Mexico Data Center Market Size, Share, Trends and Forecast by Component, Type, Enterprise Size, End User, and Region, 2026-2034

Mexico Data Center Market Summary:

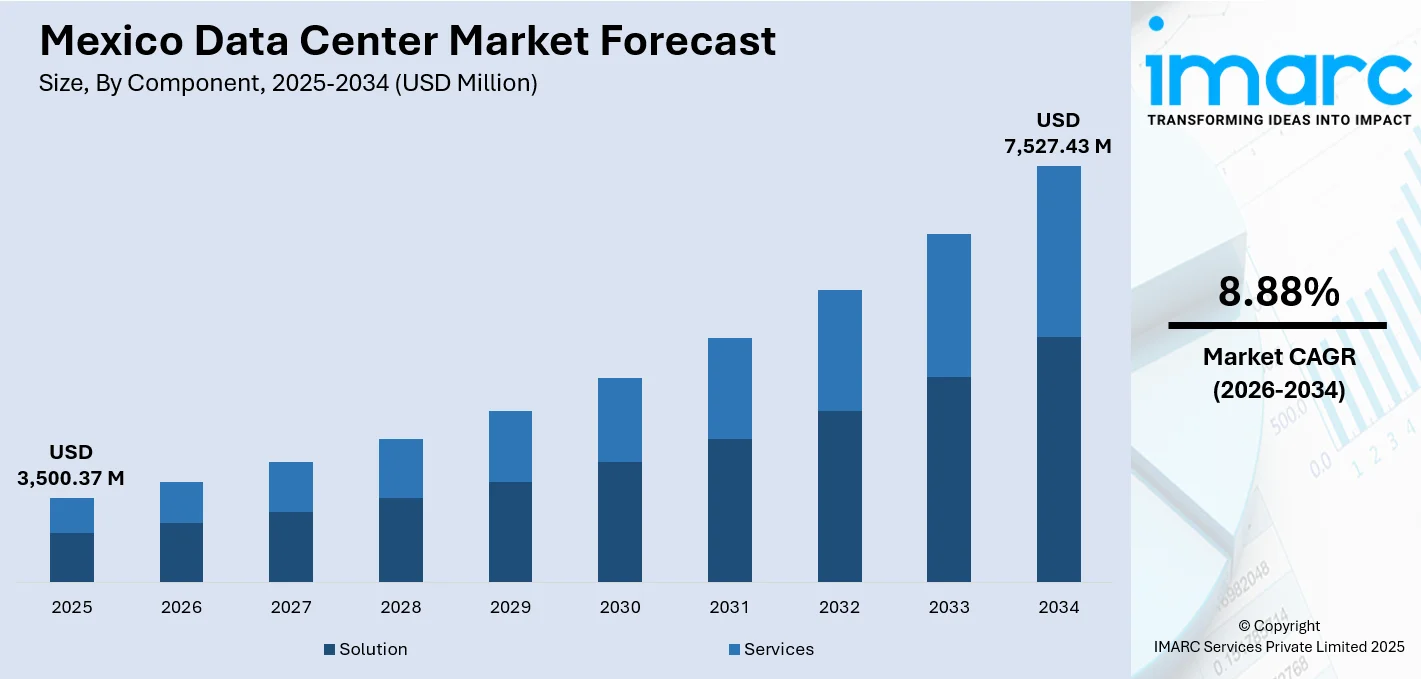

The Mexico data center market size was valued at USD 3,500.37 Million in 2025 and is projected to reach USD 7,527.43 Million by 2034, growing at a compound annual growth rate of 8.88% from 2026-2034.

The Mexico data center market is experiencing robust expansion driven by hyperscale cloud provider investments, nearshoring strategies leveraging geographic proximity to North American markets, and increasing digital transformation initiatives across industries. The market benefits from favorable regulatory environments, improving telecommunications infrastructure, submarine cable connectivity, and growing demand for localized cloud computing services supporting data sovereignty requirements and low-latency enterprise applications.

Key Takeaways and Insights:

- By Component: Solution dominates the market with a share of 62% in 2025, driven by enterprise demand for comprehensive data center management platforms, infrastructure monitoring tools, and integrated software solutions enabling efficient facility operations and resource optimization.

