Mexico Data Governance Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, Business Function, Application, End Use Industry, and Region, 2026-2034

Mexico Data Governance Market Summary:

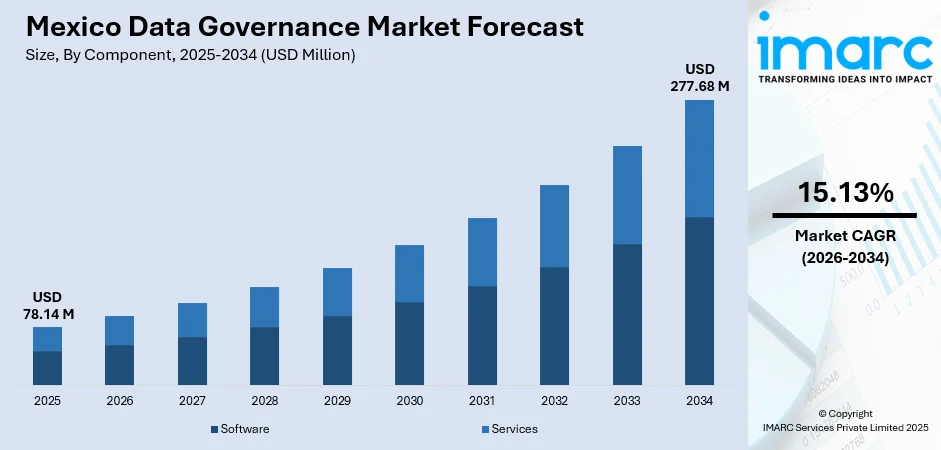

The Mexico data governance market size was valued at USD 78.14 Million in 2025 and is projected to reach USD 277.68 Million by 2034, growing at a compound annual growth rate of 15.13% from 2026-2034.

The Mexico data governance market is experiencing robust expansion driven by intensifying regulatory requirements and accelerating digital transformation initiatives across key industries. Organizations are increasingly prioritizing data quality management, compliance frameworks, and risk mitigation strategies to navigate complex regulatory landscapes. The growing adoption of cloud-based infrastructure, integration of artificial intelligence technologies, and expanding fintech ecosystem are reshaping how enterprises approach data stewardship. Rising cybersecurity concerns and the need for transparent data handling practices are compelling businesses to invest in comprehensive governance solutions that ensure regulatory adherence while maximizing operational efficiency and supporting data-driven decision-making across the Mexico data governance market share.

Key Takeaways and Insights:

-

By Component: Software dominates the market with a share of 63.52% in 2025, driven by the increasing demand for automated data cataloging, metadata management, and policy enforcement tools across enterprise environments.

-

By Deployment Mode: Cloud-based solutions lead the market with a share of 56.16% in 2025, reflecting enterprise preferences for scalable, cost-effective deployment models that enable remote accessibility and seamless integration capabilities.

-

By Organization Size: Large enterprises represent the largest segment with a market share of 65.55% in 2025, owing to complex data ecosystems, stringent compliance requirements, and substantial technology investment capacities.

-

By Business Function: Finance holds the largest share at 35.33% in 2025, attributed to rigorous regulatory oversight, sensitive data handling requirements, and risk management imperatives in financial operations.

-

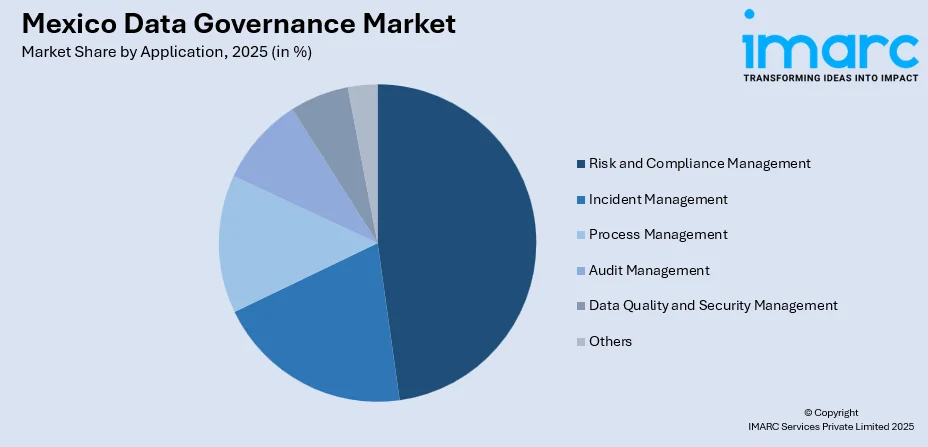

By Application: Risk and compliance management dominates with a share of 47.57% in 2025, reflecting heightened organizational focus on regulatory adherence and proactive risk mitigation across data operations.

