Mexico Dental Insurance Market Size, Share, Trends and Forecast by Type, Demographics, Coverage, End User, and Region, 2026-2034

Mexico Dental Insurance Market Summary:

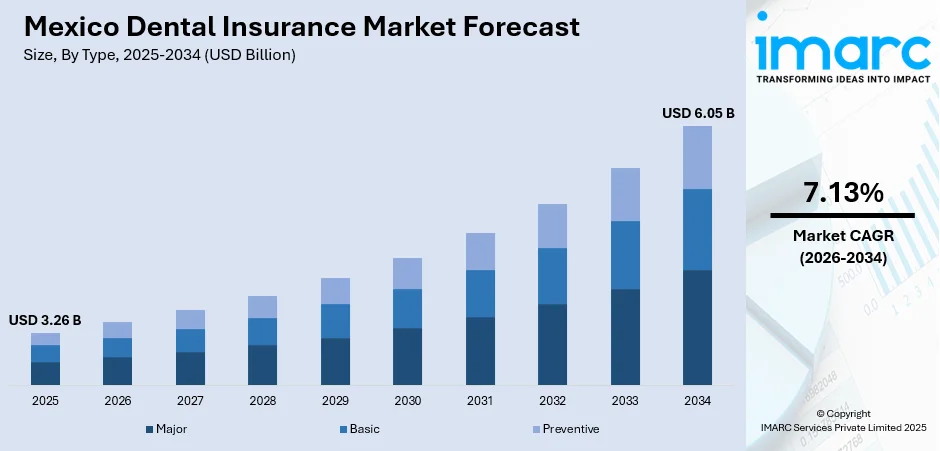

The Mexico dental insurance market size was valued at USD 3.26 Billion in 2025 and is projected to reach USD 6.05 Billion by 2034, growing at a compound annual growth rate of 7.13% from 2026-2034.

The market is driven by expanding corporate employee benefit programs, a growing middle-class population seeking preventive oral healthcare coverage, and increasing awareness of dental health’s importance. Rising disposable incomes, evolving healthcare expectations, and strategic collaborations between insurers and dental care providers are further boosting adoption. Additionally, government initiatives promoting oral health education and accessibility to quality dental services support market growth, collectively strengthening the Mexico dental insurance market share across all age groups and income segments.

Key Takeaways and Insights:

-

By Type: Preventive dominates the market with a share of 49.95% in 2025, driven by routine check-ups, employer benefits, long-term cost savings, and consumer perception of preventive care value.

-

By Demographics: Adults lead the market with a share of 59.98% in 2025, owing to higher employment, awareness of periodontal risks, purchasing power, and lifestyle needs for restorative and cosmetic dental procedures.

-

By Coverage: Dental preferred provider organizations represent the largest segment with a market share of 49.95% in 2025, driven by affordable premiums, network flexibility, negotiated fees, broad provider access, and administrative simplicity for subscribers and employers.

-

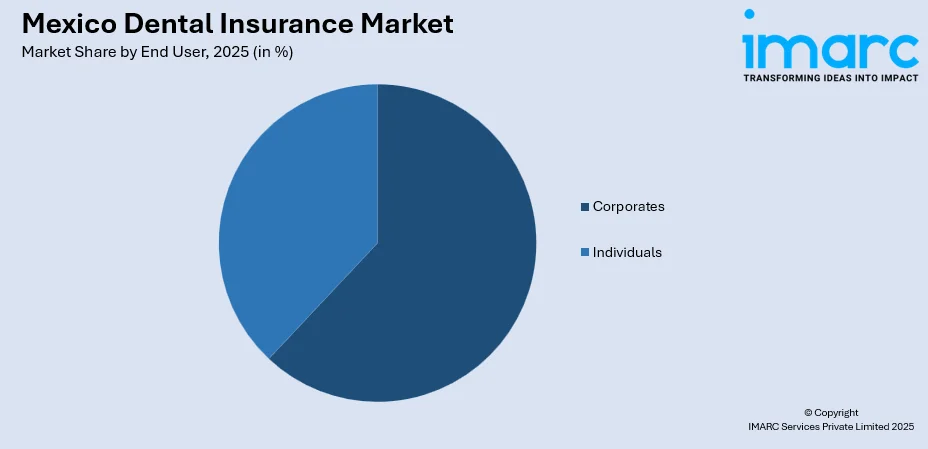

By End User: Corporates dominate the market with a share of 61.98% in 2025, owing to social security mandates, talent acquisition strategies, tax incentives, and group policy economies of scale.