- By Type: Colocation leads the market with a share of 84% in 2025, owing to enterprise preferences for shared infrastructure models that reduce capital expenditure requirements while providing reliable power, cooling, and connectivity services through established facilities.

- By Enterprise Size: Large enterprises represent the largest segment with a market share of 65% in 2025, attributed to substantial data processing requirements, complex workload demands, and significant IT infrastructure investments by multinational corporations and major domestic organizations.

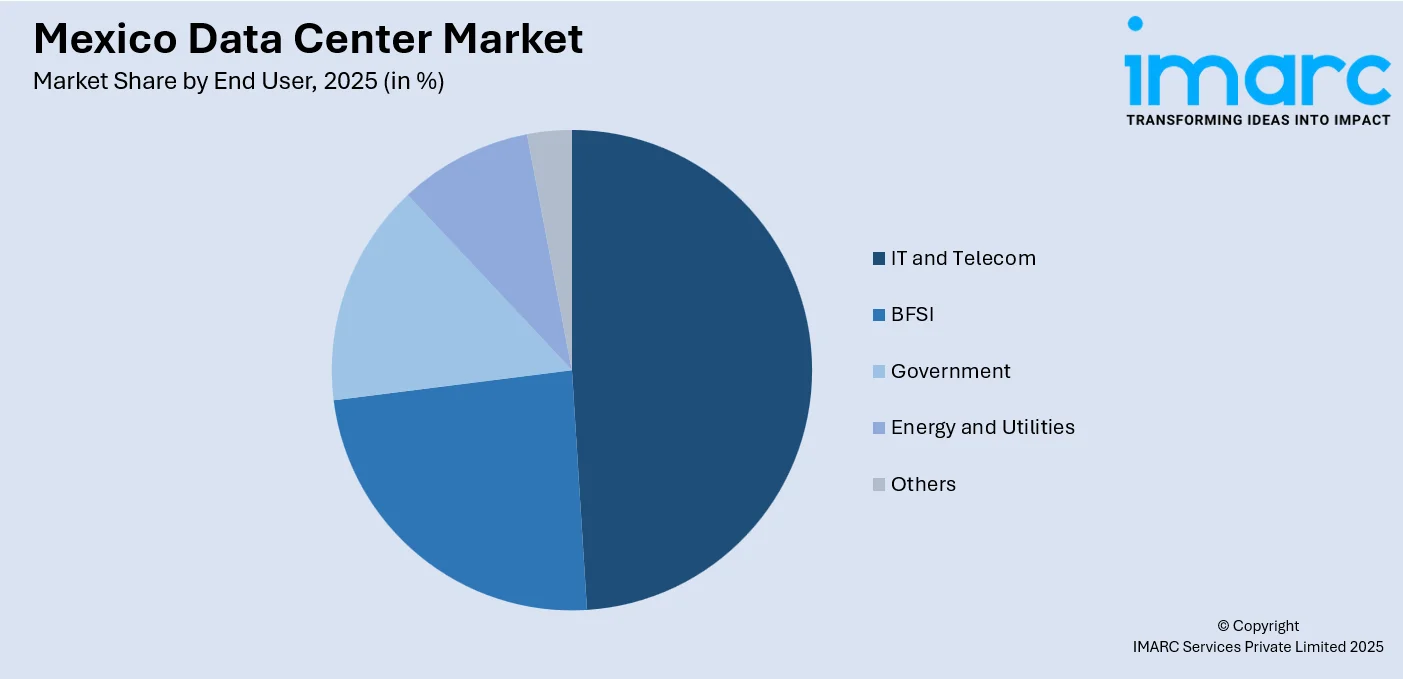

- By End User: IT and telecom dominate the market with a share of 49% in 2025, reflecting the sector's critical role in managing telecommunications networks, hosting digital services, and supporting cloud computing infrastructure across Mexico's expanding digital ecosystem.

- By Region: Northern Mexico leads the market with a share of 41% in 2025, benefiting from strategic proximity to the United States, established manufacturing corridors, superior telecommunications connectivity, and favorable business climates attracting foreign direct investment.

- Key Players: The Mexico data center market exhibits a moderately competitive landscape characterized by the presence of global hyperscale operators, international colocation providers, and regional data center companies. Market participants differentiate through service offerings, geographic coverage, sustainability certifications, and connectivity partnerships with telecommunications carriers.

