Mexico Diagnostic Testing Market Size, Share, Trends and Forecast by Test Type, Technology, Sample Type, Mode of Testing, Application, End User, and Region, 2025-2033

Mexico Diagnostic Testing Market Overview:

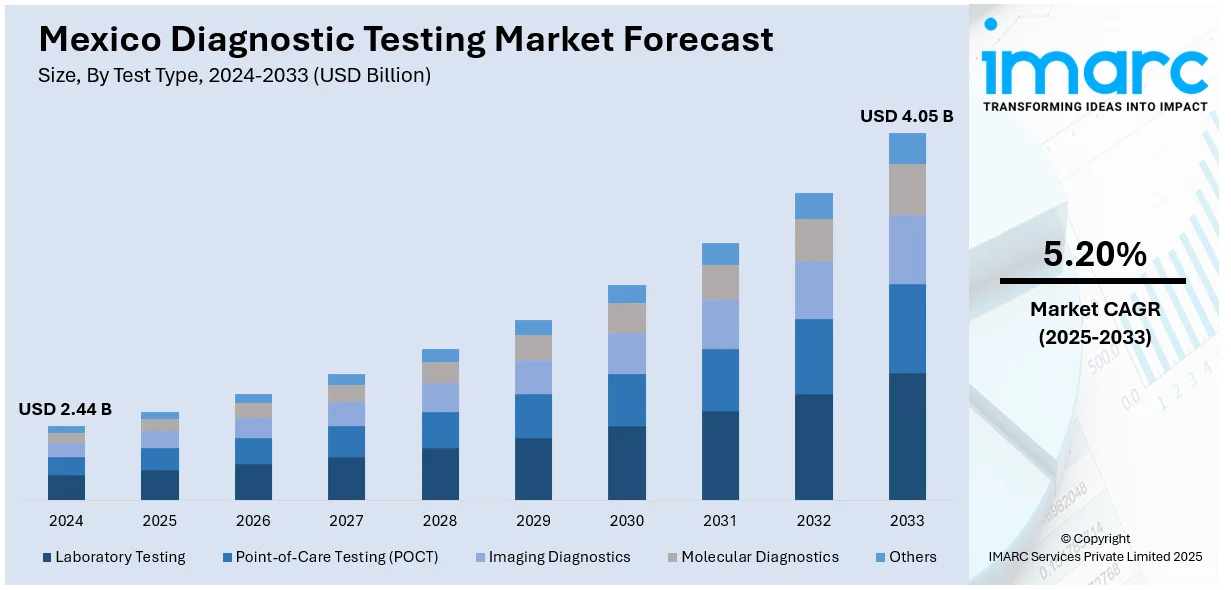

The Mexico diagnostic testing market size reached USD 2.44 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.05 Billion by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The growing health awareness and a shift toward preventive care are driving the market, as people seek early detection and disease management. Technological advancements, including artificial intelligence (AI), machine learning (ML), and mobile platforms, are enhancing testing efficiency, accessibility, and accuracy. These trends are expanding diagnostic services and contributing to the rise in the Mexico diagnostic testing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.44 Billion |

| Market Forecast in 2033 | USD 4.05 Billion |

| Market Growth Rate 2025-2033 | 5.20% |

Mexico Diagnostic Testing Market Trends:

Increasing Healthcare Awareness and Demand for Preventive Care

The rising awareness about the significance of early diagnosis and preventive health measures is propelling the market growth. As individuals are becoming more attentive to their health, there is a rise in the need for regular screenings and diagnostic examinations designed to identify illnesses in their initial phases. Health awareness initiatives, improved access to medical data, and increase in chronic illnesses are motivating people to take a more active role in their health, pursuing professional examinations to avert sickness and address current health issues. This move towards preventive care is resulting in a broad rise in diagnostic testing services nationwide, further strengthening the Mexico diagnostic testing market growth. An illustration of this trend is Mexico's "House-to-House Health" initiative introduced in 2024, aimed at enhancing healthcare access for seniors and people with disabilities. The program, designed to deliver tailored care to 13.6 million individuals, features bi-monthly home visits, medication delivery, and preventive measures like diagnostic testing to track health and avert chronic diseases. Initiatives like this not only improve the welfare of at-risk groups but also signify the increasing acknowledgment of the essential function that diagnostic testing serves in enhancing long-term health results. This is leading to higher investment and innovation in diagnostic services, enhancing healthcare accessibility and efficiency, while promoting ongoing growth in the diagnostic testing sector.

