Mexico Digital OOH Advertising Market Size, Share, Trends and Forecast by Format Type, Application, End Use Industry, and Region, 2025-2033

Mexico Digital OOH Advertising Market Overview:

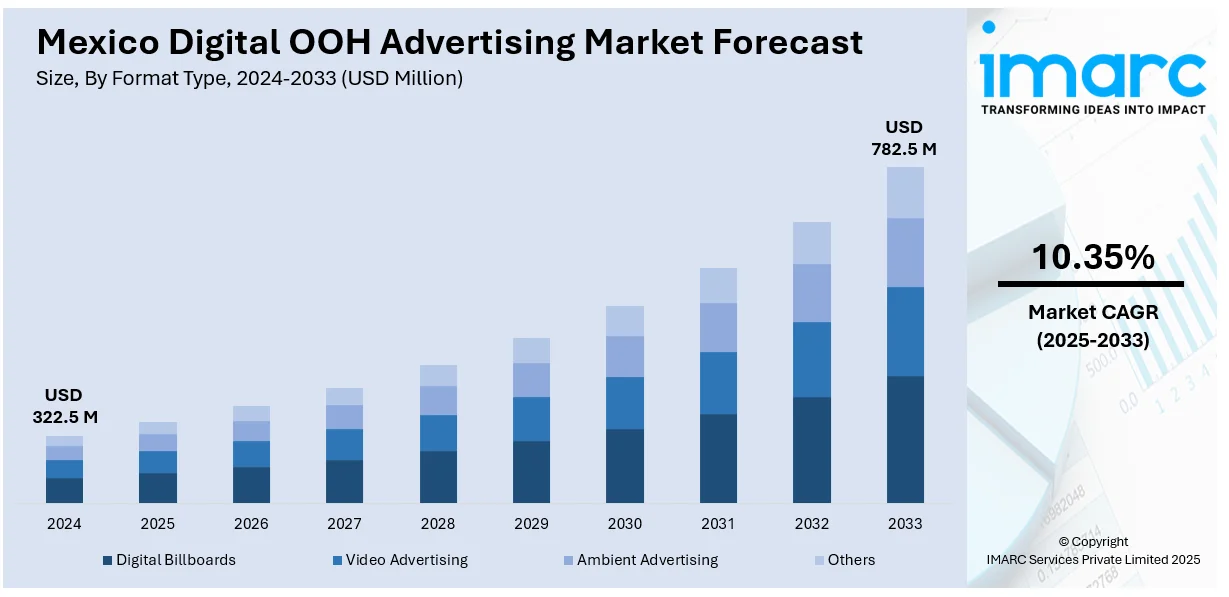

The Mexico digital OOH advertising market size reached USD 322.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 782.5 Million by 2033, exhibiting a growth rate (CAGR) of 10.35% during 2025-2033. Increasing urbanization, rising smartphone penetration, improved digital infrastructure, growing demand for real-time audience analytics, cost-effective programmatic ad buying, and the popularity of digital billboards in transit zones, malls, and public venues targeting mobile and tech-savvy consumers are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 322.5 Million |

| Market Forecast in 2033 | USD 782.5 Million |

| Market Growth Rate 2025-2033 | 10.35% |

Mexico Digital OOH Advertising Market Trends:

Expanding Reach and Market Recognition

Digital out-of-home advertising in Mexico is gaining wider recognition, supported by increased international engagement and growing local adoption of advanced display technologies. Urban centers are seeing a rise in digital formats integrated into public spaces, transportation hubs, and commercial areas, enhancing audience targeting and engagement. As the market matures, there's a noticeable push toward data-driven campaigns, real-time content delivery, and dynamic ad placements. These developments are attracting attention from both domestic and global players looking to tap into Mexico’s evolving urban media environment. The sector is also benefiting from broader shifts in consumer mobility patterns and digital connectivity, setting the stage for long-term growth and innovation. For example, in June 2024, the World Out of Home Organization announced that its 2025 Global Congress would be held in Mexico City from June 4th to 6th, 2025, marking the first time the event would take place in Latin America.

Shift toward Programmatic and Data-Driven Campaigns

Mexico’s digital out-of-home advertising market is embracing automation and precision targeting through the growing adoption of programmatic platforms. This shift allows advertisers to deliver tailored content in real time, driven by audience data and behavioral insights. The integration of technology that supports automated media buying is streamlining operations and increasing efficiency across campaigns. It also opens the door for more measurable and responsive ad strategies, allowing brands to optimize messaging based on location, time, and audience demographics. As more players explore this approach, the market is moving toward a model that blends creativity with analytics, making campaigns more relevant and impactful. This reflects a broader movement toward smarter media delivery across the urban digital advertising landscape. For instance, in April 2024, Vistar Media partnered with PRODOOH to introduce programmatic DOOH advertising to Latin America, enhancing advertisers' ability to target audiences with data-driven campaigns.