To get more information on this market Request Sample

The Mexico data center market is undergoing transformational growth as the country emerges as a strategic digital infrastructure hub for Latin America. Increasing cloud adoption among enterprises, government digitization initiatives, and the expanding e-commerce sector are fueling demand for robust data center facilities. The nearshoring trend has positioned Mexico as an attractive destination for multinational corporations seeking to relocate IT operations closer to North American headquarters while benefiting from cost advantages. Querétaro has emerged as a primary data center hub, hosting facilities from major global technology companies due to its favorable seismic stability, temperate climate, reduced cooling requirements, and excellent fiber optic connectivity. The market is witnessing substantial investments in sustainability initiatives, with operators implementing renewable energy procurement strategies and advanced cooling technologies to address environmental concerns and meet corporate sustainability mandates.

Mexico Data Center Market Trends:

Hyperscale Cloud Infrastructure Expansion

Major global cloud service providers are establishing multi-datacenter regions throughout Mexico to serve growing enterprise demand for localized cloud computing resources. These hyperscale deployments feature redundant availability zones designed to provide enterprise-grade reliability for mission-critical workloads spanning artificial intelligence, machine learning, and digital transformation initiatives. The expansion enables organizations to maintain compliance with data localization regulations while achieving reduced network latency for real-time applications. For instance, in December 2025, TERRANOVA, a newly launched hyperscale data center platform backed by Actis, a prominent investor in sustainable infrastructure and affiliated with global investment firm General Atlantic, officially commenced operations in Latin America. The platform aims to drive the region’s next wave of digital expansion by developing energy-efficient, client-centric data centers that cater to the growing demand for artificial intelligence and cloud services across Brazil, Mexico, and Chile. This initiative underscores a commitment to supporting scalable, sustainable digital infrastructure for the region’s enterprises.

Nearshoring-Driven Digital Infrastructure Investment

Mexico's strategic geographic position between North and South American markets is attracting significant data center investment as multinational corporations pursue nearshoring strategies for IT operations. The country's proximity to major technology ecosystems enables reduced data transmission latencies while providing cost advantages compared to traditional markets. Manufacturing organizations relocating production operations to Mexico require corresponding data center infrastructure to support industrial automation, supply chain management, and enterprise resource planning applications. For instance, in November 2025, US-based fiber and data transport provider Zayo expanded its North American presence with the launch of a new point-of-presence (PoP) in Mexico. Situated in Monterrey, the 400G facility represents Zayo’s first wholly owned PoP in the country and is designed to enhance the company’s network connectivity across Mexico, the US, and Canada, strengthening its cross-border data transport capabilities and supporting growing demand for high-capacity digital infrastructure in the region.

Sustainability and Energy Efficiency Prioritization

Environmental sustainability has become a central priority for data center operators, with facilities increasingly adopting renewable energy sources, advanced cooling technologies, and circular economy principles. Operators are implementing innovative solutions including liquid cooling systems, free cooling methodologies, and artificial intelligence-driven thermal management to optimize energy utilization. Power purchase agreements for renewable electricity from solar and wind facilities are becoming standard practice for hyperscale data centers committed to achieving carbon neutrality targets. For instance, in January 2026, US data center developer BorderPlex Digital Assets launched a plan to source 500MW of renewable energy by 2028, powering its New Mexico facilities and advancing sustainable, low-carbon operations.

Market Outlook 2026-2034:

The Mexico data center market is poised for significant growth, fueled by rapid digital transformation across multiple industry sectors and rising cloud adoption among small and medium enterprises. Expanding nearshoring investments are further driving demand for robust data infrastructure. The deployment of edge computing is expected to accelerate, supporting low-latency applications in manufacturing, telecommunications, and retail. Additionally, government programs promoting digital inclusion and smart city initiatives are anticipated to stimulate further investment in data center facilities, reinforcing the market’s long-term growth potential. The market generated a revenue of USD 3,500.37 Million in 2025 and is projected to reach a revenue of USD 7,527.43 Million by 2034, growing at a compound annual growth rate of 8.88% from 2026-2034.

Mexico Data Center Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Component |

Solution |

62% |

|

Type |

Colocation |

84% |

|

Enterprise Size |

Large Enterprises |

65% |

|

End User |

IT and Telecom |

49% |

|

Region |

Northern Mexico |

41% |

Component Insights:

- Solution

- Services

Solution dominates with a market share of 62% of the total Mexico data center market in 2025.

