Mexico Dishwashing Detergent Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2026-2034

Mexico Dishwashing Detergent Market Summary:

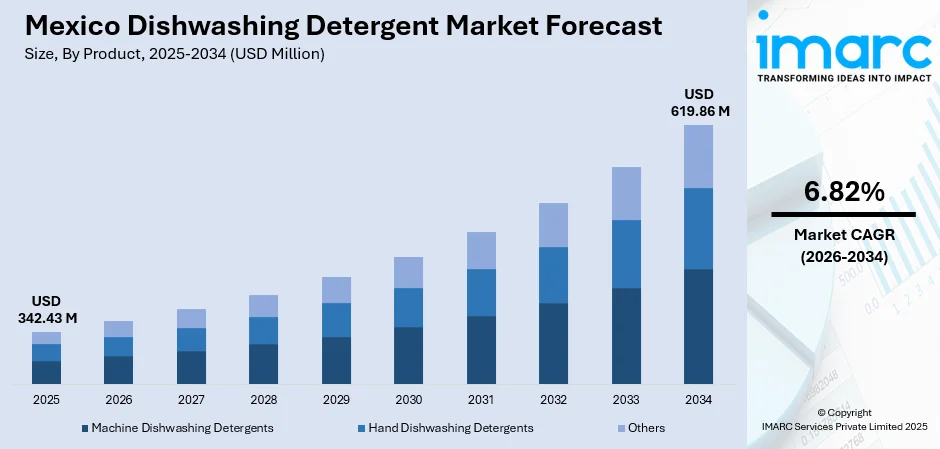

The Mexico dishwashing detergent market size was valued at USD 342.43 Million in 2025 and is projected to reach USD 619.86 Million by 2034, growing at a compound annual growth rate of 6.82% from 2026-2034.

The Mexico dishwashing detergent market is witnessing stable growth driven by increasing consumer demand for efficient and affordable cleaning solutions. Rising hygiene awareness, changing household patterns, and rapid urbanization are propelling product adoption across residential and commercial segments. The shift toward eco-friendly formulations and biodegradable ingredients reflects evolving consumer preferences for sustainable home care products. Traditional hand dishwashing practices remain prevalent, while concentrated detergent formats are gaining traction for their cost-effectiveness and convenience, contributing to the overall Mexico dishwashing detergent market share.

Key Takeaways and Insights:

-

By Product: Hand dishwashing detergents dominate the market with a share of 62% in 2025, owing to widespread consumer preference for manual dishwashing, cost-effectiveness compared to machine alternatives, and the traditional household cleaning practices prevalent across Mexican households. Rising disposable incomes are fueling the market expansion.

-

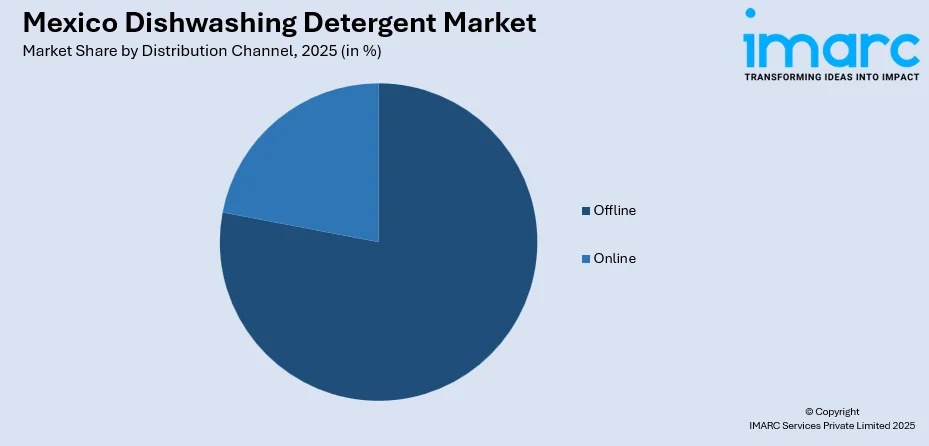

By Distribution Channel: Offline leads the market with a share of 78% in 2025. This dominance is driven by the extensive retail infrastructure of supermarkets, hypermarkets, and convenience stores that provide immediate product availability, enabling consumers to physically evaluate products before purchase.

