Mexico Corporate Wellness Market Size, Share, Trends and Forecast by Service, Category, Delivery, Organization Size, and Region, 2025-2033

Mexico Corporate Wellness Market Overview:

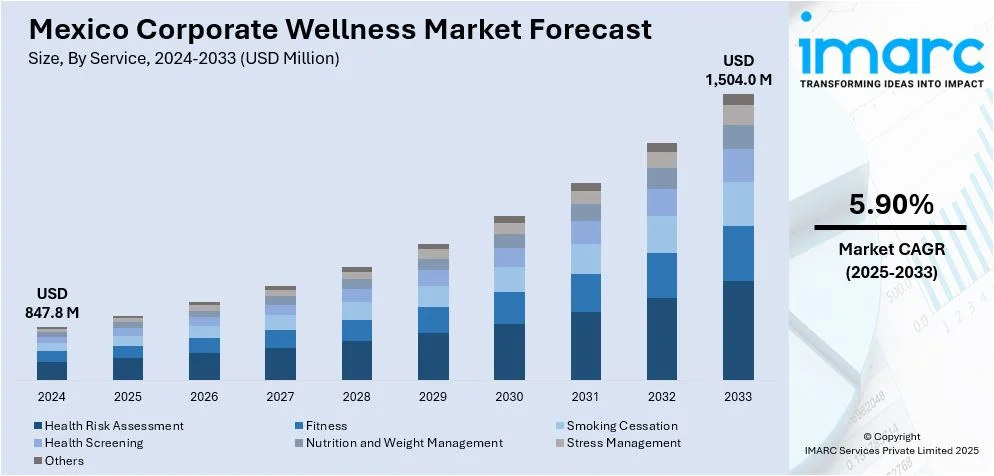

The Mexico corporate wellness market size reached USD 847.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,504.0 Million by 2033, exhibiting a growth rate (CAGR) of 5.90% during 2025-2033. The market is driven by rising healthcare costs, increasing awareness of mental and physical well-being, and employers' focus on improving productivity. Government initiatives supporting workplace health, along with the growing prevalence of chronic diseases among working professionals, also contribute to expanding demand for wellness programs across industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 847.8 Million |

| Market Forecast in 2033 | USD 1,504.0 Million |

| Market Growth Rate 2025-2033 | 5.90% |

Mexico Corporate Wellness Market Trends:

Integration of Digital Wellness Platforms

One of the key developments in Mexico’s corporate wellness market is the increasing integration of digital wellness platforms. Employers are adopting mobile apps and online portals that offer fitness tracking, mental health resources, and personalized wellness plans. These platforms enable real-time engagement and make health support more accessible, especially for remote and hybrid workforces. Companies are also using digital analytics to monitor participation rates and measure outcomes, helping them fine-tune initiatives for better results. The digital shift aligns with employee preferences for flexibility and self-directed wellness solutions. Moreover, technology allows small and medium enterprises to offer cost-effective wellness services without the need for large-scale infrastructure, making digital tools a democratizing force in the wellness ecosystem. For instance, the 2024 Wellhub study strongly reflects the rising trend of digital wellness platform integration in Mexico’s corporate wellness market. With 95% of companies tracking ROI reporting positive outcomes, up from 90% in 2023, the data underscores how digital platforms are enhancing the effectiveness of wellness initiatives. Firms leveraging holistic programs through platforms like Wellhub achieved ROIs exceeding 150%, and employee participation jumped to 80% when C-suite engagement surpassed 70%, facilitated by digital accessibility.

Customization of Wellness Programs by Industry

A growing trend in the Mexican corporate wellness space is the customization of wellness programs based on industry-specific needs. For instance, as per industry reports, Mexico’s corporate wellness sector is responding to rising workplace stress, with 1 in 3 employees facing burnout and 80% of HR leaders expecting it to impact productivity by 2024. Mexicans average 2,200 work hours per year, among the highest globally. Burnout is estimated to cost USD 40 Million annually. Despite these challenges, only 40% of adults exercise regularly. Companies are promoting tailored wellness programs based on employee data, leading to improved engagement and outcomes such as a 35% reduction in medical expenses and lower absenteeism. This targeted approach enhances employee participation and relevance. Moreover, the availability of occupational health data allows organizations to design wellness interventions that address sector-specific risks. Customization improves program effectiveness, ROI, and employee satisfaction, helping businesses meet compliance standards while reinforcing their commitment to workforce well-being.

Mexico Corporate Wellness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service, category, delivery, and organization size.

Service Insights:

- Health Risk Assessment

- Fitness

- Smoking Cessation

- Health Screening

- Nutrition and Weight Management

- Stress Management

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes health risk assessment, fitness, smoking cessation, health screening, nutrition and weight management, stress management, and others.

