Mexico Courier, Express and Parcel (CEP) Market Size, Share, Trends and Forecast by Service Type, Destination, Type, End-Use Sector, and Region, 2026-2034

Mexico Courier, Express and Parcel (CEP) Market Overview:

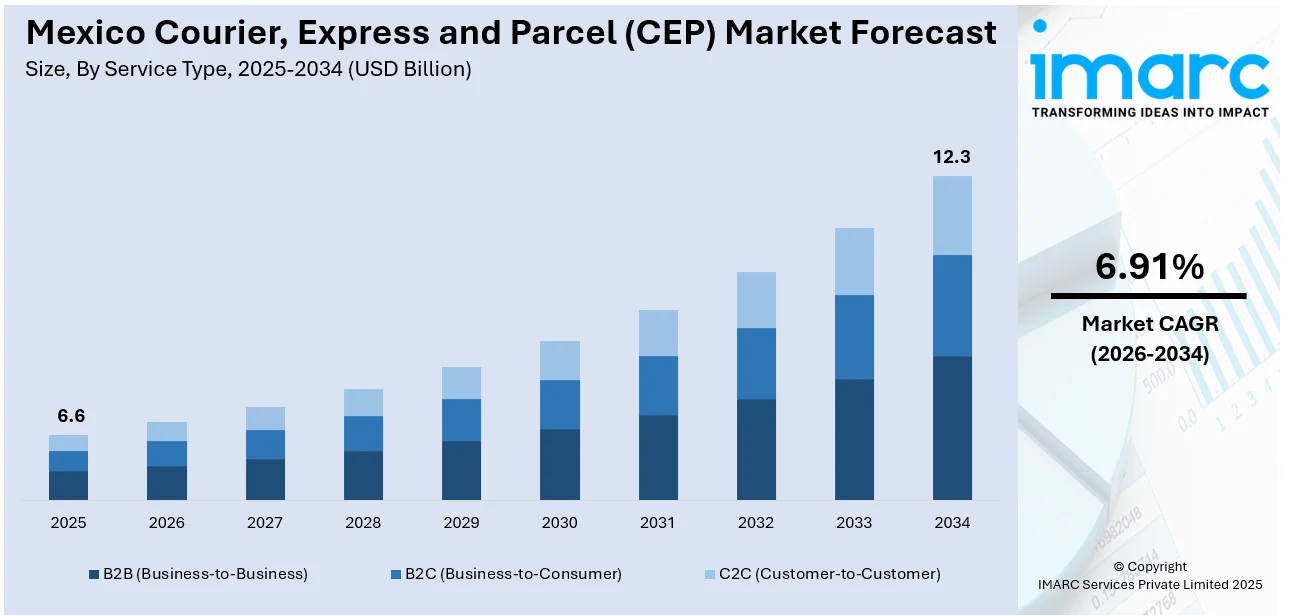

The Mexico courier, express and parcel (CEP) market size reached USD 6.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 12.3 Billion by 2034, exhibiting a growth rate (CAGR) of 6.91% during 2026-2034. The market is driven by e-commerce expansion, rapid urbanization, rising cross-border trade, ongoing technological advancements, expanding last-mile delivery innovations, growing small enterprise (SME) participation, and rising consumer expectations for faster, more reliable shipping and competitive logistics advancements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 6.6 Billion |

| Market Forecast in 2034 | USD 12.3 Billion |

| Market Growth Rate 2026-2034 | 6.91% |

Mexico Courier, Express and Parcel (CEP) Market Trends:

E-commerce Boom Driving Demand for Faster and More Reliable Deliveries

The Mexico courier express and parcel (CEP) market growth is primarily driven by the fast-growing e-commerce industry. In addition to this, the rapid growth of online shopping allows logistics providers to improve their structures, technological capabilities and enhance delivery speed to meet client expectations. Moreover, the demand for rapid delivery has become the new industry benchmark because customers want their packages delivered the same day or the next day. Organizations also maintain pace through the automation of their warehouses and the deployment of route optimization software, in addition to establishing partnerships with local delivery providers. For instance, in 2025, Cainiao, Alibaba’s logistics arm, expanded its e-commerce delivery services across Mexico, enhancing logistics infrastructure with automation and smart technology to improve delivery speed and efficiency, catering to rising consumer demand. Besides this, small businesses are increasing their parcel volumes due to the growing social commerce activities on platforms such as Facebook and WhatsApp. Major players from the industry are utilizing drone deliveries along with smart lockers and artificial intelligence (AI)-based logistics management solutions because of market competition. Furthermore, companies competing in the evolving CEP market are gaining competitive advantages by delivering fast, reliable, affordable solutions because the rising consumer demands have made speed and efficiency the deciding factors.

To get more information on this market Request Sample

Cross-Border Trade and Nearshoring Reshaping Logistics Strategies

The cross-border trade and nearshoring are reshaping logistics strategies are boosting the Mexico CEP market share by leveraging the country’s strategic position as North America’s manufacturing hub to fuel rising cross-border shipments and enhance supply chain efficiency. In line with this, global companies are increasingly choosing nearshoring production in Mexico to serve the United States markets, and as a result, they boost parcel and freight transportation. For example, Schneider introduced a new intermodal service in November 2024, providing continuous rail connectivity between Mexico, Texas, and the Southeastern United States. This initiative enhances cross-border shipment efficiency and strengthens logistics infrastructure, further facilitating trade expansion. Concurrently, the United States-Mexico-Canada Agreement (USMCA) has enabled easier international shipping operations through its customs process improvements. In confluence with this, the growing border traffic requires logistics providers to develop digital customs clearance tools and build specific infrastructure systems at major border facilities. Additionally, the growth of Mexican retailer sales to American consumers requires effective international delivery solutions that promote cost efficiency. Apart from this, logistics companies are using Mexico as a vital logistics hub to focus on improving cross-border efficiency and customs compliance while offering multimodal transport solutions, which is significantly enhancing the Mexico CEP market outlook.

