Mexico Construction Scaffolding Market Size, Share, Trends and Forecast by Type, Material, Application, End User, and Region, 2026-2034

Mexico Construction Scaffolding Market Summary

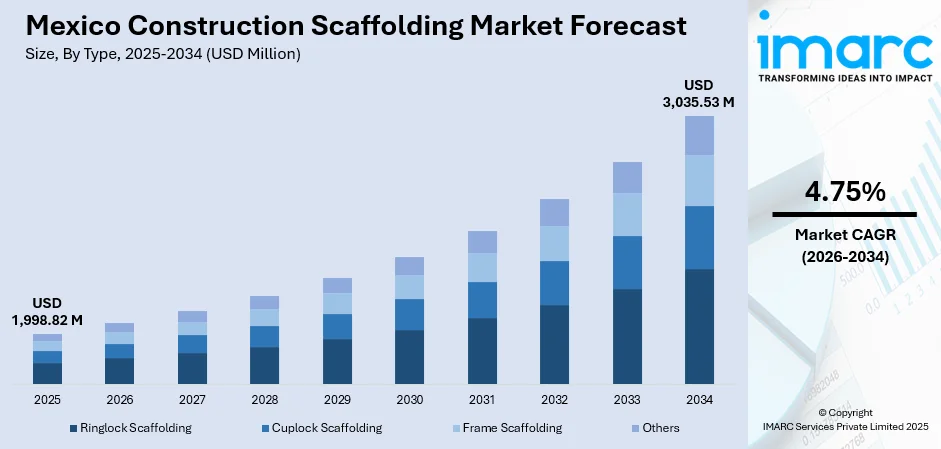

The Mexico construction scaffolding market size was valued at USD 1,998.82 Million in 2025 and is projected to reach USD 3,035.53 Million by 2034, growing at a compound annual growth rate of 4.75% from 2026-2034.

The Mexico construction scaffolding market is expanding steadily, driven by robust infrastructure development, rapid urbanization, and surging demand from the commercial and industrial construction sectors. The country's strategic position as a nearshoring hub is attracting significant foreign direct investment, particularly in Northern Mexico, fueling industrial facility construction and subsequently scaffolding demand. Government initiatives including the National Housing Program and major infrastructure projects are further propelling market growth across residential and public works segments.

Key Takeaways and Insights

-

By Type: Frame scaffolding dominates the market with a share of 40% in 2025, driven by its cost-effectiveness, ease of assembly, and widespread application across residential and commercial construction projects. The segment's popularity stems from its modular design that allows rapid deployment and disassembly, making it particularly suitable for Mexico's diverse construction landscape where project timelines vary significantly.

-

By Material: Steel leads the market with a share of 72% in 2025, owing to its superior load-bearing capacity, durability, and compliance with stringent Mexican occupational safety standards. Steel scaffolding remains the preferred choice for heavy-duty industrial and commercial applications where structural integrity and worker safety are paramount considerations.

-

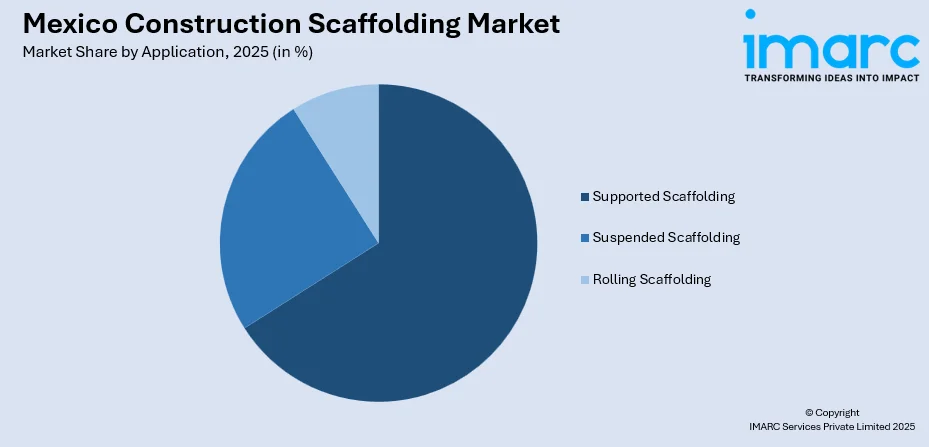

By Application: Supported scaffolding represents the largest segment with a market share of 66% in 2025, attributed to its versatility and reliability for ground-based construction activities. This application type dominates building construction, renovation projects, and industrial maintenance operations throughout Mexico.

-

By End-User: Commercial building exhibits clear dominance with a 34% share of the market in 2025, fueled by the expansion of shopping centers, office buildings, and mixed-use developments in major urban centers including Mexico City, Monterrey, and Guadalajara.

