Mexico Dental Consumables Market Size, Share, Trends and Forecast by Product, Treatment, Material, End User, and Region, 2025-2033

Mexico Dental Consumables Market Overview:

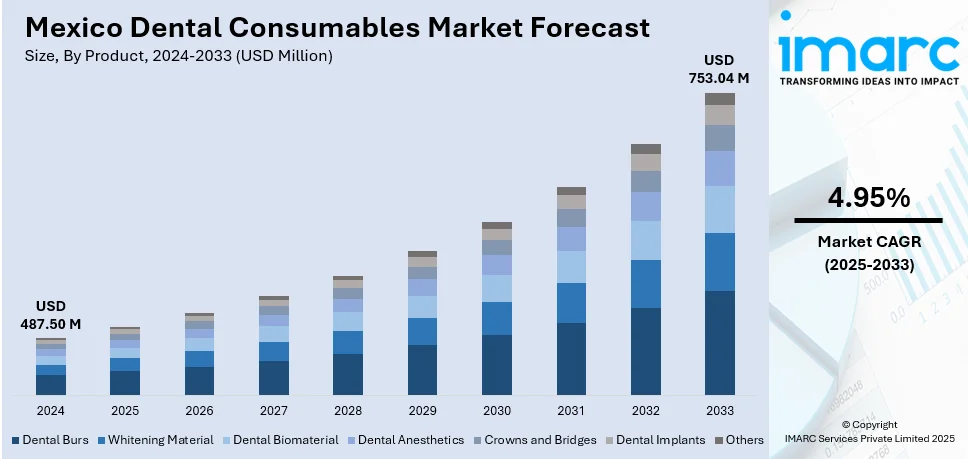

The Mexico dental consumables market size reached USD 487.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 753.04 Million by 2033, exhibiting a growth rate (CAGR) of 4.95% during 2025-2033. The market is growing due to rising dental disorders, an aging population, and increasing oral health awareness. Additionally, inflating disposable income enables patients to opt for advanced treatments, including implants and prosthetics. Continual technological advancements, such as digital dentistry and premium materials, enhance treatment quality. Additionally, dental tourism and implementation of government healthcare initiatives are further augmenting the Mexico dental consumables market share, positioning Mexico as a key regional market for dental consumables.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 487.50 Million |

| Market Forecast in 2033 | USD 753.04 Million |

| Market Growth Rate 2025-2033 | 4.95% |

Mexico Dental Consumables Market Trends:

Increasing Demand for Dental Implants and Prosthetics

The market is experiencing significant growth due to the increasing demand for prosthetics and dental implants. The factors contributing to this growth are an aging population, increased prevalence of dental problems, and increased awareness regarding oral health. In 2024, over 10% of children aged 2 to 5 years in Mexico had untreated cavities in their primary teeth, with a significantly higher prevalence of 18.5% among Mexican American children. At the ages of 6 to 8 years, the proportion of children with untreated decay increased to almost 18%, particularly in communities with high poverty rates. The prevalence of untreated cavities was most notable among Mexican American children and low-income individuals, highlighting the need for better dental care and products to alleviate these disparities in Mexico. Besides, Mexico's expanding middle class has increased disposable income, enabling patients to opt for sophisticated dental procedures such as implants and crowns instead of traditional treatments. Conversely, innovations such as CAD/CAM systems and 3D printing guarantee that these products are more accurate and affordable, thereby enhancing accessibility. Dental tourism in Mexico is also supplementing the market, offering high-quality, low-cost treatment for foreign patients. Meanwhile, domestic industries are increasing their production capacity for both the domestic and export markets, while foreign firms are forming alliances to benefit from this new industry. Therefore, the dental implants and prosthetics market is likely to dominate the Mexican market.

