Mexico Digital Banking Market Size, Share, Trends and Forecast by Services, Deployment Type, Technology, Industry, and Region, 2026-2034

Mexico Digital Banking Market Size, Share & Analysis:

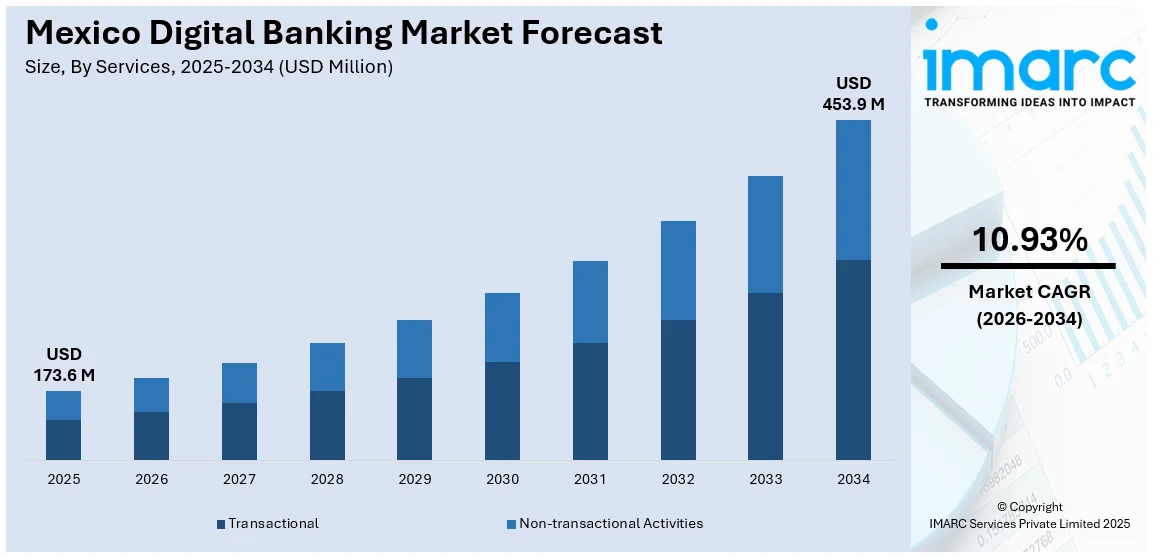

The Mexico digital banking market size reached USD 173.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 453.9 Million by 2034, exhibiting a growth rate (CAGR) of 10.93% during 2026-2034. At present, with the rise of cashless transactions in everyday activities, ranging from grocery purchases to utility bill payments, the need for digital banking is rapidly increasing. Besides this, the growing focus on cybersecurity is contributing to the expansion of the Mexico digital banking market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 173.6 Million |

| Market Forecast in 2034 | USD 453.9 Million |

| Market Growth Rate 2026-2034 | 10.93% |

Mexico Digital Banking Market Analysis:

- Growth Drivers: Expansion of mobile internet increased digital adoption, supportive fintech regulations, real-time payment systems, and rising demand for seamless, secure, and accessible banking experiences among both consumers and small businesses are aiding the Mexico digital banking market demand.

- Trends: Open banking integration, emergence of neobanks, growing use of artificial intelligence, blockchain-based security innovations, digital-only financial services, and partnerships between tech firms and traditional banks to enhance user experience.

- Market Opportunities: Untapped rural banking needs, youth-focused digital services, fintech-bank collaborations, lending platforms for underserved sectors, growth of e-commerce payments, and innovation in digital wallets and embedded finance across industries.

- Challenges: High reliance on cash, cybersecurity risks, regulatory compliance burdens, low trust in digital systems, financial illiteracy, resistance to change in traditional banking culture, and limited digital access in remote regions in the Mexico digital banking market analysis.

To get more information on this market Request Sample

Mexico Digital Banking Market Trends:

Increasing demand for contactless banking

The growing demand for contactless banking services is positively influencing the Mexico digital banking market forecast. People increasingly prefer seamless, fast, and secure financial transactions without physical interaction, especially in urban areas. With increasing smartphone penetration, more people are able to access banking services through mobile apps and digital platforms. As per industry reports, smartphone users in Mexico reached 78.37 Million in 2024. This shift is enhancing user convenience, allowing banking at any time and from anywhere. Contactless banking solutions, such as mobile wallets and tap-to-pay options are gaining popularity due to their speed and safety. Banks are responding by upgrading infrastructure and introducing user-friendly interfaces to meet these evolving preferences. The rise of fintech companies is also boosting innovations, offering competitive and accessible digital services. Furthermore, contactless banking supports financial inclusion, reaching rural and unbanked populations. Security improvements like biometric authentication and encrypted transactions build customer trust. Government support for digital transformation and investments in digital infrastructure are further strengthening this trend. As users are adopting cashless transactions in daily life, ranging from grocery shopping to utility payments, the demand for digital banking is accelerating. Businesses are also employing digital banking to streamline payroll and vendor payments. Educational campaigns are increasing awareness and digital literacy among citizens.