Mexico Digital OOH Advertising Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on format type, application, and end use industry.

Format Type Insights:

- Digital Billboards

- Video Advertising

- Ambient Advertising

- Others

The report has provided a detailed breakup and analysis of the market based on the format type. This includes digital billboards, video advertising, ambient advertising, and others.

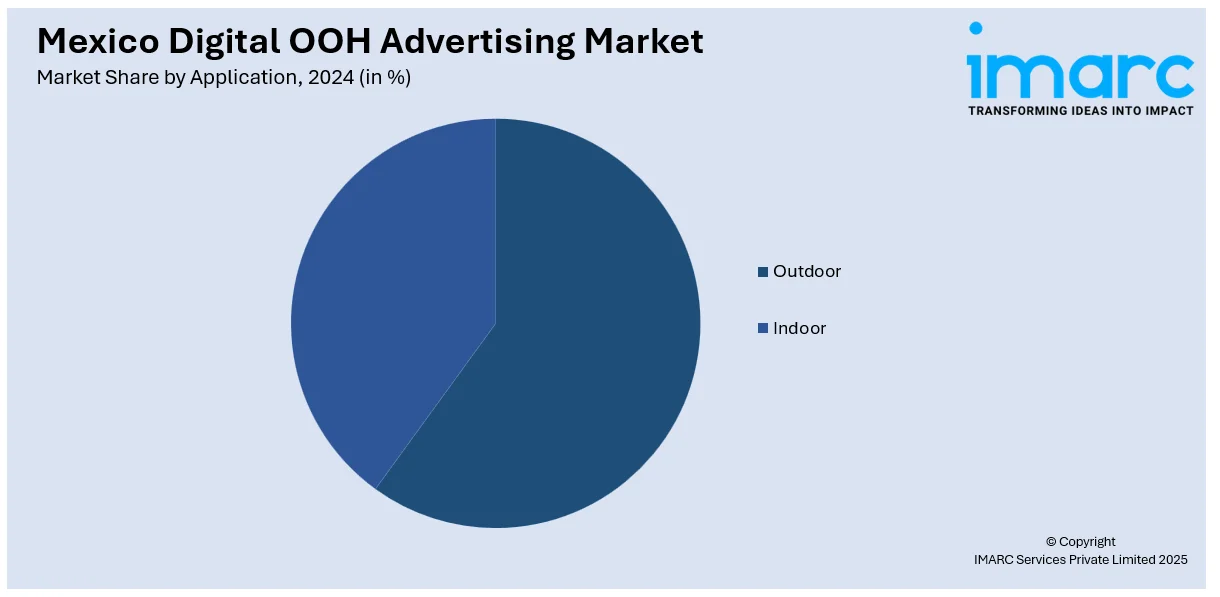

Application Insights:

- Outdoor

- Indoor

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes outdoor and indoor.

End Use Industry Insights:

- Retail

- Recreation

- Banking

- Transportation

- Education

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes retail, recreation, banking, transportation, education, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Digital OOH Advertising Market News:

- In February 2025, JCDecaux Mexico and VIOOH collaborated on a programmatic DOOH campaign to elevate the launch of the Mazda CX-70, demonstrating the effectiveness of digital out-of-home advertising in automotive marketing.

- In November 2024, Vici Media unveiled its digital out-of-home advertising product, combining digital technology with traditional out-of-home advertising to provide brands with dynamic ways to reach target audiences.

Mexico Digital OOH Advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Format Types Covered | Digital Billboards, Video Advertising, Ambient Advertising, Others |

| Applications Covered | Outdoor, Indoor |

| End Use Industries Covered | Retail, Recreation, Banking, Transportation, Education, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico digital OOH advertising market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico digital OOH advertising market on the basis of format type?

- What is the breakup of the Mexico digital OOH advertising market on the basis of application?

- What is the breakup of the Mexico digital OOH advertising market on the basis of end use industry?

- What are the various stages in the value chain of the Mexico digital OOH advertising market?

- What are the key driving factors and challenges in the Mexico digital OOH advertising market?

- What is the structure of the Mexico digital OOH advertising market and who are the key players?

- What is the degree of competition in the Mexico digital OOH advertising market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico digital OOH advertising market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico digital OOH advertising market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico digital OOH advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)