Mexico Copper Alloys Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2026-2034

Mexico Copper Alloys Market Overview:

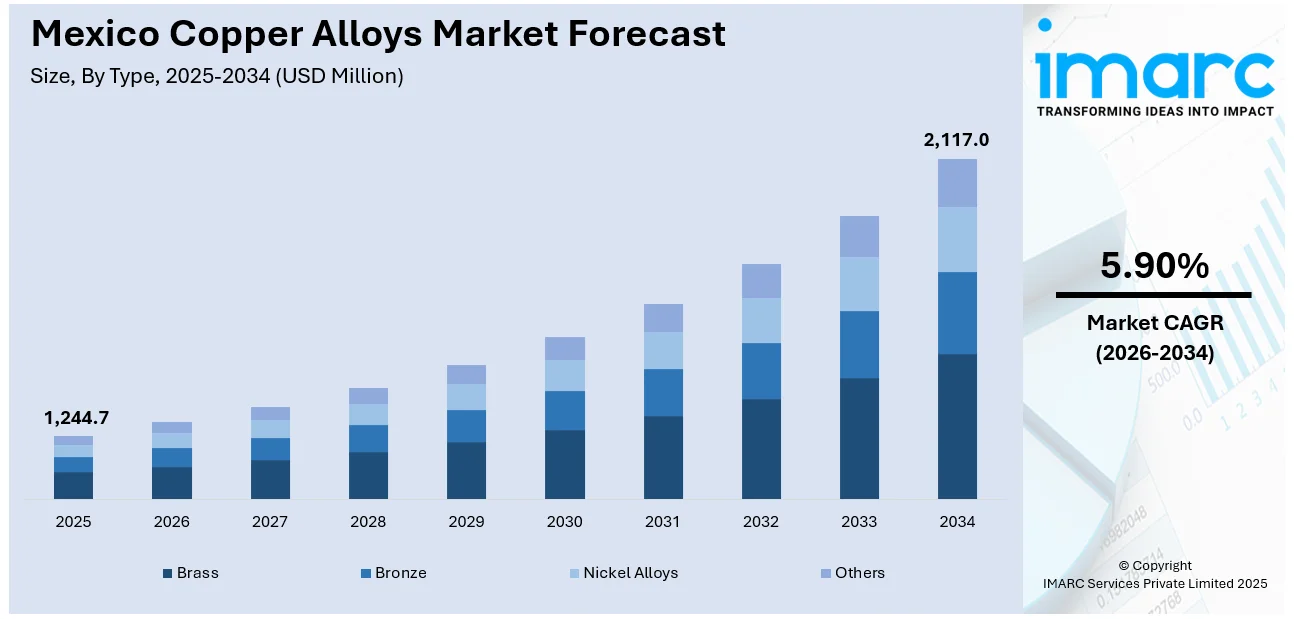

The Mexico copper alloys market size reached USD 1,244.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,117.0 Million by 2034, exhibiting a growth rate (CAGR) of 5.90% during 2026-2034. Rising demand in construction, automotive, and electrical sectors due to superior conductivity, corrosion resistance, and durability is one of the factors contributing to the Mexico copper alloys market share. Growth in infrastructure projects, electric vehicle production, and renewable energy installations further accelerates market expansion across key industrial applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,244.7 Million |

| Market Forecast in 2034 | USD 2,117.0 Million |

| Market Growth Rate 2026-2034 | 5.90% |

Mexico Copper Alloys Market Analysis:

- Key Market Drivers: Technological requirements of advanced manufacturing and infrastructure renewal programs are fueling demand for high-performance copper alloys. Development of electric vehicles, renewable energy installations, and telecommunications infrastructure demands superior conductivity materials. Growth in the construction sector and industrial automation drives further market growth across various application segments throughout the country.

- Key Market Trends: High-performance copper alloys for electric vehicle charging infrastructures and smart device applications are becoming increasingly important. Environmental regulatory guidelines propel producers towards lead-free, green formulations. Digital manufacturing technologies allow for tailored alloy solutions and sustainability emphasis fuels recycling efforts and energy-efficient manufacturing processes.

- Competitive Landscape: The industry consists of established global suppliers and emerging local producers. Strategic alliances among global firms and Mexican producers facilitate supply chain durability. Opportunities for differentiation arise from innovation in composition and processing technology as market consolidation patterns affect price drivers.

- Challenges and Opportunities: Raw material price volatility and complexity in the supply chain pose continuing challenges. Nevertheless, nearshoring developments and diversification of industries represent strong opportunities for growth. Industry growth potential from growing demand in automotive electrification and renewable energy markets is considerable for strategic players.

Mexico Copper Alloys Market Trends:

Growing Shift toward Specialized Copper Alloys

Mexico copper alloys market is seeing a rising preference for high-performance variants used in electric vehicles and electronic components. New product introductions—engineered for superior conductivity, mechanical strength, and environmental compliance—are aligning with the material needs of fast-evolving sectors. Copper alloy rods and wires designed for EV charging systems, battery connectors, and smart device components are gaining traction among local manufacturers. The Mexico copper alloys market demand is particularly strong among automotive suppliers and electronics firms seeking durable, energy-efficient inputs that meet international quality benchmarks. As the country deepens its integration into global value chains for clean mobility and digital infrastructure, specialized copper alloys are becoming essential to sustain performance and regulatory standards. This momentum signals a broader material shift, where copper alloys play a key role in enabling both technological innovation and environmental responsibility within Mexico's industrial growth. These factors are intensifying the Mexico copper alloys market growth. For example, in August 2024, bedra Vietnam Alloy Material Co., Ltd. introduced advanced copper alloy rods and wires, targeting new energy vehicles and electronics sectors. Products like EValloy92 and PlugMax11 offer high conductivity, strength, and eco-friendly alternatives. With a presence in Mexico, bedra Alloy's innovations align with the country's rising copper alloy demand in the automotive and tech industries, reinforcing its relevance in Mexico's expanding copper alloy materials market.

