Mexico Conveyor Belt Market Size, Share, Trends and Forecast by Type, End-Use, and Region, 2025-2033

Mexico Conveyor Belt Market Overview:

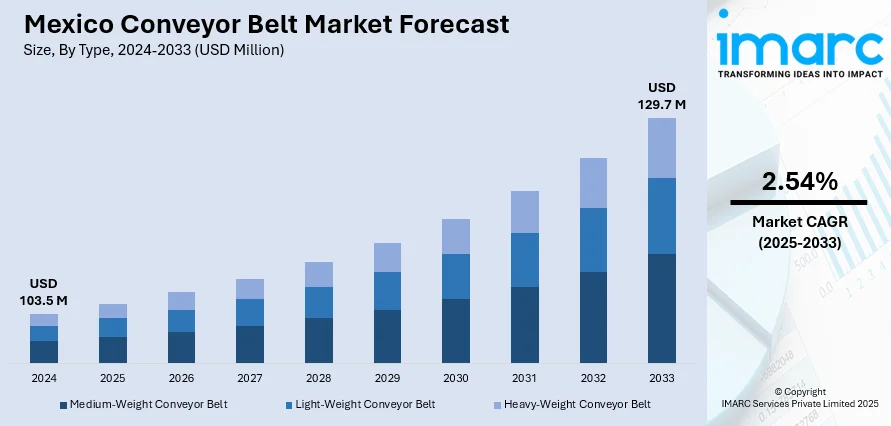

The Mexico conveyor belt market size reached USD 103.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 129.7 Million by 2033, exhibiting a growth rate (CAGR) of 2.54% during 2025-2033. The market is fueled by increased industrial demand, innovation, and a favorable outlook for sustained material handling system growth across sectors, promising effective transportation solutions to prime industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 103.5 Million |

| Market Forecast in 2033 | USD 129.7 Million |

| Market Growth Rate 2025-2033 | 2.54% |

Mexico Conveyor Belt Market Trends:

Increased Demand from the Mining Sector

The Mexican mining industry has been one of the main drivers for the expansion of the conveyor belt industry. With the nation ranking as one of the biggest silver, gold, copper, and mineral producers in the world, there is increased demand for quality and long-lasting conveyor belts. Conveyor belts form part of material transport in mines, enhancing efficiency while lowering costs. The growth in both open-pit and underground mining operations has created a greater need for conveyor belts, particularly those used in heavy-duty applications. For instance, in October 2023, Torex Gold disclosed that it will start producing copper at its Morelos Complex in Mexico's Guerrero state, backed by conveyor belt commissioning inside the Guajes tunnel under the Media Luna project. Consequently, the Mexico conveyor belt market will witness strong growth over the next few years. The contribution of the mining industry to the market share is also expected to stay robust, given the increasing demand for advanced conveyor systems, as Mexico's strategic emphasis on growing its mining capability continues. The conveyor belt market outlook is optimistic because of these developments.

Expansion of the Manufacturing Industry

Mexico's manufacturing industry is the most diverse and dynamic globally and is responsible for driving much of the economic progress in Mexico. Automotive, electronics, food processing, and textile manufacturing make up the industries covered under manufacturing and all use material handling efficiency systems such as conveyor belts. While manufacturers focus more on maximizing the lines for manufacturing and putting automated processes into practice, demand continues to grow for high-performance conveyor systems for transporting material, components, and manufactured products. The growing utilization of conveyor belts in these diversified industries is predicted to strongly accelerate the Mexico conveyor belt market growth. The utilization of medium and light-weight conveyor belts is extremely high, since manufacturers are searching for affordable and dependable solutions that can maximize manufacturing processes. Market share in the manufacturing industry is growing, stimulating by rising investment in automation and efficiency. The total market for conveyor belts in Mexico mirrors the ongoing growth of the manufacturing sector.

