Mexico Cutlery Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Application, and Region, 2025-2033

Mexico Cutlery Market Overview:

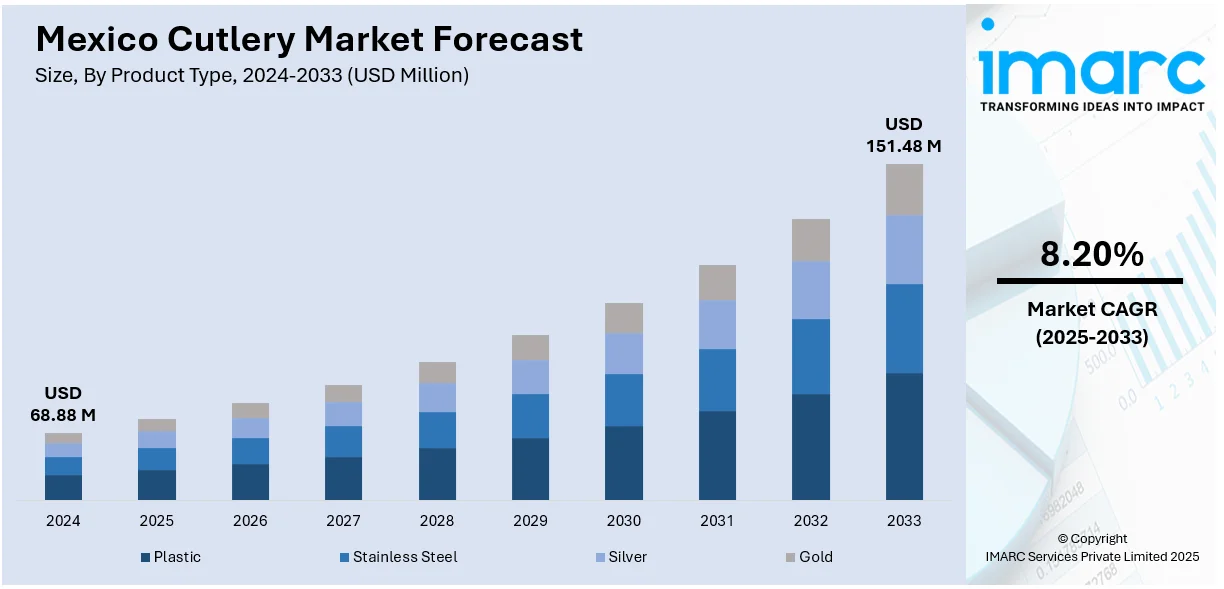

The Mexico cutlery market size reached USD 68.88 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 151.48 Million by 2033, exhibiting a growth rate (CAGR) of 8.20% during 2025-2033. The market is fueled by amplifying demand for high-quality, handcrafted products focusing on quality and heritage. Expansion of digital retail channels is expanding consumer reach, allowing manufacturers to reach more consumers with greater efficiency. Sustainability is also emerging as a major concern with green materials becoming increasingly popular among eco-friendly consumers. All these factors combined contribute to the rising Mexico cutlery market share, depicting a vibrant and changing industry scenario.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 68.88 Million |

| Market Forecast in 2033 | USD 151.48 Million |

| Market Growth Rate 2025-2033 | 8.20% |

Mexico Cutlery Market Analysis:

- Major Drivers: Increased consumer demand for high-quality, handmade cutlery products along with with Mexico's rich tradition in craftsmanship propels market growth. Online retail expansion increases accessibility, while environmental concerns enhance demand for sustainable materials. Economic stability and urbanization also contribute to the Mexico cutlery market growth path across various consumer segments.

- Key Market Trends: Growing use of eco-friendly materials such as recycled metals and biodegradable materials defines contemporary consumption habits. Online marketplaces aid in market penetration, allowing small producers to gain access to more people. Premium positioning strategies based on craftsmanship level capture quality-driven customers, reinforcing Mexico cutlery market analysis findings.

- Market Challenges: Mass-produced imports create substantial price competition that local manufacturers find difficult to contend against. Volatility in raw material prices affects profit margins. Inability of artisanal producers to increase production capacity creates limitations on scalability. Economic volatilities and shifting consumer expenditure trends cause market volatility in Mexico cutlery market trends.

- Market Opportunities: Export opportunities to global markets in need of genuine Mexican craftsmanship offer sizeable expansion prospects. Development in eco-friendly materials creates new market channels. Online marketing techniques can boost brand presence and customer interaction. Collaborations with hospitality industry drive business demand.

Mexico Cutlery Market Trends:

Increasing Demand for Luxury and Artisan Cutlery

Mexico's cutlery industry is highly dominated by a trend towards premium and artisanal products, led by demand from consumers for higher quality and distinctive craftsmanship. With lifestyles changing, there is an increasing desire for durable, high-performance cutlery constructed from high-tech materials including high-grade stainless steel and forged blades. Demand is supported by Mexico's high artisanal tradition, in which traditional manufacturing skills combine with modern design innovation. The demand for hand-made cutlery is a step away from cheap, mass-produced cutlery towards products that provide longevity and beauty. Quality over quantity is the emphasis behind the demand for hand-made cutlery, which supports local industries and craftsmen and paves the way for export markets and niche opportunities. Therefore, this trend among consumers plays a crucial role in Mexico cutlery growth, with support for investment in expertise and high-end product lines that satisfy the expectations of quality-conscious purchasers within domestic and foreign markets.

