Mexico DevOps Market Size, Share, Trends and Forecast by Type, Deployment Model, Organization Size, Tool, Industry Vertical, and Region, 2025-2033

Mexico DevOps Market Overview:

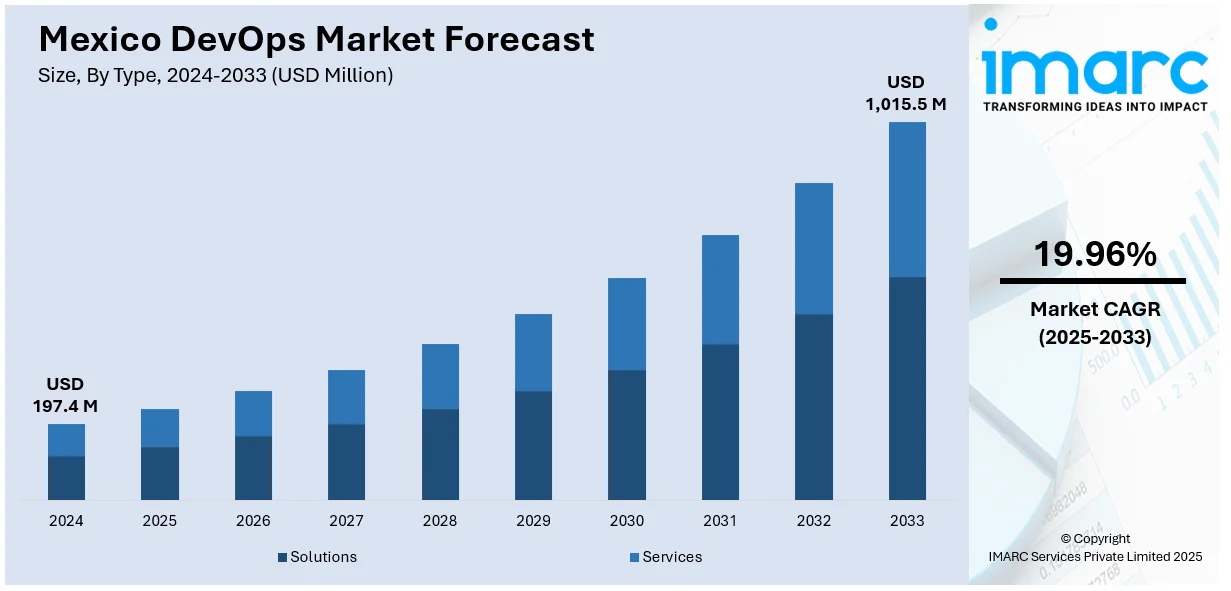

The Mexico DevOps market size reached USD 197.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,015.5 Million by 2033, exhibiting a growth rate (CAGR) of 19.96% during 2025-2033. The market is driven by the growing cybersecurity and compliance needs, cloud infrastructure investments, automation, and digital transformation, with organizations increasingly adopting DevOps practices to ensure security, scalability, faster deployment, and efficient collaboration while meeting regulatory requirements and responding to expanding market opportunities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 197.4 Million |

| Market Forecast in 2033 | USD 1,015.5 Million |

| Market Growth Rate 2025-2033 | 19.96% |

Mexico DevOps Market Trends:

Rising Importance of Cybersecurity and Compliance

With the rise of digital operations and cloud adoption, the demand for strong cybersecurity and regulatory compliance also grows, serving as a key factor in Mexico DevOps market. DevOps practices, especially by incorporating security at the initial stages of the development lifecycle (DevSecOps), allow organizations to actively manage vulnerabilities and maintain data safety without sacrificing speed or effectiveness. This is especially vital as companies encounter escalating cyber threats and the growing difficulty of complying with local and global regulations. For instance, in 2025, Mexico created the General Directorate of Cybersecurity as part of the newly established Digital Transformation and Telecommunications Agency. This department seeks to safeguard the state's digital resources, improve security on government platforms, and offer cybersecurity training to public officials. These initiatives highlight the increasing focus on protecting data and ensuring secure, compliant digital frameworks. Due to the growing need to adhere to both local and international regulations, companies in Mexico are progressively utilizing DevOps tools and practices to embed security into each phase of the development and deployment processes. This transition not only safeguards essential systems but also builds trust with clients and stakeholders, emphasizing the strategic significance of secure, efficient, and compliant practices in the current digital economy.

Growing Investments in Cloud and Automation Infrastructure

The expansion of the DevOps market in Mexico is driven by rising investments in cloud infrastructure and automation solutions, especially from international tech companies and local businesses aiming to upgrade their information technology (IT) operations. The drive for digital transformation in various sectors, spanning from finance and manufacturing to retail and telecom, is encouraging organizations to implement DevOps practices to enhance deployment speed, scalability, and teamwork between development and operations teams. Cloud service providers are crucial as they provide customized DevOps toolchains integrated within their platforms, simplifying implementation for companies of all sizes. In 2024, Microsoft announced a $1.3 billion investment in Mexico over three years to enhance cloud computing and AI infrastructure. The initiative aimed to improve connectivity and AI adoption among small and medium-sized businesses (SMBs), impacting 5 million Mexicans and 30,000 SMBs. The project also included efforts to expand internet access for 150,000 Mexicans with Viasat's help. Moreover, government-driven digitalization initiatives and regulatory backing for technology growth are promoting wider acceptance of agile practices and continuous integration/continuous deployment (CI/CD) pipelines. The availability of talent is growing as universities in Mexico and tech institutions are emphasizing DevOps skills via bootcamps and certification programs, which aids in bridging the regional skills gap. Startups and small to medium-sized businesses, especially, are becoming proactive users, utilizing DevOps for quicker product development and enhanced time-to-market. These combined trends are establishing Mexico as an expanding center for DevOps solutions, generating opportunities for international vendors and local tech companies to serve a market that is increasingly savvy in technology and driven by automation.

