Mexico Crawler Crane Market Size, Share, Trends and Forecast by Type, Capacity, End User, and Region, 2026-2034

Mexico Crawler Crane Market Summary:

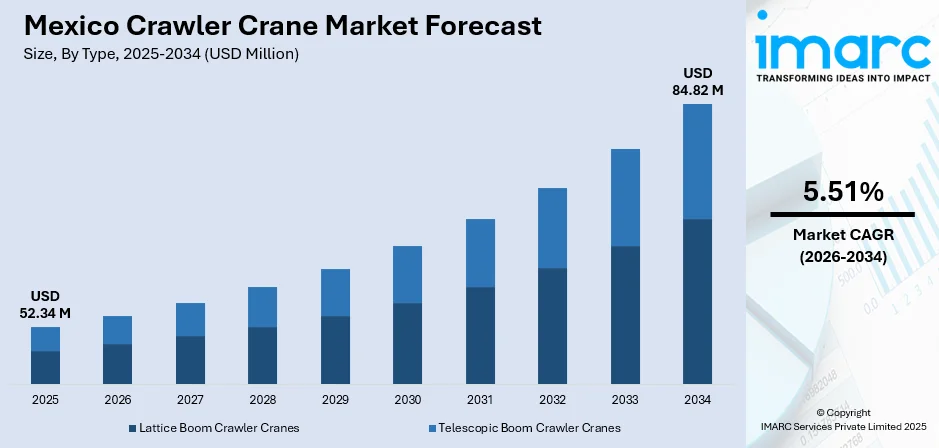

The Mexico crawler crane market size was valued at USD 52.34 Million in 2025 and is projected to reach USD 84.82 Million by 2034, growing at a compound annual growth rate of 5.51% from 2026-2034.

The Mexico crawler crane market growth is driven by the accelerating infrastructure development initiatives, including major transportation projects, expanding renewable energy installations, and sustained urbanization across key metropolitan areas. The convergence of nearshoring manufacturing trends, large-scale energy sector investments, and modernization of construction practices is fundamentally reshaping equipment demand patterns and creating substantial opportunities for market participants.

Key Takeaways and Insights:

- By Type: Lattice boom crawler cranes dominate the market with a share of 62% in 2025, driven by their superior lifting capacity and stability requirements for wind turbine installations, high-rise construction, and petrochemical infrastructure projects across Mexican industrial corridors.

- By Capacity: 50 to 250 metric tons lead the market with a share of 47% in 2025, owing to versatile application capabilities spanning mid-scale industrial construction, wind farm development, and infrastructure modernization projects requiring balanced lifting power and operational flexibility.

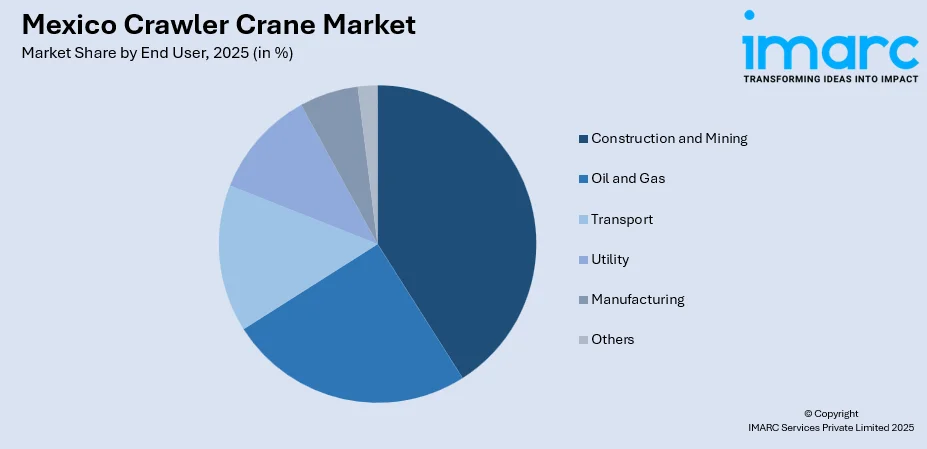

- By End User: Construction and mining represent the largest segment with a market share of 41% in 2025. This dominance is driven by the growing commercial construction activities in urban centers, expanding mining operations across mineral-rich regions, and government infrastructure investment programs.

- Key Players: The Mexico crawler crane market exhibits moderate competitive intensity, with multinational equipment manufacturers competing alongside regional rental service providers and specialized heavy lifting contractors across diverse project requirements and geographic markets.