The solution segment's dominance reflects the critical importance of comprehensive software platforms and infrastructure management tools in modern data center operations. Enterprise organizations require sophisticated solutions encompassing data center infrastructure management, building management systems, security monitoring platforms, and network management tools to optimize facility performance. These solutions enable operators to monitor power consumption, manage cooling systems, track asset utilization, and ensure compliance with service level agreements. The integration of artificial intelligence and machine learning capabilities into data center management solutions has enhanced predictive maintenance capabilities and improved operational efficiency.

The growing demand for hybrid and multi-cloud architectures has increased the importance of orchestration and automation solutions that enable seamless workload management across diverse infrastructure environments. Organizations are investing in solutions that provide unified visibility across on-premises data centers, colocation facilities, and public cloud platforms. The adoption of software-defined infrastructure principles has accelerated solution deployment, enabling greater flexibility in resource allocation and reducing the complexity associated with managing heterogeneous hardware environments across multiple locations.

Type Insights:

- Colocation

- Hyperscale

- Edge

- Others

Colocation leads with a share of 84% of the total Mexico data center market in 2025.

Colocation services have established clear market leadership as enterprises increasingly prefer shared infrastructure models that minimize capital expenditure requirements while providing access to carrier-neutral facilities with robust power, cooling, and connectivity infrastructure. The colocation model enables organizations to deploy IT equipment within professionally managed facilities featuring redundant power systems, advanced fire suppression, sophisticated physical security measures, and diverse network connectivity options. This approach allows enterprises to focus on core business operations while leveraging the expertise of specialized data center operators to ensure facility reliability and compliance with industry standards.

The growing complexity of enterprise IT environments has increased demand for colocation services that support hybrid cloud deployments and provide direct connectivity to major cloud service providers. Colocation facilities in strategic locations such as Querétaro and Monterrey offer enterprises the ability to establish infrastructure presence with reduced latency to both domestic users and international markets. The availability of diverse telecommunications carriers within carrier-neutral facilities enables organizations to implement resilient network architectures and optimize connectivity costs through competitive provider selection.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises exhibit a clear dominance with a 65% share of the total Mexico data center market in 2025.

Large enterprises constitute the primary demand driver for data center services in Mexico, reflecting their substantial data processing requirements, complex workload demands, and significant IT infrastructure investments. Multinational corporations operating in Mexico require robust data center capabilities to support enterprise resource planning systems, customer relationship management platforms, financial transaction processing, and business intelligence applications. These organizations typically maintain hybrid infrastructure strategies combining owned facilities, colocation deployments, and public cloud services to optimize performance, cost, and compliance objectives.

The digital transformation initiatives undertaken by large enterprises across banking, telecommunications, manufacturing, and retail sectors have accelerated data center demand as organizations modernize legacy systems and implement cloud-native applications. Large enterprises also demonstrate heightened sensitivity to data sovereignty requirements, driving demand for in-country data center facilities that ensure compliance with local regulations. The scale of large enterprise deployments enables negotiation of favorable commercial terms with data center operators and supports investment in advanced technologies, including high-performance computing and artificial intelligence infrastructure.

End User Insights:

Access the comprehensive market breakdown Request Sample

- BFSI

- IT and Telecom

- Government

- Energy and Utilities

- Others

IT and telecom dominate the market with a share of 49% of the total Mexico data center market in 2025.

The IT and telecom sector's market leadership reflects its fundamental role in building and operating the digital infrastructure that supports Mexico's growing digital economy. Telecommunications carriers require extensive data center facilities to host network operations centers, switching equipment, content delivery infrastructure, and managed services platforms serving enterprise and consumer customers. Technology companies operating in Mexico utilize data center facilities to deliver software-as-a-service applications, host digital platforms, and support product development activities requiring substantial computing resources.

The expansion of mobile broadband services, growth in streaming media consumption, and proliferation of Internet of Things applications have intensified telecommunications infrastructure requirements. Carriers are investing in data center facilities strategically positioned to reduce network latency and improve service quality for bandwidth-intensive applications. The convergence of telecommunications and technology services has created demand for flexible data center environments capable of supporting rapid scaling and diverse workload requirements across computing, storage, and networking resources.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico leads with a share of 41% of the total Mexico data center market in 2025.

