Mexico Digital Signage Market Size, Share, Trends and Forecast by Type, Component, Technology, Application, Location, Size, and Region, 2025-2033

Mexico Digital Signage Market Overview:

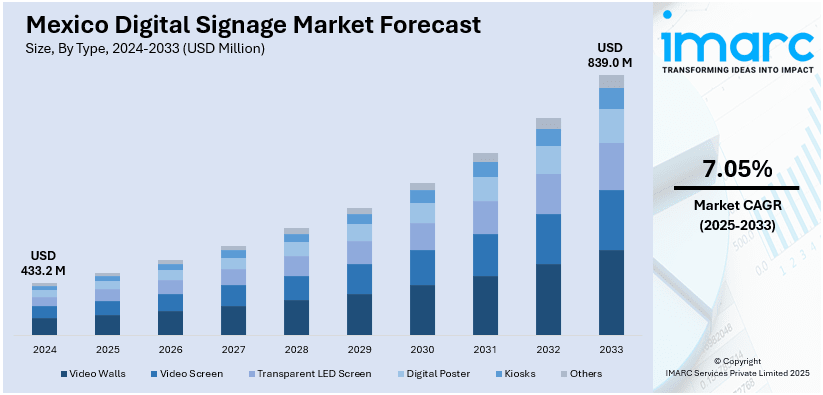

The Mexico digital signage market size reached USD 433.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 839.0 Million by 2033, exhibiting a growth rate (CAGR) of 7.05% during 2025-2033. The market is growing steadily, driven by rapid urbanization, retail sector expansion, increasing consumer engagement demand, rising adoption in transportation hubs, ongoing technological advancements, expanding cost-effective digital display solutions, and surging smart city initiatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 433.2 Million |

| Market Forecast in 2033 | USD 839.0 Million |

| Market Growth Rate 2025-2033 | 7.05% |

Mexico Digital Signage Market Trends:

Expansion of Cloud-Based Digital Signage Solutions

The Mexico digital signage market is shifting toward cloud-based solutions because businesses require flexibility, along with scalability and real-time content management capabilities. Businesses that leverage cloud platforms acquire remote controls to update and manage their signage systems across different locations, which leads to lower maintenance expenses and better operational management. Moreover, the timely delivery of important messages becomes essential for retail chains and transportation hubs, as well as quick service restaurants (QSRs), making this capability highly beneficial. Additionally, the enhanced internet infrastructure throughout Mexico enables businesses in all areas to adopt cloud technology platforms. For example, in June 2024, NowSignage announced a partnership with Footprint Global to expand into the Latin American market. This collaboration combines NowSignage’s digital signage technology with Footprint's regional expertise to drive growth and enhance customer experiences across Latin America. Cloud-based platforms facilitate the measurement of viewer engagement through analysis tools and provide personalized content from improved integration capacities. As a result, Mexican urban and commercial spaces are transitioning to cloud-based signage as a standard digital content delivery. This shift reflects a broader recognition among organizations of the operational and strategic advantages which follow global digital transformation patterns. This trend is significantly driving the Mexico digital signage market growth.

Rising Demand for Interactive and Personalized Customer Experiences

The need to improve customer relationships in the region is boosting the Mexico digital signage market share, driven by the rising interest of consumers in personalized interactive digital signage solutions. In line with this, the business sector optimizes user-specific immersive experiences by applying touchscreens alongside QR codes with motion sensors and facial recognition systems. Concurrently, the retail sector uses interactive displays to deliver product recommendations and promotional offers based on customer interactions, while the public sector leverages wayfinding kiosks to enhance operational efficiency. In confluence with this, the changing consumer preferences stand in agreement with expectations for dynamic responses during interactions. For instance, Walmart de México y Centroamérica announced an ambitious plan to double its sales by 2033 through significant e-commerce expansion. This strategy includes modernizing IT systems and integrating physical stores with online platforms, aiming to enhance customer experiences through personalized digital interactions. Besides this, the integration between gaming systems, mobile hardware, and social media enhances user engagement as it supports instant audience interaction. Furthermore, modern technology acquisitions by Mexican businesses drive store engagement through increased customer movement and enhanced customer satisfaction while achieving higher sales conversion rates. Apart from this, this technology is becoming more accessible as data analytics creates more intelligent content strategies, thus enhancing the Mexico digital signage market outlook.