Technological Advancements in Diagnostic Equipment

Improvements in diagnostic technology are influencing the market, leading to a new phase of quicker, more precise, and less invasive testing. The incorporation of advanced technologies like AI, ML, and automation is greatly enhancing the accuracy and efficiency of diagnostic tests, resulting in improved patient outcomes. Moreover, advancements in mobile diagnostic platforms and point-of-care (POC) testing solutions are improving access to testing, especially in underserved regions. A significant instance of these innovations is the introduction of United Imaging’s uMI 550 PET/CT system at the Instituto Nacional de Pediatría (INP) in Mexico in 2024. This innovative system, the first in the nation for pediatric precision medicine, improved diagnostic accuracy by delivering high-quality imaging while reducing radiation exposure. It had the potential to improve pediatric care, not just at the INP but also for peripheral hospitals across Mexico, further enhancing the accessibility of advanced diagnostic technologies. Such innovations are making diagnostic testing more reliable, efficient, and accessible, encouraging healthcare providers and institutions to invest in these solutions. These technological advancements not only improve the accuracy of test results but also help reduce healthcare costs over time, driving further expansion and innovation in the market.

Mexico Diagnostic Testing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on test type, technology, sample type, mode of testing, application, and end user.

Test Type Insights:

- Laboratory Testing

- Point-of-Care Testing (POCT)

- Imaging Diagnostics

- Molecular Diagnostics

- Others

The report has provided a detailed breakup and analysis of the market based on the test type. This includes laboratory testing, point-of-care testing (POCT), imaging diagnostics, molecular diagnostics, and others.

Technology Insights:

- Immunoassay-Based

- PCR-Based

- Next Gen Sequencing

- Spectroscopy-Based

- Chromatography-Based

- Microfluidics

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes immunoassay-based, PCR-based, next gen sequencing, spectroscopy-based, chromatography-based, microfluidics, and others.

Sample Type Insights:

- Blood

- Urine

- Saliva

- Sweat

- Hair

- Others

The report has provided a detailed breakup and analysis of the market based on the sample type. This includes blood, urine, saliva, sweat, hair, and others.

Mode of Testing Insights:

- Prescription Based Testing

- OTC Testing

A detailed breakup and analysis of the market based on the mode of testing have also been provided in the report. This includes prescription based testing and OTC testing.

