Mexico Dental Implants Market Size, Share, Trends and Forecast by Material, Product, End Use, and Region, 2025-2033

Mexico Dental Implants Market Overview:

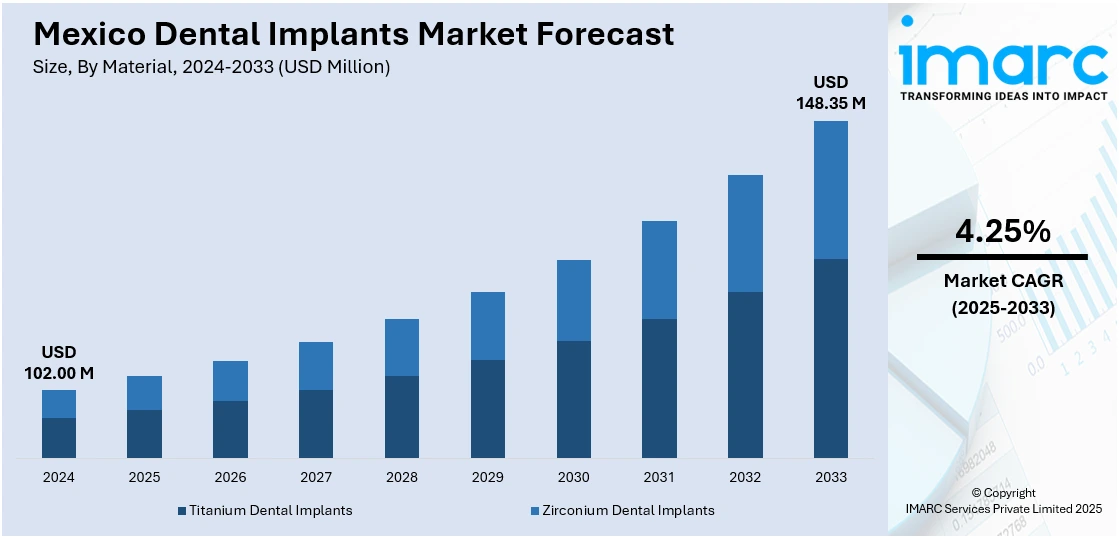

The Mexico dental implants market size reached USD 102.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 148.35 Million by 2033, exhibiting a growth rate (CAGR) of 4.25% during 2025-2033. The market is witnessing steady growth, driven by rising dental tourism, increasing elderly population, and expanding access to advanced implant procedures. In line with this, demand is supported by modern clinics, skilled professionals, and growing awareness of long-term oral health solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 102.00 Million |

| Market Forecast in 2033 | USD 148.35 Million |

| Market Growth Rate 2025-2033 | 4.25% |

Mexico Dental Implants Market Trends:

Rising Demand Due to Medical Tourism

Mexico is witnessing a steady rise in dental tourism, which is playing a major role in driving the market growth. Many patients from neighboring countries travel to Mexico to access high-quality dental care at more affordable rates. This growing cross-border movement has positioned Mexico as a popular hub for implant procedures. The Mexico dental implants market growth is also driven by the increasing reputation of cities like Tijuana, Cancun, and Los Algodones, known for their well-equipped clinics and skilled professionals. Patients are drawn to the convenience, personalized care, and modern treatment options available. For instance, in March 2025, Smile4EverMexico announced the launch of affordable dental care solutions for American patients facing rising dental costs. Located in Tijuana, the clinic will provide high-quality services, including dental implants and veneers, at prices significantly lower than those in the U.S. Patients can save up to 70%. The trust built through positive outcomes and word-of-mouth referrals continues to fuel demand. With rising international interest and expanding service offerings, the Mexico dental implants market outlook remains strong and poised for sustained expansion.

Growth in Aged and Edentulous Population

The increasing proportion of elderly individuals in Mexico is a key factor boosting the demand for dental implants. According to the data published by PAHO, in 2024, Mexico's population reached 130 861 007, a 32.7% increase since 2000. Those aged 65 and older made up 8.2% of the population, while the dependency ratio improved to 48.7 per 100 active individuals. As age-related tooth loss becomes more common, more patients are seeking durable and functional solutions to restore oral health and improve quality of life. Implants are gaining preference over traditional dentures due to their stability, comfort, and long-term benefits. This shift in patient preference reflects a broader change in dental care expectations among older adults. The market is also witnessing greater awareness and acceptance of implant procedures among seniors, supported by growing access to skilled professionals and modern treatment facilities. As dental care becomes a priority for aging individuals aiming to maintain an active lifestyle, implant procedures are becoming more routine. These demographic and behavioral changes are positively influencing the Mexico dental implants market share across both urban and semi-urban regions.

