Mexico Data Center Colocation Market Size, Share, Trends and Forecast by Type, Organization Size, End Use Industry, and Region, 2025-2033

Mexico Data Center Colocation Market Overview:

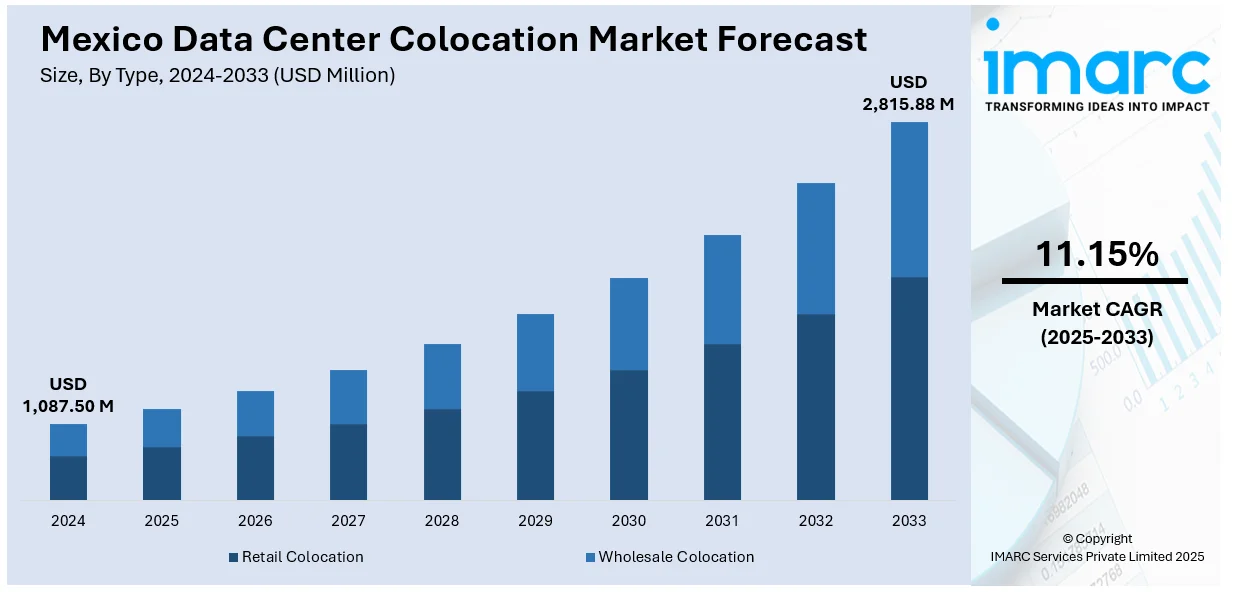

The Mexico data center colocation market size reached USD 1,087.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,815.88 Million by 2033, exhibiting a growth rate (CAGR) of 11.15% during 2025-2033. The market is driven by rapid digital transformation, growing cloud adoption, and increasing demand for scalable, secure IT infrastructure. Cost-effective solutions for enterprises, rising nearshoring trends, and strategic geographic location enhance market appeal. Additionally, strong investments in data infrastructure by global tech firms are accelerating capacity expansion and fueling the Mexico data center colocation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,087.50 Million |

| Market Forecast in 2033 | USD 2,815.88 Million |

| Market Growth Rate 2025-2033 | 11.15% |

Mexico Data Center Colocation Market Trends:

Rapid Digital Transformation and Cloud Adoption

Mexico is witnessing significant digital transformation across industries, driven by the rise of e-commerce, financial technology, and digital services. As organizations digitize operations, the demand for reliable, secure, and scalable IT infrastructure has surged. Cloud computing adoption is accelerating, pushing businesses toward colocation services to handle storage, computing, and networking needs without incurring high capital costs. Colocation providers offer a flexible alternative to building and managing private data centers, allowing companies to focus on core operations while ensuring data resilience and compliance. Moreover, increasing use of AI, IoT, and data analytics is further amplifying data traffic and processing demands, which colocation centers are well-positioned to support through scalable power and connectivity solutions.

Strategic Geographic Location and Nearshoring Momentum

Mexico’s geographic proximity to the United States and strategic position within Latin America make it an ideal hub for cross-border data operations. As nearshoring becomes a preferred business model, multinational corporations are establishing regional headquarters or IT support centers in Mexico, increasing demand for localized digital infrastructure. Colocation centers in cities like Querétaro and Mexico City provide low-latency connectivity, helping companies comply with data residency and privacy regulations while serving U.S. and Latin American markets. This positioning also reduces operational risks associated with overseas data transfers and enhances network performance. Additionally, favorable time zones and cultural alignment with the U.S. further strengthen Mexico’s appeal as a colocation hotspot, thus boosting the Mexico data center colocation market growth.