Adoption of Conveyor Systems in Chemical and Oil Industries

The Mexican chemical, oil, and gas sectors have seen a great deal of expansion, especially in the production and processing of oil, natural gas, and petrochemical products. Conveyor belts are vital in the transportation of raw materials and finished goods in these sectors. The rising need for efficient and long-lasting material handling systems in chemical plants and refineries is driving the growth of the Mexico conveyor belt market share. For example, in December 2023, RAM Enterprise installed 84 miles of conveyor belt for Atlas Energy's 42-mile Texas-New Mexico Dune Express, aimed at lowering truck traffic and emissions by late 2024. Moreover, as industries incorporate newer technologies for safety and efficiency purposes, there is growing demand for more Mexico conveyor belt, high-performance conveyor belts capable of withstanding extreme conditions, including high temperatures and corrosive products. Amplified use of conveyor systems for production continuity in this sector is among the most influencing factors propelling the Mexico conveyor belt market's growth. This market prospect in Mexico remains buoyant as the industries continue expanding and evolving.

Mexico Conveyor Belt Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and end-use.

Type Insights:

- Medium-Weight Conveyor Belt

- Light-Weight Conveyor Belt

- Heavy-Weight Conveyor Belt

The report has provided a detailed breakup and analysis of the market based on the type. This includes medium-weight conveyor belt, light-weight conveyor belt, and heavy-weight conveyor belt.

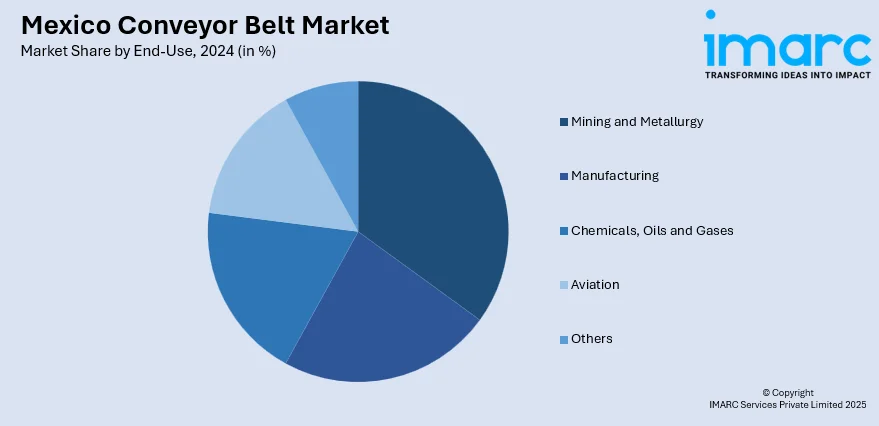

End-Use Insights:

- Mining and Metallurgy

- Manufacturing

- Chemicals, Oils and Gases

- Aviation

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. this includes mining and metallurgy, manufacturing, chemicals, oils and gases, aviation, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Conveyor Belt Market News:

- In January 2025, Märtens has reinforced its partnership with InterBelting in Mexico, capitalizing on more than 15 years of partnership. With increased technical-commercial assistance in Mexico City, Monterrey, and Queretaro, the initiative guarantees first-class service and access to Märtens' hygienic, high-performance metal conveyor belts for various industrial applications.

- In October 2024, French equipment supplier RBL-REI has installed state-of-the-art conveyor systems at Mexico's Cruz Azul Lagunas cement plant in Oaxaca. The project features a 300tph petcoke curved conveyor and 1400tph limestone conveyor with energy-producing descents and dual-overlap designs to minimize dust, transfers, and operating expenses.

Mexico Conveyor Belt Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Medium-Weight Conveyor Belt, Light-Weight Conveyor Belt, Heavy-Weight Conveyor Belt |

| End-Uses Covered | Mining and Metallurgy, Manufacturing, Chemicals, Oils and Gases, Aviation, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico conveyor belt market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico conveyor belt market on the basis of type?

- What is the breakup of the Mexico conveyor belt market on the basis of end use?

- What is the breakup of the Mexico conveyor belt market on the basis of region?

- What are the various stages in the value chain of the Mexico conveyor belt market?

- What are the key driving factors and challenges in the Mexico conveyor belt?

- What is the structure of the Mexico conveyor belt market and who are the key players?

- What is the degree of competition in the Mexico conveyor belt market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico conveyor belt market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico conveyor belt market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico conveyor belt industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)