Mexico Courier, Express and Parcel (CEP) Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on service type, destination, type and end-use sector.

Service Type Insights:

- B2B (Business-to-Business)

- B2C (Business-to-Consumer)

- C2C (Customer-to-Customer)

The report has provided a detailed breakup and analysis of the market based on the service type. This includes B2B (business-to-business), B2C (business-to-consumer), and C2C (customer-to-customer).

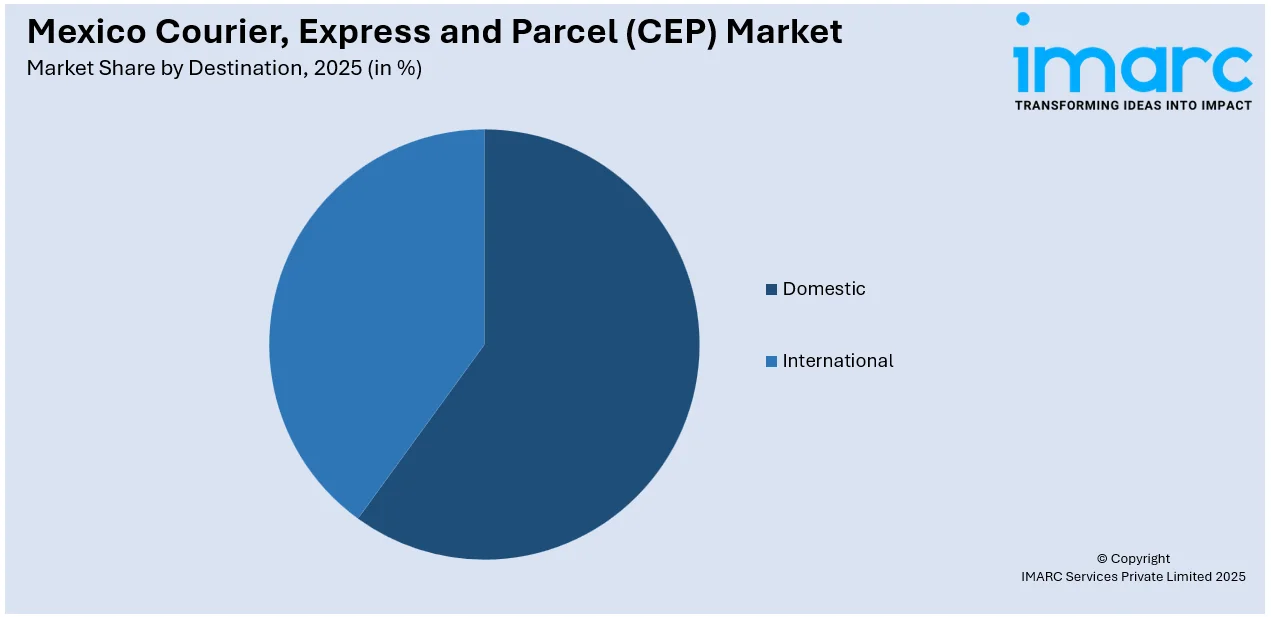

Destination Insights:

Access the comprehensive market breakdown Request Sample

- Domestic

- International

A detailed breakup and analysis of the market based on the destination have also been provided in the report. This includes domestic and international.

Type Insights:

- Air

- Ship

- Subway

- Road

The report has provided a detailed breakup and analysis of the market based on the type. This includes air, ship, subway, and road.

End-Use Sector Insights:

- Service (BFSI-Banking, Financial Services and Insurance)

- Wholesale and Retail Trade (E-commerce)

- Manufacturing, Construction, and Utilities

- Others

A detailed breakup and analysis of the market based on the end-use sector have also been provided in the report. This includes service (BFSI-banking, financial services and insurance), wholesale and retail trade (e-commerce), manufacturing, construction, and utilities, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Courier, Express and Parcel (CEP) Market News:

- In September 2024, Parcel Perform introduced a partnership program aimed at revolutionizing e-commerce delivery experiences, empowering logistics providers in Mexico to enhance their services through advanced data and technology solutions.

- In July 2024, UPS announced an agreement to acquire Estafeta, a leading Mexican express delivery company, to enhance its logistics network and capitalize on Mexico's growing role in global trade.

Mexico Courier, Express and Parcel (CEP) Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | B2B (Business-to-Business), B2C (Business-to-Consumer), C2C (Customer-to-Customer) |

| Destinations Covered | Domestic, International |

| Types Covered | Air, Ship, Subway, Road |

| End-Use Sectors Covered | Service (BFSI-Banking, Financial Services and Insurance), Wholesale and Retail Trade (E-commerce), Manufacturing, Construction, and Utilities, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico courier, express and parcel (CEP) market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico courier, express and parcel (CEP) market on the basis of service type?

- What is the breakup of the Mexico courier, express and parcel (CEP) market on the basis of destination?

- What is the breakup of the Mexico courier, express and parcel (CEP) market on the basis of type?

- What is the breakup of the Mexico courier, express and parcel (CEP) market on the basis of end-use sector?

- What is the breakup of the Mexico courier, express and parcel (CEP) market on the basis of region?

- What are the various stages in the value chain of the Mexico courier, express and parcel (CEP) market?

- What are the key driving factors and challenges in the Mexico courier express and parcel?

- What is the structure of the Mexico courier, express and parcel (CEP) market and who are the key players?

- What is the degree of competition in the Mexico courier, express and parcel (CEP) market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico courier, express and parcel (CEP) market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico courier, express and parcel (CEP) market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico courier express and parcel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)