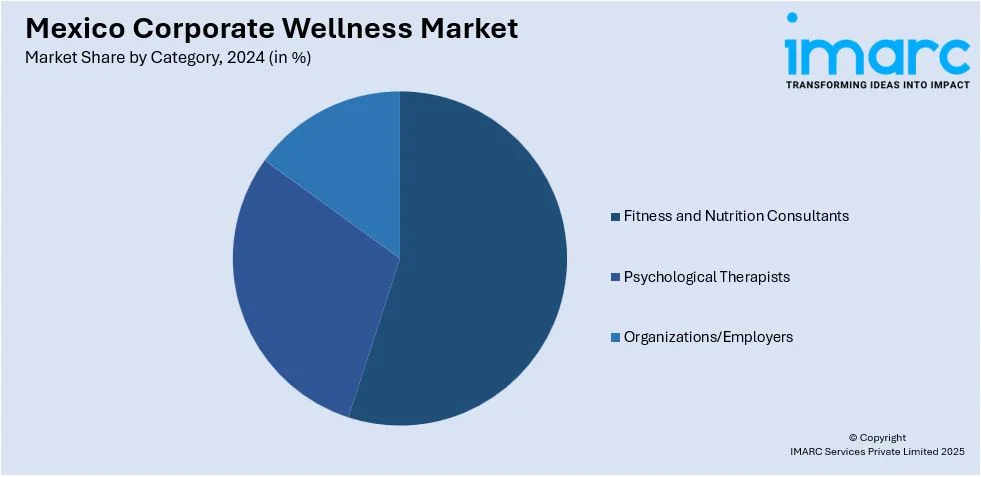

Category Insights:

- Fitness and Nutrition Consultants

- Psychological Therapists

- Organizations/Employers

A detailed breakup and analysis of the market based on the category have also been provided in the report. This includes fitness and nutrition consultants, psychological therapists, and organizations/employers.

Delivery Insights:

- Onsite

- Offsite

A detailed breakup and analysis of the market based on the delivery have also been provided in the report. This includes onsite and offsite.

Organization Size Insights:

- Small Scale Organizations

- Medium Scale Organizations

- Large Scale Organizations

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small scale organizations, medium scale organizations, and large scale organizations.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Corporate Wellness Market News:

- In November 2024, Minu, a Mexican employee wellness platform, raised USD 30 Million in a Series B funding round to help company expand its services in Mexico, reduce employee turnover by 33%, and enhance the financial health of millions as it nears profitability. Minu offers over 50 wellness benefits such as earned wage access, financial education, and healthcare services.

- In November 2024, Impro Industries Mexico launched a breast cancer awareness initiative in observance of World Day Against Breast Cancer. The campaign included offering free mammograms to female employees and promoting early detection and prevention. The initiative reflects the company’s broader commitment to improving health outcomes in the community. Breast cancer remains the leading cause of cancer-related deaths among women in Mexico, often due to late diagnoses. Impro aims to increase awareness, support screenings, and inspire positive change in public health.

- In September 2024, Workday Inc. announced the launch of Workday Wellness, an AI-powered solution aimed at helping companies personalize employee health benefits. The platform enables real-time data exchange between employers and wellness providers, offering AI-driven insights into employee preferences and program usage. Integrated with Workday HCM, it provides alerts on underused benefits and recommends improvements. Using sentiment data from Workday Peakon Employee Voice, it also identifies employee needs such as mental health support or child care. The goal is to boost engagement, reduce costs, and tailor benefits more effectively.

Mexico Corporate Wellness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Health Risk Assessment, Fitness, Smoking Cessation, Health Screening, Nutrition and Weight Management, Stress Management, Others |

| Categories Covered | Fitness and Nutrition Consultants, Psychological Therapists, Organizations/Employers |

| Deliveries Covered | Onsite, Offsite |

| Organization Sizes Covered | Small Scale Organizations, Medium Scale Organizations, Large Scale Organizations |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico corporate wellness market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico corporate wellness market on the basis of service?

- What is the breakup of the Mexico corporate wellness market on the basis of category?

- What is the breakup of the Mexico corporate wellness market on the basis of delivery?

- What is the breakup of the Mexico corporate wellness market on the basis of organization size?

- What are the various stages in the value chain of the Mexico corporate wellness market?

- What are the key driving factors and challenges in the Mexico corporate wellness market?

- What is the structure of the Mexico corporate wellness market and who are the key players?

- What is the degree of competition in the Mexico corporate wellness market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico corporate wellness market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico corporate wellness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico corporate wellness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)