Mexico Digital Signage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, component, technology, application, location and size.

Type Insights:

- Video Walls

- Video Screen

- Transparent LED Screen

- Digital Poster

- Kiosks

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes video walls, video screens, transparent LED screens, digital posters, kiosks, and others.

Component Insights:

- Hardware

- Software

- Service

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware, software, and service.

Technology Insights:

- LCD/LED

- Projection

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes LCD/LED, projection, and others.

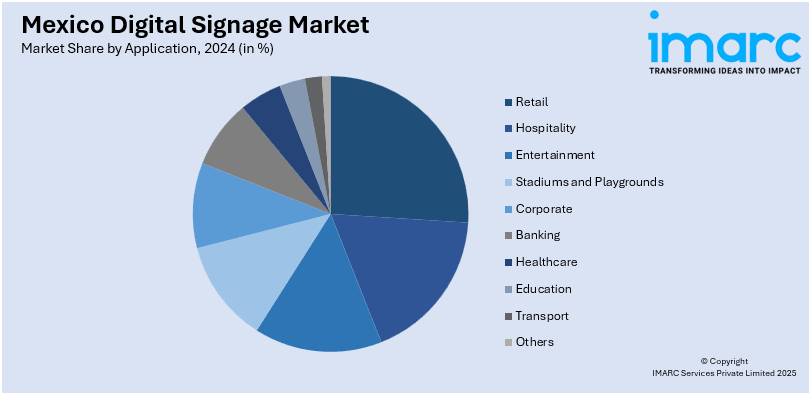

Application Insights:

- Retail

- Hospitality

- Entertainment

- Stadiums and Playgrounds

- Corporate

- Banking

- Healthcare

- Education

- Transport

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes retail, hospitality, entertainment, stadiums and playgrounds, corporate, banking, healthcare, education, transport, and others.

Location Insights:

- Indoor

- Outdoor

The report has provided a detailed breakup and analysis of the market based on the location. This includes indoor and outdoor.

Size Insights:

- Below 32 Inches

- 32 to 52 Inches

- More than 52 Inches

A detailed breakup and analysis of the market based on the size have also been provided in the report. This includes below 32 inches, 32 to 52 inches, and more than 52 inches.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Digital Signage Market News:

- In July 2024, Creative Realities, a leading digital signage solutions provider, announced its strategic expansion into Mexico and the broader Latin America market. This move aims to bring advanced digital signage technologies to the region, enhancing customer experiences and meeting the growing demand for such solutions.

- In May 2024, Monterrey International Airport collaborated with Peerless-AV, Absen, and POP Media Technology to install 29 Direct View LED video walls across various areas of the airport. This modernization enhances passenger communication and contributes to the growth of digital signage applications in transportation hubs.

Mexico Digital Signage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Video Walls, Video Screen, Transparent LED Screen, Digital Poster, Kiosks, Others |

| Components Covered | Hardware, Software, Service |

| Technologies Covered | LCD/LED, Projection, Others |

| Applications Covered | Retail, Hospitality, Entertainment, Stadiums and Playgrounds, Corporate, Banking, Healthcare, Education, Transport, Others |

| Locations Covered | Indoor, Outdoor |

| Sizes Covered | 32 Inches, 32 to 52 Inches, More than 52 Inches |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico digital signage market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico digital signage market on the basis of type?

- What is the breakup of the Mexico digital signage market on the basis of component?

- What is the breakup of the Mexico digital signage market on the basis of technology?

- What is the breakup of the Mexico digital signage market on the basis of application?

- What is the breakup of the Mexico digital signage market on the basis of location?

- What is the breakup of the Mexico digital signage market on the basis of size?

- What is the breakup of the Mexico digital signage market on the basis of region?

- What are the various stages in the value chain of the Mexico digital signage market?

- What are the key driving factors and challenges in the Mexico digital signage?

- What is the structure of the Mexico digital signage market and who are the key players?

- What is the degree of competition in the Mexico digital signage market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico digital signage market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico digital signage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico digital signage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)