Mexico Crane Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Mexico Crane Market Overview:

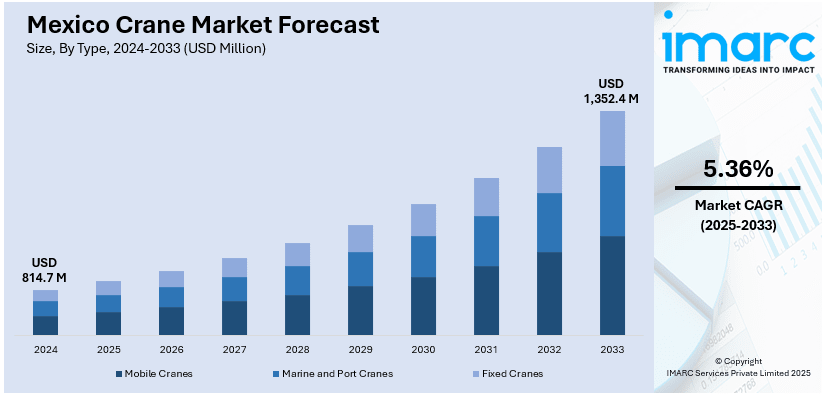

The Mexico crane market size reached USD 814.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,352.4 Million by 2033, exhibiting a growth rate (CAGR) of 5.36% during 2025-2033. The market is growing steadily, driven by rising infrastructure investments, booming construction activity, expanding manufacturing, rapid urbanization, growing demand for energy projects, continuous advancements in crane technology, and supportive government initiatives aimed at modernizing transportation and industrial facilities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 814.7 Million |

| Market Forecast in 2033 | USD 1,352.4 Million |

| Market Growth Rate 2025-2033 | 5.36% |

Mexico Crane Market Trends:

Expansion of Infrastructure and Construction Activities

The Mexico crane market is experiencing substantial growth because of the expanding construction activities and infrastructure development throughout the nation. In line with this, the government maintains its infrastructure project investments through railway development, alongside highway construction, airport construction, and port facility development. For instance, in May 2023, Altamira Terminal Portuaria (ATP) invested over US$26 million to enhance the Port of Altamira, including building a new 350-meter waterfront and acquiring yard cranes, driving regional crane demand and expanding port capacity by 30%. Moreover, the rapid urbanization in Mexico City, Monterrey, and Guadalajara is significantly driving the residential and commercial construction demand. Besides this, public-private partnerships (PPPs) are emerging as dominant forces, enabling complex capital-intensive projects that need extensive material handling solutions. Furthermore, the energy and mining sectors are contributing to crane demand through development and equipment installation activities. Consequently, both public and private sector initiatives are sustaining steady growth in the Mexican crane market. Ongoing infrastructure programs aimed at modernizing the nation and enhancing its logistics capabilities continue to drive this upward trend in market share.

Adoption of Advanced Crane Technologies

The increasing adoption of advanced crane technologies is driving the Mexico crane market growth, driven by the rising demand of contractors and fleet operators for better efficiency and safety, and sustainable practices. For example, in 2024, the Mexican government has pledged to allocate around 5% of its GDP annually toward infrastructure development, particularly in sectors such as transportation, energy, and water. This substantial public investment is creating increased demand for modern construction equipment, including technologically advanced cranes. In addition to this, modern cranes are equipped with digital control systems as well as global positioning system (GPS) tracking and remote operating capabilities for sensors to monitor loads and minimize operational downtime and boost performance statistics. Concurrently, real-time data collection that occurs through the Internet of Things (IoT) technology allows predictive maintenance and continuous safety surveillance. Besides this, smart equipment functions enable both longer equipment service periods and lower operational expenses, along with decreased risks. As maintenance costs decrease through IoT technology, more companies are adopting electric and hybrid crane models to fulfill environmental regulations in modern construction. Apart from this, modern training programs use digital tools along with simulators to improve the skills of workers. As a result, the market is undergoing a digital transformation, which attracts companies that want to maintain industry compliance together with competitiveness in modern business operations, which is enhancing the Mexico crane market outlook.

Mexico Crane Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Mobile Cranes

- Marine and Port Cranes

- Fixed Cranes

The report has provided a detailed breakup and analysis of the market based on the type. This includes mobile cranes, marine and port cranes, and fixed cranes.

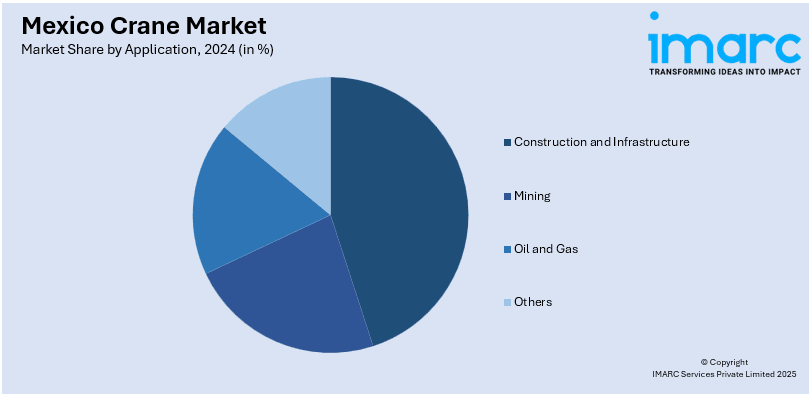

Application Insights:

- Construction and Infrastructure

- Mining

- Oil and Gas

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes construction and infrastructure, mining, oil and gas, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Crane Market News:

- In September 2024, Kinocranes showcased its advanced crane products and technologies at the FUNDIE XPD GIFA MEXICO 2024 event held from October 16-18, 2024. This participation aimed to foster communication and collaboration within the industry, driving innovation and market growth.

- In January 2024, Bobcat Company, a global leader in compact equipment, announced plans to invest approximately $300 million in a new manufacturing facility in Monterrey, Mexico, expected to begin production in early 2026. This expansion aims to increase production capacity for compact track and skid-steer loaders, creating 600 to 800 jobs and driving growth in the local crane and construction equipment market.

Mexico Crane Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Mobile Cranes, Marine and Port Cranes, Fixed Cranes |

| Application Covered | Construction and Infrastructure, Mining, Oil and Gas, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico crane market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico crane market on the basis of type?

- What is the breakup of the Mexico crane market on the basis of application?

- What is the breakup of the Mexico crane market on the basis of region?

- What are the various stages in the value chain of the Mexico crane market?

- What are the key driving factors and challenges in the Mexico crane?

- What is the structure of the Mexico crane market and who are the key players?

- What is the degree of competition in the Mexico crane market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico crane market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico crane market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico crane industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)