To get more information on this market Request Sample

Advanced Copper Alloys Powering Next-Gen Manufacturing Needs

Mexico's industrial sector is accelerating its move toward advanced materials to meet the evolving demands of next-generation manufacturing, particularly in electric mobility and electronics. As production of electric vehicles, charging infrastructure, and smart devices expands, the need for materials that combine electrical efficiency with mechanical resilience has intensified. High-conductivity copper alloys are emerging as key inputs across applications such as EV connectors, power modules, and compact circuit components. These materials not only deliver high thermal and electrical performance but also meet stricter environmental standards, supporting cleaner production processes. Local manufacturers are increasingly turning to copper alloy products designed for precision engineering, where miniaturization, durability, and long service life are essential. The Mexico copper alloys market analysis reveals that the appeal lies in their ability to handle higher loads and temperatures while maintaining performance stability, critical for automotive electrification and compact consumer electronics. With supply chains shifting closer to home and technology requirements becoming more stringent, copper alloys are positioning themselves as indispensable materials for Mexico's high-value manufacturing ecosystem. This shift reflects a broader movement toward material innovation in support of industrial competitiveness and sustainability.

Mexico Copper Alloys Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and end use.

Type Insights:

- Brass

- Bronze

- Nickel Alloys

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes brass, bronze, nickel alloys, and others.

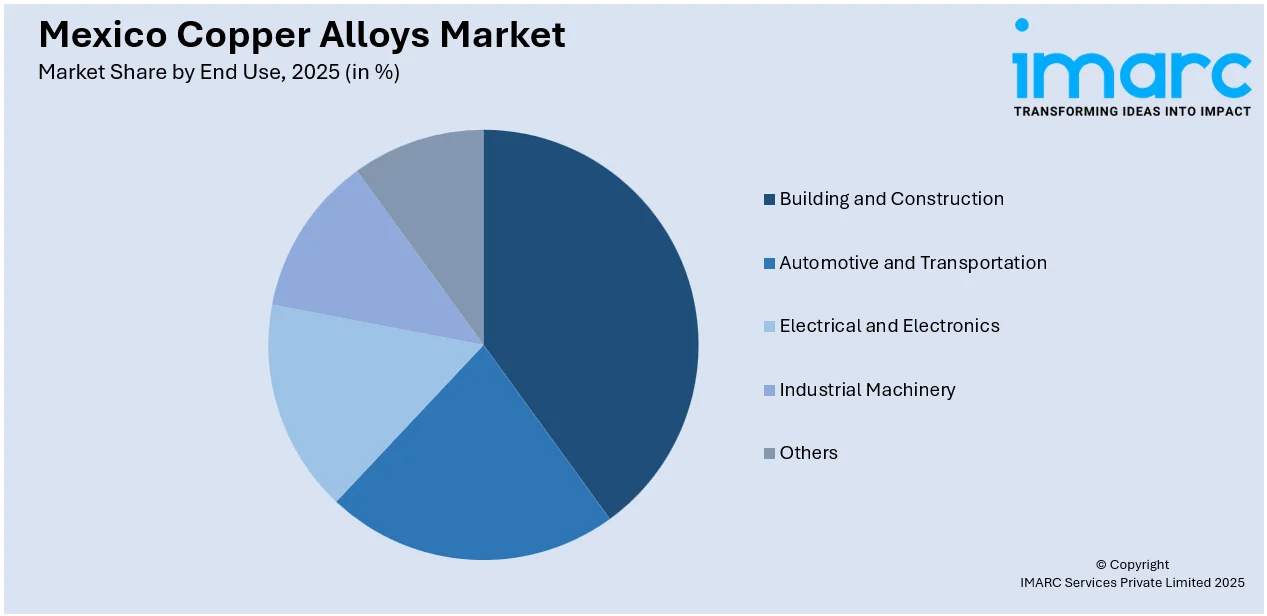

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Building and Construction

- Automotive and Transportation

- Electrical and Electronics

- Industrial Machinery

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes building and construction, automotive and transportation, electrical and electronics, industrial machinery, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Copper Alloys Market News:

- In March 2025, Conticon, a joint venture between Grupo Condumex and Xignux, expanded copper rod production in Celaya-Villagrán, Mexico, by installing a new CONTIROD CR3700 line from SMS group. This move aims to meet rising regional demand for copper alloys in the automotive and telecom sectors, increasing total capacity to 550,000 tons annually. The project, expected to complete by Q4 2026, highlights Mexico’s growing role in copper alloy manufacturing.

Mexico Copper Alloys Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Brass, Bronze, Nickel Alloys, Others |

| End Uses Covered | Building and Construction, Automotive and Transportation, Electrical and Electronics, Industrial Machinery, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico copper alloys market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico copper alloys market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico copper alloys industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The copper alloys market in Mexico was valued at USD 1,244.7 Million in 2025.

The Mexico copper alloys market is projected to exhibit a CAGR of 5.90% during 2026-2034, reaching a value of USD 2,117.0 Million by 2034.

Rising demand in construction, automotive, and electrical sectors drives market growth due to superior conductivity, corrosion resistance, and durability of copper alloys. Infrastructure projects, electric vehicle production, renewable energy installations, and digital manufacturing requirements further accelerate market expansion across key industrial applications throughout Mexico.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)