Mexico Dental Implants Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on material, product, and end use.

Material Insights:

- Titanium Dental Implants

- Zirconium Dental Implants

The report has provided a detailed breakup and analysis of the market based on the material. This includes Titanium Dental Implants and Zirconium Dental Implants.

Product Insights:

- Endosteal Implants

- Subperiosteal Implants

- Transosteal Implants

- Intramucosal Implants

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes endosteal implants, subperiosteal implants, transosteal implants, and intramucosal implants.

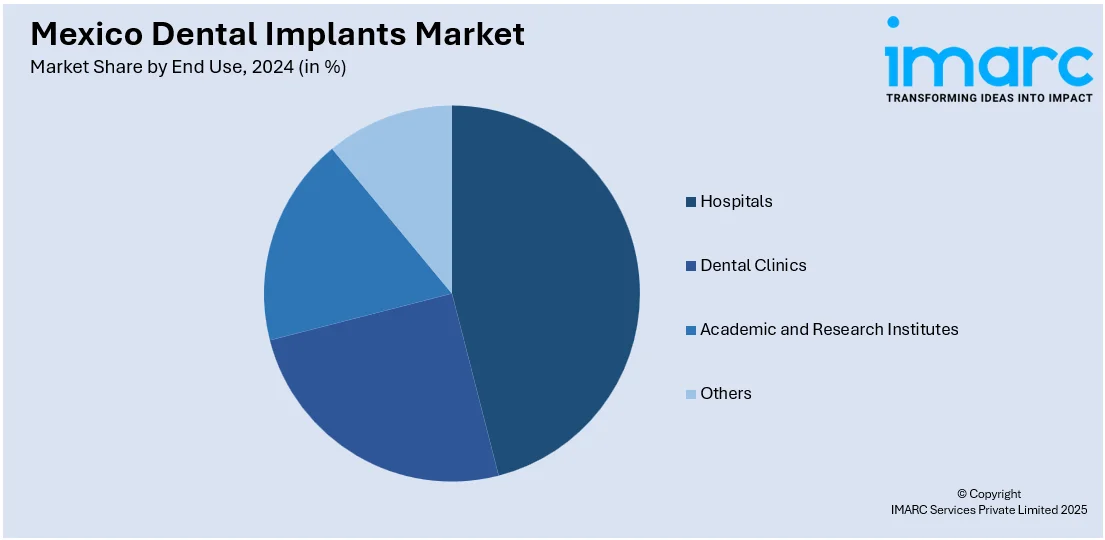

End Use Insights:

- Hospitals

- Dental Clinics

- Academic and Research Institutes

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes hospitals, dental clinics, academic and research institutes, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Dental Implants Market News:

- In December 2024, Smile4EverMexico announced the launch of a single-visit tooth restoration service using advanced digital dentistry and Neo Dent implants. This efficient option significantly lowers costs, providing comprehensive treatments like the All-on-4 procedure.

Mexico Dental Implants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Titanium Dental Implants, Zirconium Dental Implants |

| Products Covered | Endosteal Implants, Subperiosteal Implants, Transosteal Implants, Intramucosal Implants |

| End Uses Covered | Hospitals, Dental Clinics, Academic and Research Institutes, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico dental implants market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico dental implants market on the basis of material?

- What is the breakup of the Mexico dental implants market on the basis of product?

- What is the breakup of the Mexico dental implants market on the basis of end use?

- What is the breakup of the Mexico dental implants market on the basis of region?

- What are the various stages in the value chain of the Mexico dental implants market?

- What are the key driving factors and challenges in the Mexico dental implants?

- What is the structure of the Mexico dental implants market and who are the key players?

- What is the degree of competition in the Mexico dental implants market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico dental implants market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico dental implants market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico dental implants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)