Mexico Digestive Health Supplements Market Size, Share, Trends and Forecast by Product, Form Type, Distribution Channel, and Region, 2025-2033

Mexico Digestive Health Supplements Market Overview:

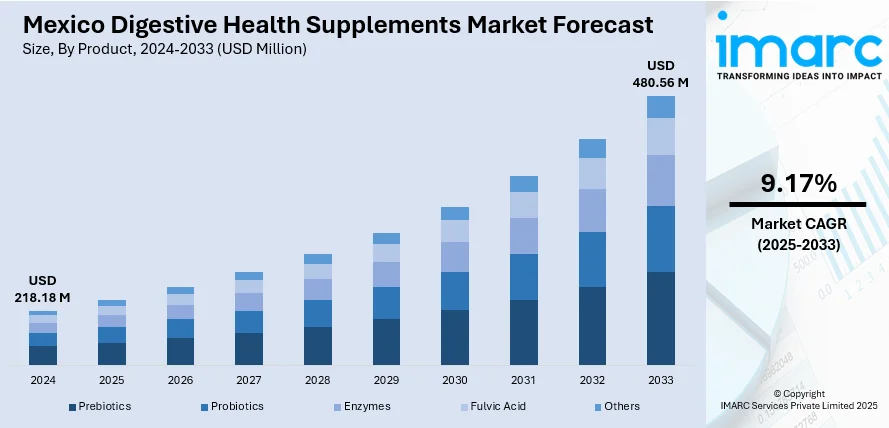

The Mexico digestive health supplements market size reached USD 218.18 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 480.56 Million by 2033, exhibiting a growth rate (CAGR) 9.17% during 2025-2033. At present, consumers are becoming increasingly health-conscious and making major changes in their diet and lifestyle. This trend, along with the rising availability of new innovative products to meet the local tastes, is impelling the growth of the market. Moreover, the prevalence of digestive disorders is expanding the Mexico digestive health supplements market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 218.18 Million |

| Market Forecast in 2033 | USD 480.56 Million |

| Market Growth Rate 2025-2033 | 9.17% |

Mexico Digestive Health Supplements Market Analysis:

- Major Market Drivers: Mexican consumers increasing health awareness lead demand for preventive healthcare options. Rising incidence of digestive disorders, urban lifestyles, and changing dietary habits are creating high opportunities in the market. The market trends show rising usage of probiotics and fiber supplements for gut health and immune function.

- Key Market Trends: Product formulation innovation in products aimed at local tastes increases marketability. Retail availability through e-commerce growth and store presence enhances product accessibility in urban and rural areas. Organic and natural ingredient trends support clean-label consumer expectations for quality and transparency.

- Competitive Landscape: Market competition becomes more aggressive with international and local players providing diverse ranges of products. Strategic alliances and distribution partnerships enhance market presence. Firms emphasize clinical research validation and premium positioning to differentiate their products.

- Challenges and Opportunities: Compliance with regulation and quality standards are constant challenges to the market players. Rural markets and new consumer segments remain untapped, with enhanced expansion opportunities. Digital marketing and education programs can improve consumer awareness and adoption rates.

Mexico Digestive Health Supplements Market Trends:

Rising Health Consciousness and Preventive Healthcare Awareness

The Mexico digestive health supplements sector is witnessing steady growth because consumers are becoming increasingly health conscious. Consumers are recognizing the need for good digestive health and actively looking for preventive healthcare options. Such growing knowledge is encouraging people to use supplements in their day-to-day lives to aid digestive function and overall health. Also, the focus on preventive healthcare is driving a transformation from reactive treatments to proactive management of digestive problems. As consumers are constantly learning about the advantages of digestive health supplements, they are shifting towards products that assist in maintaining a healthy gut, improving immunity, and digestion. This trend is creating a strong demand for a range of digestive health supplements, such as probiotics, fiber supplements, and enzymes. The growing Mexico digestive health supplements market demand reflects this shift toward proactive wellness management.

To get more information on this market, Request Sample

Expanding Product Availability and Innovation

The Mexican market for digestive health supplements is growing as companies keep rolling out new innovative products to meet the locals' tastes. The growing number of supplements on the market with their enhanced formulations is appealing to a greater consumer population. The growing demand for clean-label offerings is encouraging manufacturers add natural and organic ingredients to improve their formulations. This ongoing innovation can also be observed in the creation of supplements with targeted benefits, for example, those that aim at gut microbiome health or beneficially affect digestion in particular age groups or disease states. Additionally, the increasing accessibility of these products from various distribution channels, including the internet and retail locations, is further impelling the Mexico digestive health supplements market growth. Mexico digestive health supplements market analysis shows that In 2024, UK-based ProBiotix Health plc unveiled its partnership with Mexico-based raw materials and ingredients expert, Raff, for the distribution of probiotics used for supporting cardiometabolic health.