Northern Mexico has emerged as the dominant regional market driven by strategic proximity to the United States, established manufacturing corridors attracting nearshoring investments, and superior telecommunications infrastructure connecting to North American networks. The Querétaro Metropolitan area has become Mexico's primary data center hub, benefiting from favorable seismic conditions, temperate climate reducing cooling costs, skilled workforce availability, and supportive state government policies encouraging technology sector development. Monterrey serves as a secondary hub, leveraging its industrial base and cross-border connectivity to attract data center investments serving both Mexican enterprises and multinational corporations.

The concentration of manufacturing operations in northern states has created substantial demand for data center services supporting industrial automation, supply chain management, and enterprise systems. Foreign direct investment flowing into the region, as companies relocate production from Asia, has generated corresponding requirements for digital infrastructure. The availability of submarine cable landing stations and terrestrial fiber routes connecting northern Mexico to the United States provides diverse connectivity options essential for enterprises requiring resilient international network connections.

Market Dynamics:

Growth Drivers:

Why is the Mexico Data Center Market Growing?

Accelerating Digital Transformation Across Enterprise Sectors

Mexican enterprises across banking, telecommunications, manufacturing, retail, and government sectors are accelerating digital transformation initiatives that fundamentally reshape IT infrastructure requirements. Organizations are migrating legacy applications to cloud-native architectures, implementing advanced analytics platforms, deploying customer experience solutions, and modernizing operational technology systems. This transformation necessitates robust data center capabilities providing the computing power, storage capacity, and network connectivity essential for running sophisticated enterprise applications. The adoption of artificial intelligence and machine learning technologies further intensifies infrastructure demands as organizations seek to derive actionable insights from growing data volumes. Financial services institutions are implementing real-time transaction processing systems, fraud detection algorithms, and personalized customer engagement platforms that require low-latency, high-availability data center environments. For instance, in June 2025, Mexican company Edgenet officially entered the market with plans to roll out a network of 30 Edge data centers nationwide. The firm unveiled Mayia, the country’s first artificial intelligence (AI) center to receive the "Made in Mexico" certification from the Ministry of Economy, marking a milestone in domestic AI infrastructure development.

Strategic Nearshoring Trends Driving Foreign Direct Investment

Global supply chain restructuring has positioned Mexico as a premier nearshoring destination, attracting manufacturing relocations that generate corresponding demand for digital infrastructure investment. Multinational corporations transferring production operations from distant locations to Mexican facilities require local data center services to support manufacturing execution systems, quality management platforms, supply chain visibility tools, and enterprise integration applications. The proximity to the United States market reduces logistics costs and enables just-in-time manufacturing models dependent on reliable digital connectivity. Technology companies are establishing engineering and development centers in Mexico, creating demand for data center facilities supporting software development workflows, testing environments, and collaborative platforms. The favorable USMCA trade framework reinforces Mexico's competitive position for nearshoring investment across technology-intensive industries. For instance, in January 2025, Amazon Web Services (AWS) launched the AWS Mexico (Central) Region, offering local data center access for developers, enterprises, and public institutions. AWS plans to invest $5 billion over 15 years and launched a $300,000 InCommunities Fund in Querétaro to support local projects.

Growing Cloud Adoption Among Small and Medium Enterprises

The democratization of cloud computing services is enabling small and medium enterprises throughout Mexico to access enterprise-grade IT capabilities previously available only to large organizations with substantial technology budgets. Cloud service providers have established localized infrastructure that delivers improved performance for Mexican businesses while ensuring compliance with data residency preferences. The availability of software-as-a-service applications spanning customer relationship management, accounting, human resources, and productivity tools has reduced barriers to technology adoption. Government programs promoting digital inclusion and small business modernization have accelerated cloud uptake across diverse industry sectors. The expansion of reliable broadband connectivity in secondary cities and rural areas is extending cloud accessibility beyond traditional technology adoption centers, broadening the addressable market for data center services. For instance, in August 2025, ODATA, part of Aligned Data Centers, launched its QR04 data center near San Miguel de Allende, Querétaro, completing a network of four interconnected hyperscale facilities. Designed for cloud and AI services, it enables clients to scale operations across multiple sites with redundancy, addressing Mexico’s power reliability challenges and reinforcing ODATA’s leadership in sustainable hyperscale infrastructure.