-

Key Players: The Mexico construction scaffolding market exhibits a moderately fragmented competitive landscape, with established domestic manufacturers competing alongside international scaffolding solution providers. Market participants differentiate through rental services, customized solutions, and safety compliance certifications.

To get more information on this market Request Sample

Mexico's construction scaffolding market is experiencing transformative growth aligned with the country's broader construction sector expansion. The nearshoring phenomenon has emerged as a pivotal market catalyst, driving industrial facility construction particularly in northern states where foreign direct investment continues accelerating manufacturing sector development. The government's commitment to construct 1.1 million new homes in April 2025, combined with ongoing commercial development in technology hubs and retail expansion, creates sustained scaffolding demand across diverse end-user segments throughout the forecast period. Additionally, major infrastructure initiatives including transportation network expansions and preparations for international sporting events are generating significant scaffolding requirements for stadium construction, hospitality developments, and urban facility upgrades across key metropolitan areas.

Mexico Construction Scaffolding Market Trends:

Nearshoring-Driven Industrial Construction Surge

The relocation of manufacturing operations from Asia to Mexico has triggered unprecedented industrial construction activity, generating substantial scaffolding demand. Northern Mexican states, including Nuevo León, Coahuila, and Tamaulipas, are witnessing new industrial facilities under construction, with investment in industrial parks projected to reach USD 6 Billion in 2025. This trend particularly benefits frame and steel scaffolding segments as industrial facility construction requires robust temporary support structures for extended project durations and heavy-duty applications.

Adoption of Modular and Lightweight Scaffolding Systems

Mexican construction companies are increasingly adopting modular and lightweight scaffolding systems that enhance installation efficiency and reduce labor costs. Advanced aluminum and composite material scaffolding products are gaining traction in urban construction projects where portability and quick assembly are essential. The integration of digital technologies including Building Information Modeling enables more precise scaffolding planning, optimizing material usage and improving worksite safety compliance with evolving Mexican occupational health standards.

Enhanced Safety Regulations and Compliance Requirements

Mexico's Ministry of Labor has intensified workplace safety enforcement, with the recently published NOM-017-STPS-2024 introducing stricter personal protective equipment requirements effective September 2025. These regulatory developments are compelling construction companies to invest in certified scaffolding systems and safety-compliant temporary structures. The emphasis on worker safety is driving preference for steel scaffolding with integrated safety features including guardrails, anti-slip surfaces, and standardized connection mechanisms that meet international safety benchmarks.

Market Outlook 2026-2034:

The Mexico construction scaffolding market outlook remains positive despite broader economic uncertainties, supported by sustained government infrastructure investment and private sector construction activity. Mexico's construction market is creating parallel scaffolding demand growth. Major infrastructure initiatives including the Sierra Madre gas pipeline and preparations for the 2026 FIFA World Cup co-hosting responsibilities will generate significant scaffolding requirements for stadium construction, transportation network expansion, and facility upgrades. The market generated a revenue of USD 1,998.82 Million in 2025 and is projected to reach a revenue of USD 3,035.53 Million by 2034, growing at a compound annual growth rate of 4.75% from 2026-2034.

Mexico Construction Scaffolding Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Frame Scaffolding |

40% |

|

Material |

Steel |

72% |

|

Application |

Supported Scaffolding |

66% |

|

End-User |

Commercial Building |

34% |

Type Insights:

- Ringlock Scaffolding

- Cuplock Scaffolding

- Frame Scaffolding

- Others

The frame scaffolding dominates with a market share of 40% of the total Mexico construction scaffolding market in 2025.

Frame scaffolding maintains its dominant position in Mexico's construction scaffolding market due to its exceptional versatility and cost-effectiveness across diverse project types. The segment benefits from straightforward assembly procedures that require minimal specialized training, making it accessible to construction crews of varying skill levels. Mexican contractors particularly favor frame scaffolding for residential building projects, commercial renovations, and facade maintenance work where rapid installation and dismantling optimize project timelines and labor costs.

The frame scaffolding segment continues expanding as Mexico's construction sector embraces standardized scaffolding solutions that comply with both domestic safety regulations and international quality standards. Growing adoption of prefabricated and modular frame systems enhances installation efficiency while reducing on-site assembly time significantly. The segment's growth trajectory aligns with the broader trend toward construction industrialization, where prefabricated components and systematic approaches are replacing traditional labor-intensive methods across Mexican construction projects.

Material Insights:

- Steel

- Aluminum

- Wood

The steel leads with a share of 72% of the total Mexico construction scaffolding market in 2025.

