Mexico Digital Signature Market Size, Share, Trends and Forecast by Component, Deployment Model, Enterprise Size, Industry Vertical, and Region, 2026-2034

Mexico Digital Signature Market Overview:

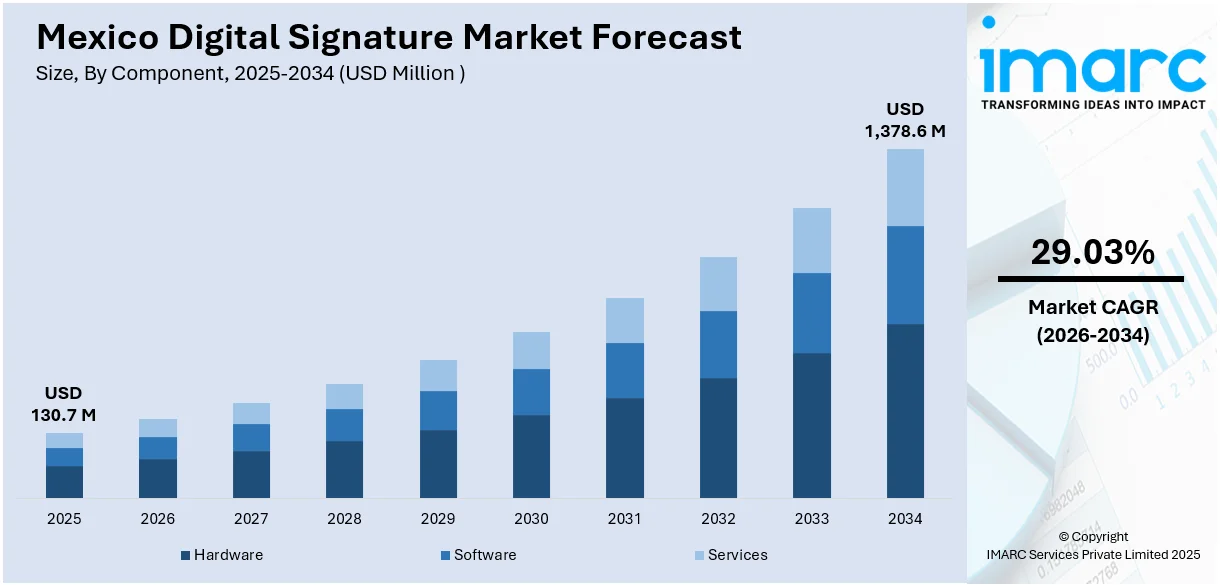

The Mexico digital signature market size reached USD 130.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,378.6 Million by 2034, exhibiting a growth rate (CAGR) of 29.03% during 2026-2034. Factors driving the market include increasing government initiatives promoting digitalization, the growing adoption of e-commerce, the need for enhanced security in electronic transactions, and the rising demand for efficient, paperless workflows across various industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 130.7 Million |

| Market Forecast in 2034 | USD 1,378.6 Million |

| Market Growth Rate 2026-2034 | 29.03% |

Mexico Digital Signature Market Trends:

Increasing Mobile Integration

The proliferation of mobile devices and the increasing reliance on mobile transactions are fostering the integration of digital signature solutions with mobile platforms. For instance, as per industry reports, Mexico has over five million POS terminals, 70% of which are mobile. The 2024 payments industry is projected at USD 676 Billion, with USD 618 Billion in POS transactions, 62% digital, rising to 66% by 2027. This trend reflects a demand for seamless and convenient signing processes that accommodate the dynamic nature of modern business operations. Mobile integration allows users to execute legally binding agreements from smartphones and tablets, thereby enhancing efficiency and expediting workflows. As mobile commerce continues to expand within Mexico, the adoption of mobile-enabled digital signature technologies is poised to gain further prominence.

To get more information on this market Request Sample

Enhanced Regulatory Frameworks

The evolution of legal and regulatory frameworks surrounding digital signatures in Mexico is a key trend. The establishment of clear legal standards and the harmonization of regulations with international best practices are crucial for fostering trust and confidence in digital signature technology. These advancements provide a robust legal foundation, encouraging businesses and individuals to adopt digital signatures for a wider range of transactions. For instance, in April 2024, Mexico approved a bill to legally recognize electronic promissory notes and other financial transactions. The reform to the General Law of Negotiable Instruments and Credit Transactions aims to boost electronic credit transactions by clarifying legal presumptions and applying the "functional equivalence" principle. While challenges remain, the move is expected to enhance the use of technology in finance. The ongoing refinement of these frameworks will likely continue to drive market growth by reducing legal uncertainties and promoting interoperability.