Cost Efficiency and Focus on Core Business

Colocation enables organizations to avoid the high capital expenditures associated with building and maintaining their data centers. In a cost-sensitive market like Mexico, this is a compelling value proposition, especially for SMEs and startups. By colocating, companies gain access to enterprise-grade infrastructure, redundant power supply, security systems, and reliable connectivity—all managed by specialists. This model frees internal IT teams from infrastructure maintenance, allowing them to focus on business innovation and customer service. As economic uncertainty prompts businesses to optimize operational expenses, colocation becomes a smart, budget-conscious choice. Additionally, shared facilities allow for better resource utilization and easier scalability compared to traditional on-premise systems.

Mexico Data Center Colocation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, organization size, and end use industry.

Type Insights:

- Retail Colocation

- Wholesale Colocation

The report has provided a detailed breakup and analysis of the market based on the type. This includes retail colocation and wholesale colocation.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium enterprises and large enterprises.

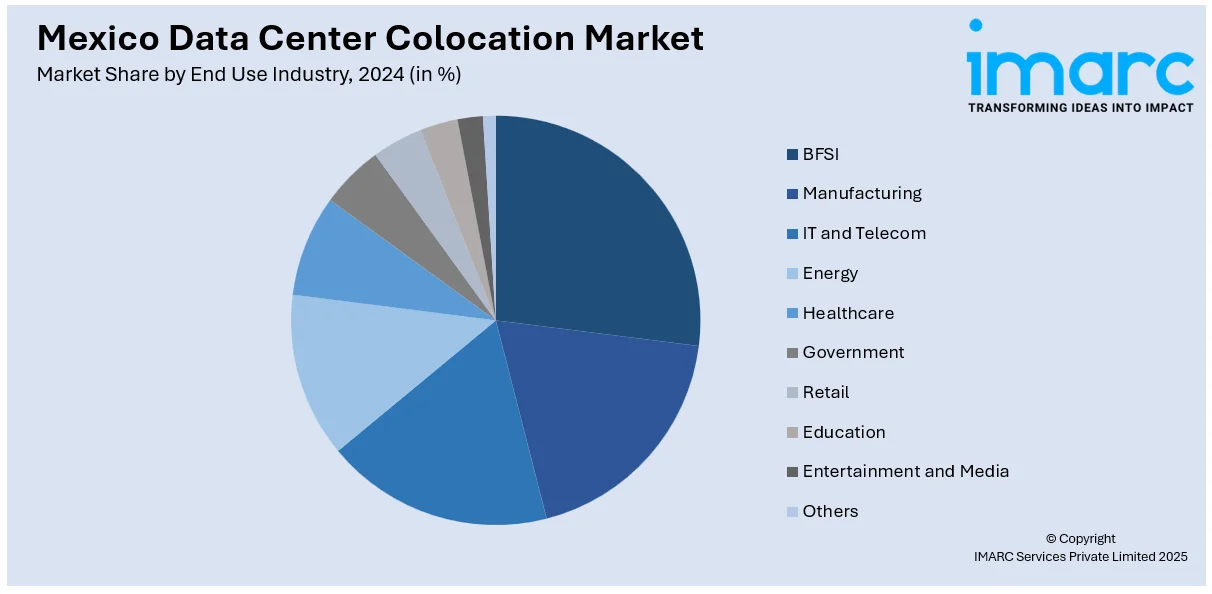

End Use Industry Insights:

- BFSI

- Manufacturing

- IT and Telecom

- Energy

- Healthcare

- Government

- Retail

- Education

- Entertainment and Media

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes BFSI, manufacturing, IT and telecom, energy, healthcare, government, retail, education, entertainment and media, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Data Center Colocation Market News:

- In January 2025, Amazon Web Services (AWS), a subsidiary of Amazon.com, Inc., announced the introduction of the AWS Mexico (Central) Region. Beginning from the day, startups, developers, enterprises, entrepreneurs, along with government, educational, and nonprofit entities, will enjoy enhanced options for operating their applications and serving end users from AWS data centers situated in Mexico. In alignment with its long-term strategy, AWS intends to invest over $5 billion in Mexico over the next 15 years. AWS introduced a $300,000 AWS InCommunities Fund in Queretaro to support local groups, schools, and organizations in starting new community initiatives.

- In February 2024, OData, owned by Aligned, announced an expansion of its QR01 data center located in Querétaro. The firm indicated that it has begun constructing two new hyperscale data center campuses in Mexico, located in Guanajuato and El Marqués.

Mexico Data Center Colocation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Retail Colocation, Wholesale Colocation |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| End Use Industries Covered | BFSI, Manufacturing, IT and Telecom, Energy, Healthcare, Government, Retail, Education, Entertainment and Media, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico data center colocation market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico data center colocation market on the basis of type?

- What is the breakup of the Mexico data center colocation market on the basis of organization size?

- What is the breakup of the Mexico data center colocation market on the basis of end use industry?

- What is the breakup of the Mexico data center colocation market on the basis of region?

- What are the various stages in the value chain of the Mexico data center colocation market?

- What are the key driving factors and challenges in the Mexico data center colocation market?

- What is the structure of the Mexico data center colocation market and who are the key players?

- What is the degree of competition in the Mexico data center colocation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico data center colocation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico data center colocation market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico data center colocation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)