Increasing Prevalence of Digestive Disorders and Lifestyle Changes

The prevalence of digestive disorders in Mexico is continuously rising, significantly driving the demand for digestive health supplements. Factors such as poor dietary habits, stress, and sedentary lifestyles are contributing to an increase in conditions like acid reflux, irritable bowel syndrome (IBS), and constipation among the population. This is encouraging individuals to seek effective and convenient solutions to manage their digestive health. As people are becoming more conscious of their digestive well-being due to the growing prevalence of such disorders, they are relying on supplements that can provide relief or support in managing symptoms. As per the Mexico 2024: knowledge and behaviors about microbiota report, more than half of the population in Mexico have changed their habits to maintain a proper microbiota. Furthermore, the shift toward more urbanized lifestyles and the growing availability of processed foods are increasing the consumption of digestive health supplements. The rising incidence of digestive problems in Mexico is playing a pivotal role in driving the market for digestive health supplements.

Mexico Digestive Health Supplements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, form type, and distribution channel.

Product Insights:

- Prebiotics

- Probiotics

- Enzymes

- Fulvic Acid

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes prebiotics, probiotics, enzymes, fulvic acid, and others.

Form Type Insights:

- Capsules

- Tablets

- Powders

- Liquids

- Others

A detailed breakup and analysis of the market based on the form type have also been provided in the report. This includes capsules, tablets, powders, liquids, and others.

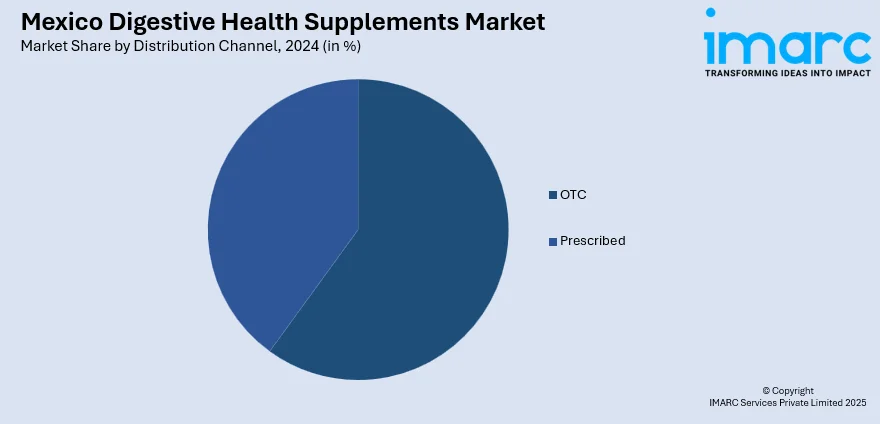

Distribution Channel Insights:

- OTC

- Supermarkets/Hypermarkets/Food Stores

- Drug Stores and Pharmacies

- Convenience Stores

- Online

- Others

- Prescribed

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes OTC (supermarkets/hypermarkets/food stores, drug stores and pharmacies, convenience stores, online, and others) and prescribed.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- September 2025 – Metagenics has launched its 2-in-1 UltraFlora Probiotic + Multivitamin in Mexico, combining clinically studied probiotic strains with essential vitamins and minerals. The product offers a convenient, all-in-one solution to support digestion, immunity, and nutrient absorption, enhancing the range of functional digestive health supplements in the Mexican market.

- March 2025 – Nature Made® has launched new clinically studied probiotic innovations to support gut health, helping consumers enhance digestive function and overall wellness. The initiative emphasizes evidence-based formulations designed to meet growing demand for effective digestive health supplements, reinforcing Nature Made®’s presence in the gut health market.

Mexico Digestive Health Supplements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Prebiotics, Probiotics, Enzymes, Fulvic Acid, Others |

| Form Types Covered | Capsules, Tablets, Powders, Liquids, Others |

| Distribution Channels Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico digestive health supplements market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico digestive health supplements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico digestive health supplements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The digestive health supplements market in Mexico was valued at USD 218.18 Million in 2024.

The Mexico digestive health supplements market is projected to exhibit a CAGR of 9.17% during 2025-2033, reaching a value of USD 480.56 Million by 2033.

Key drivers include rising health consciousness, increasing prevalence of digestive disorders, urbanization, lifestyle changes, growing awareness of gut health benefits, product innovation with natural ingredients, expanding e-commerce accessibility, and shift toward preventive healthcare solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)