Mexico Digital Signature Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component, deployment model, enterprise size, and industry vertical.

Component Insights:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services.

Deployment Model Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment model have also been provided in the report. This includes on-premises and cloud-based.

Enterprise Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes small and medium-sized enterprises and large enterprises.

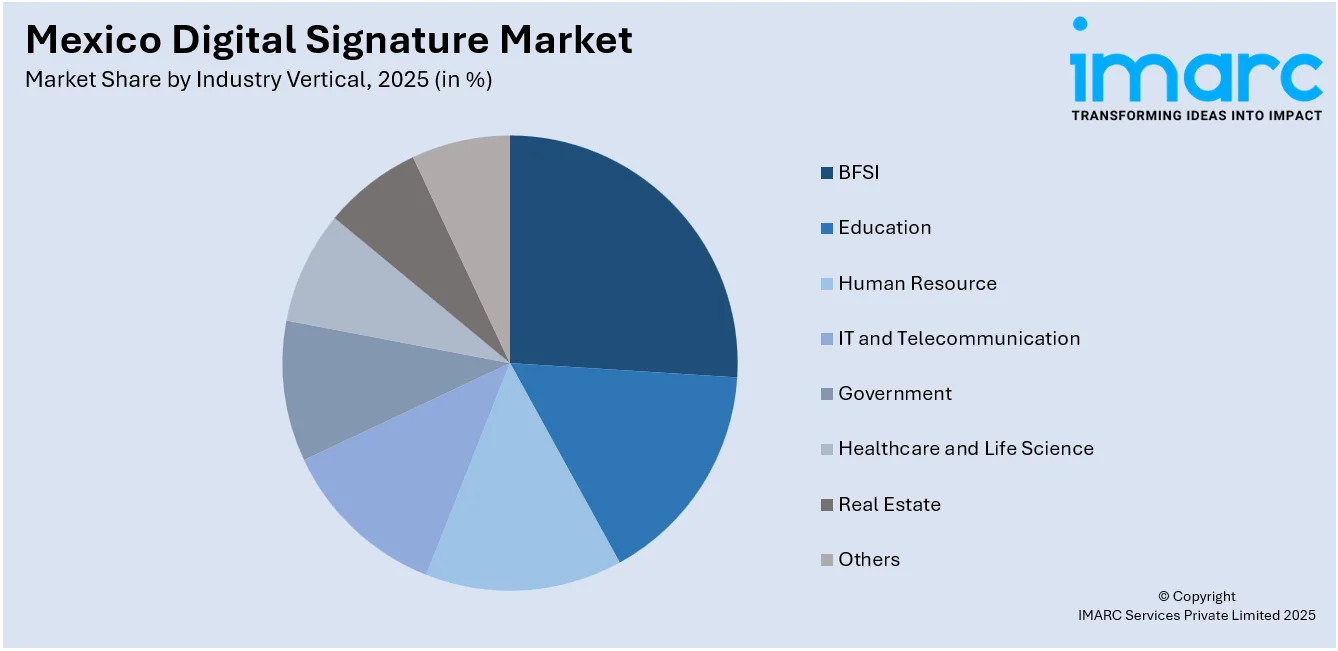

Industry Vertical Insights:

Access the comprehensive market breakdown Request Sample

- BFSI

- Education

- Human Resource

- IT and Telecommunication

- Government

- Healthcare and Life Science

- Real Estate

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes BFSI, education, human resource, IT and telecommunication, government, healthcare and life science, real estate, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Digital Signature Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Deployment Models Covered | On-premises, Cloud-based |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Industry Verticals Covered | BFSI, Education, Human Resource, IT and Telecommunication, Government, Healthcare and Life Science, Real Estate, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico digital signature market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico digital signature market on the basis of component?

- What is the breakup of the Mexico digital signature market on the basis of deployment model?

- What is the breakup of the Mexico digital signature market on the basis of enterprise size?

- What is the breakup of the Mexico digital signature market on the basis of industry vertical?

- What is the breakup of the Mexico digital signature market on the basis of region?

- What are the various stages in the value chain of the Mexico digital signature market?

- What are the key driving factors and challenges in the Mexico digital signature market?

- What is the structure of the Mexico digital signature market and who are the key players?

- What is the degree of competition in the Mexico digital signature market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico digital signature market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico digital signature market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico digital signature industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)