-

Key Players: Key players drive the Mexico dishwashing detergent market by expanding product portfolios, improving cleaning formulations, and strengthening nationwide distribution networks. Their investments in sustainable packaging, marketing initiatives, and partnerships with retailers boost brand awareness and product accessibility across diverse consumer segments.

To get more information on this market Request Sample

The Mexico dishwashing detergent market is characterized by strong consumer preference for effective and affordable cleaning solutions that address the country's diverse household needs. The market benefits from increasing urbanization rates, with 81.86% of Mexico's population residing in urban areas as of 2024, reshaping consumption habits and driving demand for convenient home care products. Manufacturers are responding to heightened environmental awareness by reformulating products with plant-based surfactants and biodegradable ingredients, aligning with global sustainability movements while maintaining cleaning efficacy. The expansion of organized retail channels and growing middle-class population are creating favorable conditions for premium product adoption, while regional manufacturers continue to innovate with concentrated formulations that offer superior performance and reduced packaging waste.

Mexico Dishwashing Detergent Market Trends:

Rising Demand for Eco-Friendly and Biodegradable Formulations

Mexican consumers are increasingly gravitating toward environmentally sustainable dishwashing products that contain no harmful chemicals, phosphates, or synthetic fragrances. This shift is particularly prominent among younger demographics, including millennials and Gen Z, who actively support brands aligning with their environmental values. Manufacturers are reformulating products using natural, plant-based ingredients and packaging them in recyclable materials. The movement parallels worldwide sustainability initiatives as consumers prioritize products that deliver effective cleaning while remaining safe for health and the environment.

Growing Popularity of Concentrated Dishwashing Detergents

Concentrated dishwashing detergents are emerging as a significant trend in Mexico, driven by their efficiency and cost-saving advantages. These products require smaller volumes to deliver equivalent cleaning capability compared to standard detergents, offering consumers better value while minimizing packaging waste. Households are increasingly attracted to concentrated formats for their extended shelf life and convenient storage requirements. With stronger active ingredients providing superior grease and stain removal performance, manufacturers are launching concentrated products with sustainable formulas to capture growing consumer interest.

Expansion of Multi-Functional Cleaning Solutions

Multi-functional dishwashing detergents are gaining substantial traction in Mexico as consumers seek convenient and effective cleaning solutions that address multiple needs simultaneously. Products with enhanced antibacterial properties, grease-cutting capabilities, and skin-friendly formulations are resonating with health-conscious households. These versatile products allow consumers to perform various cleaning tasks with a single purchase, making them attractive for busy households and commercial kitchens. Manufacturers continue innovating specialized formulations that combine cleaning efficacy with additional benefits such as hand protection and pleasant fragrances.

Market Outlook 2026-2034:

The Mexico dishwashing detergent market outlook remains optimistic, supported by sustained consumer demand for hygiene-focused cleaning products and ongoing retail expansion. Innovation in product formulations, particularly eco-friendly and concentrated variants, will continue shaping competitive dynamics. The market generated a revenue of USD 342.43 Million in 2025 and is projected to reach a revenue of USD 619.86 Million by 2034, growing at a compound annual growth rate of 6.82% from 2026-2034. E-commerce channels are expected to gain momentum while offline retail maintains dominance through strategic promotional activities.

Mexico Dishwashing Detergent Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Hand Dishwashing Detergents |

62% |

|

Distribution Channel |

Offline |

78% |

Product Insights:

- Machine Dishwashing Detergents

- Hand Dishwashing Detergents

- Others

Hand dishwashing detergents dominate with 62% share of the total Mexico dishwashing detergent market in 2025.

