Mexico Cutting Tools Market Size, Share, Trends and Forecast by Type, Material Type, Application, and Region, 2025-2033

Mexico Cutting Tools Market Overview:

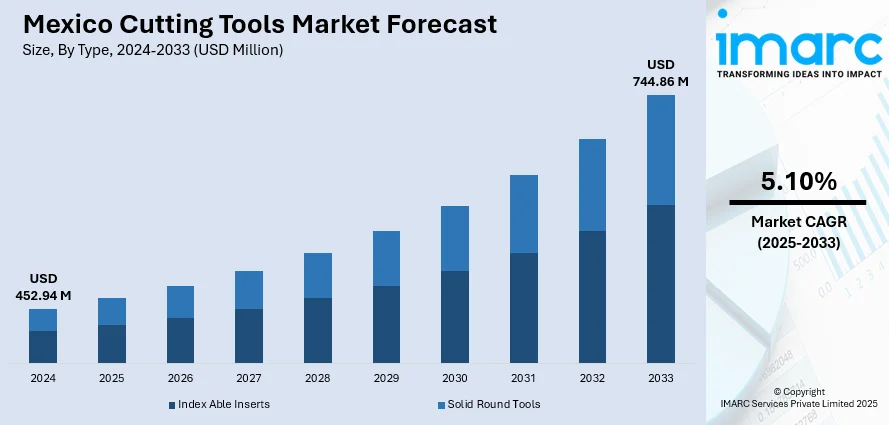

The Mexico cutting tools market size reached USD 452.94 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 744.86 Million by 2033, exhibiting a growth rate (CAGR) of 5.10% during 2025-2033. The market is driven by rapid industrial growth, especially in automotive and aerospace manufacturing. Increasing demand for precision and efficiency pushes adoption of advanced cutting tools. Technological advancements like computer numerical control (CNC) machines and Industry 4.0 integration enhance productivity, fueling market expansion. Additionally, trade agreements boost foreign investment and manufacturing activities. Growing focus on sustainability encourages use of durable, eco-friendly materials thus strengthening the Mexico cutting tools market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 452.94 Million |

| Market Forecast in 2033 | USD 744.86 Million |

| Market Growth Rate 2025-2033 | 5.10% |

Mexico Cutting Tools Market Analysis:

- Major Drivers: The Mexico cutting tools market growth is primarily driven by the rapid expansion of automotive and aerospace industries, technological advancements in smart manufacturing, increasing foreign investments through trade agreements, and growing demand for precision-engineered components requiring high-performance cutting tools.

- Key Market Trends: Key trends shaping the Mexico cutting tools market analysis include adoption of Industry 4.0 technologies, shift towards sustainable materials like carbide and ceramics, integration of IoT and CNC systems, and focus on digitalization and automation in manufacturing processes.

- Market Challenges: The market faces challenges including intense competition from established international players, need for continuous technological upgrades, skilled workforce shortage, fluctuating raw material costs, and maintaining quality standards while managing production costs in a competitive environment.

- Market Opportunities: Significant opportunities exist in expanding manufacturing capabilities, developing advanced material technologies, strengthening supply chain networks, capitalizing on nearshoring trends, and meeting growing demand for precision tools in emerging industrial sectors across Mexico.

Mexico Cutting Tools Market Trends:

Expansion of Automotive and Aerospace Sectors

Mexico's cutting tool market is largely propelled by the high-speed growth of its automotive and aerospace industries. Mexico's strategic geographic location and robust trade agreements render it an excellent destination for international manufacturers. These markets demand high-precision cutting tools to manufacture intricate parts such as engine components and turbine blades. As vehicle and aircraft production volumes keep increasing, manufacturers more and more require tough, high-performance tools that guarantee accuracy and efficiency. This increasing demand is challenging toolmakers to experiment with new materials like carbide and ceramics and emphasize precision engineering. The Mexico cutting tools market trends show significant growth in these sectors, with manufacturers investing heavily in advanced tooling technologies. In addition, the need to meet international quality and performance requirements has challenged local as well as international suppliers to invest in latest tooling technologies. Cumulatively, these aspects are establishing a vibrant landscape in which Mexico is becoming a principal hub for high-end cutting tool production and distribution.

To get more information on this market, Request Sample

Adoption of Smart Manufacturing Technologies

Industry 4.0 is transforming Mexico’s manufacturing sector, driving major shifts in the cutting tools market. The growing adoption of CNC machines, IoT, and robotics highlighted by a 23% increase in industrial robot imports from 2017 to 2022 totaling USD 4.14 billion—demonstrates a clear move toward smart manufacturing. These technologies enhance machining precision, speed, and efficiency while enabling predictive maintenance that reduces tool wear and downtime. As a result, manufacturers increasingly require cutting tools compatible with automated and digitally controlled systems. This demand fuels innovation in high-performance, connected tools made from advanced materials. The trend is also aligned with productivity goals and cost-efficiency, prompting investments in smarter tooling solutions. These developments position Mexico as a rising hub for Industry 4.0, where the cutting tools market evolves rapidly to meet the needs of an increasingly automated and data-driven manufacturing environment focused on quality, sustainability, and precision.

