Mexico Dialysis Equipment Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

Mexico Dialysis Equipment Market Overview:

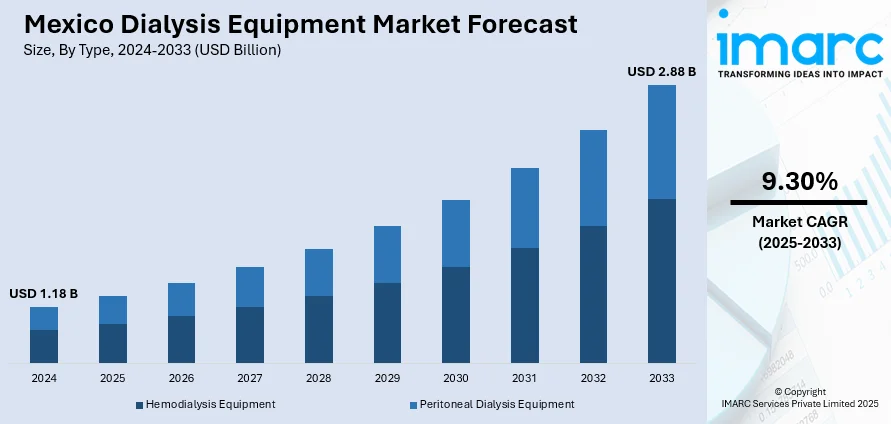

The Mexico dialysis equipment market size reached USD 1.18 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.88 Billion by 2033, exhibiting a growth rate (CAGR) of 9.30% during 2025-2033. The market is expanding due to the increasing chronic kidney disease cases, prevailing aging population, a shift toward home-based treatments, technological advancements, and private healthcare expansion. Several leaders like Fresenius and Baxter are also driving innovation to enhance patient access and care quality. These factors collectively influence the competitive landscape of the Mexico dialysis equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.18 Billion |

| Market Forecast in 2033 | USD 2.88 Billion |

| Market Growth Rate 2025-2033 | 9.30% |

Mexico Dialysis Equipment Market Analysis:

- Key Market Drivers: Increasing chronic kidney disease incidence, spurred by diabetes and hypertension, results in significant equipment demand. Mexico's aging populace increasingly needs dialysis care, as government healthcare programs increase treatment availability. Private healthcare industry expansion and technological advances in portable dialysis units also fuel Mexico dialysis equipment market demand.

- Key Market Trends: Home-based dialysis adoption is on the rise as patients opt for convenience and comfort. Sophisticated technologies such as automated systems and remote monitoring functions increase the efficiency of treatment. Private healthcare growth fuels the demand for high-quality equipment. Increased emphasis on nanotechnology incorporation and biomaterial advances increases equipment biocompatibility and patient outcomes are some of the major Mexico dialysis equipment market trends.

- Market Challenges: Excessive cost of equipment restricts access to lower-income patients in public healthcare. Lack of skilled nephrologists and technicians restricts service growth. Limited infrastructural capacity in rural regions prohibits deployment of equipment. Complicated regulations and dependence on imports introduce supply chain risks into Mexico dialysis equipment market analysis.

- Market Opportunities: Universal access to healthcare supported by government initiatives provides growth potential. Market for home dialysis offers large growth opportunities with portable equipment innovation. Public-private collaboration can address gaps in accessibility. Innovation in artificial intelligence and telemedicine technologies allows remote monitoring and enhanced patient care delivery systems.

Mexico Dialysis Equipment Market Trends:

Technological Advancements in Dialysis Equipment

Innovations in dialysis equipment are improving patient care and driving adoption across Mexico. Devices now feature more automated systems, touchscreen interfaces, remote monitoring, and compact designs that support home-based therapy. These advancements enhance treatment efficiency, reduce manual intervention, and improve patient comfort and outcomes. Healthcare providers are increasingly investing in such technologies to modernize clinics and compete in a growing market. Additionally, innovations in peritoneal dialysis and portable hemodialysis machines are expanding options for patients in rural or underserved areas. As the market evolves, manufacturers offering user-friendly, efficient, and high-quality equipment are gaining traction, thereby propelling the demand for technologically advanced dialysis solutions in Mexico.

To get more information on this market, Request Sample

Shift Toward Home-Based Dialysis Treatments

Mexico is seeing a notable shift toward home-based dialysis treatments due to rising healthcare decentralization and patient preference for flexibility. Home dialysis reduces the burden on hospitals while offering greater comfort and independence for patients. With improvements in portable dialysis machines and supportive government initiatives, more patients are choosing this model. Educational programs and remote monitoring technologies have also enabled safer and more manageable home treatment. Additionally, the COVID-19 pandemic accelerated the demand for home-based care, further normalizing this trend. As healthcare providers and policymakers continue promoting at-home therapies, demand for compact and easy-to-use dialysis equipment is growing steadily across Mexico.

