Mexico Corrugated Boxes Market Size, Share, Trends and Forecast by Material Used, End Use, and Region, 2025-2033

Mexico Corrugated Boxes Market Overview:

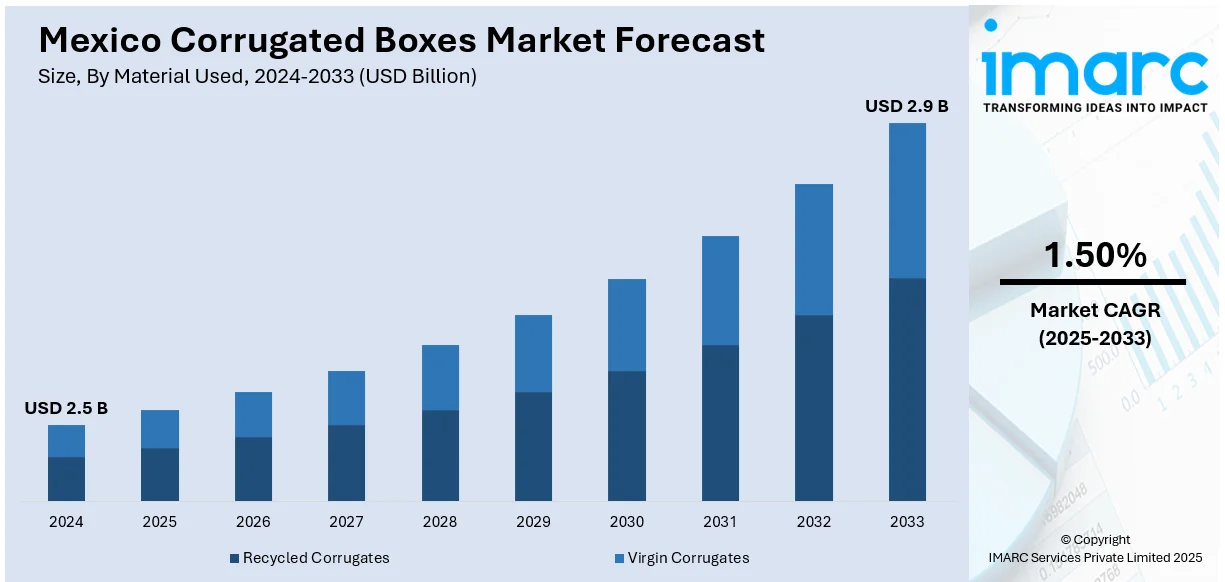

The Mexico corrugated boxes market size reached USD 2.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.9 Billion by 2033, exhibiting a growth rate (CAGR) of 1.50% during 2025-2033. The market is expanding due to the rising demand from the retail, industrial, and agricultural industries, driven by the growth in exports, mounting logistics networks, and a move toward sustainable, lightweight packaging solutions that are cost-effective and provide protection to the products throughout supply chains.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 2.9 Billion |

| Market Growth Rate 2025-2033 | 1.50% |

Mexico Corrugated Boxes Market Trends:

Growth of E-Commerce and Home Deliveries

Mexico's growing e-commerce business is driving demand for corrugated boxes sharply higher. As more shoppers buy online, retailers and logistics companies need secure, light, and protective packaging. Corrugated boxes are especially popular because they are cost-effective, recyclable, and have high structural integrity. Online food delivery, consumer electronics, personal care products, and apparel are among the main drivers of demand. The growth of express delivery operations and fulfillment centers nationwide is driving faster turnover of secondary and tertiary packaging. Retailers are also turning to branded and customized corrugated solutions to improve unboxing experiences. At the same time, regulations driving sustainable packaging are fueling this trend, as corrugated boxes fit within recyclability objectives. As a result of Mexico's robust manufacturing sector and access to the U.S. market, cross-border e-commerce is also driving stable box exports. These factors are together supporting the importance of corrugated packaging in last-mile delivery and distribution networks.

Preference for Lightweight and Recyclable Packaging

There is increased demand in Mexico for light, recyclable packaging, which has led to a trend towards corrugated box manufacturing. Companies are increasingly choosing materials that reduce shipping weight and environmental impact while maintaining durability. Corrugated boxes meet these needs with their excellent strength-to-weight ratio and high recyclability. Packaging efficiency has now emerged as a strategic priority for industries like food and beverages (F&B), electronics, and pharmaceuticals where storage and transportation cost optimization are paramount. Also, as corporate sustainability targets become more aggressive, corrugated packaging from recycled content is increasingly coming into focus. Manufacturers are investing in less-material design innovation without sacrificing integrity. For instance, in December of 2024, Baja Box introduced self-assembling corrugated boxes made from recycled materials, enhancing production capacity and cutting down logistics costs through automation and eco-friendly practices specific to automotive, manufacturing, and medical industries. Moreover, perceived consumer attitudes are also changing, with customers gravitating toward products packaged in smaller, sustainable, and biodegradable materials. These trends are driving the widespread adoption of corrugated alternatives over single-use rigid plastics or multi-packs, supporting sustained growth across retail, industrial, and agricultural supply chains.