Growing need for cybersecurity solutions

Rising demand for cybersecurity solutions is impelling the Mexico digital banking market growth. As the number of cyberattacks is increasing, banks and financial institutions are prioritizing stronger security measures to protect user data and transactions. As per industry reports, in 2024, Mexico documented 31 Million cyberattack attempts, representing 55% of all assaults in Latin America. Customers demand secure platforms to ensure their sensitive financial information stays safe, encouraging banks to invest in advanced cybersecurity technologies. Tools, such as multi-factor authentication, biometric verification, and end-to-end encryption, are becoming standard features in digital banking apps. The focus on cybersecurity builds trust among users, encouraging them to adopt online and mobile banking services more confidently. Financial institutions also train employees and educate customers about phishing threats and fraud prevention. Regulatory bodies in Mexico are introducing guidelines to enhance data protection and ensure safe digital banking operations. These efforts are making digital platforms more resilient and reliable.

Mexico Digital Banking Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on services, deployment type, technology, and industry.

Services Insights:

- Transactional

- Cash Deposits and Withdrawals

- Fund Transfers

- Auto-Debit/Auto-Credit Services

- Loans

- Non-transactional Activities

- Information Security

- Risk Management

- Financial Planning

- Stock Advisory

The report has provided a detailed breakup and analysis of the market based on the services. This includes transactional (cash deposits and withdrawals, fund transfers, auto-debit/auto-credit services, and loans) and non-transactional activities (information security, risk management, financial planning, and stock advisory).

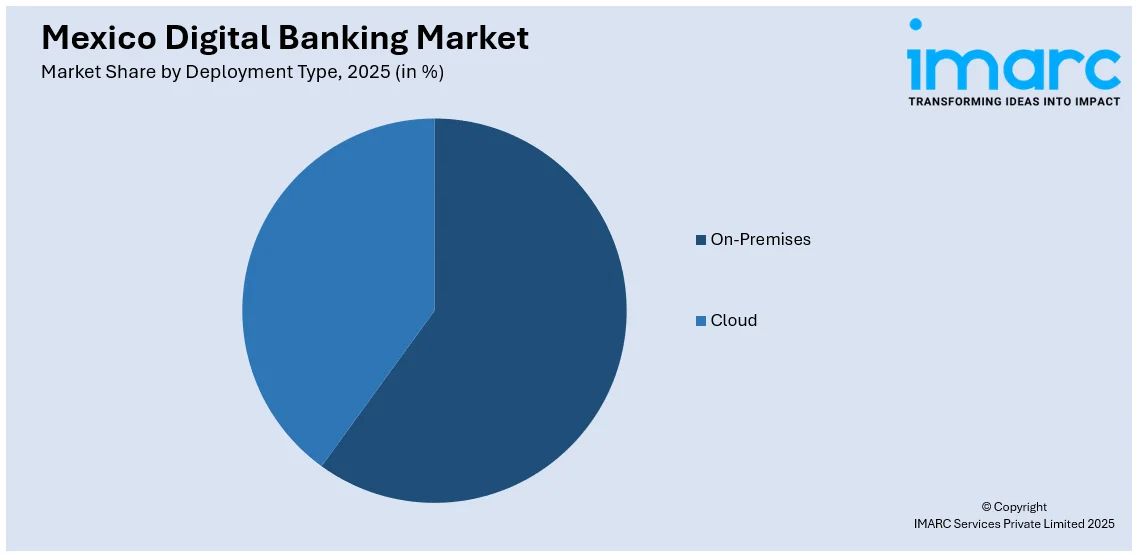

Deployment Type Insights:

Access the comprehensive market breakdown Request Sample

- On-Premises

- Cloud

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes on-premises and cloud.

Technology Insights:

- Internet Banking

- Digital Payments

- Mobile Banking

The report has provided a detailed breakup and analysis of the market based on the technology. This includes internet banking, digital payments, and mobile banking.

Industry Insights:

- Media and Entertainment

- Manufacturing

- Retail

- Banking

- Healthcare

A detailed breakup and analysis of the market based on the industry have also been provided in the report. This includes media and entertainment, manufacturing, retail, banking, and healthcare.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Digital Banking Market News:

- In April 2025, Grupo Financiero Banorte of Mexico was set to reorganize its digital bank Bineo, a little over a year after it started. The bank was in a restructuring phase and was reassessing its value proposition for digital customers.

- In November 2024, Santander introduced Openbank Digital Banking in Mexico. The Openbank Mexico site and application became functional, offering a completely digital banking experience, no minimum balance requirements, no fees, and attractive interest rates. Customers could additionally make use of round-the-clock phone support and all 10,000 Santander Mexico ATMs.

Mexico Digital Banking Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Servicess Covered |

|

| Deployment Types Covered | On-Premises, Cloud |

| Technologies Covered | Internet Banking, Digital Payments, Mobile Banking |

| Industries Covered | Media and Entertainment, Manufacturing, Retail, Banking, Healthcare |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico digital banking market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico digital banking market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico digital banking industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The digital banking market in Mexico was valued at USD 173.6 Million in 2025.

The Mexico digital banking market is projected to exhibit a CAGR of 10.93% during 2026-2034, reaching a value of USD 453.9 Million by 2034.

Key factors driving the Mexico digital banking market include widespread mobile and internet usage, supportive fintech regulations, rising consumer demand for convenient financial services, the emergence of neobanks, and increased adoption of real-time payments. Additionally, collaboration between fintechs and traditional banks is enhancing innovation and expanding digital financial inclusion nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)