Growth of Private Healthcare and Insurance Access

The expansion of Mexico’s private healthcare sector is fueling demand for advanced dialysis equipment. More private clinics and hospitals are entering the dialysis space, offering higher-quality services and shorter wait times. These facilities often invest in state-of-the-art equipment to attract patients seeking better care than what is typically available in the public system. Increased access to private health insurance and employer-sponsored plans is making these services more accessible to a broader population. As a result, manufacturers are partnering with private providers to supply modern machines and consumables. This sector’s continued growth supports the broader expansion of dialysis services and drives Mexico dialysis equipment market growth.

Mexico Dialysis Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end user.

Type Insights:

- Hemodialysis Equipment

- Hemodialysis Machines

- n-Center Hemodialysis Machines

- Home Based Hemodialysis Machines

- Hemodialysis Consumables

- Dialyzers

- Dialysate

- Access Products

- Others

- Hemodialysis Machines

- Peritoneal Dialysis Equipment

- Peritoneal Dialysis Equipment Type

- Continuous Ambulatory Peritoneal Dialysis (CAPD)

- Automated Peritoneal Dialysis (APD)

- Peritoneal Dialysis Product

- Cyclers

- Fluids

- Others

- Peritoneal Dialysis Equipment Type

The report has provided a detailed breakup and analysis of the market based on the type. This includes hemodialysis equipment [hemodialysis machines (n-center hemodialysis machines, and home-based hemodialysis machines) and hemodialysis consumables (dialyzers, dialysate, access products, and others)] and peritoneal dialysis equipment [peritoneal dialysis equipment type (continuous ambulatory peritoneal dialysis (CAPD) and automated peritoneal dialysis (APD)] and peritoneal dialysis product (cyclers, fluids, and others).

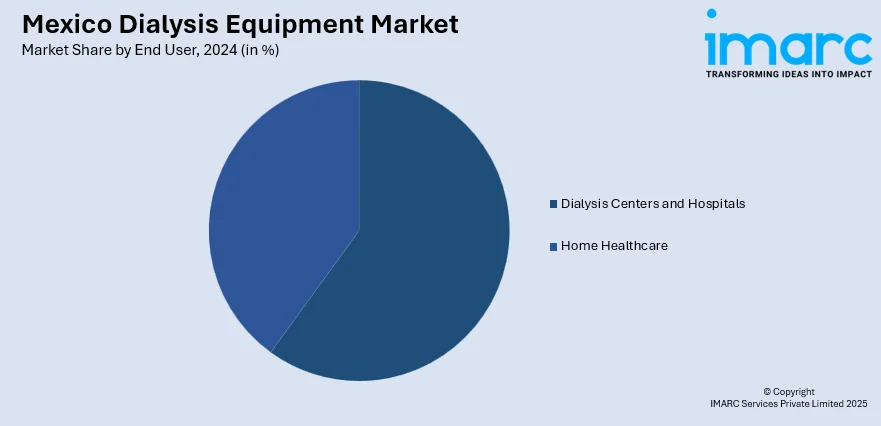

End User Insights:

- Dialysis Centers and Hospitals

- Home Healthcare

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes dialysis centers and hospitals and home healthcare.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Recent News and Developments:

- In July 2025, Fresenius Medical Care (FME) is expanding access to High-Volume Hemodiafiltration (HighVolumeHDF) in Mexico through a partnership with the Coordination of National Institutes of Health and Specialty Hospitals (CCINSHAE). The two-year pilot program installs 150 Fresenius 5008S CorDiax systems in seven out of ten centers, offering advanced dialysis to low-income patients without coverage. So far, 240 new patients and 410 insured patients now receive HighVolumeHDF, improving outcomes and cost-effectiveness in chronic kidney disease treatment.

- In May 2025, Chinese dialysis company SWS Medical is expanding its presence in Latin America, showcasing its technology at Hospitalar 2025 in Brazil. Already operating in 50% of the continent, including Mexico, Colombia, and Brazil, SWS has installed hundreds of dialysis machines and offers training, diagnostic software, and remote maintenance. Its SWS-4000A and SWS-6000 systems provide Online HDF, automated heparin injection, and real-time monitoring, improving treatment efficiency, access, and patient care across the region.

- In March 2025, High-Volume Hemodiafiltration (HighVolumeHDF) is becoming more widely available in seven of the ten facilities in Mexico run by Fresenius Medical Care, a company that creates goods and services for people with kidney disorders. A collaboration with Mexico's Coordination of the National Institutes of Health and High Specialty Hospitals (CCINSHAE) allowed for the growth. Through this program, low-income individuals in Mexico without health insurance will have access to cutting-edge dialysis treatments, particularly for those suffering from chronic kidney disease (CKD).

Mexico Dialysis Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| End Users Covered | Dialysis Centers and Hospitals, Home Healthcare |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico dialysis equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico dialysis equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico dialysis equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The dialysis equipment market in Mexico was valued at USD 1.18 Billion in 2024.

The Mexico dialysis equipment market is projected to exhibit a CAGR of 9.30% during 2025-2033, reaching a value of USD 2.88 Billion by 2033.

Rising chronic kidney disease prevalence driven by diabetes and hypertension, increasing aging population requiring dialysis services, government healthcare initiatives expanding treatment accessibility, private healthcare sector growth, and technological innovations in portable dialysis systems are key market drivers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)