-

Key Players: The market features diverse participation from multinational insurance carriers, regional specialty dental insurers, and hybrid health-dental coverage providers competing across premium tiers. Strategic differentiation occurs through network breadth, claims processing efficiency, coverage customization capabilities, and digital service delivery platforms enhancing member experience and retention rates.

To get more information on this market Request Sample

The Mexico dental insurance market experiences robust expansion through fundamental shifts in healthcare consumption patterns and employment structures. Corporate sector growth drives systematic benefit standardization, while emerging middle-income households prioritize preventive health investments over reactive treatments. Cultural attitudes toward oral health evolve beyond basic necessity toward aesthetic and wellness considerations, supported by urbanization concentrating populations near quality dental infrastructure. Insurance penetration deepens as regulatory frameworks encourage private coverage complementing public health systems, and competitive market dynamics improve policy affordability and accessibility. In August 2025, Bupa Mexico expanded its customized health and dental coverage options through its partnership with BBVA, strengthening access to specialized care and reinforcing consumer adoption of private insurance solutions. Moreover, digital transformation enables streamlined enrollment processes and claims management, reducing traditional barriers to adoption. Educational initiatives by healthcare providers and insurers elevate understanding of dental insurance value propositions, particularly regarding cost predictability and access to specialized care networks.

Mexico Dental Insurance Market Trends:

Digital Transformation and Insurtech Integration

Insurance providers are investing heavily in advanced technologies including mobile platforms, artificial intelligence-driven underwriting, and automated claims management systems. In 2025, Insurtech Crabi secured a US$13.6 million Series A round to scale its AI-powered underwriting and real-time claims automation, strengthening Mexico’s rapidly digitizing insurance ecosystem. Moreover, insurtech startups are entering the market with innovative tech-enabled solutions such as subscription-based models and on-demand insurance that appeal to younger demographics. The use of big data analytics enables insurers to personalize offerings according to customer behavior and risk profiles, improving product relevance and engagement across Mexico's digitally literate urban population.

Growing Emphasis on Preventive Care Coverage

Healthcare institutions, government health departments, and private insurance companies are launching campaigns to encourage regular dental check-ups and early intervention among the population. As per sources, in 2025, IMSS and SEP launched a nationwide school health initiative deploying 738 brigades to 90,832 public schools, aiming to improve oral-health access as 40% of children lacked prior dental care. Moreover, this shift toward prevention-focused coverage reflects the recognition that routine care reduces long-term treatment costs and improves oral health outcomes. Insurance plans increasingly cover preventive services at minimal cost, encouraging policyholders to prioritize regular dental visits and preventive treatments.

Expansion of Corporate Dental Benefits Programs

Employers across Mexico are increasingly adding dental coverage to employee benefit packages as part of comprehensive health offerings. In March 2024, Aon’s 2023 Benefits Survey revealed that 70.9% of Mexican companies provide health benefits to employees, with 54.5% offering multiple plan options to enhance workforce well-being. Furthermore, group dental plans are becoming an affordable benefit that enhances employee morale, health outcomes, and workforce retention, while insurers develop scalable group products with streamlined onboarding and claims settlement processes.

Market Outlook 2026-2034:

The Mexico dental insurance market is poised for robust expansion through the forecast period, supported by rising oral health awareness, increasing corporate adoption of dental benefits, and continued digital transformation across the insurance sector. Growing urbanization, expanding middle-class populations, and higher disposable incomes are expected to drive demand for comprehensive dental coverage options. The market generated a revenue of USD 3.26 Billion in 2025 and is projected to reach a revenue of USD 6.05 Billion by 2034, growing at a compound annual growth rate of 7.13% from 2026-2034.

