Mexico Diesel Power Plant Market Size, Share, Trends and Forecast by Component, Capacity Range, Application, and Region, 2025-2033

Mexico Diesel Power Plant Market Overview:

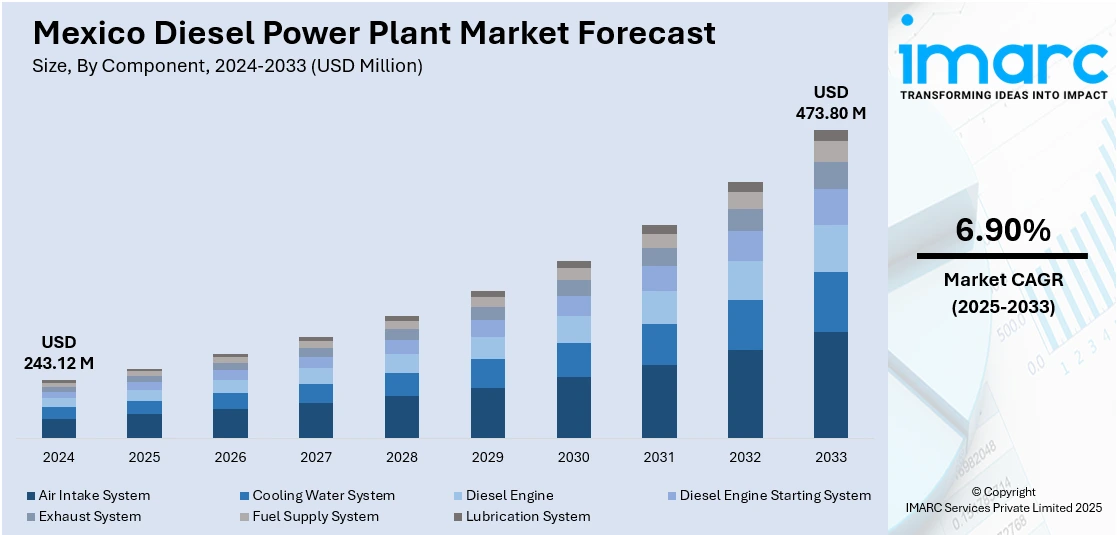

The Mexico diesel power plant market size reached USD 243.12 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 473.80 Million by 2033, exhibiting a growth rate (CAGR) of 6.90% during 2025-2033. The market is witnessing significant growth driven by rising focus on reliable and efficient power generation. Diesel plants commonly used for providing backup and primary power in both industrial and residential sectors are also driving the market. With rapid infrastructure development and the need for stable electricity supply, diesel power plants remain a key component in Mexico's energy mix, further contributing to the Mexico diesel power plant market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 243.12 Million |

| Market Forecast in 2033 | USD 473.80 Million |

| Market Growth Rate 2025-2033 | 6.90% |

Mexico Diesel Power Plant Market Analysis:

- Major Market Drivers: Rising industrialization and infrastructure development across Mexico drive substantial demand for reliable backup power solutions. Manufacturing facilities, data centers, and construction sites require uninterrupted electricity supply during grid outages. The market trends indicate increasing adoption in remote locations where grid connectivity remains limited, supporting the country's economic expansion initiatives.

- Key Market Trends: Integration of hybrid power systems combining diesel generators with renewable energy sources represents a significant trend. Advanced emission control technologies and fuel-efficient engines are becoming standard features. The Mexico diesel power plant market analysis reveals growing preference for containerized units offering portability and rapid deployment capabilities for various industrial applications.

- Competitive Landscape: The market features established international manufacturers alongside local players offering maintenance and service solutions. Companies focus on developing environmentally compliant engines meeting stringent emission standards. Strategic partnerships between equipment suppliers and local distributors enhance market penetration and after-sales support across different Mexican regions.

- Challenges and Opportunities: Environmental regulations pose challenges requiring investment in cleaner technologies and emission reduction systems. However, opportunities emerge from nearshoring trends bringing foreign manufacturing to Mexico. The market share growth is supported by increasing backup power requirements in industrial parks and telecommunications infrastructure.

Mexico Diesel Power Plant Market Trends:

Shift Toward Hybrid Power Solutions

The integration of Mexico diesel power plant with renewable energy sources, such as solar and wind, is becoming a key trend in the Mexico diesel power plant market trends. For instance, in May 2025, CFE commenced operations at the 429MW Mexicali Oriente power plant in Baja California, utilizing natural gas with diesel backup. This facility aims to enhance the reliability of the local electricity grid, supporting clean energy integration. The project was financed by a US$ 358mn loan from Banco Santander. This hybrid technology provides more effective power generation by merging the dependability of diesel with the environmental friendliness of renewable energy. Hybrid power systems have the potential to diminish fuel usage and operating expenses and minimize environmental footprint. Hybrid power systems provide a versatile option for locations with unstable grid connections or distant locations where Mexico diesel power plant are largely dependent. The hybrid model provides a stable and assured electricity supply, particularly during peak demand periods, and accelerates Mexico's increasing focus on clean energy objectives. As new technology continues to emerge, the trend is predicted to expand, with attention to maximizing energy output and maximizing the efficiency of diesel and renewable energy resources.

