Mexico Construction Safety Equipment Market Size, Share, Trends and Forecast by Equipment Type, Construction Type, Application, and Region, 2025-2033

Mexico Construction Safety Equipment Market Overview:

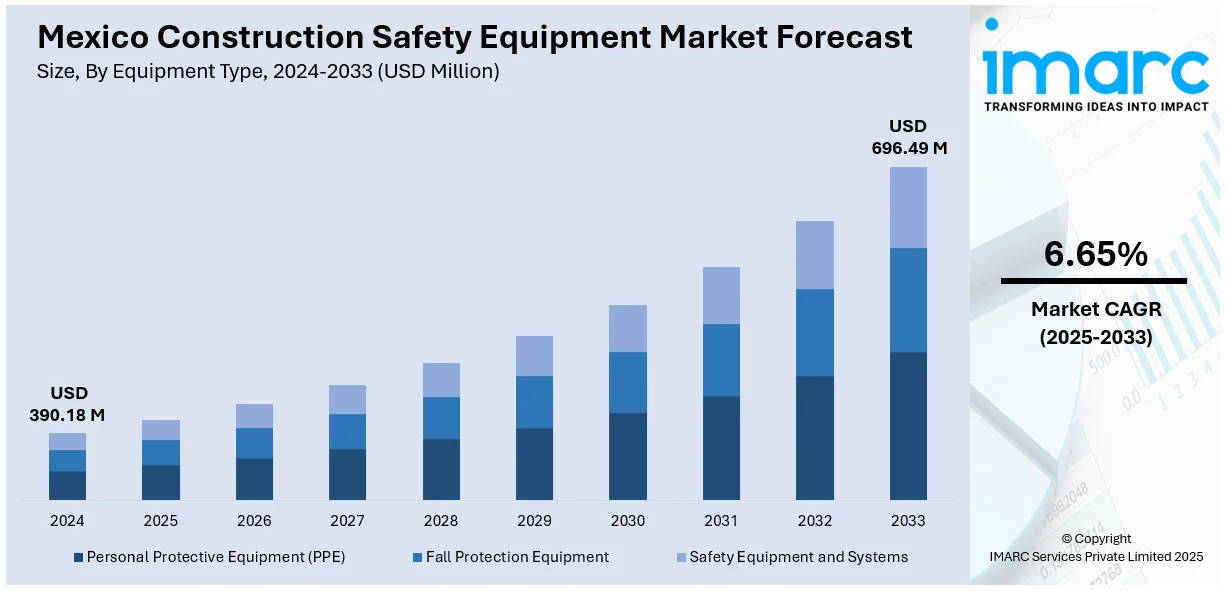

The Mexico construction safety equipment market size reached USD 390.18 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 696.49 Million by 2033, exhibiting a growth rate (CAGR) of 6.65% during 2025-2033. The market is progressing with the integration of smart technologies, ergonomic personal protective gear, and superior fall protection solutions. These are signs of a focus on enhancing worker protection, comfort, and regulatory compliance in different construction activities. The use of real-time monitoring, adjustable gear, and complete risk management solutions is propelling innovation and efficiency. All these solutions are together most important factors behind the growth of the Mexico construction safety equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 390.18 Million |

| Market Forecast in 2033 | USD 696.49 Million |

| Market Growth Rate 2025-2033 | 6.65% |

Mexico Construction Safety Equipment Market Analysis:

- Major Market Drivers: Growing infrastructure development projects, increasing government regulations for workplace safety, rising awareness about worker protection, and technological advancements in safety equipment are driving the Mexico construction safety equipment market demand. These factors collectively enhance adoption rates across construction sectors.

- Key Market Trends: Smart technology integration, ergonomic PPE design improvements, enhanced fall protection systems, and IoT-enabled monitoring solutions represent major trends. The market analysis reveals increasing focus on data-driven safety management and worker comfort optimization.

- Competitive Landscape: The market features established international players alongside domestic manufacturers, competing through innovation, product quality, and distribution networks. Companies focus on developing comprehensive safety solutions and strengthening market presence through strategic partnerships.