Expansion of Industrial and Agricultural Exports

Mexico's export-oriented manufacturing sector—autos parts and components, electronics, and fresh fruit and vegetables—is driving growth in stable demand for corrugated boxes. Corrugated packaging provides protective and economic solutions for long-distance deliveries, particularly of delicate or perishable products. Exporters appreciate its convenience of customization, stacking strength, and moisture resistance, which makes it ideal for shipping in changed conditions of climate. Agricultural exports such as avocados, berries, and citrus often depend on corrugated trays and cartons, which maintain product integrity. Industrial exporters, in turn, need heavy-duty corrugated solutions to manage sophisticated supply chains. With increasing trade agreements serving to make Mexico a strategic trade partner for export markets, demands for standardized and export-compliant packaging are mounting. Corrugated boxes are serving at the center of achieving such logistics requirements. Continued infrastructure investment in warehousing and transport infrastructure is similarly adding to corrugated product throughput and reaffirming its significance to export-linked industry segments. These trends indicate future investment and innovation in export-grade corrugated packaging. According to the sources, in October 2023, Mexico's corrugated packaging industry gained prominence as Monterrey welcomed ACCCSA's 41st convention, bringing together 100+ international exhibitors to highlight innovation, sustainability, and supply chain partnership.

Mexico Corrugated Boxes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on material used and end use.

Material Used Insights:

- Recycled Corrugates

- Virgin Corrugates

The report has provided a detailed breakup and analysis of the market based on the material used. This includes recycled corrugates and virgin corrugates.

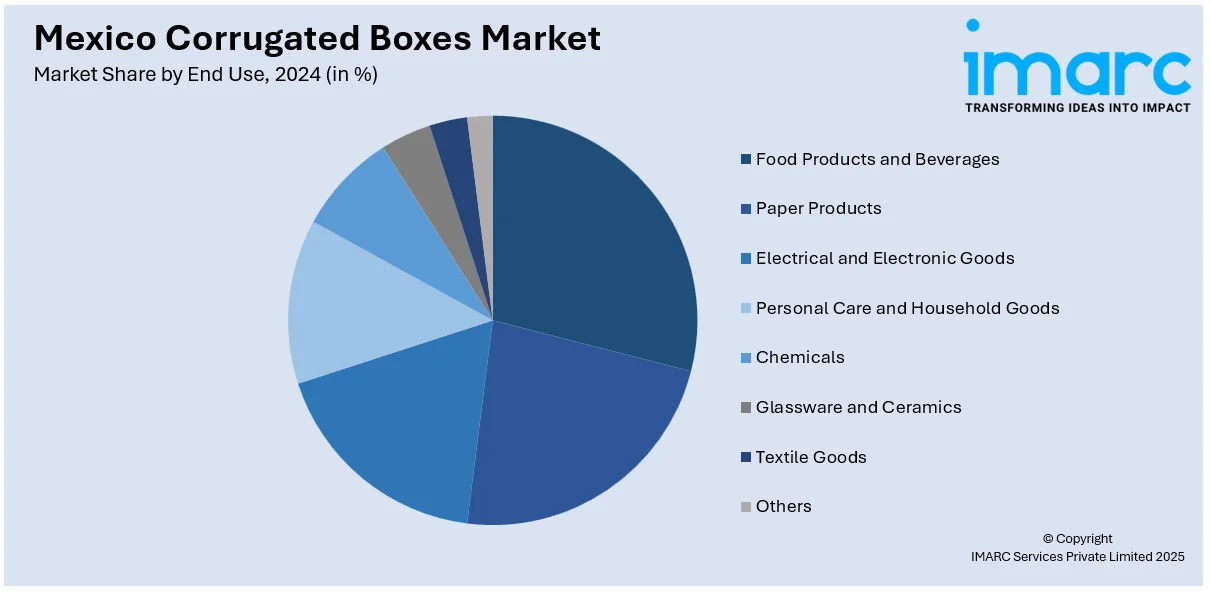

End Use Insights:

- Food Products and Beverages

- Paper Products

- Electrical and Electronic Goods

- Personal Care and Household Goods

- Chemicals

- Glassware and Ceramics

- Textile Goods

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes food products and beverages, paper products, electrical and electronic goods, personal care and household goods, chemicals, glassware and ceramics, textile goods and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Corrugated Boxes Market News:

- In January 2024, Nefab diversified its operations in Mexico by investing strategically in growing industrial packaging activities in major cities. The business improved its production facilities with the latest corrugated board machinery and foam converting machines, increasing efficiency and sustainability with products such as FiberFlute and returnable thermoformed trays to suit market demand.

- In September 2023, International Paper opened a $100 million Pennsylvania food, beverage, and e-commerce box-based corrugated packaging plant. Pratt Industries announced a $700 million recycled paper mill and box plant in Kentucky, adding North American production capacity, including the extension of its operations into Mexico's corrugated market.

Mexico Corrugated Boxes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Used Covered | Recycled Corrugates, Virgin Corrugates |

| End Uses Covered | Food Products and Beverages, Paper Products, Electrical and Electronic Goods, Personal Care and Household Goods, Chemicals, Glassware and Ceramics, Textile Goods, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico corrugated boxes market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico corrugated boxes market on the basis of material used?

- What is the breakup of the Mexico corrugated boxes market on the basis of end use?

- What is the breakup of the Mexico corrugated boxes market on the basis of region?

- What are the various stages in the value chain of the Mexico corrugated boxes market?

- What are the key driving factors and challenges in the Mexico corrugated boxes?

- What is the structure of the Mexico corrugated boxes market and who are the key players?

- What is the degree of competition in the Mexico corrugated boxes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico corrugated boxes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico corrugated boxes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico corrugated boxes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)