-

By End Use Industry: BFSI leads the market with a share of 24.42% in 2025, driven by stringent regulatory scrutiny, complex data management needs, and imperative security requirements in banking and financial services.

-

Key Players: The Mexico data governance market exhibits moderate competitive intensity, featuring established global technology providers competing alongside regional solution integrators. Market leaders are differentiating through AI-enhanced governance capabilities, cloud-native architectures, and industry-specific compliance frameworks to capture enterprise adoption.

To get more information on this market Request Sample

The Mexico data governance market is advancing as organizations confront expanding data volumes and evolving regulatory mandates. The dissolution of the National Institute of Transparency, Access to Information and Personal Data Protection and the subsequent transfer of oversight functions to the Ministry of Anti-Corruption and Good Governance has prompted businesses to reassess their compliance strategies and governance frameworks. Enterprises are increasingly deploying integrated governance platforms that combine data quality management, lineage tracking, and policy automation capabilities to address these changing requirements. The growing penetration of cloud computing is accelerating demand for cloud-native governance solutions across industries. Financial institutions are leading adoption, implementing AI-driven data governance frameworks to enhance fraud detection and regulatory reporting. Manufacturing sectors are leveraging governance tools to support digital twin implementations and supply chain optimization initiatives across nearshoring operations.

Mexico Data Governance Market Trends:

Integration of Artificial Intelligence and Machine Learning in Governance Frameworks

Organizations across Mexico are increasingly embedding artificial intelligence and machine learning capabilities into data governance platforms to automate metadata management, data classification, and access control functions. These technologies enable predictive analytics for identifying data quality anomalies and potential compliance violations before they materialize. Automated data lineage tracking powered by machine learning algorithms provides unprecedented visibility into data flows across complex enterprise environments. The Mexico data governance market growth is being propelled by AI-driven solutions that reduce manual oversight requirements while enhancing governance effectiveness and supporting real-time decision-making capabilities.

Accelerated Cloud-Based Data Governance Adoption

Cloud-based governance solutions are witnessing accelerated adoption as enterprises seek scalable, flexible deployment models that accommodate hybrid work environments and distributed data architectures. The establishment of hyperscale data center infrastructure in Mexico, including Amazon Web Services' commitment of investing more than USD 5 Billion in Mexico announced in February 2024, is strengthening cloud governance capabilities. Organizations are migrating governance workloads to cloud platforms to leverage advanced analytics, improved collaboration features, and reduced infrastructure maintenance burdens. Software-as-a-Service governance offerings are enabling mid-market enterprises to access sophisticated governance capabilities previously available only to large corporations.

Evolution of Regulatory Compliance Frameworks

Mexico's regulatory landscape is undergoing significant transformation following the enactment of the new Federal Law on the Protection of Personal Data Held by Private Parties in March 2025. This regulatory evolution is compelling organizations to implement more robust governance frameworks that address expanded data subject rights, enhanced consent requirements, and stricter enforcement mechanisms. The transition of regulatory oversight from INAI to the Ministry of Anti-Corruption and Good Governance has introduced new compliance considerations that are driving governance platform investments. Enterprises are prioritizing solutions that offer automated regulatory monitoring, policy management, and audit trail capabilities to navigate evolving compliance obligations.

Market Outlook 2026-2034:

The Mexico data governance market is positioned for sustained expansion as digital transformation initiatives intensify across public and private sectors. Enterprise investments in data governance are transitioning from compliance-focused implementations to strategic assets that enable competitive differentiation and operational excellence. The proliferation of generative AI applications and the increasing integration of data analytics into core business processes are amplifying governance requirements. Microsoft's confirmed investment of USD 1.3 billion in AI infrastructure in Mexico during September 2024 reflects the broader technology ecosystem development supporting governance market growth. The market generated a revenue of USD 78.14 Million in 2025 and is projected to reach a revenue of USD 277.68 Million by 2034, growing at a compound annual growth rate of 15.13% from 2026-2034.

