Mexico Die Casting Market Size, Share, Trends and Forecast by Process, Raw Material, Application, and Region, 2026-2034

Mexico Die Casting Market Overview:

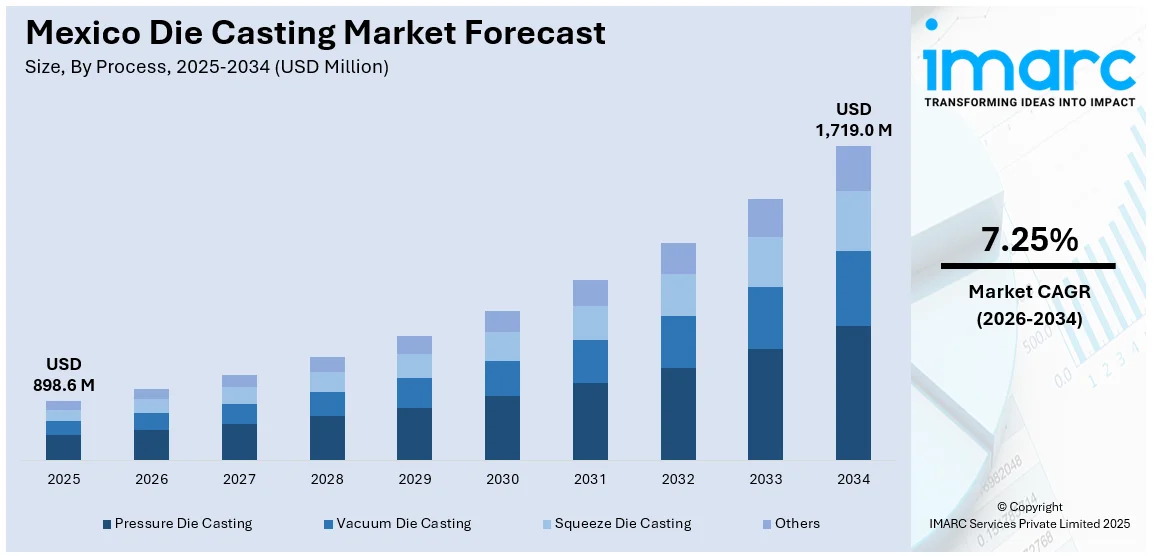

The Mexico die casting market size reached USD 898.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,719.0 Million by 2034, exhibiting a growth rate (CAGR) of 7.25% during 2026-2034. The market is driven by the increasing demand for light and robust metal parts in industries like the automotive sector, aerospace, and electronics. In addition to this, the automation trend and technological innovations in die casting processes also fuel the growth of the market, allowing for more accurate and efficient manufacturing. Moreover, advantageous trade agreements, such as the USMCA, combined with its strategic location near the U.S. market, continue to attract foreign investments, which are augmenting the Mexico die casting market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 898.6 Million |

| Market Forecast in 2034 | USD 1,719.0 Million |

| Market Growth Rate 2026-2034 | 7.25% |

Mexico Die Casting Market Analysis:

- Major Drivers: The increasing automotive industry demand for lightweight components, particularly electric vehicle battery housings and structural parts is impelling the market demand. Strategic location benefits under USMCA trade agreements attract foreign investments, while nearshoring trends boost manufacturing capacity expansion significantly.

- Key Market Trends: Technological automation integration including Industry 4.0 and IoT systems enhances production efficiency and quality control. The Mexico die casting market outlook indicates rising adoption of high-pressure die casting and vacuum processes for precision components in aerospace and electronics applications.

- Market Challenges: Rising raw material costs, particularly aluminum and zinc, impact profitability margins. Labor shortage concerns and increasing energy costs present operational challenges, while environmental regulations require investments in cleaner production technologies and waste management systems across facilities.

- Market Opportunities: Electric vehicle transition creates substantial demand for lightweight battery enclosures and motor housings. Infrastructure development projects and renewable energy sector expansion offer new application opportunities, while advanced manufacturing technologies enable higher value-added component production capabilities.