Market Restraints:

What Challenges is the Mexico Data Center Market Facing?

Power Infrastructure Limitations and Energy Cost Volatility

The reliable and cost-effective electricity supply essential for data center operations faces constraints in certain regions of Mexico, with grid capacity limitations, transmission infrastructure gaps, and energy price fluctuations creating operational challenges. Data center operators must invest substantially in backup power generation, uninterruptible power supplies, and redundant electrical systems to ensure service continuity during grid instability events. The complexity of securing renewable energy procurement agreements and navigating evolving energy regulations adds uncertainty to long-term operational cost projections.

Skilled Workforce Availability in Specialized Technical Roles

The rapid expansion of data center capacity in Mexico has created heightened competition for specialized technical professionals including facility engineers, network architects, security specialists, and operations personnel. Educational institutions and technical training programs have not fully scaled to meet industry workforce requirements, creating talent shortages that constrain operational capabilities and increase labor costs. Data center operators must invest in recruitment, training, and retention programs while competing with other technology employers for qualified candidates.

Regulatory Complexity and Permitting Process Challenges

The development of new data center facilities in Mexico involves navigating complex permitting processes spanning environmental assessments, construction approvals, electrical interconnection procedures, and telecommunications licensing requirements. Regulatory frameworks vary across federal, state, and municipal jurisdictions, creating compliance complexity for operators planning multi-site deployments. Evolving data protection regulations and potential changes to foreign investment rules introduce uncertainty that may influence investment timing and location decisions for international data center operators.

Competitive Landscape:

The Mexico data center market exhibits a moderately competitive landscape characterized by the participation of global hyperscale cloud providers, international colocation operators, regional data center companies, and telecommunications carriers operating facility infrastructure. Market participants compete across dimensions including geographic coverage, facility specifications, power density capabilities, connectivity options, sustainability credentials, and service level commitments. The entry of major hyperscale operators has intensified competitive dynamics while simultaneously validating Mexico's strategic importance as a digital infrastructure hub. Colocation providers differentiate through carrier-neutral connectivity ecosystems, financial flexibility in commercial arrangements, and specialized industry expertise addressing sector-specific requirements in banking, healthcare, and manufacturing. Regional operators leverage local market knowledge, established customer relationships, and responsive service delivery to compete against larger international competitors. Strategic partnerships between data center operators and telecommunications carriers create differentiated connectivity offerings that enhance competitive positioning.

Recent Developments:

- In September 2025, Alibaba Cloud announced plans for new data center establishments with Mexico among the countries slated for deployment. The declaration was made during the Apsara Conference 2025 in Hangzhou, China, as part of a global expansion strategy encompassing multiple international markets.

- In September 2024, Genesys announced a strategic investment in Mexico commencing with the establishment of a local data center. The initiative includes the implementation of customer experience orchestration technologies aimed at transforming business-customer engagement through advanced artificial intelligence solutions.

- In May 2024, Microsoft launched its first hyperscale cloud datacenter region in Mexico, specifically the Mexico Central region located in the Querétaro Metropolitan area. This deployment marks Mexico as the first Microsoft datacenter region in Spanish-speaking Latin America, providing local access to scalable cloud services with in-country data storage capabilities.

Mexico Data Center Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Types Covered | Colocation, Hyperscale, Edge, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| End Users Covered | BFSI, IT and Telecom, Government, Energy and Utilities, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico data center market size was valued at USD 3,500.37 Million in 2025.

The Mexico data center market is expected to grow at a compound annual growth rate of 8.88% from 2026-2034 to reach USD 7,527.43 Million by 2034.

Colocation represents the largest market share at 84% in 2025, driven by enterprise preferences for shared infrastructure models offering reduced capital expenditure, reliable power and cooling systems, and carrier-neutral connectivity within professionally managed facilities.

Key factors driving the Mexico data center market include accelerating digital transformation across enterprise sectors, nearshoring trends attracting foreign direct investment, growing cloud adoption among small and medium enterprises, and hyperscale cloud provider expansion, establishing regional infrastructure.

Major challenges include power infrastructure limitations and energy cost volatility, skilled workforce availability in specialized technical roles, regulatory complexity and permitting process challenges, and competition for suitable real estate in primary data center hub locations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)