Mexico Data Governance Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Component |

Software |

63.52% |

|

Deployment Mode |

Cloud-based |

56.16% |

|

Organization Size |

Large Enterprises |

65.55% |

|

Business Function |

Finance |

35.33% |

|

Application |

Risk and Compliance Management |

47.57% |

|

End Use Industry |

BFSI |

24.42% |

Component Insights:

- Software

- Services

The software dominates with a market share of 63.52% of the total Mexico data governance market in 2025.

The software component's market leadership reflects enterprise demand for comprehensive data governance platforms that integrate cataloging, quality management, and policy enforcement capabilities. Organizations are prioritizing software solutions that offer automated data discovery, classification, and lineage tracking functionalities to address expanding data volumes and complexity. Cloud-native software architectures are gaining traction as enterprises seek governance solutions that seamlessly integrate with existing technology ecosystems including enterprise resource planning systems, data warehouses, and business intelligence platforms. Vendors are differentiating through AI-enhanced features that automate routine governance tasks while providing actionable insights.

As businesses look for governance solutions that easily interface with current technological ecosystems, such as enterprise resource planning systems, data warehousing, and business intelligence platforms, cloud-native software architectures are becoming more popular. The proliferation of software-as-a-service delivery models is democratizing access to sophisticated governance capabilities, enabling organizations of varying sizes to implement enterprise-grade data management practices. AI-enhanced capabilities that automate regular governance processes and give data stewardship teams meaningful insights are how vendors are differentiating themselves.

Deployment Mode Insights:

- Cloud-based

- On-premises

The cloud-based solutions lead with a share of 56.16% of the total Mexico data governance market in 2025.

Cloud-based deployment dominance is driven by enterprise preferences for scalable, flexible infrastructure that accommodates dynamic data governance requirements without substantial capital expenditure commitments. The expansion of hyperscale cloud infrastructure across Mexico, including significant investments from major cloud service providers in the Querétaro and Mexico City regions, is strengthening cloud governance adoption. Organizations are leveraging cloud platforms to achieve faster deployment cycles, simplified maintenance, and enhanced collaboration capabilities across geographically distributed teams.

The cloud deployment model enables organizations to access advanced governance features including real-time analytics, automated compliance monitoring, and seamless integration with third-party data sources. Enterprises are increasingly adopting hybrid cloud strategies that combine cloud-based governance platforms with on-premises data repositories, particularly in regulated industries requiring data residency compliance. The personal data law mandating Mexican storage for certain financial and telecom records is influencing deployment decisions toward domestic cloud regions.

Organization Size Insights:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Large enterprises account for the highest revenue with a 65.55% share of the total Mexico data governance market in 2025.

Large enterprises are driving market growth due to complex data ecosystems spanning multiple business units, geographic locations, and regulatory jurisdictions. These organizations manage substantial data volumes requiring sophisticated governance frameworks that ensure consistency, quality, and compliance across diverse data sources. Enterprise-scale implementations typically involve comprehensive platform deployments integrating data cataloging, quality management, metadata management, and policy enforcement capabilities. Large organizations are establishing governance centers of excellence that define data ownership structures and enforce standardized policies across business functions.

The increasing digital maturity of Mexican enterprises is accelerating governance investments, with approximately half of enterprises in Mexico making extensive use of cloud computing according to industry surveys. Governance centers of excellence, which create data ownership structures, execute data stewardship practices, and enforce uniform norms across business activities, are being implemented by large enterprises. Investment decisions are increasingly tied to demonstrating measurable return on investment through improved data quality, reduced compliance costs, and enhanced analytical capabilities.

Business Function Insights:

- Operation and IT

- Legal

- Finance

- Others

The finance holds the largest share at 35.33% of the total Mexico data governance market in 2025.

Finance function leadership reflects the stringent regulatory requirements and data integrity imperatives governing financial operations across Mexican enterprises. Financial data governance encompasses transaction processing, regulatory reporting, audit trail maintenance, and risk assessment activities that require comprehensive data quality and lineage capabilities. The banking sector's digital transformation initiatives, including implementation of AI-driven fraud detection systems, are intensifying governance requirements for financial data assets and driving increased investment in specialized governance solutions.