Mexico DevOps Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, deployment model, organization size, tool, and industry vertical.

Type Insights:

- Solutions

- Services

The report has provided a detailed breakup and analysis of the market based on the type. This includes solutions and services.

Deployment Model Insights:

- Public Cloud

- Private Cloud

- Hybrid Cloud

A detailed breakup and analysis of the market based on the deployment model have also been provided in the report. This includes public cloud, private cloud, and hybrid cloud.

Organization Size Insights:

- Large Enterprises

- Medium-Sized Enterprises

- Small-Sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes large enterprises, medium-sized enterprises, and small-sized enterprises.

Tool Insights:

- Development Tools

- Testing Tools

- Operation Tools

A detailed breakup and analysis of the market based on the tool have also been provided in the report. This includes development tools, testing tools, and operation tools.

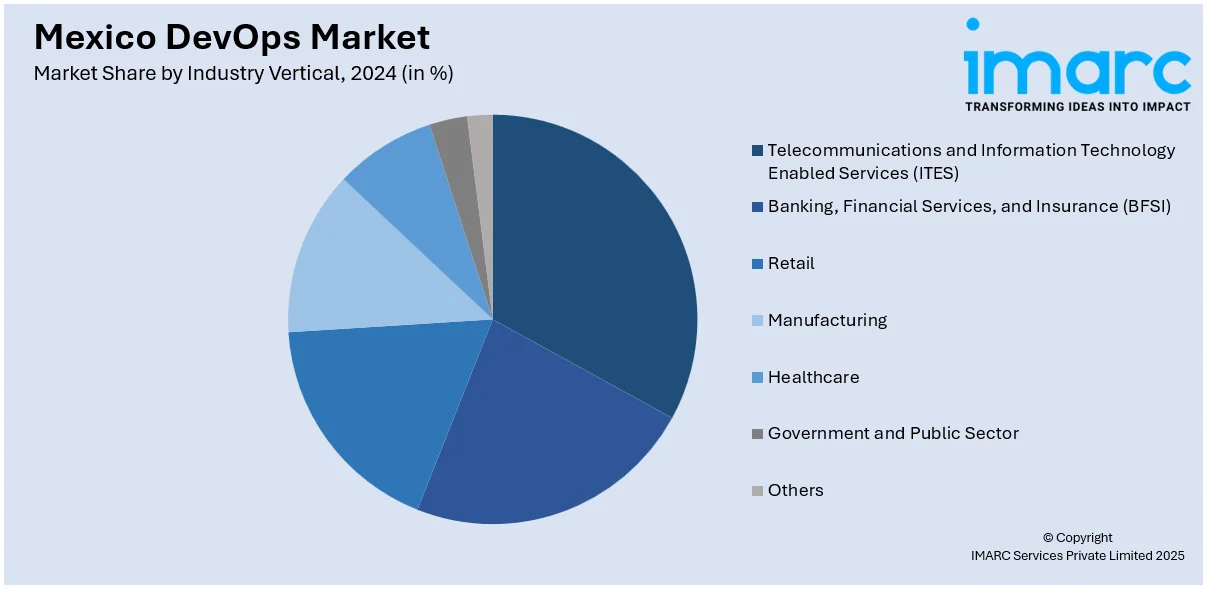

Industry Vertical Insights:

- Telecommunications and Information Technology Enabled Services (ITES)

- Banking, Financial Services, and Insurance (BFSI)

- Retail

- Manufacturing

- Healthcare

- Government and Public Sector

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes telecommunications and information technology enabled services (ITES), banking, financial services, and insurance (BFSI), retail, manufacturing, healthcare, government and public sector, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico DevOps Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Solutions, Services |

| Deployment Models Covered | Public Cloud, Private Cloud, Hybrid Cloud |

| Organization Sizes Covered | Large Enterprises, Medium-Sized Enterprises, Small-Sized Enterprises |

| Tools Covered | Development Tools, Testing Tools, Operation Tools |

| Industry Verticals Covered | Telecommunications and Information Technology Enabled Services (ITES), Banking, Financial Services, and Insurance (BFSI), Retail, Manufacturing, Healthcare, Government and Public Sector, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico DevOps market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico DevOps market on the basis of type?

- What is the breakup of the Mexico DevOps market on the basis of deployment mode?

- What is the breakup of the Mexico DevOps market on the basis of organization size?

- What is the breakup of the Mexico DevOps market on the basis of tool?

- What is the breakup of the Mexico DevOps market on the basis of industry vertical?

- What is the breakup of the Mexico DevOps market on the basis of region?

- What are the various stages in the value chain of the Mexico DevOps market?

- What are the key driving factors and challenges in the Mexico DevOps?

- What is the structure of the Mexico DevOps market and who are the key players?

- What is the degree of competition in the Mexico DevOps market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico DevOps market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico DevOps market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico DevOps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)