Mexico Dimethyl Ether Market Size, Share, Trends and Forecast by Raw Material, Application, End-Use Industry, and Region, 2025-2033

Mexico Dimethyl Ether Market Overview:

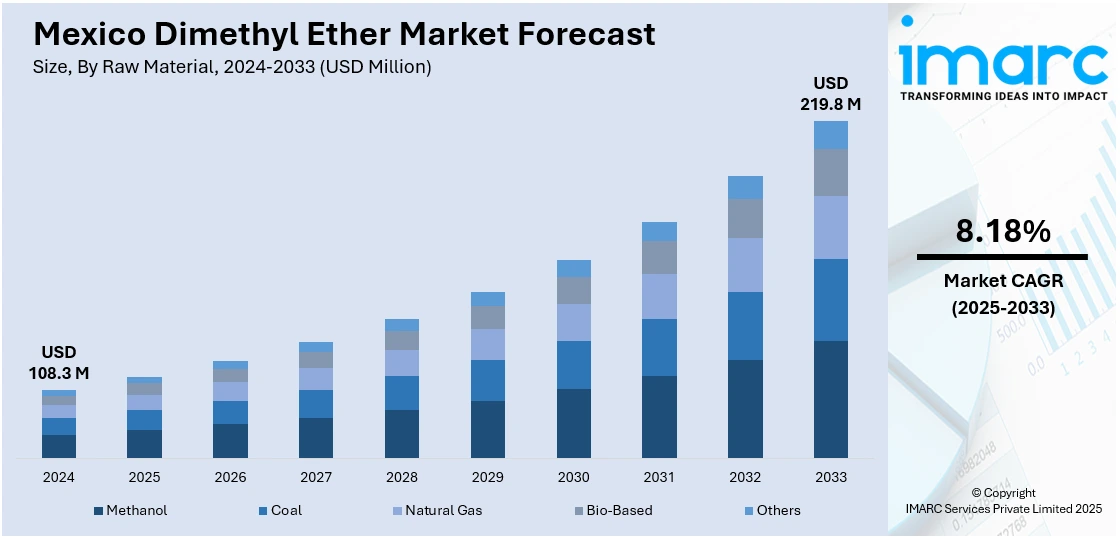

The Mexico dimethyl ether market size reached USD 108.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 219.8 Million by 2033, exhibiting a growth rate (CAGR) of 8.18% during 2025-2033. The market is expanding due to rising interest in clean-burning fuels, government initiatives on emissions reduction, and growth in LPG blending applications. Demand from transport and industrial sectors is also pushing its adoption across multiple downstream segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 108.3 Million |

| Market Forecast in 2033 | USD 219.8 Million |

| Market Growth Rate 2025-2033 | 8.18% |

Mexico Dimethyl Ether Market Trends:

Rising Cleaner Fuel Demand

The need for cleaner alternatives to traditional fossil fuels is shaping the demand for dimethyl ether in Mexico. As the country works to reduce its carbon emissions, DME is gaining recognition for its low particulate output and clean combustion profile. These characteristics make it suitable for applications in transportation and domestic fuel use, especially as a substitute or blend for liquefied petroleum gas (LPG). The shift toward sustainable energy choices is visible in urban centers where environmental policies are more actively enforced. In the latter half of this trend, energy suppliers are experimenting with DME blends to improve fuel efficiency while meeting air quality norms. Domestic manufacturing of DME is also slowly gaining attention as energy diversification becomes more of a national goal. Investment in related infrastructure and technology is beginning to rise, helping the market move beyond early-stage adoption. These developments reflect growing confidence in DME as part of Mexico’s broader energy transition strategy.

