Mexico Display Market Size, Share, Trends and Forecast by Display Type, Technology, Application, Industry Vertical, and Region, 2025-2033

Mexico Display Market Overview:

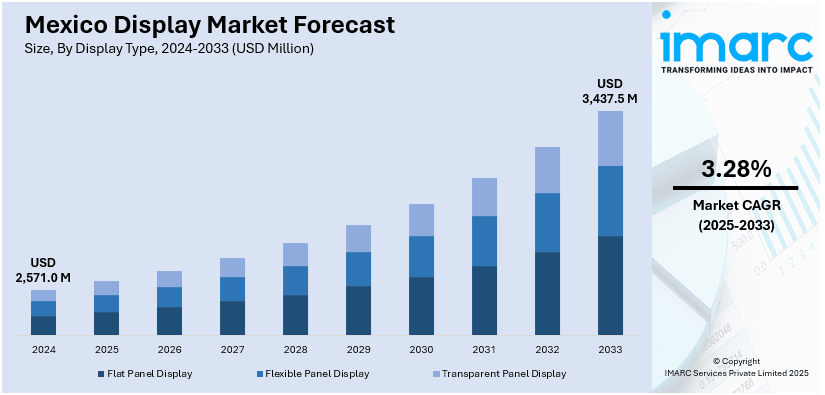

The Mexico display market size reached USD 2,571.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,437.5 Million by 2033, exhibiting a growth rate (CAGR) of 3.28% during 2025-2033. The market is expanding digitization in all industries, improved demand for visual communication, and investments in innovative infrastructure, further facilitating widespread implementation of display technology in retail, transportation, educational, and government environments across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,571.0 Million |

| Market Forecast in 2033 | USD 3,437.5 Million |

| Market Growth Rate 2025-2033 | 3.28% |

Mexico Display Market Trends:

Rising Demand for Interactive and Touchscreen Displays

Growing digitization of consumer-centric services has created a steep incline in the utilization of interactive and touch displays in Mexico. Retail, education, and transportation are among the sectors embracing these technologies to engage users and offer real-time access to information. In educational institutions, digital kiosks and smartboards are progressively substituting conventional whiteboards. Moreover, retail spaces have embraced touchscreen kiosks as a means of customer service to enable more tailored shopping experiences. Public infrastructure is also gaining, with wayfinding displays and service terminals becoming increasingly prevalent in city spaces. For example, in May 2024, BYD introduced the Shark hybrid-electric pickup in Mexico, featuring cutting-edge in-vehicle display systems—emphasizing Mexico's increasing position as a center for automotive display innovation and adoption. Furthermore, the trend is part of the wider global move toward interactive digital solutions, spurred by consumer familiarity and institutional investments in modernization. Mexico display market outlook is heavily influenced by this increased demand for interactivity, meaning a sustained emphasis on innovation throughout private and public digital infrastructure platforms to address heightened expectations for interactivity and a seamless digital experience.

Growth of LED and OLED Technologies Across Applications

LED and OLED displays are rapidly being embraced in Mexico because they offer high resolution, efficiency in terms of power consumption, and design flexibility. For example, in May 2024, Dahua Technology launched advanced 3D video screens and immersive LED displays at Expo Seguridad México 2024, transforming the indoor and outdoor advertising and entertainment process with the latest visual technology. Moreover, these technologies are now being used in advertising boards, television, car displays, and even lighting in architecture. Their capability to display bright colors and high contrast ratios is highly prized by industries where visual impact is very important. In addition, flexible OLED displays are leading to new opportunities for implementation in curved shapes and small devices, while further expanding applications. Businesses and consumers are switching to the newer technologies because they offer better performance and increasingly affordable production costs. Mexico display market growth is closely tied with the growing penetration of LED and OLED technology, which portends a revolution in visual content consumption and presentation. This growth highlights a larger trend toward dynamic, visually engaging digital platforms that improve both commercial appeal and user interaction in a wide range of environments.