To get more information on this market Request Sample

The Mexico crawler crane market is being driven by a combination of factors, including strong demand from the construction, mining, and energy sectors. Ongoing infrastructure projects, such as highway construction, bridge development, and urban expansion, are a primary driver, requiring specialized cranes for heavy lifting and precise operations. The strong demand from the construction, mining, and energy sectors, especially for heavy lifting in ongoing infrastructure projects, is exemplified by Mexico's investment of USD91.3 million in the reconstruction of two crucial bridges near Mexico City International Airport, with the first 500m bridge slated for completion by May 2026 and the second 700m bridge by October 2027. Additionally, the need for advanced technological features, such as telematics, remote monitoring, and improved safety systems, is catalyzing the demand for more sophisticated models. Moreover, the expansion of the mining industry in Mexico, requiring cranes for resource extraction and site development, contributes to the market growth, reinforcing its dynamic expansion.

Mexico Crawler Crane Market Trends:

Infrastructure Development

The Mexico crawler crane market growth is driven by large-scale infrastructure projects, including the construction of highways, bridges, and residential complexes. As urbanization accelerates, the demand for heavy-duty equipment like crawler cranes rises to support complex construction tasks, such as lifting heavy materials and providing the reach needed for multi-story buildings. In 2025, the completion of the Bavispe-Nuevo Casas Grandes highway, a USD 100 million project linking Sonora and Chihuahua, highlights Mexico's commitment to expanding its infrastructure. This project, part of a larger national plan with 370 billion pesos in investments, strengthens the need for specialized cranes, ensuring both efficiency and safety during construction.

Rising Demand for Sustainable Construction Practices

As Mexico embraces eco-friendly construction practices, there is an increase in the need for specialized machinery capable of supporting renewable energy projects, green building initiatives, and sustainable urban development. Crawler cranes equipped with efficient fuel systems and low-emission technologies are essential in meeting these sustainability goals. In 2025, Mexico's Ministry of Environment and Natural Resources approved the $1.3 billion Tango Solar green hydrogen project in Sinaloa, a key initiative in Mexico's National Renewable Hydrogen Plan. This project, which will produce up to 41,485 tons of hydrogen annually, exemplifies the increasing demand for environmentally-conscious construction methods, driving the need for cranes that meet stringent sustainability standards.

Increased Investment in Construction and Real Estate

The rise in both residential and commercial construction in Mexico is driving the demand for heavy-duty cranes capable of handling large, complex projects. This need is especially pronounced with the construction of skyscrapers, multi-story commercial buildings, and large infrastructure projects that require precise lifting and heavy material handling. In 2025, Mexico’s Housing for Well-Being program, supported by INFONAVIT, aims to deliver 6,401 homes by year-end, contributing to the broader goal of constructing 1.2 million homes during President Sheinbaum's administration. This ongoing investment in construction activities further drives the demand for crawler cranes to ensure the efficient execution of these high-demand projects.

Market Outlook 2026-2034:

The Mexico crawler crane market is poised for growth during the forecast period, driven by ongoing infrastructure development and evolving industrial expansion. As the country continues to invest in large-scale construction projects, including roads, bridges, and energy facilities, the demand for specialized machinery like crawler cranes is expected to increase. The market generated a revenue of USD 52.34 Million in 2025 and is projected to reach a revenue of USD 84.82 Million by 2034, growing at a compound annual growth rate of 5.51% from 2026-2034.

Mexico Crawler Crane Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Lattice Boom Crawler Cranes | 62% |

| Capacity | 50 to 250 Metric Tons | 47% |

| End User | Construction and Mining | 41% |

Type Insights:

- Lattice Boom Crawler Cranes

- Telescopic Boom Crawler Cranes

Lattice boom crawler cranes exhibit a clear dominance with a 62% share of the total Mexico crawler crane market in 2025.

Lattice boom crawler cranes represent the largest segment, driven by their robust design and versatility. The suitability of lattice boom crawler cranes for heavy lifting in large-scale energy developments is particularly relevant as Mexico progresses with projects like its first tidal energy project, set to launch in Cozumel between August and September 2025, which aims to diversify the country's energy sources.

Additionally, lattice boom crawler cranes offer superior stability and reach, which are essential for tasks that require high lifting capacity and extended reach. Their ability to handle extreme loads and operate on rough terrain further enhances their dominance in the market, particularly in demanding industrial applications.

