Mexico Crop Insurance Market Size, Share, Trends and Forecast by Coverage, Distribution Channel, and Region, 2025-2033

Mexico Crop Insurance Market Overview:

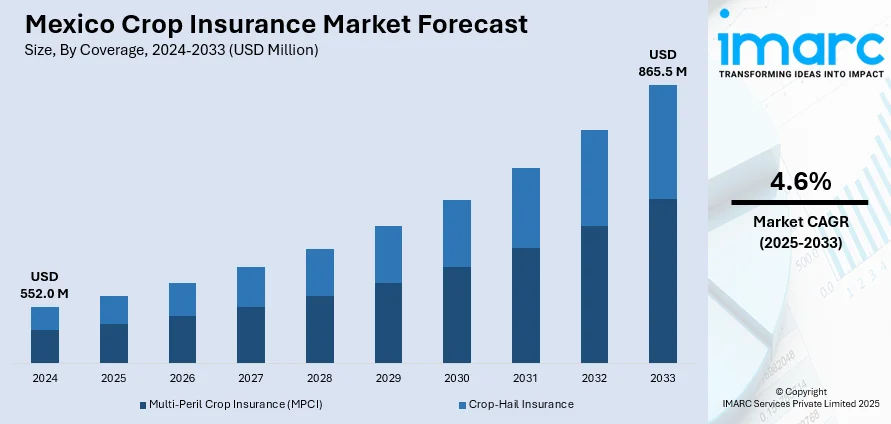

The Mexico crop insurance market size reached USD 552.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 865.5 Million by 2033, exhibiting a growth rate (CAGR) of 4.6% during 2025-2033. The market is driven by the growing climate uncertainty causing significant losses in agricultural output, government intervention in the form of subsidies and policy initiatives, and rising use of precision farming technologies, high-yielding seed varieties, and mechanized farming.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 552.0 Million |

| Market Forecast in 2033 | USD 865.5 Million |

| Market Growth Rate 2025-2033 | 4.6% |

Mexico Crop Insurance Market Trends:

Climate Change and Weather-Related Risks

The growing climate uncertainty is offering a favorable market outlook in Mexico. Almost 76% of the nation was suffering from drought by the end of May 2024, the North American Drought Monitor (NADM) reported. It is the widest-reaching drought that Mexico has suffered since June 30, 2011, when slightly more than 85% of the nation was affected. The country is extremely vulnerable to extreme weather conditions like droughts, floods, hurricanes, and abnormal rainfall because of its varied geography and climatic regions. These conditions lead to significant losses in agricultural output, affecting food security and farmers' incomes. As climate change worsens the severity and frequency of such events, financial risk management tools, including crop insurance, become more urgent. Insurance products are becoming more sophisticated to account for a multitude of weather-related perils through parametric models and satellite data for actual damage measurement. Further, climatic unpredictability promotes both big agribusinesses and small farmers to acquire financial protection to continue their operations and invest in subsequent cropping seasons. Increasing awareness about climate resilience among stakeholders also contributes to the market growth.

Government Subsidies and Policy Support

Government intervention in the form of subsidies and policy initiatives is increasing the adoption of crop insurance in Mexico. The government is offering premium subsidies to reduce the financial burden on farmers, particularly those involved in small-scale and subsistence farming. Secretariat of Agriculture and Rural Development (SADER) 2024 fiscal year budget allowance was 74.1 billion pesos (approximately USD 4.3 billion), up about five percent from SADER's 2023 budget. The rise in budget is in line with inflation, which was 4.7 percent in 2023. Moreover, with various institutions, federal and state governments cover, fully or in part, catastrophic losses. These measures limit the financial risk of crop loss and encourage the purchase of insurance. Also, a regulatory framework in support of public-private partnerships is promoting the involvement of commercial insurers, with the infusion of innovation and greater product range. Policy regimes to boost financial inclusion, rural growth, and climate risk management still strengthen the structural backbone of the market. Such policy-driven environment facilitates a sustainable and scalable growth trajectory of crop insurance for traditional as well as emerging agricultural zones.

Agricultural Modernization and Technological Advancements

The modernization of Mexico's agricultural sector is another major factor bolstering the market growth. The use of precision farming technologies, high-yielding seed varieties, and mechanized farming is raising the financial stakes for farmers, leading to the need for insurance protection. These advancements also enable insurers to more accurately evaluate risk and create personalized coverage plans based on data analytics, geospatial methodologies, and remote sensing. For example, drones and satellite imagery allow for real-time monitoring and post-disaster evaluation, cutting down on claim disputes and accelerating settlements. Further, digital platforms are making the insurance buying and claims process easier, increasing accessibility to remote rural villages. The application of fintech and agri-tech applications is also allowing farmers to access insurance services, usually through mobile phones. This integration of technology enhances risk management structures and builds confidence in insurance products. The IMARC Group predicts that the Mexico fintech marker size is expected to reach USD 65.9 Billion by 2033.

Mexico Crop Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forforecasts at the region level 2025-2033. Our report has categorized the market based on coverage and distribution channel.

Coverage Insights:

- Multi-Peril Crop Insurance (MPCI)

- Crop-Hail Insurance

The report has provided a detailed breakup and analysis of the market based on the coverage. This includes multi-peril crop insurance (MPCI) and crop-hail insurance.

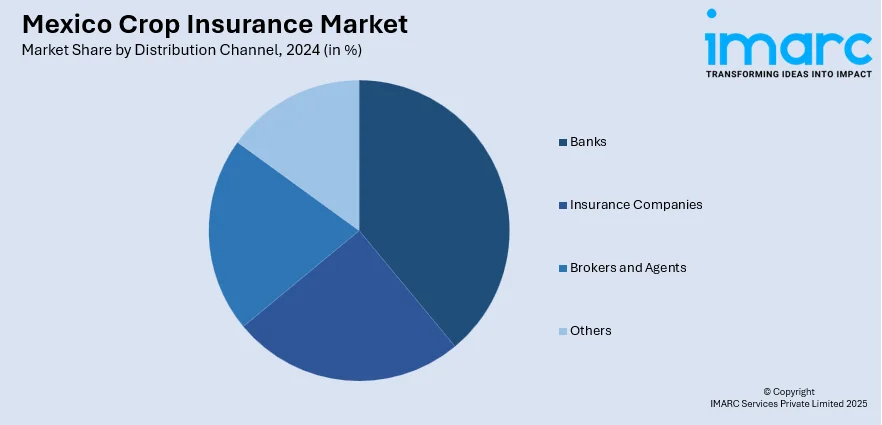

Distribution Channel Insights:

- Banks

- Insurance Companies

- Brokers and Agents

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes banks, insurance companies, brokers and agents, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Crop Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Coverages Covered | Multi-Peril Crop Insurance (MPCI), Crop-Hail Insurance |

| Distribution Channels Covered | Banks, Insurance Companies, Brokers and Agents, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico crop insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico crop insurance market on the basis of coverage?

- What is the breakup of the Mexico crop insurance market on the basis of distribution channel?

- What is the breakup of the Mexico crop insurance market on the basis of region?

- What are the various stages in the value chain of the Mexico crop insurance market?

- What are the key driving factors and challenges in the Mexico crop insurance market?

- What is the structure of the Mexico crop insurance market and who are the key players?

- What is the degree of competition in the Mexico crop insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico crop insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico crop insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico crop insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)