Shift Toward Digital Dentistry and Advanced Materials

The rapid adoption of digital dentistry and advanced materials is significantly supporting the Mexico dental consumables market growth. Dentists are moving to digital technology, including intraoral scanners, cone-beam computed tomography (CBCT), and digital impression systems that enhance the accuracy and efficiency of their procedures. Digital technologies also deliver fewer human mistakes, shorter treatment times, and increased comfort for patients, leading to higher acceptance by the practitioner. Additionally, high-performance materials such as zirconia, ceramics, and bioactive composites are steadily becoming more accepted and plentiful, with dental professionals appreciating the strength and aesthetic visual qualities of these materials in their work. Minimal intervention (or minimally invasive) treatment is a rising new trend that is resulting in a demand for high-performance bonding agents or adhesives and tooth-colored restorative materials. Further, government-sponsored campaigns promoting oral hygiene and private investment in dental infrastructure and tourism are also supporting the trend. According to industry reports, as of 2025, dental tourism in Mexico continues to be strong, with potential savings of as much as 90% from dental procedures compared to U.S. dental costs. For instance, a dental implant in Mexico is USD 650, quite a contrast to USD 5,000 in the U.S., and porcelain crowns are only USD 350, an 80% savings from U.S. prices. This cost-effective treatment facility, supported by a solid dental framework and trusted brands, attracts foreign patients seeking low-cost and reliable dental care. Moreover, the dental practices in Mexico are expected to modernize rapidly, positioning the country as a competitive player in the global dental consumables market.

Mexico Dental Consumables Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, treatment, material, and end user.

Product Insights:

- Dental Burs

- Whitening Material

- Dental Biomaterial

- Dental Anesthetics

- Crowns and Bridges

- Dental Implants

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes dental burs, whitening material, dental biomaterial, dental anesthetics, crowns and bridges, dental implants, and others.

Treatment Insights:

- Orthodontic

- Endodontic

- Periodontic

- Prosthodontic

A detailed breakup and analysis of the market based on the treatment have also been provided in the report. This includes orthodontic, endodontic, periodontic, and prosthodontic.

Material Insights:

- Metals

- Polymers

- Ceramics

- Biomaterials

The report has provided a detailed breakup and analysis of the market based on the material. This includes metals, polymers, ceramics, and biomaterials.

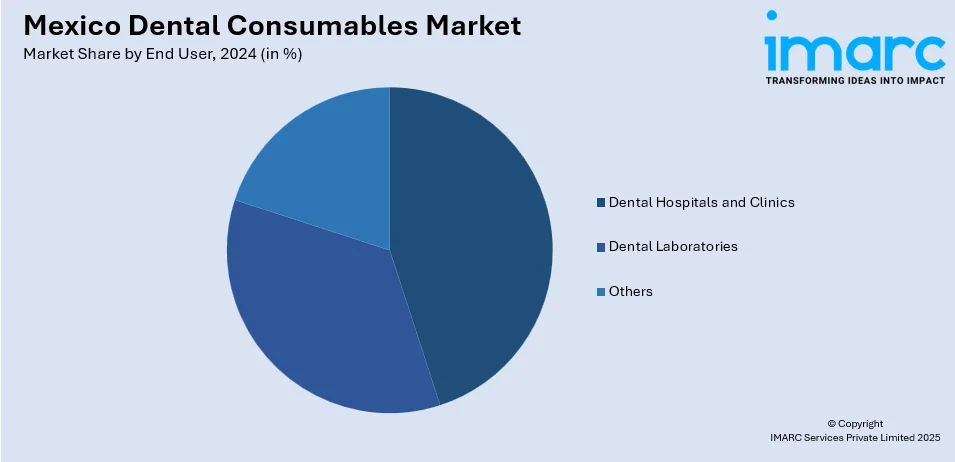

End User Insights:

- Dental Hospitals and Clinics

- Dental Laboratories

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes dental hospitals and clinics, dental laboratories, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Dental Consumables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Dental Burs, Whitening Material, Dental Biomaterial, Dental Anesthetics, Crowns and Bridges, Dental Implants, Others |

| Treatments Covered | Orthodontic, Endodontic, Periodontic, Prosthodontic |

| Materials Covered | Metals, Polymers, Ceramics, Biomaterials |

| End Users Covered | Dental Hospitals and Clinics, Dental Laboratories, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico dental consumables market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico dental consumables market on the basis of product?

- What is the breakup of the Mexico dental consumables market on the basis of treatment?

- What is the breakup of the Mexico dental consumables market on the basis of material?

- What is the breakup of the Mexico dental consumables market on the basis of end user?

- What is the breakup of the Mexico dental consumables market on the basis of region?

- What are the various stages in the value chain of the Mexico dental consumables market?

- What are the key driving factors and challenges in the Mexico dental consumables market?

- What is the structure of the Mexico dental consumables market and who are the key players?

- What is the degree of competition in the Mexico dental consumables market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico dental consumables market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico dental consumables market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico dental consumables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)