Mexico Die Casting Market Trends:

Increasing Demand from the Automotive Sector

The automotive industry is a primary driver for the development of the market in Mexico. According to industry reports, the sales of electric and plug-in hybrid vehicles (EVs and PHEVs) in Mexico's automotive industry have seen a significant upsurge, representing an increase of 83.8% in 2024 from 2023. This surge in electric and hybrid vehicle production directly contributes to the demand for high-performance, lightweight components, a trend that is accelerating the use of die casting technologies in Mexico. Die casting enables the production of complex shapes and intricate designs, which are essential for automotive applications such as engine blocks, transmission components, and structural parts. The Mexico die casting market forecast remains positive as automakers increasingly prioritize weight reduction for enhanced fuel efficiency and emission compliance. Moreover, the EV trend is further accelerating demand for high-quality, precision die-cast components applied in battery cases, motor housings, and chassis items. Mexico, as a key automaker manufacturing hub, is enhanced by its strategic location next to the U.S. market and its low-cost labor and production base. The demand in the market will continue to increase as both new entrants and established automakers raise production within the nation to serve the needs of North America's market.

To get more information on this market Request Sample

Technological Advancements and Automation in Die Casting

Technological developments and automation are playing a key role in propelling the Mexico die casting market growth. The merging of Industry 4.0 with technologies like robotics, artificial intelligence (AI), and the Internet of Things (IoT) is enhancing manufacturing efficiency, accuracy, and quality of die-cast products. According to an industry report, the market for industrial IoT market in Mexico is expected to reach USD 11.9 Billion by 2033, exhibiting a growth rate (CAGR) of 13.10% during 2025-2033. This suggests the extensive application of networked systems in the manufacturing industry. These technologies are allowing manufacturers to maximize production cycles while maintaining consistent quality standards, directly supporting the positive market outkook. In addition to this, new die casting technologies like HPDC and squeeze casting are also widely used to obtain better material properties and closer tolerances. Automation not only improves productivity but also helps fill labor gaps and escalating labor costs in the area. Furthermore, the use of real-time monitoring and predictive maintenance via connected systems guarantees improved equipment performance and downtime reduction. As Mexican industries persist in adopting automation, these advanced technologies are set to raise Mexico's competitiveness in the international market.

Nearshoring and Trade Agreement Benefits

The Mexico Die Casting Market Outlook is significantly enhanced by strategic nearshoring initiatives and favorable trade agreements, particularly the USMCA (United States-Mexico-Canada Agreement). International companies are increasingly relocating production facilities to Mexico to capitalize on proximity to North American markets, reduced logistics costs, and streamlined supply chains. This nearshoring trend has attracted substantial foreign direct investment in manufacturing infrastructure, creating increased demand for high-quality die-cast components across multiple industries. Mexico's competitive labor costs, combined with skilled workforce availability and established industrial zones, make it an attractive destination for die casting operations. The country's well-developed transportation network and port facilities enable efficient distribution of finished products throughout North America. Additionally, Mexico's participation in various free trade agreements beyond USMCA, including partnerships with European and Asian markets, provides die casting manufacturers with access to diverse export opportunities. These strategic advantages position Mexico as a critical hub for die casting production, supporting sustained market growth and industrial competitiveness in the global manufacturing landscape.

Mexico Die Casting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on process, raw material, and application.

Process Insights:

- Pressure Die Casting

- Vacuum Die Casting

- Squeeze Die Casting

- Others

The report has provided a detailed breakup and analysis of the market based on the process. This includes pressure die casting, vacuum die casting, squeeze die casting, and others.

Raw Material Insights:

- Aluminum

- Magnesium

- Zinc

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes aluminum, magnesium, and zinc.