Organizations are implementing finance-specific governance frameworks that address Anti-Money Laundering compliance, financial statement accuracy, and internal control requirements. The integration of governance platforms with enterprise resource planning and financial reporting systems enables automated data validation, reconciliation, and exception management. Finance teams are leveraging governance tools to improve forecast accuracy, accelerate month-end closing processes, and enhance visibility into financial data quality metrics across organizational hierarchies and reporting structures.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Incident Management

- Process Management

- Risk and Compliance Management

- Audit Management

- Data Quality and Security Management

- Others

Risk and compliance management exhibits a clear dominance with a 47.57% share of the total Mexico data governance market in 2025.

Risk and compliance management application dominance reflects organizational priorities in navigating Mexico's evolving regulatory landscape. The enactment of the new Federal Law on the Protection of Personal Data Held by Private Parties has intensified compliance requirements across industries. Organizations are deploying governance platforms that automate regulatory monitoring, policy management, and compliance reporting to address expanded data protection obligations and potential sanctions. Enterprises are leveraging risk and compliance governance capabilities to identify sensitive data assets, implement appropriate access controls, and maintain comprehensive audit trails for regulatory examinations.

Businesses are identifying sensitive data assets, putting in place suitable access restrictions, and keeping thorough audit trails for regulatory inspections by utilizing risk and compliance governance capabilities. The integration of AI and machine learning technologies enables proactive risk identification through pattern analysis and anomaly detection across enterprise data environments. According to industry analysis, organizations integrating AI into governance frameworks are achieving significant reductions in compliance-related incidents while improving overall data quality metrics.

End-Use Industry Insights:

- IT and Telecom

- Healthcare

- Retail

- Defense

- BFSI

- Others

The BFSI leads the market with a share of 24.42% of the total Mexico data governance market in 2025.

The banking, financial services, and insurance sector's market leadership stems from intense regulatory scrutiny and complex data management requirements inherent to financial operations. Mexican financial institutions are implementing comprehensive governance frameworks to address data privacy regulations, anti-money laundering compliance, and customer data protection mandates. The fintech ecosystem expansion, with NuBank announcing its ten millionth loan in Mexico in January 2025, is accelerating governance adoption across traditional and digital financial service providers.

BFSI organizations are prioritizing governance solutions that integrate with core banking systems, payment platforms, and customer relationship management applications. The sector's digital transformation initiatives are generating substantial governance requirements for managing customer data across omnichannel experiences. Financial institutions are deploying AI-enhanced governance capabilities to improve fraud detection, automate regulatory reporting, and ensure data quality across risk management functions. The growing adoption of digital banking and mobile payment solutions is further amplifying enterprise data governance requirements.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents a significant market concentration driven by the region's industrial manufacturing base and proximity to cross-border data flows with the United States. The nearshoring trend is accelerating governance adoption as multinational corporations establish operations requiring data management aligned with both Mexican and international regulatory standards. Monterrey and surrounding industrial zones are witnessing increased governance investments as enterprises implement digital transformation initiatives across supply chain operations.

Central Mexico, anchored by Mexico City and the State of Mexico, constitutes the primary market hub for data governance solutions given its concentration of financial institutions, government agencies, and corporate headquarters. The region's established data center infrastructure and connectivity advantages support enterprise governance deployments. Querétaro has emerged as a critical technology corridor, concentrating on Mexico's installed data center capacity and attracting significant hyperscale investments that strengthen regional governance capabilities.

Southern Mexico presents emerging growth opportunities as digital infrastructure investments expand connectivity and cloud accessibility across traditionally underserved markets. Government digitalization programs aimed at migrating citizen services to sovereign cloud platforms are creating governance requirements for public sector implementations. The region's developing technology ecosystem is attracting governance solution providers seeking to establish presence in emerging market segments.

Market Dynamics:

Growth Drivers:

Why is the Mexico Data Governance Market Growing?

Intensifying Regulatory and Compliance Requirements

The regulatory landscape governing data management in Mexico is undergoing fundamental transformation, compelling organizations to implement comprehensive governance frameworks. The dissolution of INAI and transfer of regulatory oversight to the Ministry of Anti-Corruption and Good Governance has created a centralized enforcement structure that is intensifying compliance scrutiny. Organizations are investing in governance platforms that automate regulatory monitoring, policy management, and audit trail maintenance to navigate evolving obligations. The potential for substantial financial penalties for non-compliance is accelerating enterprise governance investments across regulated industries.