Expanding Industrial and Transport Use

Industries across Mexico are showing more interest in dimethyl ether due to its suitability for use in industrial burners, power generation, and as a transportation fuel. Its chemical properties make it easier to store and transport compared to other alternatives, improving operational convenience for commercial users. Logistics fleets and small-scale transport operators are exploring DME as a fuel option to lower engine wear and comply with stricter fuel norms. At the industrial level, manufacturers are evaluating DME as a feedstock or energy source that can help improve their emissions profile without a major infrastructure overhaul. During the latter stages of this shift, collaboration between local distributors and global technology providers has helped introduce DME-compatible equipment in some areas. Regulatory backing, pilot programs, and tax incentives for cleaner fuels are gradually improving awareness. These steps are encouraging businesses to consider DME not just for its cleaner performance but also for long-term cost benefits and reduced maintenance needs in fuel-intensive operations.

Mexico Dimethyl Ether Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on raw material, application, and end-use industry.

Raw Material Insights:

- Methanol

- Coal

- Natural Gas

- Bio-Based

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes methanol, coal, natural gas, bio-based, and others.

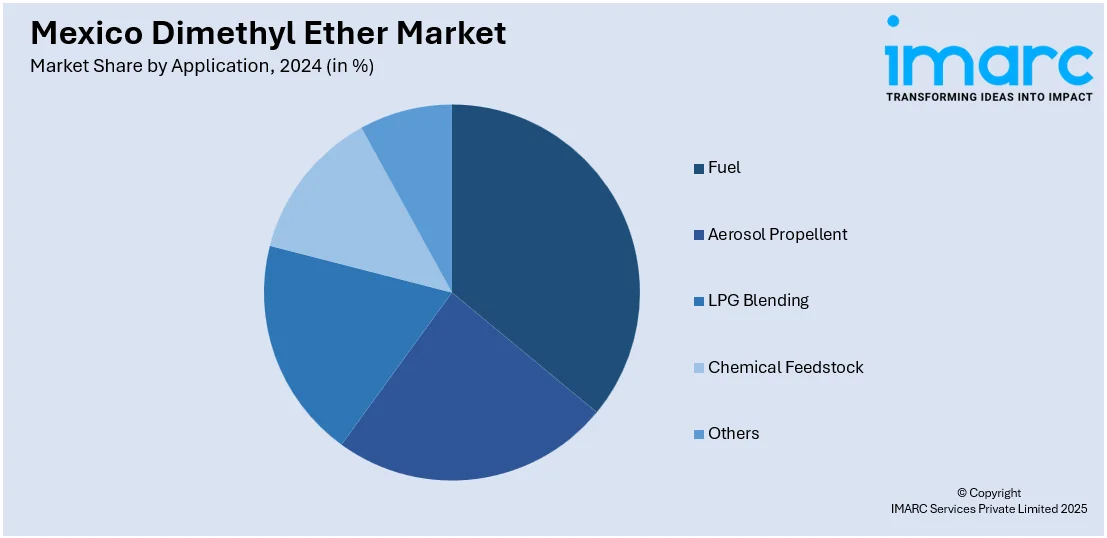

Application Insights:

- Fuel

- Aerosol Propellent

- LPG Blending

- Chemical Feedstock

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes fuel, aerosol propellent, LPG blending, chemical feedstock, and others.

End Use Industry Insights:

- Oil and Gas

- Automotive

- Power Generation

- Cosmetics

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes oil and gas, automotive, power generation, cosmetics, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Dimethyl Ether Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Methanol, Coal, Natural Gas, Bio-Based, Others |

| Applications Covered | Fuel, Aerosol Propellent, LPG Blending, Chemical Feedstock, Others |

| End Use Industries Covered | Oil and Gas, Automotive, Power Generation, Cosmetics, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico dimethyl ether market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico dimethyl ether market on the basis of raw material?

- What is the breakup of the Mexico dimethyl ether market on the basis of application?

- What is the breakup of the Mexico dimethyl ether market on the basis of end use industry?

- What are the various stages in the value chain of the Mexico dimethyl ether market?

- What are the key driving factors and challenges in the Mexico dimethyl ether market?

- What is the structure of the Mexico dimethyl ether market and who are the key players?

- What is the degree of competition in the Mexico dimethyl ether market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico dimethyl ether market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico dimethyl ether market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico dimethyl ether industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)