Mexico Dietary Supplements Market Size, Share, Trends and Forecast by Product Type, Form, Distribution Channel, Application, End-Use, and Region, 2025-2033

Mexico Dietary Supplements Market Overview:

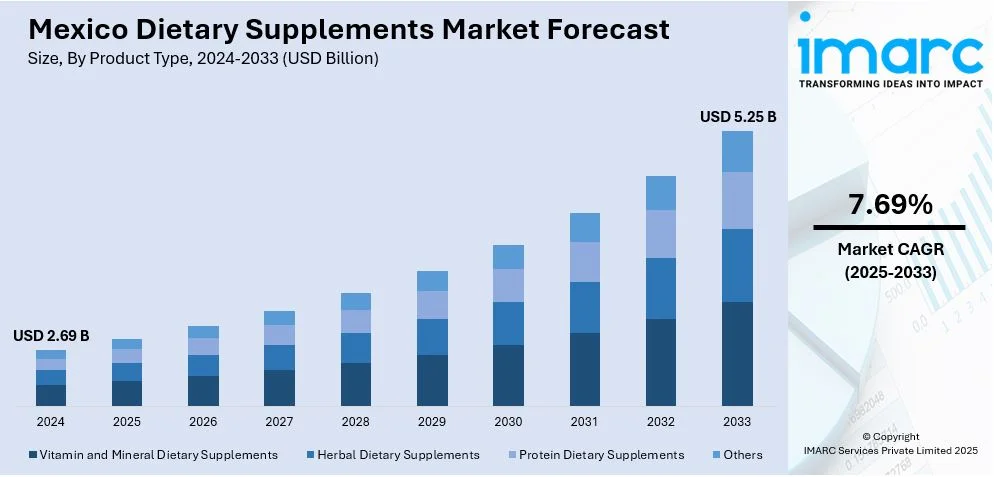

The Mexico dietary supplements market size reached USD 2.69 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.25 Billion by 2033, exhibiting a growth rate (CAGR) of 7.69% during 2025-2033. Focus on preventive health, rising incidence of lifestyle diseases, strong digital education efforts, supermarket and convenience channel expansion, e-commerce accessibility, personalized delivery options, and omnichannel strategies are some of the factors positively impacting the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.69 Billion |

| Market Forecast in 2033 | USD 5.25 Billion |

| Market Growth Rate 2025-2033 | 7.69% |

Mexico Dietary Supplements Market Trends:

Preventive Health Orientation and Changing Lifestyle Patterns

In Mexico, a growing emphasis on personal health management has led to increased interest in preventive nutrition. With a steady rise in lifestyle-related conditions such as obesity, type 2 diabetes, and cardiovascular disease, more consumers are taking proactive steps to avoid future complications. Dietary supplements have become an accessible tool for individuals aiming to strengthen immunity, regulate metabolism, and improve digestive health. These products are now commonly integrated into daily routines, particularly among urban populations, health-conscious millennials, and the expanding middle class. Marketing campaigns led by healthcare brands and local influencers have played a central role in educating consumers about the long-term benefits of consistent supplement use. The presence of educational content through digital platforms and partnerships with pharmacies has also contributed to building awareness. Traditional remedies and herbal products continue to hold appeal, particularly when repositioned in modern packaging formats. A study discussing the role of Vitamin D3 and Zinc in alleviating primary dysmenorrhea, with 16% to 81% of women of childbearing age affected, and 2% to 29% reporting moderate to severe pain shows these supplements help by inhibiting prostaglandin synthesis and improving uterine microcirculation, making them relevant to the Mexico dietary supplements market, where their use for pain management and wellness is growing. The Mexico dietary supplements market share has expanded with rising consumer knowledge, visible particularly in segments targeting energy, weight management, and immune support. Overall, the country's shift toward preventative solutions and the normalization of supplements as a part of everyday self-care have built a strong base for sustained consumer adoption in both retail and online formats.