To get more information on this market, Request Sample

Rapid Urbanization and Infrastructure Growth

Rapid urbanization and the expansion of infrastructure projects in Mexico are major contributors to the growing Mexico diesel power plant market demand. According to industry reports, as of May 2025, Mexico's population is 131,815,031, with an estimated mid-year total of 131,946,900. Urban residents comprise 87.86%, totaling 115,925,945 individuals. The country ranks 11th globally by population, with a density of 68 people per km² over a land area of 1,943,950 km². As cities and towns expand, the need for reliable and continuous power supply becomes even more critical, especially in newly developed areas or remote locations where grid connectivity might be limited. Diesel power plants provide a flexible and quick solution for meeting these energy demands, supporting residential, commercial, and industrial sectors. The increasing construction of new housing complexes, industrial parks, and commercial centers boosts the need for backup power and primary electricity generation, further driving the market. Additionally, infrastructure projects like transportation networks, hospitals, and educational institutions require dependable power sources, which diesel plants can provide. This growth in urbanization and infrastructure development plays a pivotal role in Mexico diesel power plant market growth.

Mexico Diesel Power Plant Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, capacity range, and application.

Component Insights:

- Air Intake System

- Cooling Water System

- Diesel Engine

- Diesel Engine Starting System

- Exhaust System

- Fuel Supply System

- Lubrication System

The report has provided a detailed breakup and analysis of the market based on the component. This includes air intake system, cooling water system, diesel engine, diesel engine starting system, exhaust system, fuel supply system, and lubrication system.

Capacity Range Insights:

- Large Scale

- Medium Scale

- Small Scale

A detailed breakup and analysis of the market based on the capacity range have also been provided in the report. This includes large scale, medium scale, and small scale.

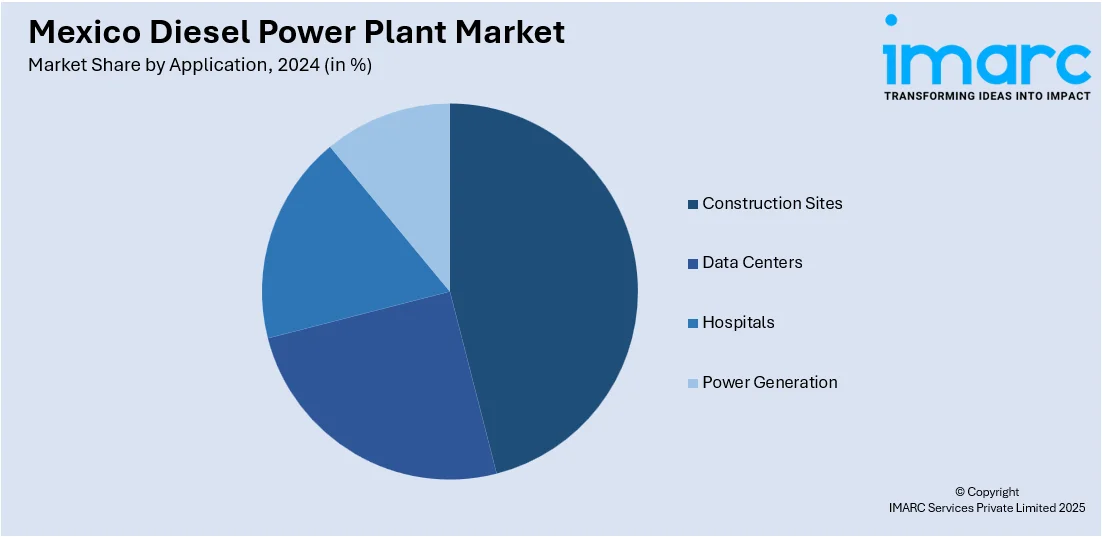

Application Insights:

- Construction Sites

- Data Centers

- Hospitals

- Power Generation

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes construction sites, data centers, hospitals, and power generation.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Diesel Power Plant Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Air Intake System, Cooling Water System, Diesel Engine, Diesel Engine Starting System, Exhaust System, Fuel Supply System, Lubrication System |

| Capacity Ranges Covered | Large Scale, Medium Scale, Small Scale |

| Applications Covered | Construction Sites, Data Centers, Hospitals, Power Generation |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico diesel power plant market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico diesel power plant market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico diesel power plant industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The diesel power plant market in Mexico was valued at USD 243.12 Million in 2024.

The Mexico diesel power plant market is projected to exhibit a CAGR of 6.90% during 2025-2033, reaching a value of USD 473.80 Million by 2033.

Growing industrialization, infrastructure development, and need for reliable backup power in industrial and residential sectors drive market growth. Rapid urbanization and expansion of manufacturing facilities boost demand for uninterrupted electricity supply.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)