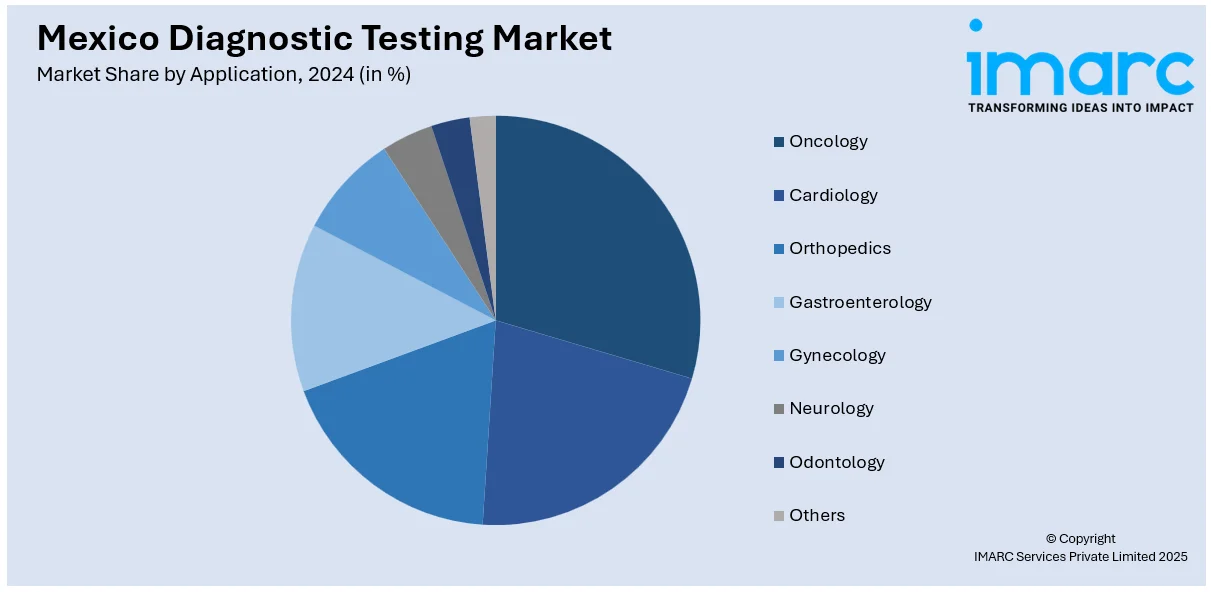

Application Insights:

- Oncology

- Cardiology

- Orthopedics

- Gastroenterology

- Gynecology

- Neurology

- Odontology

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes oncology, cardiology, orthopedics, gastroenterology, gynecology, neurology, odontology, and others.

End User Insights:

- Hospitals

- Diagnostic Center

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Homecare

- Blood Banks

- Research Labs and Institutes

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, diagnostic center, ambulatory surgical centers (ASCs), specialty clinics, homecare, blood banks, research labs and institutes, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Diagnostic Testing Market News:

- In March 2025, IMSS Bienestar launched the La Muestra Viaja initiative to simplify access to laboratory testing for individuals without social security in Mexico. The program enables patients to send lab samples from local health centers to specialized labs, reducing diagnostic costs and wait times. It will expand across the country throughout 2025, starting in Colima, Veracruz, and Mexico City.

- In March 2025, the Bridge Project launched in Mexico to improve access to pediatric cancer diagnostic testing, particularly for leukemia. The initiative, part of a collaboration with St. Jude Global, centralizes testing to reduce geographical barriers and ensure timely diagnoses. The project has already provided 1,000 children with comprehensive diagnostic panels, improving early diagnosis and treatment.

Mexico Diagnostic Testing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Test Types Covered | Laboratory Testing, Point-of-Care Testing (POCT), Imaging Diagnostics, Molecular Diagnostics, Others |

| Technologies Covered | Immunoassay-Based, PCR-Based, Next Gen Sequencing, Spectroscopy-Based, Chromatography-Based, Microfluidics, Others |

| Sample Types Covered | Blood, Urine, Saliva, Sweat, Hair, Others |

| Mode of Testings Covered | Prescription Based Testing, OTC Testing |

| Applications Covered | Oncology, Cardiology, Orthopedics, Gastroenterology, Gynecology, Neurology, Odontology, Others |

| End Users Covered | Hospitals, Diagnostic Center, Ambulatory Surgical Centers (ASCs), Specialty Clinics, Homecare, Blood Banks, Research Labs and Institutes, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico diagnostic testing market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico diagnostic testing market on the basis of test type?

- What is the breakup of the Mexico diagnostic testing market on the basis of technology?

- What is the breakup of the Mexico diagnostic testing market on the basis of sample type?

- What is the breakup of the Mexico diagnostic testing market on the basis of mode of testing?

- What is the breakup of the Mexico diagnostic testing market on the basis of application?

- What is the breakup of the Mexico diagnostic testing market on the basis of end user?

- What is the breakup of the Mexico diagnostic testing market on the basis of region?

- What are the various stages in the value chain of the Mexico diagnostic testing market?

- What are the key driving factors and challenges in the Mexico diagnostic testing market?

- What is the structure of the Mexico diagnostic testing market and who are the key players?

- What is the degree of competition in the Mexico diagnostic testing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico diagnostic testing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico diagnostic testing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico diagnostic testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)