks and product innovation strengths. Strategic alliances among manufacturers and contractors increase supply chain efficiency. Technology advancement programs and sustainable product development provide competitive differentiation opportunities while ensuring cost savings in material purchasing procedures.

- Challenges and Opportunities: Raw material price volatility and economic uncertainty pose constant market challenges that demand adaptive solutions. Uncertainties in trade policy influence import-oriented materials and pricing models. Nevertheless, increasing nearshoring activity and infrastructure upgrading initiatives introduce immense growth opportunities for material vendors increasing market coverage.

Mexico Construction Materials Market Trends:

Growing Need for Green Construction Materials

Mexico's growth in construction materials is being driven increasingly by the escalating demand for environmentally friendly and sustainable building materials. As per the reports, in February 2025, India and Mexico boosted the trade of construction materials by noting India's US$4 billion investment in Mexico and a 93% increase in ceramic exportation, facilitating sustainable economic and infrastructure growth. Moreover, as climate change and environmental concern gain traction, developers and contractors are moving toward materials like recycled aggregates, low-carbon alternatives to cement, and energy-efficient insulation technologies. Sustainable materials help lower the carbon intensity of construction projects and encourage resource efficiency. Furthermore, stricter environmental policies throughout Mexico are fueling the use of greener materials in residential, commercial, and infrastructure developments. Sustainable building materials also come with long-term advantages such as better durability and lower maintenance costs, thus making them economically viable. The market is reacting with sustainable innovations, tightening Mexico's stance on green construction. This increasing focus on sustainable materials aids overall Mexico construction materials market analysis and fits with worldwide initiatives aimed at responsible building.

To get more information on this market, Request Sample

Use of Advanced High-Performance Materials

The growth in Mexico construction materials market is underpinned by growing usage of advanced, high-performance materials that improve the quality and longevities of buildings. For example, in February 2025, Holcim Mexico lowered 1.7 million tons of CO2 in 2024 using environmentally friendly building materials such as ECOPact and ECOPlanet, promoting ecofriendly construction and targeting the promotion of low-carbon sales by 2027. Furthermore, fiber-reinforced concrete, corrosion-resistant metals, and new cement composites are becoming increasingly popular, particularly in infrastructure and commercial construction. These products bring enhanced structural strength, better protection against degradation from the environment, and extended service life, in line with the needs of urbanization and industrial growth. Modular and prefabricated building materials are increasingly popular as well, allowing for quicker construction schedules and minimizing on-site waste. Utilization of such advanced technology materials satisfies contemporary safety and construction codes while ensuring cost-effectiveness throughout the building life cycle. This trend symbolizes the increasing sophistication of Mexico's construction industry and is a part of ensuring competitive and strong infrastructure, thus driving long-term growth in the Mexico construction materials market size.

Infrastructure Expansion Driving Material Consumption

Infrastructure development is a key driver of Mexico's Mexico construction materials expansion, as high expenditures on roadways, bridges, and waste treatment plants drive demand for critical materials such as cement, aggregates, metal, and brick. Public programs aimed at upgrading transportation routes and city infrastructure underlie the expansion, responding to population needs and driving economic growth. These massive projects need high-quality materials that guarantee durability and safety, which in turn stimulates innovation and supply chain enhancement in the construction materials industry. Moreover, growth in residential and commercial construction is complemented by infrastructure development, increasing the Mexico construction materials market demand for different materials. The stable material consumption driven by infrastructure projects guarantees a stable market condition and fuels long-term growth. This focus on developing infrastructure continues at the heart of Mexico's construction sector, buttressing the role of the sector in national economic development and continued urbanization.

Mexico Construction Materials Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on material type and end user.

Material Type Insights:

- Aggregate

- Cement

- Bricks and Blocks

- Metals

- Others

The report has provided a detailed breakup and analysis of the market based on the material type. This includes aggregate, cement, bricks and blocks, metals, and others.

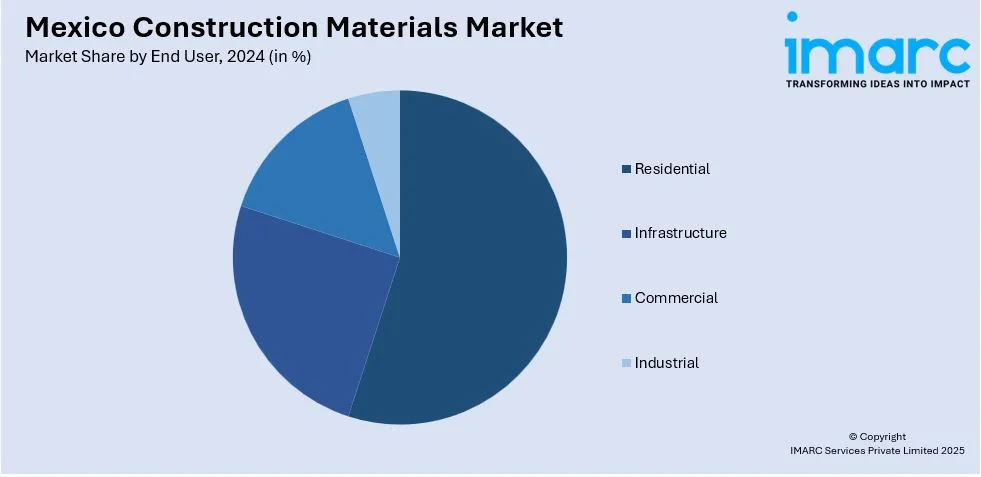

End User Insights:

- Residential

- Infrastructure

- Roads

- Bridges

- Waste Management

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential, infrastructure (roads, bridges, waste management), commercial, and industrial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Construction Materials Market News:

- In March 2025, Mexico's National Autonomous University unveiled Sargapanel, a revolutionary wallboard constructed of sargassum seaweed. The green substitute for conventional gypsum boards seeks to minimize environmental footprint while solving the issue of organic garbage on Mexican Caribbean beaches, encouraging environmentally friendly construction technologies.

- In September 2024, Cemex introduced a new anti-humidity, water-repellent cement in Mexico in an effort to fight against moisture problems in the construction industry. Being one of the low-CO₂ Vertua line, it offers improved strength and a more even finish. The new product was showcased at the Construrama Convention on September 12 and is currently available countrywide.

Mexico Construction Materials Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Aggregate, Cement, Bricks and Blocks, Metals, Others |

| End Users Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico construction materials market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico construction materials market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico construction materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Mexico construction materials market was valued at USD 19.08 Million in 2024.

The Mexico construction materials market is projected to exhibit a CAGR of 3.65% during 2025-2033, reaching a value of USD 26.34 Million by 2033.

The market is driven by accelerating demand for eco-friendly and high-performance materials that enhance building durability and environmental efficiency. Infrastructure development including roads, bridges, and waste management initiatives also boosts material usage. Developments in recycled aggregates, high-tech cement composites, and modular parts determine the industry's future growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)