Mexico Crushing and Screening Equipment Market Size, Share, Trends and Forecast by Equipment Type, Mobility Type, End User, and Region, 2025-2033

Mexico Crushing and Screening Equipment Market Overview:

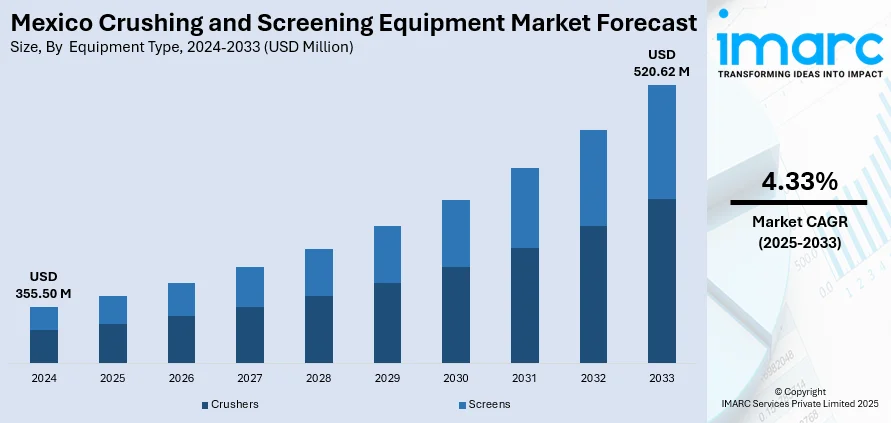

The Mexico crushing and screening equipment market size reached USD 355.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 520.62 Million by 2033, exhibiting a growth rate (CAGR) of 4.33% during 2025-2033. Expanding infrastructure projects, increasing government investments in renewable energy and power plants, and rising demand for aggregates in the construction industry are fueling the market growth. Moreover, technological advancements in equipment, the preference for mobile machinery, growth in public-private partnerships, and the push for recycled construction materials are supporting the market growth. Furthermore, surging construction and demolition waste, stricter environmental regulations, the adoption of smart technologies, greater presence of international players, and improved equipment efficiency are factors stimulating the Mexico crushing and screening equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 355.50 Million |

| Market Forecast in 2033 | USD 520.62 Million |

| Market Growth Rate 2025-2033 | 4.33% |

Mexico Crushing and Screening Equipment Analysis:

- Major Market Drivers: Expanding infrastructure projects and increasing government investments in renewable energy and power plants are the primary growth catalysts. Rising demand for aggregates in construction industry, coupled with technological advancements in equipment and preference for mobile machinery, further accelerates market expansion.

- Key Market Trends: Growing adoption of smart technologies, increased presence of international players, and improved equipment efficiency characterize current market dynamics. Public-private partnerships and push for recycled construction materials create new growth avenues in the Mexico crushing and screening equipment market analysis.

- Market Challenges: Environmental regulations impose stricter compliance requirements while construction and demolition waste management presents operational challenges. Market players face pressure to balance cost-effectiveness with sustainability requirements, potentially impacting market growth.

- Market Opportunities: Surging construction activities in urban centers and government focus on infrastructure modernization present significant growth opportunities. The shift toward sustainable practices and recycled materials opens new market segments, enhancing Mexico crushing and screening equipment market demand across industries.

Mexico Crushing and Screening Equipment Market Trends:

Expansion of Infrastructure Development in Mexico

Mexico's infrastructure growth is one of the main drivers for the crushing and screening equipment industry. The nation has experienced strong growth in road networks, urbanization, and industrial schemes over the last ten years. The government's focus on enhancing roads, bridges, and ports has resulted in higher demand for construction aggregates like crushed stone, sand, and gravel as these are prime materials for these developments. Additionally, the demand for processed aggregates is rising due to growing urbanization within the nation, where populations in large urban centers like Monterrey and Mexico City continue to rise and demand more construction activity and aggregates. These activity requires efficient, high-capacity machinery to meet mounting demand for aggregate material, thus driving demand for crushing and screening.