Capacity Insights:

- Below 50 Metric Tons

- 50 to 250 Metric Tons

- 250 to 450 Metric Tons

- More than 450 Metric Tons

50 to 250 metric tons lead with a share of 47% of the total Mexico crawler crane market in 2025.

Crawlers with a capacity of 50 to 250 metric tons hold the biggest market share due to their ideal balance of power and versatility. These cranes are capable of handling a wide range of construction projects, making them well-suited for medium to large-scale industrial applications. This demand for efficient, high-capacity cranes in urban and infrastructure projects is directly reflected in procurement decisions, as demonstrated by Magruber, a Mexican crane company, which added six new Liebherr mobile cranes with lifting capacities between 120 and 230 tons to its fleet in 2024 for projects in Mexico City.

Moreover, cranes within this capacity range are highly sought after for their efficiency in urban and infrastructure development projects. Their ability to lift substantial weights while maintaining mobility and stability on various terrains makes them a preferred choice for construction, energy, and mining sectors across Mexico.

End User Insights:

Access the Comprehensive Market Breakdown Request Sample

- Construction and Mining

- Oil and Gas

- Transport

- Utility

- Manufacturing

- Others

Construction and mining dominate with a market share of 41% of the total Mexico crawler crane market in 2025.

Construction and mining lead the market owing to the significant demand for heavy-duty machinery in large-scale infrastructure and resource extraction projects. Crawler cranes provide essential lifting capabilities for tasks, such as building skyscrapers, roads, bridges, and mining operations. This dominance of the construction and mining sectors, which drives the demand for heavy-duty crawler cranes, is validated by major public works, such as Mexico's 2025 announcement of a USD103 million investment to rehabilitate and modernize 68 bridges in Guerrero, which includes the construction of 45 new bridges.

Additionally, the construction and mining sectors require cranes capable of operating on rough terrains and handling extreme loads, making crawler cranes the ideal choice. Their versatility, stability, and ability to reach great heights make them indispensable for both construction sites and mining fields, driving market growth in Mexico.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico is a key region for the crawler crane market, driven by its strong industrial base. The demand for cranes is supported by large-scale infrastructure projects, particularly in energy, mining, and manufacturing sectors.

Central Mexico, especially Mexico City, is a hub for construction and industrial activities. The region’s urban development and infrastructure projects drives the demand for crawler cranes. This market is also driven by ongoing investment in roads, commercial buildings, and energy infrastructure.

Southern Mexico is witnessing growth in the crawler crane market, with increased focus on improving infrastructure in rural and underserved areas. Expansion projects in energy, mining, and tourism are driving demand for cranes capable of handling diverse, often challenging terrain.

Others include regions like the Yucatán Peninsula, where the crawler crane market is growing. These areas are seeing investments in infrastructure and tourism-related projects, catalyzing the demand for specialized cranes to meet the needs of large-scale construction and development.

Market Dynamics:

Growth Drivers:

Why is the Mexico Crawler Crane Market Growing?

Growing Employment in Mining Sector

Crawler cranes are indispensable in mining operations, particularly for handling heavy machinery and moving large payloads in challenging terrains. As Mexico continues to develop its mining resources, the demand for specialized lifting equipment is increasing. Cranes with stability, extended reach, and high lifting capacities are crucial for efficient mining, especially in remote or rugged locations. In October 2024, five mining companies in Mexico are set to launch new operations, including Torex Gold's Media Luna project in Guerrero and Endeavor Silver's Terronera project in Jalisco. These ventures, alongside Mexico's growing prominence as a gold and silver producer, further drives the demand for crawler cranes in the mining sector.

Government Initiatives and Policy Support

Significant government investments in Mexico’s infrastructure sector are catalyzing the demand for crawler cranes to support large-scale construction projects. These large-scale projects, including highways, airports, and railways, require advanced lifting equipment for construction and maintenance. In 2025, Mexico’s Ministry of Infrastructure, Communications, and Transport (SICT) launched its National Highway Infrastructure Program for 2025-2030, allocating MXN 173 billion (USD 8.47 billion) to improve 4,000 km of roads and construct 18 bridges. Such public sector initiatives, coupled with policies enhancing urban development and industrial capacity, increase the need for high-capacity, reliable crawler cranes.

