Mexico Dialysis Market Size, Share, Trends and Forecast by Type, Product and Services, End User, and Region, 2025-2033

Mexico Dialysis Market Overview:

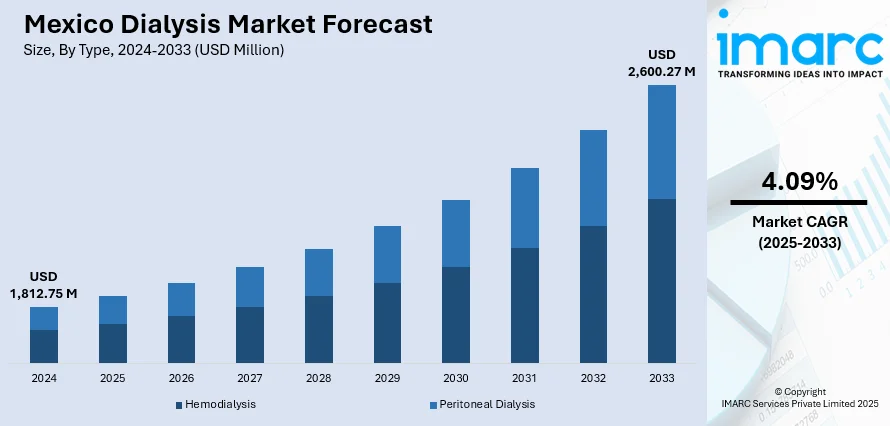

The Mexico dialysis market size reached USD 1,812.75 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,600.27 Million by 2033, exhibiting a growth rate (CAGR) of 4.09% during 2025-2033. Rising diabetes and hypertension rates, rapid urbanization, burgeoning aging population, expanding public insurance coverage, inflating private sector investment, growing peritoneal dialysis adoption, technological innovation, increasing awareness campaigns, and international collaboration in equipment supply and training are factors stimulating the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,812.75 Million |

| Market Forecast in 2033 | USD 2,600.27 Million |

| Market Growth Rate 2025-2033 | 4.09% |

Mexico Dialysis Market Trends:

Rising Prevalence of Diabetes and Hypertension

Mexico faces a mounting burden of chronic diseases, with diabetes and hypertension leading as primary contributors to chronic kidney disease (CKD). In 2025, Projections show a gradual rise in diagnosed chronic kidney disease (CKD) cases in Mexico, increasing from 2,425 per 100,000 people in 2022 to 2,446 per 100,000 by 2027. This indicates a slow but steady growth, reflecting ongoing challenges in prevention, early detection, and management of CKD nationwide. Moreover, the dietary transition toward processed foods, growing obesity rates, and reduced physical activity have intensified these conditions, especially in urban centers are factors boosting Mexico dialysis market share. As CKD advances in these patients, dialysis becomes a critical life-sustaining intervention. This epidemiological trend has directly influenced demand patterns across the dialysis market, prompting capacity expansion in both public and private healthcare facilities. In line with this, the increasing diagnosis of end-stage renal disease (ESRD) among middle-aged adults has reshaped the patient demographic, compelling providers to cater to a more diverse age base, which is another growth-inducing factor. Apart from this, the growing caseload from non-communicable diseases underscores the structural need for ongoing dialysis services across Mexico’s healthcare system.

Urbanization and Lifestyle Shifts

The Mexico dialysis market outlook is increasingly shaped by broader socioeconomic changes, especially the rapid pace of urbanization and associated lifestyle modifications. Over 80% of the population now resides in urban areas, a shift that has brought with it higher exposure to risk factors for kidney disease, including sedentary behavior, poor dietary habits, and increased stress. These conditions often lead to metabolic disorders such as type 2 diabetes and hypertension, both of which are major precursors to kidney failure. Moreover, urban healthcare facilities, especially in cities like Mexico City, Guadalajara, and Monterrey, are witnessing rising demand for renal care services, prompting investment in outpatient dialysis centers and home-based care options, which is bolstering the market growth. This urban-driven disease burden has also raised awareness among policy makers and insurers about the need for targeted intervention.