Accelerating Digital Transformation and Cloud Adoption

Mexico's enterprise digital transformation trajectory is creating substantial demand for data governance solutions that ensure data quality, security, and accessibility across increasingly complex technology environments. AWS is the cloud provider of choice for 24% of Mexican businesses. Nonetheless, 69% of Mexican cloud-using businesses choose Microsoft Azure, making it the most popular cloud provider overall. Organizations are recognizing that effective data governance is foundational to successful digital transformation initiatives, enabling trusted analytics, reliable automation, and compliant data sharing across business processes.

Expansion of Financial Services and Fintech Ecosystem

Mexico's dynamic financial services sector is driving significant governance market growth as institutions implement frameworks to manage expanding data assets and meet regulatory requirements. The fintech ecosystem has grown substantially, with Mexico representing the second largest fintech market in Latin America with over 773 registered fintech companies as of 2024. Digital lending, insurtech, and payment innovations are generating governance requirements for managing customer data, transaction records, and regulatory reporting across novel business models. Traditional financial institutions are accelerating digital transformation to compete with fintech disruptors, implementing governance platforms that support omnichannel customer engagement while ensuring data protection compliance. The growing integration of AI in financial services for fraud detection and risk assessment is amplifying governance requirements for model transparency and data quality assurance.

Market Restraints:

What Challenges the Mexico Data Governance Market is Facing?

Critical Shortage of Skilled Data Governance Professionals

The limited availability of professionals with specialized data governance expertise represents a significant constraint on market growth. Organizations struggle to recruit and retain talent capable of implementing comprehensive governance frameworks, managing data stewardship programs, and ensuring regulatory compliance. The shortage is compounded by competing demand for data professionals across analytics, engineering, and AI development functions.

Integration Complexity with Legacy Systems and Data Silos

Many Mexican enterprises operate complex technology environments characterized by legacy systems, disparate data sources, and fragmented data architectures that complicate governance implementation. Integrating governance platforms with existing enterprise resource planning systems, data warehouses, and business applications requires substantial technical effort and organizational change management. Data quality challenges arising from inconsistent formats, duplicated records, and incomplete data sets impede governance program effectiveness.

Regulatory Uncertainty Following Institutional Restructuring

The dissolution of INAI and transfer of regulatory functions to the Ministry of Anti-Corruption and Good Governance has introduced uncertainty regarding enforcement approaches, compliance criteria, and resolution procedures. Organizations face challenges in anticipating regulatory interpretations and adjusting governance practices accordingly. The concentration of oversight functions within the executive branch has raised concerns about enforcement independence and potential delays in resolving pending matters.

Competitive Landscape:

The Mexico data governance market exhibits a moderately concentrated competitive structure featuring established global technology providers alongside regional solution integrators and emerging cloud-native vendors. Market leaders are differentiating through AI-enhanced governance capabilities, cloud-native platform architectures, and industry-specific compliance frameworks tailored to Mexican regulatory requirements. Strategic partnerships between governance platform vendors and cloud infrastructure providers are strengthening market positions and expanding solution ecosystems. The competitive landscape is characterized by ongoing product innovation, with vendors enhancing automation capabilities, improving user experience, and expanding integration options to capture enterprise adoption. Market participants are investing in localized sales and support infrastructure to address growing demand across diverse industry verticals.

Mexico Data Governance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Deployment Modes Covered | Cloud-Based, On-Premises |

| Organization Sizes Covered | Small and Medium-Sized Enterprises (SMEs), Large Enterprises |

| Business Functions Covered | Operation and IT, Legal, Finance, Others |

| Applications Covered | Incident Management, Process Management, Risk and Compliance Management, Audit Management, Data Quality and Security Management, Others |

| End Use Industries Covered | IT And Telecom, Healthcare, Retail, Defense, BFSI, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico data governance market size was valued at USD 78.14 Million in 2025.

The market is expected to grow at a compound annual growth rate of 15.13% from 2026-2034 to reach USD 277.68 Million by 2034.

Software holds the largest component share at 63.52% in 2025, driven by enterprise demand for comprehensive data cataloging, metadata management, quality management, and policy enforcement capabilities that address expanding data volumes and regulatory compliance requirements.

Key factors driving the Mexico data governance market include intensifying regulatory requirements following the data protection law reforms, accelerating digital transformation and cloud adoption across enterprises, and expansion of the financial services and fintech ecosystem.

Major challenges include critical shortage of skilled data governance professionals, integration complexity with legacy systems and data silos, regulatory uncertainty following the dissolution of INAI, and the substantial investment requirements for comprehensive governance implementations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)