Increasing Employment in Oil and Gas Sector

Mexico’s oil and gas sector, particularly in offshore and onshore drilling operations, is a key factor bolstering the market growth. Cranes are essential for lifting heavy equipment and facilitating the installation and maintenance of large structures in challenging environments. In 2024, Mexico’s hydrocarbons regulator CNH approved Pemex's US$35.2 million drilling plan for the Nichte-1EXP well in Tabasco, scheduled to start in July. This project, targeting heavy oil at depths of over 3,400 meters, underscores the growing need for high-capacity crawler cranes to support complex and high-load operations, positively influencing the market.

Market Restraints:

What Challenges the Mexico Crawler Crane Market is Facing?

Regulatory and Permitting Complexities Delaying Project Execution

Complex regulatory frameworks and lengthy permitting processes in Mexico create delays in project execution, affecting crawler crane deployment schedules. Environmental impact assessments, land use approvals, and sector-specific permits require significant time and documentation, resulting in uncertainty for project initiation. These regulatory hurdles complicate equipment procurement planning, delaying construction timelines and hindering market growth.

Skilled Operator Availability Constraining Market Expansion

A shortage of certified, skilled operators for modern crawler cranes is limiting the market growth in Mexico. Advanced cranes with sophisticated systems require operators with specialized training beyond basic certification. This gap in workforce expertise leads to delays in project execution, restricting the number of cranes that can be deployed efficiently and hindering overall market growth.

Safety Concerns and Accidents

Safety is a major concern in the crawler crane market due to their size and complexity. Accidents or equipment failures can lead to expensive downtime, legal liabilities, and property damage. To mitigate these risks, it’s crucial to implement stringent safety protocols, conduct regular maintenance, and ensure compliance with safety regulations to protect workers and assets.

Competitive Landscape:

The Mexico crawler crane market exhibits moderate competitive intensity characterized by the presence of multinational equipment manufacturers alongside established regional rental service providers and specialized heavy lifting contractors. Market dynamics reflect strategic positioning ranging from equipment sales emphasizing advanced technology, enhanced lifting capacities, and operational efficiency to rental-focused business models serving project-specific requirements across diverse end-user segments. The competitive landscape is increasingly shaped by after-sales service capabilities, operator training programs, and fleet modernization investments as contractors seek reliable equipment partners capable of supporting complex projects.

Recent Developments:

- April 2025: Mexican heavy lifting firm ESEASA expanded its fleet by acquiring five new Liebherr mobile cranes including two LTM 1650-8.1 models, two LTM 1400-6.1 units, and one LTM 1250-5.1. The equipment will support projects across wind energy, oil and gas, and infrastructure sectors throughout Mexico.

- November 2024: ESEASA, a Mexican crane and heavy haulage company, received the first Liebherr LR 1700-1.0W narrow track crawler crane in Central and South America. This 700-ton crane was the most powerful of its type, designed for wind power and offshore platform projects. ESEASA's investment aimed to enhance their lifting capabilities for energy sector projects across Mexico and beyond.

- July 2024: Elecnor commenced construction of the Cimarrón wind farm in Baja California, representing approximately three hundred twenty megawatts of capacity with sixty-four wind turbines. The project, developed by Sempra Infrastructure, represents one of the largest wind power developments in Mexico requiring substantial crawler crane deployment for turbine installation.

Mexico Crawler Crane Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Lattice Boom Crawler Cranes, Telescopic Boom Crawler Cranes |

| Capacities Covered | Below 50 Metric Tons, 50 to 250 Metric Tons, 250 to 450 Metric Tons, More than 450 Metric Tons |

| End Users Covered | Construction and Mining, Oil and Gas, Transport, Utility, Manufacturing, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico crawler crane market size was valued at USD 52.34 Million in 2025.

The Mexico crawler crane market is expected to grow at a compound annual growth rate of 5.51% from 2026-2034 to reach USD 84.82 Million by 2034.

Lattice boom crawler cranes dominated the market with approximately 62% revenue share in 2025, driven by superior lifting capacities required for wind energy installations and petrochemical infrastructure projects.

Key factors driving the Mexico crawler crane market include rise in residential and commercial construction, which require heavy-duty cranes capable of handling large projects. In 2025, Mexico’s Housing for Well-Being program plans to deliver 6,401 homes, contributing to the goal of 1.2 million homes, further increasing the need for crawler cranes.

Major challenges include regulatory complexities and permitting delays, which hinders timely project execution, impacting crawler crane deployment. Environmental assessments and sector-specific approvals add uncertainty, complicating procurement planning. Additionally, a shortage of skilled operators further restricts market growth by limiting crane efficiency and deployment capacity.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)