Retail Transformation and Direct-to-Consumer Integration

Mexico's dietary supplements industry has benefited significantly from the structural transformation of retail channels. Traditional distribution via pharmacies remains dominant, but other formats, especially supermarkets, convenience stores, and digital platforms, are gaining relevance. Modern retail outlets now dedicate entire aisles to nutritional supplements, featuring both local and international brands. Branded in-store displays, bundle deals, and seasonal promotions have helped convert foot traffic into consistent sales. Meanwhile, e-commerce has emerged as a fast-growing segment, with improved logistics networks, regional delivery support, and simplified online payment systems contributing to accessibility. These changes have collectively fueled Mexico dietary supplements market growth, especially among younger demographics who are more comfortable with digital-first transactions. Additionally, subscription-based delivery models and auto-replenishment features are helping brands retain loyal users. Digital marketing strategies, including influencer tie-ups and targeted email campaigns, are increasing engagement and driving conversion rates. In addition, customer feedback loops enabled through online reviews and app-based interfaces are helping manufacturers fine-tune product offerings. A research study analyzing the production feasibility of Moringa oleifera (commonly used in dietary supplements) capsules in Mexico estimates that producing 1,000 Moringa oleifera capsules in Mexico costs approximately 10 USD, with a processing time of about 2 hours per production cycle. The economic feasibility analysis highlights the potential for scaling up Moringa capsule production, supporting its growth within the market. With strong momentum in omnichannel access, personalized recommendations, and increased consumer convenience, the Mexico dietary supplements market outlook remains stable. Continued investment in last-mile delivery, local manufacturing, and tailored marketing is expected to reinforce growth across major cities and suburban centers.

Mexico Dietary Supplements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, form, distribution channel, application, and end-use.

Product Type Insights:

- Vitamin and Mineral Dietary Supplements

- Herbal Dietary Supplements

- Protein Dietary Supplements

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes vitamin and mineral dietary supplements, herbal dietary supplements, protein dietary supplements, and others.

Form Insights:

- Tablets

- Capsules

- Powders

- Liquids

- Soft Gels

- Gel Caps

The report has provided a detailed breakup and analysis of the market based on the form. This includes tablets, capsules, powders, liquids, soft gels, and gel caps.

Distribution Channel Insights:

.webp)

- Pharmacies and Drug Stores

- Supermarkets and Hypermarkets

- Online Channels

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes pharmacies and drug stores, supermarkets and hypermarkets, online channels, and others.

Application Insights:

- Additional Supplements

- Medicinal Supplement

- Sports Nutrition

The report has provided a detailed breakup and analysis of the market based on the application. This includes additional supplements, medicinal supplement, and sports nutrition.

End-Use Insights:

- Infant

- Children

- Adults

- Pregnant Women

- Old-Aged

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes infant, children, adults, pregnant women, and old-aged.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Dietary Supplements Market News:

- On October 23, 2024, ProBiotix Health announced a five-year exclusive distribution agreement with Mexico-based Raff to commercialize Lactobacillus plantarum LPLDL, a probiotic strain targeting cardiometabolic health. The partnership aims to address Mexico's high cardiovascular disease rates, which account for nearly 24% of all deaths in the country. The product launch is anticipated in the first half of 2025, with commercial sales commencing by late 2025 or early 2026.

Mexico Dietary Supplements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Vitamin and Mineral Dietary Supplements, Herbal Dietary Supplements, Protein Dietary Supplements, Others |

| Forms Covered | Tablets, Capsules, Powders, Liquids, Soft Gels, Gel Caps |

| Distribution Channels Covered | Pharmacies and Drug Stores, Supermarkets and Hypermarkets, Online Channels, Others |

| Applications Covered | Additional Supplements, Medicinal Supplement, Sports Nutrition |

| End-Uses Covered | Infant, Children, Adults, Pregnant Women, Old-Aged |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico dietary supplements market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico dietary supplements market on the basis of product type?

- What is the breakup of the Mexico dietary supplements market on the basis of form?

- What is the breakup of the Mexico dietary supplements market on the basis of distribution channel?

- What is the breakup of the Mexico dietary supplements market on the basis of application?

- What is the breakup of the Mexico dietary supplements market on the basis of end-use?

- What is the breakup of the Mexico dietary supplements market on the basis of region?

- What are the various stages in the value chain of the Mexico dietary supplements market?

- What are the key driving factors and challenges in the Mexico dietary supplements market?

- What is the structure of the Mexico dietary supplements market and who are the key players?

- What is the degree of competition in the Mexico dietary supplements market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico dietary supplements market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico dietary supplements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico dietary supplements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)