- Challenges and Opportunities: Cost constraints and training requirements present challenges, while nearshoring trends, infrastructure investments, and regulatory compliance create significant growth opportunities. Market expansion potential exists in underserved regional segments.

Mexico Construction Safety Equipment Market Trends:

Increase in Smart Safety Technologies in the Construction Sector

The Mexico construction sector is more and more adopting smart safety technologies to enhance onsite risk management and laborer protection. Some of these technologies are wearable devices with sensors that track body functions, identify dangerous environmental conditions, and monitor the locations of laborers in real time. The interconnectivity of these wearables to central digital platforms allows supervisors to react in real time to potential safety hazards, hence minimizing accidents and improving regulatory compliance. The application of data analytics also facilitates predictive safety practices, transforming the industry from reactive to proactive safety management. These innovations are being used across residential, commercial, and infrastructure projects, demonstrating a greater emphasis on utilizing technology for improved safety results. For instance, in September 2024, PPG introduced Steelguard 951 in Mexico, a fire-resistant coating with four-hour protection, raising the standard for construction safety in high-risk facilities such as EV factories and data centers. Moreover, this is an important driver of Mexico construction safety equipment market share growth, as businesses are choosing more advanced solutions to protect employees and streamline site operations.

To get more information on this market, Request Sample

Focus on Ergonomic and Modular Personal Protective Equipment

Within Mexico's building industry, the focus has shifted towards ergonomic and modular personal protective equipment (PPE) that is intended to maximize worker comfort and protection. Contemporary PPE features adjustable elements, light weight, and enhanced ventilation to help eliminate fatigue and support various body shapes. Such enhancements enhance prolonged use under extended working hours with challenging conditions common on most construction projects. Modular systems for PPE enable individuals to adjust protective equipment to suit the individual requirements of a job for greater efficiency and conformity. Such attention towards ergonomics also justifies the engagement of older labor without sacrificing safety measures. Accordingly, the integration of such devices in the form of equipment has grown commoner within different levels of the construction sector. According to the reports, in October 2023, storagetech delivered top-grade valves and safety gear to Mexico's largest project of PEMEX, Dos Bocas Refinery, improving safety and facilitating the resolution of the nation's energy crisis. Moreover, the heightened focus on people-centered PPE is providing substantial impetus for growth, a key highlight emerging from the Mexico Construction Safety Equipment Market analysis, which underscores how worker wellness and productivity are now shaping safety innovation in the sector.

Enhanced Attention to Fall Guard Systems

Fall protection continues to be a high priority in Mexico's growing construction industry, particularly as urban high-rise construction and massive infrastructure projects gain momentum. The use of sophisticated fall arrest systems like self-retracting lifelines, shock-absorbing lanyards, and full-body harnesses has grown extensively. Such systems are engineered to reduce the risk of injury by arresting falls rapidly and safely. Moreover, most construction sites now include routine inspection protocols and digital tools for ensuring equipment integrity and regulatory compliance. Detailed fall risk analysis to specific project conditions is becoming the norm as well, allowing for the development of customized safeguards. Fall prevention training programs for workers further enhance safety culture. Altogether, these are at the core of the consistent Mexico construction safety equipment expansion, improving total worker protection and lowering the rates of accidents throughout the construction sector.

Mexico Construction Safety Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on equipment type, construction type, and application.

Equipment Type Insights:

- Personal Protective Equipment (PPE)

- Head Protection

- Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Foot Protection

- Hearing Protection

- Fall Protection Equipment

- Harnesses

- Lanyards

- Lifelines

- Anchors

- Safety Equipment and Systems

- Fire Safety Equipment

- Safe Access Equipment

- Gas Detection Systems

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes personal protective equipment PPE (head protection, eye and face protection, respiratory protection, hand and arm protection, protective clothing, foot protection, and hearing protection), fall protection equipment (harnesses, lanyards, lifelines, and anchors), and safety equipment and systems (fire safety equipment, safe access equipment, and gas detection systems).