Shift Towards Sustainable and High-Performance Materials

Mexico's cutting tool market is shifting toward sustainability and performance enhancement due to environmental concerns and efficiency goals. Manufacturers are increasingly looking towards newer materials like carbide and ceramics, which are more resistant, thermally resistant, and offer improved tool life compared to traditional metals. It minimizes waste, energy usage, and downtime, because of which it is in sync with global-scale long-term sustainability goals. The focus on green-friendly practices is also encouraged by more stringent regulations and corporate responsibilities towards reducing carbon. As a result, toolmakers are creating designs that are both highly efficient and environmentally friendly. This trend is particularly important for industries like automobile and aviation, where precision is critical in addition to being green-friendly. Overall, the move towards green products and processes is just one component of Mexico's broader strategy to retool its base of manufacturing to be more competitive and sustainable in the face of rising global expectations.

Mexico Cutting Tools Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, material type, and application.

Type Insights:

- Index Able Inserts

- Solid Round Tools

The report has provided a detailed breakup and analysis of the market based on the type. This includes index able inserts and solid round tools.

Material Type Insights:

- Cemented Carbide

- High-Speed Steel

- Ceramics

- Stainless Steel

- Polycrystalline Diamond

- Cubic Boron Nitride

- Exotic Materials

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes cemented carbide, high-speed steel, ceramics, stainless steel, polycrystalline diamond, cubic boron nitride, and exotic materials.

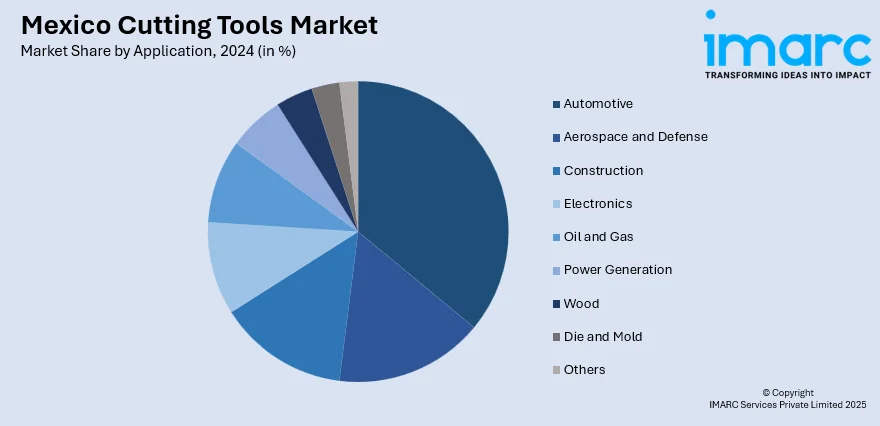

Application Insights:

- Automotive

- Aerospace and Defense

- Construction

- Electronics

- Oil and Gas

- Power Generation

- Wood

- Die and Mold

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive, aerospace and defense, construction, electronics, oil and gas, power generation, wood, die and mold, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Recent News and Development:

- In February 2025, Alibaba Cloud launched its first cloud region in Mexico, boosting digital transformation and innovation across Latin America. This new infrastructure offers secure, scalable cloud services to businesses, startups, and developers, strengthening Mexico’s role as a regional tech hub. With 87 availability zones globally, Alibaba Cloud reinforces its market leadership. The move highlights Alibaba’s commitment to supporting local growth and building an inclusive ecosystem in Mexico and Latin America.

- In May 2025, New-Form Tools opened NFT Saws Mexico in Querétaro, bringing high-performance cutting solutions and local support to manufacturers. The new facility offers premium Carbide Tipped (TCT) saw blades, on-site technical support, training, and reliable inventory. Designed for major machinery brands, the expansion reduces downtime and import delays, helping manufacturers boost cutting efficiency and productivity.

- In November 2024, Kitamura Machinery has appointed Hi-Tec CNC as its exclusive dealer in Mexico, expanding access to its high-precision machining centers, including vertical, horizontal, double-column, and five-axis models. Hi-Tec CNC will provide full product support, automation solutions, parts replacement, and application guidance. The partnership aims to enhance productivity and optimize manufacturing processes, leveraging Hi-Tec CNC’s local expertise to deliver Kitamura’s advanced technology and services to Mexican manufacturers.

- In December 2024, Solvay launched an advanced biodigester at its Ciudad Juarez site in Mexico, producing biomethane from local organic waste. This project will replace part of the natural gas used for boiler and kiln operations, cutting CO2 emissions by 12% compared to 2021. Despite challenges like securing steady feedstock and system adaptations, the initiative highlights Solvay’s commitment to cleaner energy and sustainable operations in the region.

Mexico Cutting Tools Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Index Able Inserts, Solid Round Tools |

| Material Types Covered | Cemented Carbide, High-Speed Steel, Ceramics, Stainless Steel, Polycrystalline Diamond, Cubic Boron Nitride, Exotic Materials |

| Applications Covered | Automotive, Aerospace and Defense, Construction, Electronics, Oil and Gas, Power Generation, Wood, Die and Mold, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico cutting tools market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico cutting tools market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico cutting tools industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cutting tools market in Mexico was valued at USD 452.94 Million in 2024.

The Mexico cutting tools market is projected to exhibit a CAGR of 5.10% during 2025-2033, reaching a value of USD 744.86 Million by 2033.

The market is driven by rapid industrial growth in automotive and aerospace sectors, technological advancements in smart manufacturing, increasing foreign investments through trade agreements, and growing demand for precision-engineered components requiring high-performance cutting tools.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)