Steel scaffolding dominates the Mexican market owing to its superior structural integrity, exceptional durability, and compliance with stringent occupational safety requirements. The material's high load-bearing capacity makes it indispensable for industrial construction, heavy commercial projects, and infrastructure development where worker safety and structural stability are non-negotiable priorities. Mexico's steel production sector is experiencing significant expansion, with major steelmakers including ArcelorMittal Mexico planning capacity increases to 5.3 Million Tons at their Lázaro Cárdenas facility, ensuring reliable domestic supply for scaffolding manufacturers.

The steel scaffolding segment's prominence is reinforced by Mexico's enhanced workplace safety regulatory framework, including the recently published NOM-017-STPS-2024 personal protective equipment standard. Construction companies increasingly prefer certified steel scaffolding systems that demonstrate compliance with Official Mexican Standards and international safety certifications. The material's longevity and reusability also provide favorable economics for scaffolding rental companies, which represent a significant distribution channel in Mexico's construction equipment market.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Supported Scaffolding

- Suspended Scaffolding

- Rolling Scaffolding

The supported scaffolding exhibits a clear dominance with a 66% share of the total Mexico construction scaffolding market in 2025.

Supported scaffolding maintains overwhelming market dominance as the most widely utilized scaffolding application across Mexico's construction landscape. This application type provides stable, ground-based platforms essential for building construction, industrial facility development, and maintenance operations. The segment's prevalence reflects Mexico's construction composition, where low-to-medium rise residential and commercial buildings constitute the majority of ongoing projects, particularly in the government's ambitious housing development initiatives.

The supported scaffolding segment benefits from its adaptability across diverse construction scenarios, from simple residential exteriors to complex industrial plant configurations. Mexican construction companies value supported scaffolding's stability characteristics and straightforward safety compliance procedures compared to suspended or specialized scaffolding alternatives. The application's growth trajectory remains closely correlated with Mexico's overall construction output expansion driven by infrastructure investment and urbanization trends.

End-User Insights:

- Residential Building

- Commercial Building

- Industrial

- Oil and Gas Industry

- Others

The commercial building dominates with a market share of 34% of the total Mexico construction scaffolding market in 2025.

Commercial building construction drives the largest share of scaffolding demand in Mexico, propelled by the expansion of retail centers, office developments, and mixed-use projects across major metropolitan areas. Mexico City, Monterrey, and Guadalajara are experiencing surging commercial construction activity as developers capitalize on growing consumer demand and corporate expansion. The hospitality sector is emerging as a significant growth driver, with Mexico consolidating its position as a premier global tourism destination requiring substantial hotel and resort development.

The commercial building segment's scaffolding requirements are characterized by demanding specifications including extended deployment periods, higher safety standards, and aesthetic considerations for urban construction sites. As Mexico prepares to co-host major international sporting events, commercial construction is accelerating with stadium developments, hospitality expansions, and urban infrastructure improvements generating substantial scaffolding demand. Developers are increasingly investing in premium properties that require extended scaffolding deployment for detailed finishing work and sophisticated facade treatments throughout project lifecycles.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents the fastest-growing regional market for construction scaffolding, driven by the nearshoring phenomenon attracting substantial foreign direct investment into manufacturing and industrial facilities. States including Nuevo León, Coahuila, Chihuahua, and Tamaulipas are experiencing unprecedented industrial construction activity, with new industrial facilities under development in Nuevo León alone.

Central Mexico, anchored by Mexico City and surrounding states, dominates overall scaffolding consumption owing to concentrated commercial construction, residential development, and infrastructure projects. The region benefits from the government's ambitious housing initiatives and urban densification policies targeting construction of affordable homes in well-connected central neighborhoods.

Southern Mexico is witnessing growing scaffolding demand driven by tourism infrastructure development, including projects supporting the Maya Train initiative and resort construction in coastal destinations. The region's construction activity focuses on hospitality, cultural facilities, and transportation infrastructure connecting major tourist destinations.

Market Dynamics:

Growth Drivers

Why is the Mexico Construction Scaffolding Market Growing?

Accelerating Infrastructure Investment and Government Construction Initiatives

Mexico's construction scaffolding market is experiencing robust growth driven by substantial government infrastructure investment and ambitious public construction programs. Major infrastructure megaprojects including transportation network expansions, energy facility developments, and public institution construction require extensive scaffolding deployment throughout extended project lifecycles. The government's Plan México economic initiative prioritizes infrastructure development as a cornerstone of economic resilience, ensuring continued public sector construction activity regardless of broader economic fluctuations. These systematic government investments create predictable scaffolding demand patterns that enable market participants to plan capacity expansions and inventory investments with greater confidence.