Construction Type Insights:

- Residential Construction

- Commercial Construction

- Industrial Construction

A detailed breakup and analysis of the market based on the construction type have also been provided in the report. This includes residential construction, commercial construction, and industrial construction.

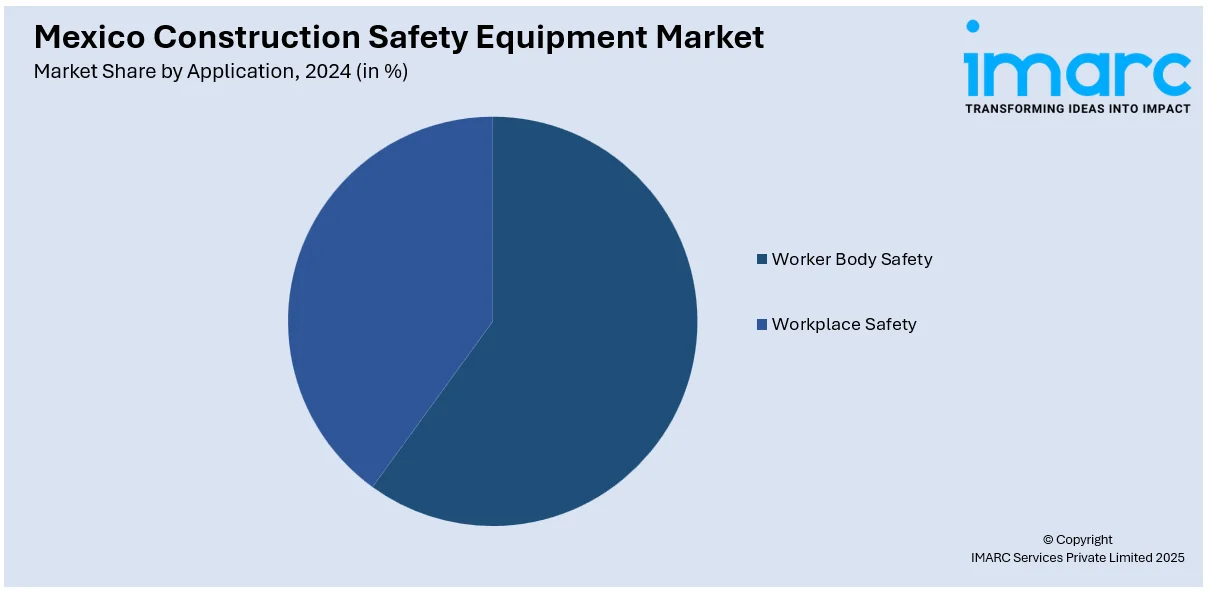

Application Insights:

- Worker Body Safety

- Workplace Safety

The report has provided a detailed breakup and analysis of the market based on the application. This includes worker body safety and workplace safety.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Construction Safety Equipment Market News:

- In November 2024, Honeywell signed an agreement for sale of its Personal Protective Equipment (PPE) unit to Protective Industrial Products in a deal worth \\$1.325 billion. The sale affects Mexico's construction safety equipment market by passing on enhanced PPE manufacturing and distribution capacity, facilitating higher worker protection and safety standards throughout the region.

Mexico Construction Safety Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered |

|

| Construction Types Covered | Residential Construction, Commercial Construction, Industrial Construction |

| Application’s Covered | Worker Body Safety, Workplace Safety |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico construction safety equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico construction safety equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico construction safety equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The construction safety equipment market in Mexico was valued at USD 390.18 Million in 2024.

The Mexico construction safety equipment market is projected to exhibit a CAGR of 6.65% during 2025-2033, reaching a value of USD 696.49 Million by 2033.

Growing infrastructure development, increasing government safety regulations, rising worker protection awareness, technological advancement integration, smart monitoring systems adoption, and ergonomic equipment demand are primary market drivers enhancing construction safety standards and equipment adoption rates.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)