Mexico Convenience Food Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Region, 2025-2033

Mexico Convenience Food Market Overview:

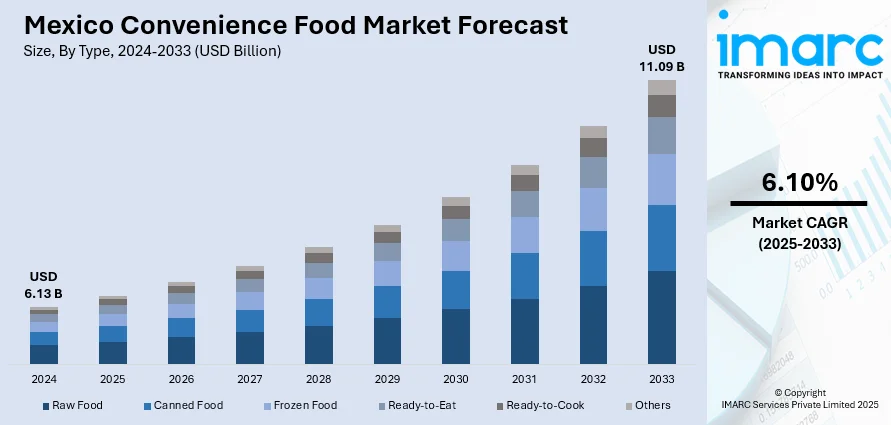

The Mexico Convenience Food Market size reached USD 6.13 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.09 Billion by 2033, exhibiting a growth rate (CAGR) of 6.10% during 2025-2033. The market is growing due to rapid urbanization and lifestyle changes which have resulted in heightened demand for fast and convenient meals, especially in urban regions. The proliferation of food delivery websites has also facilitated consumers' access to a wide range of ready-to-eat foodstuffs. The popularity of Mexican cuisine both within and outside the country has further driven innovation in convenience food products, adding traditional flavors to the ready-to-eat forms, and thereby increasing the Mexico convenience food market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.13 Billion |

| Market Forecast in 2033 | USD 11.09 Billion |

| Market Growth Rate 2025-2033 | 6.10% |

Mexico Convenience Food Market Trends:

Urbanization and New Lifestyles

Mexico's speedy urbanization is profoundly affecting the convenience food sector. As additional people move into cities, eating a traditional home-cooked meal is less of an option owing to busy working schedules and extensive traveling times. This has necessitated a rising demand for readily prepared and easily consumable food products. Shopping malls, convenience shops, and fast-food restaurants have increased to respond to this demand, stocking diverse products to support the urban lifestyles of residents. The availability of these stores has contributed to increasing convenience food access, hence enhancing consumption. Moreover, the diffusion of Western-style fast food has promoted new cuisines and foods and the dietary patterns they follow, contributing to increased demand for convenience foods. This phenomenon mirrors a larger global trend of convenience in food consumption, with Mexico responding to these changes in its own cultural environment.

Growth of Online Food Delivery Services

The emergence of online food delivery companies has transformed the convenience food sector in Mexico. With the universal presence of smartphones and internet connectivity, consumers can now order food from a number of restaurants and food establishments with just a few touches. In June 2024, Nielsen IQ's recent Consumer Pulse Report involving 1,200 participants aged 18 to 54 in urban areas of Mexico revealed that an impressive 43% of consumers choose online ordering for its perceived time savings, while 41% mention improved time management, and 34% enjoy the increased opportunity to explore menus offered by digital platforms. This has been extremely attractive to professionals, students, and families in search of fast and convenient meal options. Platforms such as Uber Eats, Rappi, and Didi Food have become popular, providing consumers with a diverse array of food options delivered right to their doorsteps. The rising popularity of such platforms has further been fueled by consumers' growing preference for home delivery as a safer and more convenient option compared to eating out. Consequently, online food delivery has emerged as a central component influencing the Mexico convenience food market growth.

Health Consciousness and Demand for Nutritious Options

Amid increased consumption of convenience foods, Mexican consumers are showing a significant shift toward healthier options. With growing awareness about the health risks linked to ultra-processed foods, consumers are looking for convenience foods that are healthy without sacrificing taste or convenience. This trend has led into the development of foods that include natural ingredients, less sodium, and less fat. Food manufacturers are reacting by reformulating existing products and launching new ranges with health-focused offerings. In addition, consumers are increasingly looking for organic and local ingredients in convenience foods as a result of a wider global shift toward healthy eating. This is shaping product development and marketing strategies within the convenience food industry in Mexico, with companies seeking to address the changing tastes of their customers.

Mexico Convenience Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, product, and distribution channel.

Type Insights:

- Raw Food

- Canned Food

- Frozen Food

- Ready-to-Eat

- Ready-to-Cook

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes raw food, canned food, frozen food, ready-to-eat, ready-to-cook, others.

Product Insights:

- Meat/Poultry Products

- Cereal-based Products

- Vegetable-based Products

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes meat/poultry products, cereal-based products, vegetable-based products, and others.

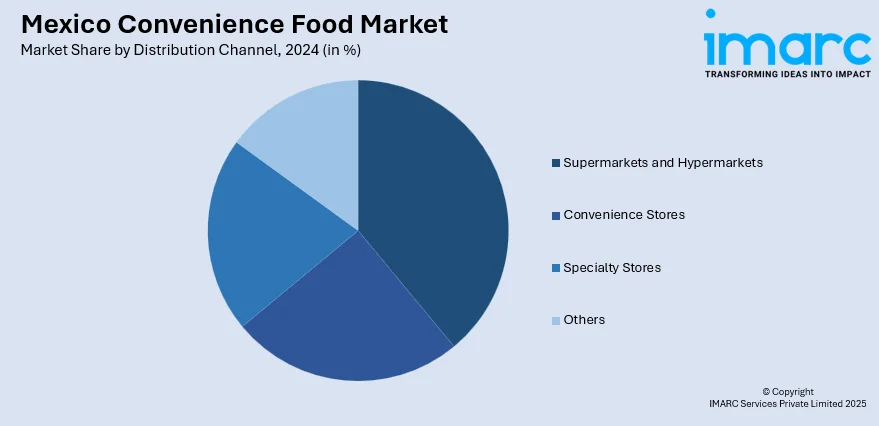

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, specialty stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Convenience Food Market News:

- In October 2023, Grupo Bimbo launched its initial location of Bimbo Go, a new convenience store chain catering to employees. Last year, Bimbo announced its intentions to set up these stores, which would showcase brands such as Marinela, Tía Rosa, Barcel, El Globo, and Wonderbread. There has been increasing interest in these shops, with new ones opening in Monterrey, Nuevo Leon, and Mexico City. Shoppers have observed that within Bimbo Go stores, they can acquire not just products but also branded items.

Mexico Convenience Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Raw Food, Canned Food, Frozen Food, Ready-To-Eat, Ready-To-Cook, Others |

| Products Covered | Meat/Poultry Products, Cereal-based Products, Vegetable-based Products, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico convenience food market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico convenience food market on the basis of type?

- What is the breakup of the Mexico convenience food market on the basis of product?

- What is the breakup of the Mexico convenience food market on the basis of distribution channel?

- What is the breakup of the Mexico convenience food market on the basis of region?

- What are the various stages in the value chain of the Mexico convenience food market?

- What are the key driving factors and challenges in the Mexico convenience food market?

- What is the structure of the Mexico convenience food market and who are the key players?

- What is the degree of competition in the Mexico convenience food market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico convenience food market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico convenience food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico convenience food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)