Hand dishwashing detergents maintain market leadership in Mexico due to the prevalence of traditional manual dishwashing practices across residential households. Limited penetration of automatic dishwashers, particularly in rural and semi-urban areas, sustains strong demand for liquid and gel formulations designed for manual cleaning. Mexican consumers prefer the tactile control and immediate results offered by hand dishwashing, with affordability remaining a key purchase driver. The segment benefits from established distribution networks ensuring product availability across diverse retail formats.

The dominance of hand dishwashing detergents is reinforced by product innovations addressing consumer preferences for enhanced grease-cutting capabilities and antibacterial properties. Manufacturers are launching variants with natural ingredients and skin-friendly formulations to capture health-conscious consumers. Cultural factors, including communal dining traditions and multi-generational households, continue supporting higher consumption volumes of hand dishwashing products across the country.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline

- Online

Offline leads with a share of 78% of the total Mexico dishwashing detergent market in 2025.

Offline distribution channels dominate the Mexico dishwashing detergent market through an extensive network of supermarkets, hypermarkets, and convenience stores serving both urban centers and rural communities. These retail formats enable consumers to physically examine products, compare prices, and benefit from promotional discounts that influence purchasing decisions. The immediate product availability and established consumer trust in traditional retail environments reinforce offline channel supremacy, highlighting the importance of accessible distribution points for household cleaning products.

Supermarkets and hypermarkets maintain their position as primary offline distribution channels by offering diverse product assortments, competitive pricing, and bundled promotions that attract value-conscious shoppers. Store-based retail benefits from the ability to provide personalized customer service and product demonstrations that enhance consumer confidence. While e-commerce is experiencing rapid growth, offline channels continue dominating through strategic in-store merchandising, loyalty programs, and localized marketing initiatives that resonate with Mexican consumer shopping preferences.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents a significant market for dishwashing detergents, driven by industrial development, nearshoring activities, and rising household incomes in manufacturing hubs. The region's proximity to the United States influences consumer preferences toward premium cleaning products and international brand availability across modern retail formats.

Central Mexico, encompassing Mexico City metropolitan area, constitutes a major consumption hub with high population density and extensive retail infrastructure. The region's urbanized lifestyle and growing middle-class population drive demand for diverse dishwashing product categories and innovative cleaning solutions.

Southern Mexico presents growth opportunities with increasing retail penetration and rising consumer awareness about hygiene practices. Traditional convenience stores and local retailers serve as primary distribution channels, while regional manufacturers address price-sensitive consumer segments with affordable product offerings.

Other regions across Mexico contribute to market expansion through evolving consumption patterns and improving distribution networks. Tourism-driven coastal areas and emerging urban centers demonstrate growing demand for household cleaning products as economic development supports higher household spending.

Market Dynamics:

Growth Drivers:

Why is the Mexico Dishwashing Detergent Market Growing?

Increasing Urbanization and Changing Household Patterns

Mexico has experienced significant rural-to-urban migration as people seek improved employment opportunities, education access, and modern lifestyles. This urbanization trend is reshaping household consumption patterns, with urban dwellers demonstrating higher adoption rates for packaged cleaning products compared to rural counterparts. Growing numbers of nuclear families and dual-income households are driving demand for convenient and efficient dishwashing solutions that save time and effort. The expansion of apartment living in metropolitan areas further supports demand for compact, easy-to-store cleaning products. Rising disposable incomes among urban consumers enable purchases of premium formulations with enhanced cleaning performance and additional benefits such as antibacterial properties and skin protection features.

Heightened Hygiene Awareness and Health Consciousness

Consumer awareness regarding hygiene and cleanliness has intensified significantly, driving increased expenditure on household cleaning products including dishwashing detergents. Mexican households are prioritizing effective cleaning solutions that eliminate bacteria, grease, and food residues from kitchenware and cooking utensils. Health-conscious consumers are seeking products with antibacterial properties and natural ingredients that ensure food safety without harsh chemical exposure. Public health campaigns and educational initiatives have reinforced the importance of kitchen hygiene practices, supporting sustained demand growth. The integration of wellness considerations into purchasing decisions is encouraging manufacturers to develop formulations that combine cleaning efficacy with health-protective attributes.