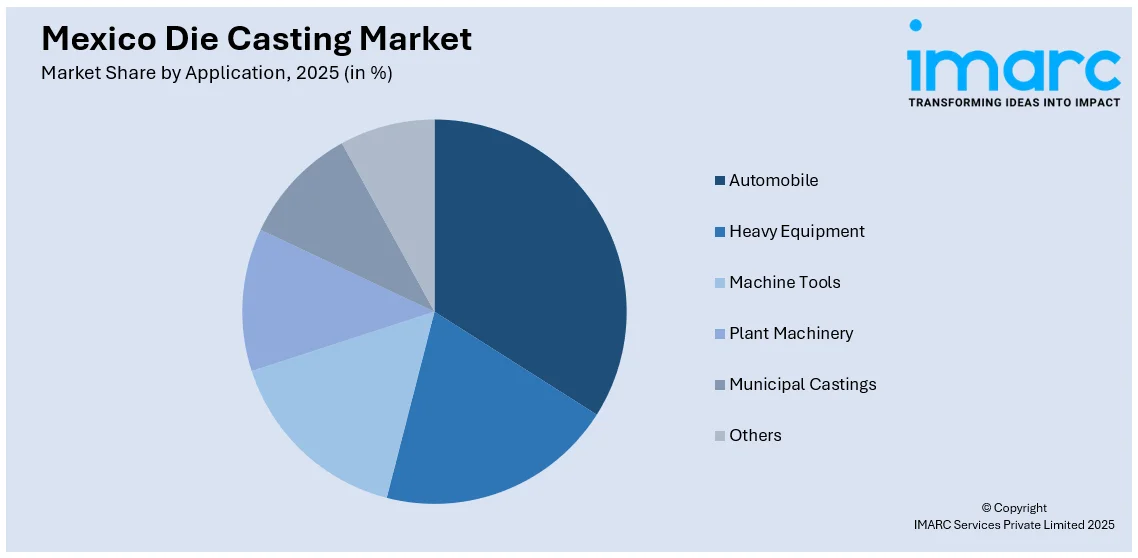

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automobile:

- Body Parts

- Engine Parts

- Transmission Parts

- Others

- Heavy Equipment:

- Construction

- Farming

- Mining

- Machine Tools

- Plant Machinery:

- Chemical Plants

- Petroleum Plants

- Thermal Plants

- Paper

- Textile

- Others

- Municipal Castings:

- Valves and Fittings and Pipes

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automobile (body parts, engine parts, transmission parts, and others), heavy equipment (construction, farming, and mining), machine tools, plant machinery (chemical plants, petroleum plants, thermal plants, paper, textile, and others), municipal castings (valves and fittings and pipes), and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Die Casting Market News:

- In June 2024, Ryobi Limited is expanding its RDCM factory in Irapuato, Guanajuato, Mexico, adding 8,500 m² of floor space and five new die casting machines. The expansion aims to meet growing North American demand for EV parts while supporting local employment. Construction starts in July 2024, with completion expected by April 2025, enhancing RDCM’s capacity to supply aluminum die cast products to automakers efficiently.

- In May 2024, Ryobi Die Casting is investing $50 million to expand its Irapuato, Mexico aluminum diecasting plant, adding five high-pressure diecasting machines to meet growing demand for electric vehicle components. The facility, one of two Ryobi plants in North America, will boost production capacity for aluminum diecast parts, including e-axle cases. Ryobi, a global leader with 11 plants across six countries, specializes in high-pressure diecastings and casting dies.

- On May 7, 2024, Ryobi Die Casting announced a USD 50 Million investment to expand its aluminum die casting facility in Irapuato, Mexico. The project, aimed at supporting anticipated electric vehicle market demand, will add 91,500 square feet of manufacturing space and five large high-pressure die-cast machines, with construction commencing in June 2024 and completion expected by April 2025. This expansion underscores Ryobi’s strategic commitment to growth in North America.

Mexico Die Casting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Processes Covered | Pressure Die Casting, Vacuum Die Casting, Squeeze Die Casting, Others |

| Raw Materials Covered | Aluminum, Magnesium, Zinc |

| Applications Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico die casting market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico die casting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico die casting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The die casting market in Mexico was valued at USD 898.6 Million in 2025.

The Mexico die casting market is projected to exhibit a CAGR of 7.25% during 2026-2034, reaching a value of USD 1,719.0 Million by 2034.

The market is driven by increasing automotive industry demand for lightweight components, particularly for electric vehicle applications including battery housings and motor components. Technological advancements in automation and Industry 4.0 integration enhance production efficiency. Strategic location benefits under USMCA trade agreements and nearshoring trends attract foreign investments, supporting sustained market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)