Mexico Contact Lenses Market Size, Share, Trends and Forecast by Material, Design, Usage, Application, Distribution Channel, and Region, 2025-2033

Mexico Contact Lenses Market Overview:

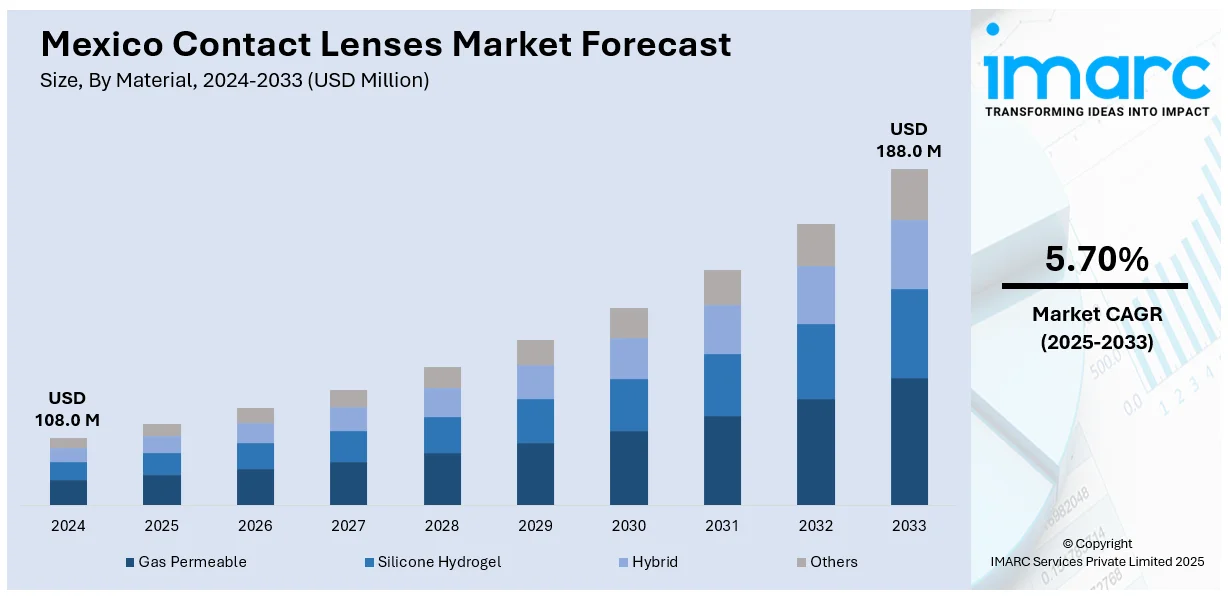

The Mexico contact lenses market size reached USD 108.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 188.0 Million by 2033, exhibiting a growth rate (CAGR) of 5.70% during 2025-2033. The market is driven by the growing incidence of refractive errors like myopia, hyperopia, astigmatism, and presbyopia, advancements in contact lens technology and product innovation, and fast expansion of physical optical retail chains and online e-commerce websites.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 108.0 Million |

| Market Forecast in 2033 | USD 188.0 Million |

| Market Growth Rate 2025-2033 | 5.70% |

Mexico Contact Lenses Market Trends:

Rising Prevalence of Refractive Errors and Vision Disorders

One of the major market growth driver in Mexico is the growing incidence of refractive errors like myopia, hyperopia, astigmatism, and presbyopia. Uncorrected refractive errors are among the leading causes of visual impairment, and they are even more common in Mexico. Urban lifestyle and prolonged viewing of computer and television screens have also gone a long way towards a rise in these disorders among young adults and children attending schools. Demand for correction lenses, in particular contact lenses, is consequently showing healthy growth as people search for alternative correction solutions to those involving glasses. Contact lenses present cosmetic convenience, increased field of view, and greater compatibility with sporting and active lifestyles, increasing their popularity within the youth category. In addition, the rising awareness about vision care through mass campaigns and regular screenings is facilitating earlier diagnosis and driving the demand for vision correction treatments, hence driving the market. In 2024, the International Agency for the Prevention of Blindness (IAPB) assembled more than 600 in-person and virtual delegates for 2030 IN SIGHT LIVE in Mexico City. The gathering highlighted the imperative to address the worldwide eye health emergency and the life-changing potential of cooperation in resolving one of the world's greatest health issues.

Advancements in Contact Lens Technology and Product Innovation

Advances in contact lens technology are contributing significantly to improved wearer comfort, increasing product performance, and bringing the product to a wider consumer market. Technologies, such as silicone hydrogel materials, daily disposable contact lenses, and ultraviolet (UV)-blocking contact lenses, are tackling historical consumer issues with oxygen permeability, eye dryness, and cleanliness. Also, smart contact lenses are entering the market with the ability to track intraocular pressure or glucose levels, extremely useful for diabetics and glaucoma patients. All these technologies are slowly making a transition from the clinical trials to commercialization stage, and thereby lenses may switch from vision corrective devices to health monitoring devices that can be worn. Moreover, the Mexico health and wellness market size is expected to reach USD 80.9 Billion by 2033. This will further drive the need for effective healthcare items like contact lenses.

