Mexico Digital Diabetes Management Market Size, Share, Trends and Forecast by Product Type, Device Type, and Region, 2025-2033

Mexico Digital Diabetes Management Market Overview:

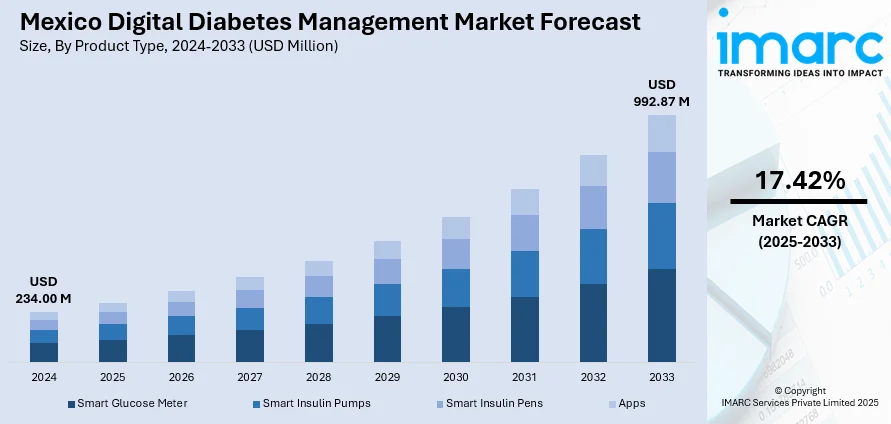

The Mexico digital diabetes management market size reached USD 234.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 992.87 Million by 2033, exhibiting a growth rate (CAGR) of 17.42% during 2025-2033. The market is transforming with AI personalization, mobile health applications, and wearable glucose monitoring, encouraging patient empowerment and remote treatment, illustrating a strong market outlook fueled by technology adoption, improved outcomes, and growing demand for effective, connected chronic disease management solutions, enhancing Mexico digital diabetes management share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 234.00 Million |

| Market Forecast in 2033 | USD 992.87 Million |

| Market Growth Rate 2025-2033 | 17.42% |

Mexico Digital Diabetes Management Market Trends:

Increasing AI Integration in Individualized Diabetes Treatment

Artificial Intelligence (AI) is increasingly emerging as a key facilitator for personalizing diabetes treatment according to individual patient requirements in Mexico. Due to innovations in data analytics, AI-based platforms are now processing real-time blood glucose readings, eating habits, and exercise levels to provide personalized treatment plans. Intelligent systems are improving precision in recommending insulin dosage and forecasting hypoglycemic episodes, thus minimizing healthcare risks. AI integration is not only enhancing patient outcomes but also promoting more widespread use of digital health solutions by care providers. This is in line with growing technological literacy among healthcare consumers in both urban and rural settings, such that AI-based diabetes platforms will drive care toward more normalcy. This shift demonstrates a major Mexico digital diabetes management market forecast marked by growing investment and increased digital innovation. As per the reports, in June 2023, Clivi's artificial intelligence-based platform projected to reach one million individuals within five years, targeting Mexico's increasing prevalence of diabetes and enhancing the patient outcomes that drive the fast expansion of the digital management market for diabetes. Moreover, the nation is well-suited to take a leadership role in AI-powered healthcare as a regional player, mirroring a data-driven, preventative model in the management of chronic conditions such as diabetes.

Increase in Mobile Health Apps for Diabetes Self-Management

The high level of smartphone penetration in Mexico has spurred utilization of mobile health (mHealth) applications for the self-management of diabetes. These applications provide tools like glucose monitoring, food diaries, medication reminders, and alerts in real-time, which enable daily monitoring of their condition by the patients. In addition to self-management, numerous of these applications also facilitate remote contact with healthcare professionals, enhancing treatment compliance and continuity of care. The accessibility and convenience of mHealth applications are drawing in a younger, technology-oriented audience and promoting healthier, more proactive health habits. These mobile technologies are particularly influential in underserved communities where healthcare access is compromised. The rising adoption of mobile applications represents a dynamic change in the management of chronic conditions and is a leading trend in the Mexico digital diabetes management growth story. As functionality and user experience are further improved by developers, mHealth solutions will remain at the forefront in enabling Mexico's developing digital healthcare system.