Mexico Dental Insurance Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Preventive | 49.95% |

| Demographics | Adults | 59.98% |

| Coverage | Dental Preferred Provider Organizations | 49.95% |

| End Use | Corporates | 61.98% |

Type Insights:

- Major

- Basic

- Preventive

The preventive dominates with a market share of 49.95% of the total Mexico dental insurance market in 2025.

Preventive dental insurance coverage encompasses routine care services designed to maintain oral health and prevent dental problems before they escalate. This includes services such as regular dental examinations, professional cleanings, diagnostic X-rays, fluoride treatments, and dental sealants. The segment's dominance reflects the growing recognition among Mexican consumers and insurers that early intervention and routine maintenance significantly reduce long-term healthcare costs while improving overall oral health outcomes.

Insurance providers increasingly cover preventive services at minimal or no cost to policyholders, encouraging regular dental visits and early detection of potential issues. As per sources, in 2024, Sedesa reported that during the 2023–2024 school year, authorities conducted 1,574,226 preventive oral health activities in Mexico City public schools, benefiting 184,503 children. Moreover, government health campaigns and dental professionals continue to emphasize the importance of preventive care, educating the population about the connection between oral health and overall wellbeing. This shift toward prevention-focused coverage is supported by clinical evidence demonstrating that routine dental care reduces the incidence of serious oral diseases and costly restorative procedures.

Demographics Insights:

- Senior Citizens

- Adults

- Minors

The adults lead with a share of 59.98% of the total Mexico dental insurance market in 2025.

The adult demographic segment encompasses working-age individuals who represent the primary beneficiaries of employer-sponsored dental insurance plans. This segment's market leadership reflects the concentration of corporate dental benefits among employed adults who have access to group insurance programs through their workplace. As per sources, in December 2024, Grupo Auna reported holding over three million dental insurance policies in Mexico following its acquisition of Dentegra Seguros Dentales, reflecting strong adoption of private adult dental coverage. Further, adults in Mexico's urban centers demonstrate higher health awareness and disposable income levels, enabling greater participation in comprehensive dental coverage options.

The segment benefits from the expansion of corporate dental benefits programs across Mexico's manufacturing, technology, and service sectors. Working adults increasingly recognize the importance of maintaining oral health for professional and personal wellbeing, driving demand for dental insurance products that offer comprehensive coverage for preventive, basic, and major dental procedures. Individual insurance options complement employer-sponsored plans, providing additional coverage choices for adults seeking enhanced protection.

Coverage Insights:

- Dental Preferred Provider Organizations

- Dental Health Maintenance Organizations

- Dental Indemnity Plans

- Others

The dental preferred provider organizations exhibit a clear dominance with a 49.95% share of the total Mexico dental insurance market in 2025.

Dental preferred provider organizations represent a flexible coverage model that allows policyholders to choose from a network of preferred dental providers while maintaining the option to seek treatment from out-of-network dentists. This flexibility appeals to Mexican consumers who value provider choice and accessibility, particularly in urban areas where diverse dental care options exist. DPPO plans typically offer higher reimbursement rates for in-network services while still providing partial coverage for out-of-network treatments.

The segment's market leadership reflects consumer preference for balanced coverage that combines cost control with provider flexibility. As of September 2024, Mexico’s health and dental insurance market generated 10.46 Billion pesos in revenue, reflecting strong growth and rising adoption of network-based dental coverage plans. Moreover, DPPO plans have gained traction among corporate employers seeking to offer comprehensive dental benefits that satisfy diverse employee preferences. Insurers continue to expand their provider networks and enhance digital platforms for seamless claims processing, further strengthening the appeal of DPPO coverage models in Mexico's evolving dental insurance landscape.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Individuals

- Corporates

The corporates dominate with a market share of 61.98% of the total Mexico dental insurance market in 2025.