To get more information on this market, Request Sample

Governmental Investments in Green Power and Energy Plants

Mexico's development of power plants and renewable energy is another key impetus for the crushing and screening equipment market. The government has introduced ambitious goals to diversify its energy mix, including the percentage of renewable energy contribution to the power industry. Mexico aims to generate 35% of its power from clean energy sources by 2024, according to the Mexican Energy Ministry. These include large-scale renewable energy projects such as wind farms, solar power plants, and geothermal power plants, for which aggregates are utilized in their construction. For example, wind farm installations require crushed rock and other base materials, while solar power plant installations require great tons of crushed stone for their frames. All these power projects create demand for high-quality, large-scale crushing and screening machinery, which can process raw materials at very high efficiency. As investments in such machinery continue to increase, the need for the same is bound to register a steep rise in the coming years.

Growing Demand for Aggregates in the Construction Industry

The construction industry in Mexico is a primary driver of demand for crushing and screening equipment. The country's fast-growing population and urbanization have led to residential, commercial, and industrial construction projects surging. This growth is specifically due to the rising demand for construction materials, namely aggregates, such as crushed stone, gravel, and sand, which play a vital role in developing infrastructure, residential homes, roads, and commercial buildings. This demand has led contractors and construction companies to invest in efficient crushing and screening plants that possess the ability to crush raw materials at the location, reducing transportation expenses and improving efficiency in operations. With more building projects lined up in the next couple of years, particularly in urban areas, demand for crushing and screening equipment in Mexico is projected to witness a positive surge.

Mexico Crushing and Screening Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on equipment type, mobility type, end user.

Equipment Type Insights:

- Crushers

- Jaw Crushers

- Cone Crushers

- Impact Crushers

- Others

- Screens

- Vibrating Screens

- Trommel Screens

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes crushers (jaw crushers, cone crushers, impact crushers, and others) and screens (vibrating screens, trommel screens, and others).

Mobility Type Insights:

- Stationary Equipment

- Mobile Equipment

A detailed breakup and analysis of the market based on the mobility type have also been provided in the report. This includes stationary equipment and mobile equipment.

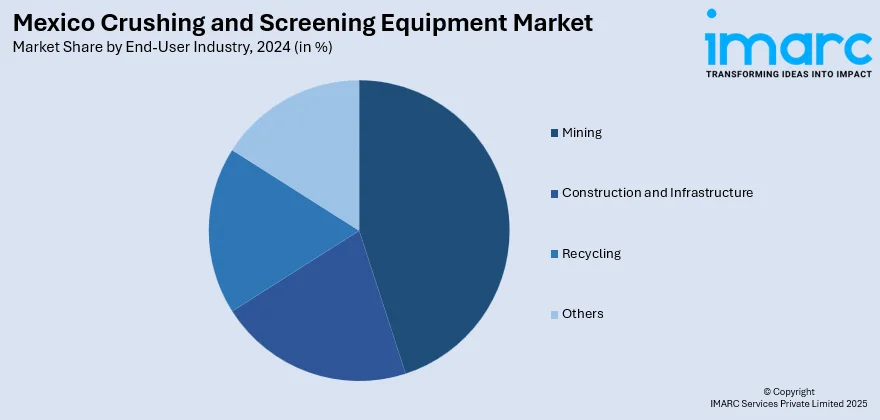

End-User Industry Insights:

- Mining

- Construction and Infrastructure

- Recycling

- Others

The report has provided a detailed breakup and analysis of the market based on the end-user industry. This includes mining, construction and infrastructure, recycling, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Recent News and Development:

- In March 2024, Metso launched three new products: the Nordberg HP350e cone crusher, TSE Series triple shaft horizontal screen, and new wear parts to enhance uptime and performance. The HP350e, part of the Nordberg HPe series, is a larger, high-performance crusher compared to the HP200e, expanding the series’ offerings for various production needs. Metso, headquartered in Finland, continues to strengthen its global presence with innovative solutions for the aggregates industry.

Mexico Crushing and Screening Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered |

|

| Mobility Types Covered | Stationary Equipment, Mobile Equipment |

| End User Industries Covered | Mining, Construction and Infrastructure, Recycling, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico crushing and screening equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico crushing and screening equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico crushing and screening equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The crushing and screening equipment market in Mexico was valued at USD 355.50 Million in 2024.

The Mexico crushing and screening equipment market is projected to exhibit a CAGR of 4.33% during 2025-2033, reaching a value of USD 520.62 Million by 2033.

Expanding infrastructure projects, increasing government investments in renewable energy and power plants, rising demand for aggregates in construction industry, technological advancements in equipment, preference for mobile machinery, growth in public-private partnerships, push for recycled construction materials, surging construction and demolition waste, and adoption of smart technologies are key drivers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)