Expanding Retail and E-commerce Channels

The fast expansion of physical optical retail chains and online e-commerce websites in Mexico is bolstering the market growth. Physical optical chains are penetrating tier 2 and tier 3 cities, enhancing access to professional eye care services and vision correction products. At the same time, the spread of online platforms and specialized optical e-commerce websites is changing buying habits. E-commerce portals provide higher price transparency, product selection, and convenience, especially for repeat purchases such as monthly or daily disposable lenses. They tend to have subscription models, promotions, and virtual try-on functionalities, creating higher consumer interaction and retention. In addition, digital platforms provide direct-to-consumer (D2C) models for brands, cutting out intermediaries and enhancing profit margins. With increasing internet penetration and smartphone usage in Mexico, the online channel is emerging as an important part of the contact lens distribution ecosystem. The IMARC Group states that the Mexico e-commerce market size is expected to reach USD 176.6 Billion by 2033.

Mexico Contact Lenses Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on material, design, usage, application, and distribution channel.

Material Insights:

- Gas Permeable

- Silicone Hydrogel

- Hybrid

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes gas permeable, silicone hydrogel, hybrid, and others.

Design Insights:

- Spherical

- Toric

- Multifocal

- Others

A detailed breakup and analysis of the market based on the design have also been provided in the report. This includes spherical, toric, multifocal, and others.

Usage Insights:

- Daily Disposable

- Disposable

- Frequently Replacement

- Traditional

A detailed breakup and analysis of the market based on the usage have also been provided in the report. This includes daily disposable, disposable, frequently replacement, and traditional.

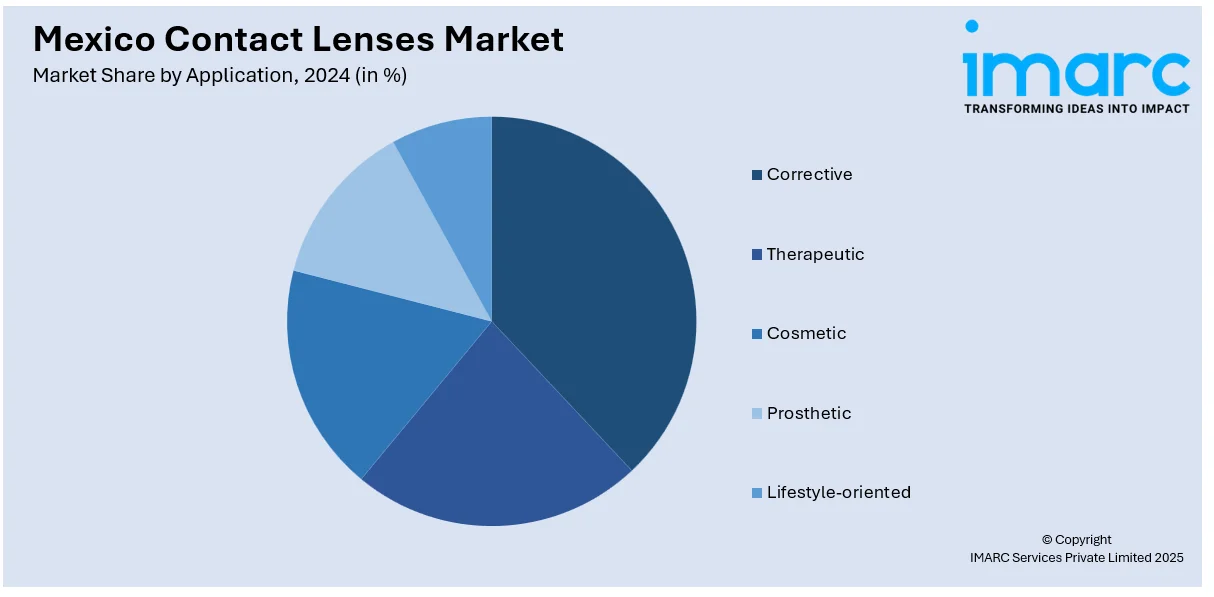

Application Insights:

- Corrective

- Therapeutic

- Cosmetic

- Prosthetic

- Lifestyle-oriented

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes corrective, therapeutic, cosmetic, prosthetic, and lifestyle-oriented.

Distribution Channel Insights:

- E-commerce

- Eye Care Practitioners

- Retail Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes e-commerce, eye care practitioners, and retail stores.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include northern Mexico, central Mexico, southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Contact Lenses Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Gas Permeable, Silicone Hydrogel, Hybrid, Others |

| Designs Covered | Spherical, Toric, Multifocal, Others |

| Usages Covered | Daily Disposable, Disposable, Frequently Replacement, Traditional |

| Applications Covered | Corrective, Therapeutic, Cosmetic, Prosthetic, Lifestyle-oriented |

| Distribution Channels Covered | E-commerce, Eye Care Practitioners, Retail Stores |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico contact lenses market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico contact lenses market on the basis of material?

- What is the breakup of the Mexico contact lenses market on the basis of design?

- What is the breakup of the Mexico contact lenses market on the basis of usage?

- What is the breakup of the Mexico contact lenses market on the basis of application?

- What is the breakup of the Mexico contact lenses market on the basis of distribution channel?

- What are the various stages in the value chain of the Mexico contact lenses market?

- What are the key driving factors and challenges in the Mexico contact lenses market?

- What is the structure of the Mexico contact lenses market and who are the key players?

- What is the degree of competition in the Mexico contact lenses market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico contact lenses market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico contact lenses market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico contact lenses industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)