Corporates represent the primary distribution channel for dental insurance in Mexico, offering group dental plans as part of comprehensive employee benefit packages. This segment's dominance reflects the strategic importance of dental benefits in workforce attraction and retention, particularly in competitive industries such as manufacturing, information technology, and professional services. Group dental plans enable employers to negotiate favorable terms with insurers while providing cost-effective coverage options for employees.

This segment benefits from economies of scale in insurance purchasing and administrative efficiency in plan management. Employers increasingly recognize dental benefits as essential components of holistic employee wellness programs that improve productivity and reduce absenteeism related to dental health issues. Insurers respond by developing scalable group products with streamlined enrollment processes, digital claims management, and flexible coverage options tailored to diverse workforce compositions.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents a significant market for dental insurance driven by its industrialized economy and proximity to the United States. States including Nuevo León, Baja California, Chihuahua, and Coahuila host major manufacturing clusters in automotive, aerospace, and electronics sectors, supporting strong corporate demand for employee dental benefits. The region's higher income levels and advanced healthcare infrastructure enable greater insurance penetration and premium coverage adoption.

Central Mexico, anchored by Mexico City and surrounding states including Querétaro, Puebla, and Guanajuato, constitutes the largest regional market for dental insurance. The region's concentration of corporate headquarters, financial services, and technology companies generates substantial demand for comprehensive employee benefits. Dense urban populations with higher health awareness and disposable incomes support both corporate and individual insurance segments across diverse coverage options.

Southern Mexico, comprising states such as Chiapas, Oaxaca, Yucatán, and Quintana Roo, presents emerging opportunities for dental insurance expansion. While historically underserved due to lower urbanization and income levels, the region benefits from growing tourism industries and government development initiatives. Increasing healthcare awareness campaigns and expanding digital insurance platforms are gradually improving access to dental coverage among previously uninsured populations.

Other regions including western Mexico and various smaller markets contribute to the national dental insurance landscape through diverse economic activities. States such as Jalisco and Sinaloa feature growing technology and agricultural sectors that support increasing corporate benefits adoption. Regional variations in healthcare infrastructure, income distribution, and insurance awareness create differentiated market opportunities requiring tailored product strategies and distribution approaches.

Market Dynamics:

Growth Drivers:

Why is the Mexico Dental Insurance Market Growing?

Rising Awareness of Oral Health and Preventive Care

The Mexico dental insurance market is experiencing growth as awareness about oral health and preventive dental care increases across the population. In April 2025, Mexico’s dental tourism grew significantly, offering high-quality care with modern technology at 50–70% lower costs than the U.S. and Canada, attracting numerous international patients. Furthermore, healthcare institutions, government health departments, and private insurance companies are launching campaigns to encourage regular dental check-ups and early intervention. Educational initiatives emphasize the connection between oral health and overall wellbeing, including links to chronic conditions such as cardiovascular disease and diabetes. The Mexican Ministry of Health's programs, including initiatives targeting children through school-based oral health awareness campaigns, are fostering preventive health behaviors from early ages. As consumers recognize the cost-effectiveness of preventive care over restorative treatments, demand for insurance products covering routine dental services continues to expand.

Expansion of Corporate Employee Benefit Programs

Corporate employers across Mexico are increasingly incorporating dental coverage into comprehensive employee benefit packages, driving significant market growth. This trend is particularly pronounced in high-skilled workforce sectors including manufacturing, information technology, and professional services where competition for talent intensifies. Employers recognize that dental benefits enhance workforce retention, improve employee morale, and reduce absenteeism related to dental health issues. As of 2023, IMSS’s ELSSA program supported more than 3 million 321 thousand workers in 10,250 companies, advancing workplace safety, health, and preventive care across Mexico. Additionally, group dental plans offer economies of scale that make coverage affordable for businesses of various sizes, while insurers develop scalable products with streamlined administration. The growing recognition of dental benefits as essential components of holistic employee wellness programs continues to accelerate corporate adoption rates across Mexico's diverse industrial sectors.