Aging Demographics and Chronic Kidney Disease Risk

As per the Mexico dialysis market forecast, the burgeoning aging population in the country has had major implications for the market, as age is a known risk factor for CKD progression. Older adults are more likely to have comorbidities such as diabetes, cardiovascular disease, and hypertension, all of which accelerate kidney function decline. With life expectancy on the rise, more individuals are living long enough to require long-term renal care. Older individuals are more prone to comorbid conditions such as diabetes, cardiovascular disease, and hypertension, all of which contribute to the accelerated decline of kidney function. Moreover, age-specific healthcare planning by public agencies, such as Instituto Mexicano del Seguro Social (IMSS) and Instituto de Seguridad y Servicios Sociales de los Trabajadores del Estado (ISSSTE), has led to expanded dialysis coverage under elderly care programs, which is driving the Mexico dialysis market growth. Providers are also tailoring service models for older patients by integrating geriatric care, home dialysis options, and mobile units. In this context, demographic aging represents both a market opportunity and a clinical priority in Mexico’s renal care ecosystem.

Mexico Dialysis Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, product and services, and end user.

Type Insights:

- Hemodialysis

- Conventional Hemodialysis

- Short Daily Hemodialysis

- Nocturnal Hemodialysis

- Peritoneal Dialysis

- Continuous Ambulatory Peritoneal Dialysis (CAPD)

- Automated Peritoneal Dialysis (APD)

The report has provided a detailed breakup and analysis of the market based on the type. This includes hemodialysis (conventional hemodialysis, short daily hemodialysis, and nocturnal hemodialysis) and peritoneal dialysis (continuous ambulatory peritoneal dialysis (CAPD) and automated peritoneal dialysis (APD)).

Product and Services Insights:

- Services

- Equipment

- Dialysis Machines

- Water Treatment Systems

- Others

- Consumables

- Dialyzers

- Catheters

- Others

- Dialysis Drugs

A detailed breakup and analysis of the market based on the product and services have also been provided in the report. This includes services, equipment (dialysis machines, water treatment systems, and others), consumables (dialyzers, catheters, and others), and dialysis drugs.

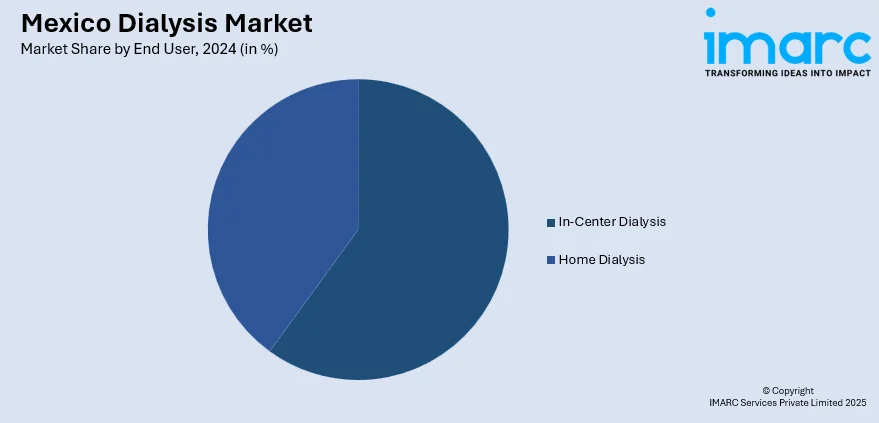

End User Insights:

- In-Center Dialysis

- Home Dialysis

The report has provided a detailed breakup and analysis of the market based on the end user. This includes in-center dialysis and home dialysis.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Dialysis Market News:

- In 2025, Fresenius Medical Care partnered with Mexico’s Coordination of the National Institutes of Health (CCINSHAE) to deploy 150 5008S CorDiax systems across seven public renal centers. This initiative aims to provide advanced High-Volume Hemodiafiltration (HighVolumeHDF) therapy to over 650 patients, including uninsured individuals, enhancing treatment outcomes for chronic kidney disease (CKD) patients.

Mexico Dialysis Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Product and Services Covered |

|

| End Users Covered | In-Center Dialysis, Home Dialysis |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico dialysis market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico dialysis market on the basis of type?

- What is the breakup of the Mexico dialysis market on the basis of product and services?

- What is the breakup of the Mexico dialysis market on the basis of end user?

- What is the breakup of the Mexico dialysis market on the basis of region?

- What are the various stages in the value chain of the Mexico dialysis market?

- What are the key driving factors and challenges in the Mexico dialysis market?

- What is the structure of the Mexico dialysis market and who are the key players?

- What is the degree of competition in the Mexico dialysis market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico dialysis market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico dialysis market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico dialysis industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)