To get more information on this market, Request Sample

Growth of Online Retail Channels

Mexico's retail market is being rapidly digitalized, changing the way people buy cutlery, with online platforms becoming ever more crucial. E-commerce platforms provide the convenience of wide product availability, product feature comparisons, and reviews, making purchase decisions easier. Consumers are not only gaining from increased choice and competitive prices but also enabling small and medium-sized producers to reach beyond the local markets. Amplified smartphone penetration and internet access throughout Mexico are propelling this shift, where digital sales are becoming an important pillar for the growth of the cutlery market. Improved payment systems and logistics also contribute to seamless transactions, complementing the long-term rise in buying cutlery through digital channels. This boosting dependence on internet shopping adds to Mexico cutlery growth by expanding consumer access as well as allowing for creative marketing and sales initiatives optimized for contemporary purchasing behavior.

Sustainability and Eco-Friendly Materials Catching On

Sustainability is highly becoming a determining influence in Mexico's cutlery industry as consumers intensely become aware of their environment and look for products that consume less. There is an increasing demand for cutlery produced using recycled metals, biodegradable materials, and green coatings, as evidence of a worldwide move toward green consumerism. For instance, in December 2024, Mexico's BioFase launched cutlery from avocado seeds that biodegrades after only 240 days, providing a sustainable substitute for plastic using local agricultural residues. Moreover, companies are increasingly embracing green production methods, such as the minimization of packaging waste and enhanced resource use efficiency. This movement appeals to an amplifying demographic that is concerned with responsible consumption and corporate environmental stewardship. As consumers become more aware of sustainability matters, new ways in material sourcing and product design are evolving, which appeal not only to green consumers but also help brands stand out in a crowded marketplace. These trends facilitate the sustained Mexico cutlery growth, encouraging producers to adapt to environmental norms while serving consumers' demands for quality and sustainability.

Mexico Cutlery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and application.

Product Type Insights:

- Plastic

- Stainless Steel

- Silver

- Gold

The report has provided a detailed breakup and analysis of the market based on the product type. This includes plastic, stainless steel, silver, and gold.

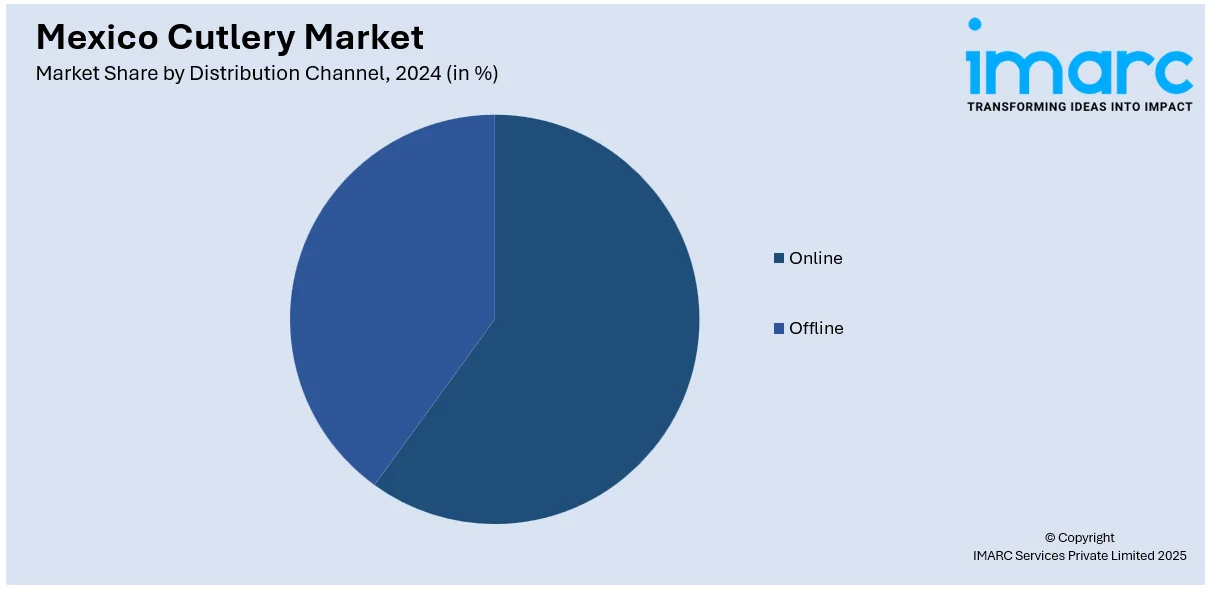

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

Application Insights:

- Household

- Public Consumption Restaurant

- High-end Restaurant

The report has provided a detailed breakup and analysis of the market based on the application. This includes household, public consumption restaurant, and high-end restaurant.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Cutlery Market News:

- In March 2024, Mexican brand GreenprintMX introduced high-end biodegradable straws and cutlery made from agave by-products, starch, and groundbreaking PHA bioplastics. This makes it sustainable by upcycling tequila industry waste while also encouraging economic development for small-scale farmers. GreenprintMX is further expanding its green products in international markets.

Mexico Cutlery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Plastic, Stainless Steel, Silver, Gold |

| Distribution Channels Covered | Online, Offline |

| Applications Covered | Household, Public Consumption Restaurant, High-end Restaurant |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico cutlery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico cutlery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico cutlery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cutlery market in Mexico was valued at USD 68.88 Million in 2024.

The Mexico cutlery market is projected to exhibit a CAGR of 8.20% during 2025-2033, reaching a value of USD 151.48 Million by 2033.

The market is driven by amplifying demand for high-quality, handcrafted products focusing on quality and heritage. Digital retail channel expansion enhances consumer reach and accessibility. Sustainability concerns promote eco-friendly material adoption among environmentally conscious consumers supporting sustained market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)