Digital Transformation and Insurtech Innovation

Insurance providers are investing in advanced technologies to transform customer engagement and operational efficiency in Mexico's dental insurance market. Mobile platforms, artificial intelligence-driven underwriting, and automated claims management systems streamline policyholder experiences while reducing operational costs. Insurtech startups are entering the market with innovative solutions including subscription-based models and on-demand insurance that appeal to younger, digitally-native demographics. As of September 2025, MetLife acquired a 20% stake in Mexican insurtech Klimber, enhancing digital insurance distribution and embedded coverage for over 13.9 Million users across Mexico. Furthermore, big data analytics enable insurers to personalize offerings based on customer behavior and risk profiles, increasing product relevance and engagement. As digital literacy rises across Mexico's urban centers, this technological evolution plays a pivotal role in expanding the customer base and improving service delivery across the dental insurance sector.

Market Restraints:

What Challenges the Mexico Dental Insurance Market is Facing?

Limited Insurance Penetration in Rural Areas

A significant portion of Mexico's population, particularly in rural and remote areas, lacks access to dental insurance due to limited infrastructure and distribution networks. Lower income levels and informal employment in these regions reduce the capacity for insurance premium payments. The concentration of dental care facilities in urban centers creates accessibility barriers that diminish the perceived value of insurance coverage among rural populations.

High Out-of-Pocket Healthcare Expenditures

Mexico maintains among the highest out-of-pocket healthcare expenditure rates in Latin America, with households bearing substantial costs even when insurance coverage exists. Coverage limitations, exclusions, and copayment requirements often leave policyholders with unexpected expenses for dental treatments. This financial burden can discourage insurance adoption among cost-sensitive consumers who question the value proposition of dental coverage.

Regulatory Complexity and Compliance Requirements

Insurance providers face evolving regulatory frameworks that create compliance challenges and operational complexity. Data protection requirements, advertising restrictions, and licensing procedures impose administrative burdens that can limit market entry and product innovation. Navigating these regulatory landscapes requires significant investment in compliance infrastructure and legal expertise.

Competitive Landscape:

The Mexico dental insurance market exhibits a moderately competitive landscape characterized by established domestic insurers operating alongside multinational healthcare companies. Key market participants leverage brand recognition, extensive provider networks, and diversified product portfolios to maintain competitive positions. Strategic initiatives focus on digital platform development, corporate partnership expansion, and innovative product offerings targeting underserved segments. Competition intensifies around service quality, claims processing efficiency, and premium pricing, while insurtech entrants introduce disruptive distribution models and technology-enabled solutions. Market consolidation trends emerge as larger players pursue acquisitions to expand geographic reach and enhance product capabilities.

Mexico Dental Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Major, Basic, Preventive |

| Demographics Covered | Senior Citizens, Adults, Minors |

| Coverages Covered | Dental Preferred Provider Organizations, Dental Health Maintenance Organizations, Dental Indemnity Plans, Others |

| End Users Covered | Individuals, Corporates |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico dental insurance market size was valued at USD 3.26 Billion in 2025.

The Mexico dental insurance market is expected to grow at a compound annual growth rate of 7.13% from 2026-2034 to reach USD 6.05 Billion by 2034.

Preventive held the largest market share, driven by strong consumer preference for routine dental check-ups, growing focus on early oral disease detection, widespread inclusion of preventive services in employer benefit plans, and the rising appeal of low-cost care that reduces future treatment expenses.

Key factors driving the Mexico dental insurance market include rising awareness of oral health and preventive care, expansion of corporate employee benefit programs, digital transformation initiatives by insurers, and growing middle-class populations with increasing disposable incomes.

Major challenges include limited insurance penetration in rural and remote areas, high out-of-pocket healthcare expenditures among consumers, regulatory complexity affecting market entry and product innovation, and persistent healthcare access disparities across different regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)