Digital Signage Expansion in Urban Commercial Hubs

Mexican urbanization and infrastructure growth have driven the growth of digital signage in business centers, public places, and transport hubs. Digital billboards, video walls, and intelligent signage systems are overtaking static printed versions, with greater flexibility, real-time refreshment, and content customization. They are being used for advertisement, public announcements, and interactive consumer interaction. The availability of digital signage within transportation networks like airports, train stations, and bus stations has enhanced wayfinding and passenger communication. Retail and hospitality industries have also embraced digital signage to develop immersive brand experiences and communicate with customers about products and promotions. Mexico display market share is significantly on the rise as a result of extensive use of digital signage in busy metropolitan areas, with a focus on a move towards smart display solutions that cater to both marketing and informative objectives. The trend is indicative of a definite move towards digitalizing the country's visual communications system.

Mexico Display Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on display type, technology, application, and industry vertical.

Display Type Insights:

- Flat Panel Display

- Flexible Panel Display

- Transparent Panel Display

The report has provided a detailed breakup and analysis of the market based on the display type. This includes flat panel display, flexible panel display, and transparent panel display.

Technology Insights:

- OLED

- Quantum Dot

- LED

- LCD

- E-Paper

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes OLED, quantum dot, LED, LCD, e-paper, and others.

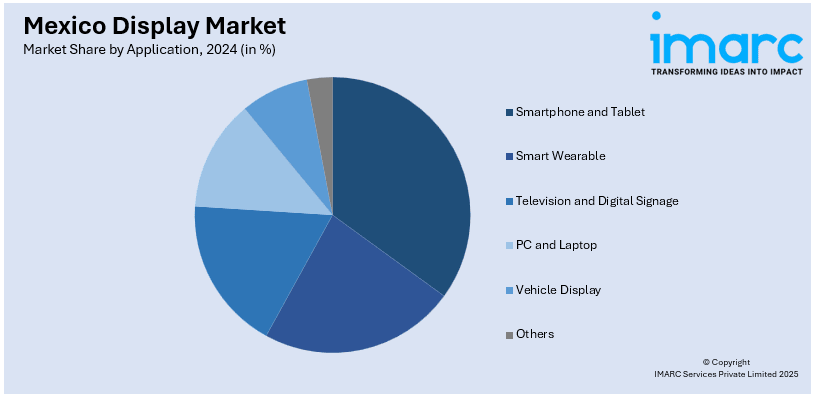

Application Insights:

- Smartphone and Tablet

- Smart Wearable

- Television and Digital Signage

- PC and Laptop

- Vehicle Display

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes smartphone and tablet, smart wearable, television and digital signage, PC and laptop, vehicle display, and others.

Industry Vertical Insights:

- BFSI

- Retail

- Healthcare

- Consumer Electronics

- Military and Defense

- Automotive

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes BFSI, retail, healthcare, consumer electronics, military and defense, automotive, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Display Market News:

- In April 2024, SRYLED displayed its cutting-edge LED screens, such as P2.6 GOB, fine-pitch, and glasses-free 3D displays, at Sound Check Xpo 2024. Attracting huge crowds and selling out all the products featured, the event reflected Mexico's increasing need for innovative LED display technology and advancements.

Mexico Display Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Display Types Covered | Flat Panel Display, Flexible Panel Display, Transparent Panel Display |

| Technologies Covered | OLED, Quantum Dot, LED, LCD, E-Paper, Others |

| Applications Covered | Smartphone And Tablet, Smart Wearable, Television and Digital Signage, PC And Laptop, Vehicle Display, Others |

| Industry Verticals Covered | BFSI, Retail, Healthcare, Consumer Electronics, Military and Defense, Automotive, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico display market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico display market on the basis of display type?

- What is the breakup of the Mexico display market on the basis of technology?

- What is the breakup of the Mexico display market on the basis of application?

- What is the breakup of the Mexico display market on the basis of industry vertical?

- What is the breakup of the Mexico display market on the basis of region?

- What are the various stages in the value chain of the Mexico display market?

- What are the key driving factors and challenges in the Mexico display?

- What is the structure of the Mexico display market and who are the key players?

- What is the degree of competition in the Mexico display market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico display market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico display market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico display industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)