Product Innovation and Sustainable Formulation Development

Continuous product innovation by manufacturers is expanding consumer choices and stimulating market growth through differentiated offerings. Companies are investing in research and development to create concentrated formulations, eco-friendly variants, and multi-functional products that address evolving consumer needs. The introduction of plant-based surfactants, biodegradable ingredients, and recyclable packaging responds to growing environmental consciousness among Mexican consumers. Fragrance innovations, skin-friendly formulas, and enhanced grease-cutting technologies differentiate premium products in competitive retail environments. Strategic product launches aligned with sustainability trends and consumer preferences are enabling manufacturers to capture emerging market segments and command premium pricing.

Market Restraints:

What Challenges the Mexico Dishwashing Detergent Market is Facing?

Price Sensitivity and Economic Constraints

A significant portion of Mexican consumers operates within constrained income levels, particularly in rural and underserved areas. This price consciousness limits the appeal of premium, eco-friendly, or concentrated formulations. Economic fluctuations and inflation impact purchasing power, prompting consumers to favor lower-cost alternatives or smaller package sizes.

Intense Competition and Market Fragmentation

The Mexico dishwashing detergent market faces intense competition among domestic and international brands, leading to price wars and margin pressures. Market fragmentation with numerous regional players creates challenges for brand differentiation. Established manufacturers must continually innovate while managing competitive pricing strategies to maintain market position.

Raw Material Cost Volatility

Fluctuations in raw material costs, particularly surfactants and packaging materials influenced by global oil prices, impact manufacturing expenses and profit margins. Supply chain disruptions affect ingredient availability and logistics costs. These volatilities challenge manufacturers' ability to maintain consistent pricing while preserving product quality standards.

Competitive Landscape:

The Mexico dishwashing detergent market exhibits a moderately competitive landscape with established multinational corporations and regional manufacturers vying for market share. Key players focus on product differentiation through innovative formulations, sustainable packaging, and strategic marketing campaigns. Distribution partnerships with major retail chains strengthen market presence across urban and rural territories. Companies are investing in brand building, promotional activities, and consumer engagement initiatives to enhance loyalty. Competitive strategies include portfolio expansion with eco-friendly variants, concentrated products, and antibacterial formulations addressing diverse consumer preferences. Regional manufacturers compete through value-oriented offerings targeting price-sensitive segments while multinational brands leverage technological expertise and global best practices.

Recent Developments:

-

In February 2025, Procter & Gamble introduced the Dawn PowerSuds, its most effective liquid dish soap featuring double the suds. The new formula creates twice as many bubbles that trap grease and prevent residue from spreading across dishes, enhancing cleaning efficiency for consumers handling large dishwashing loads.

Mexico Dishwashing Detergent Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Machine Dishwashing Detergents, Hand Dishwashing Detergents, Others |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico dishwashing detergent market size was valued at USD 342.43 Million in 2025.

The Mexico dishwashing detergent market is expected to grow at a compound annual growth rate of 6.82% from 2026-2034 to reach USD 619.86 Million by 2034.

Hand dishwashing detergents dominated the market with a share of 62%, driven by widespread consumer preference for manual dishwashing practices and the affordability of liquid dish soaps across Mexican households.

Key factors driving the Mexico dishwashing detergent market include increasing urbanization, heightened hygiene awareness, growing demand for eco-friendly products, product innovation with concentrated formulations, and expansion of retail distribution networks.

Major challenges include price sensitivity among consumers, intense competition leading to margin pressures, raw material cost volatility, economic fluctuations impacting purchasing power, and the need for continuous product differentiation in a fragmented market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)