Nearshoring-Driven Industrial Facility Expansion

The nearshoring phenomenon has emerged as a transformative growth catalyst for Mexico's construction scaffolding market, as multinational corporations relocate manufacturing operations from Asia to capitalize on proximity to North American consumer markets. In 2024, foreign direct investment (FDI) in Mexico received USD 36.87 Billion, with significant portions directed toward industrial facility construction in northern Mexican states. The Mexican Association of Private Industrial Parks projects investment in industrial parks are further creating substantial scaffolding requirements for warehouse, manufacturing plant, and logistics center construction. This industrial construction surge particularly benefits steel and frame scaffolding segments, as heavy industrial facilities demand robust temporary support structures capable of withstanding extended deployment periods and demanding operational conditions throughout lengthy construction schedules.

Commercial Real Estate Development and Urban Densification

Mexico's commercial construction sector is experiencing significant expansion driven by retail center development, office building construction, and mixed-use project proliferation across major metropolitan areas. Urban densification policies are encouraging vertical construction in city centers, generating scaffolding demand for high-rise residential and commercial developments. The hospitality sector's growth, supported by Mexico's strengthening tourism industry, is driving hotel and resort construction that requires specialized scaffolding solutions for facade work and interior finishing. The Mexican Chamber of Construction Industry (CMIC), the nation's building association, and the real estate market research company Softec have estimated at least 100,000 new dwellings in central boroughs by 2030, exemplifying the urban densification trend generating sustained scaffolding requirements. Commercial developers are increasingly investing in premium properties that demand extended scaffolding deployment for detailed finishing work and facade treatments.

Market Restraints:

What Challenges the Mexico Construction Scaffolding Market is Facing?

Rising Material Costs and Steel Price Volatility

The Mexico construction scaffolding market faces significant headwinds from rising material costs, particularly steel price fluctuations that directly impact scaffolding manufacturing and rental economics. International trade uncertainties and potential tariff implementations create pricing volatility that challenges scaffolding companies' ability to maintain stable customer pricing while preserving profit margins.

Skilled Labor Shortages in Construction Sector

Mexico's construction industry faces persistent skilled labor shortages that affect scaffolding installation quality and project execution efficiency. The shortage of trained scaffolding erectors and safety inspectors creates operational challenges, particularly for complex industrial and commercial projects requiring specialized scaffolding configurations and rigorous safety compliance documentation.

Regulatory Complexity and Compliance Burden

The evolving Mexican regulatory landscape, including new occupational safety standards and environmental compliance requirements, creates compliance challenges for scaffolding providers. Companies must navigate complex certification procedures and invest in documentation systems to demonstrate adherence to Official Mexican Standards, increasing operational costs and administrative burdens.

Competitive Landscape:

The Mexico construction scaffolding market exhibits a moderately fragmented competitive structure characterized by the presence of established domestic manufacturers, regional rental specialists, and international scaffolding solution providers. Market participants compete across multiple dimensions including product quality, rental service flexibility, safety certification compliance, and geographic coverage. Leading companies differentiate through comprehensive service offerings that combine equipment rental, installation services, and safety consulting. The market demonstrates growing consolidation tendencies as larger players acquire regional operators to expand geographic reach and service capabilities. International companies are establishing Mexican operations to capture nearshoring-driven industrial construction demand, intensifying competitive dynamics in the premium scaffolding segment. Rental services represent an increasingly important competitive battleground, with companies investing in fleet expansion and digital platform development to enhance customer convenience and operational efficiency.

Mexico Construction Scaffolding Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Ringlock Scaffolding, Cuplock Scaffolding, Frame Scaffolding, Others |

| Materials Covered | Steel, Aluminum, Wood |

| Applications Covered | Supported Scaffolding, Suspended Scaffolding, Rolling Scaffolding |

| End Users Covered | Residential Building, Commercial Building, Industrial, Oil and Gas Industry, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico construction scaffolding market size was valued at USD 1,998.82 Million in 2025.

The Mexico construction scaffolding market is expected to grow at a compound annual growth rate of 4.75% from 2026-2034 to reach USD 3,035.53 Million by 2034.

Frame scaffolding dominated with a 40% market share in 2025, driven by its cost-effectiveness, ease of assembly, and widespread applicability across residential, commercial, and industrial construction projects throughout Mexico.

Key factors driving the Mexico construction scaffolding market include accelerating government infrastructure investment, nearshoring-driven industrial facility expansion, commercial real estate development, and enhanced workplace safety regulations requiring certified scaffolding solutions.

Major challenges include rising material costs and steel price volatility, skilled labor shortages in the construction sector, regulatory complexity and compliance burdens, trade policy uncertainties affecting material supply chains, and competition from informal scaffolding providers operating outside regulatory frameworks.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)