Expansion of Wearable Devices in Real-Time Glucose Monitoring

Wearable devices are transforming diabetes management by offering continuous, real-time monitoring of glucose levels without recourse to periodic finger-pricking. For instance, in November 2024, Medtronic introduced its Smart MDI system in Mexico, combining the InPen™ app and Simplera™ CGM to provide real-time, tailored insulin dosing guidance and missed dose detection functionality. Further, in Mexico, wearables are increasingly popular among patients who want greater convenience and independence in managing their blood sugar levels. With Bluetooth support and integration into the cloud, wearables permit effortless data exchange with clinicians so that there are timely interventions and informed decision-making. This increasing popularity is also driven by awareness campaigns and greater affordability, so more advanced diabetes devices become available across socioeconomic levels. Wearable devices' functionality includes monitoring physical activity, heart rate, and sleep—providing a comprehensive picture of patient health. These advances are key to driving user engagement and enhancing long-term health outcomes. The trend highlights the growing Mexico digital diabetes management market share, both indicative of consumer demand and policy-favourable interventions to bring digital into chronic disease management platforms across the country.

Mexico Digital Diabetes Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and device type.

Product Type Insights:

- Smart Glucose Meter

- Smart Insulin Pumps

- Smart Insulin Pens

- Apps

The report has provided a detailed breakup and analysis of the market based on the product type. This includes smart glucose meter, smart insulin pumps, smart insulin pens, and apps.

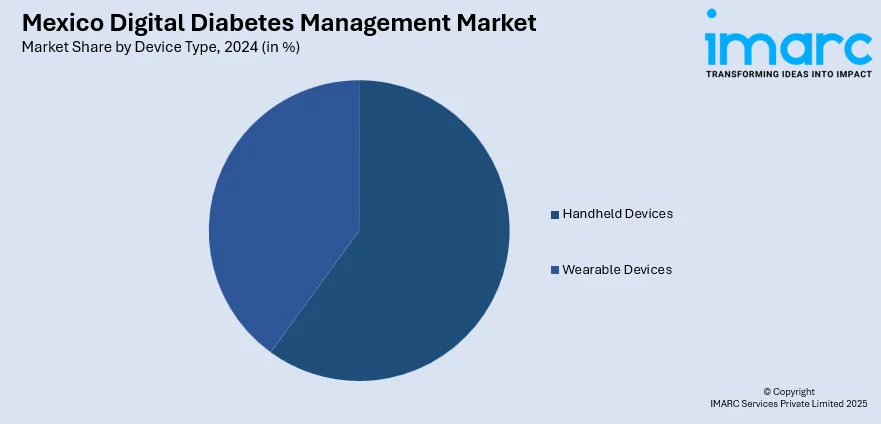

Device Type Insights:

- Handheld Devices

- Wearable Devices

A detailed breakup and analysis of the market based on the device type have also been provided in the report. This includes handheld devices and wearable devices.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Digital Diabetes Management Market News:

- In January 2024, Tandem Diabetes Care introduced the t:slim X2 insulin pump, the first automated insulin delivery system to connect with Abbott's FreeStyle Libre 2 Plus sensor. This innovation offers users more advanced glucose monitoring and predictive insulin adjustments, enhancing diabetes management with real-time information and automatic correction boluses.

Mexico Digital Diabetes Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Smart Glucose Meter, Smart Insulin Pumps, Smart Insulin Pens, Apps |

| Device Type Covered | Handheld Devices, Wearable Devices |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico digital diabetes management market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico digital diabetes management market on the basis of product type?

- What is the breakup of the Mexico digital diabetes management market on the basis of device type?

- What is the breakup of the Mexico digital diabetes management market on the basis of region?

- What are the various stages in the value chain of the Mexico digital diabetes management market?

- What are the key driving factors and challenges in the Mexico digital diabetes management?

- What is the structure of the Mexico digital diabetes management market and who are the key players?

- What is the degree of competition in the Mexico digital diabetes management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico digital diabetes management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico digital diabetes management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico digital diabetes management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)