Mexico Doors Market Size, Share, Trends and Forecast by Type, Material, Mechanism, Application, End User, and Region, 2026-2034

Mexico Doors Market Summary:

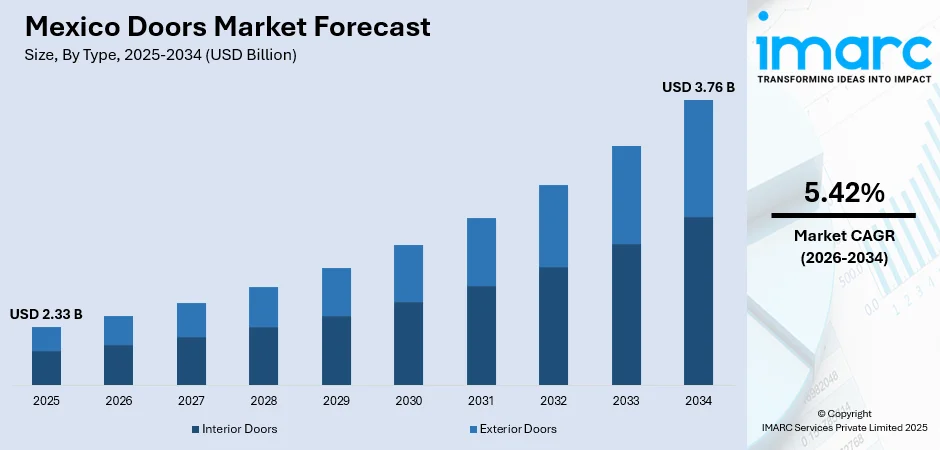

The Mexico doors market size was valued at USD 2.33 Billion in 2025 and is projected to reach USD 3.76 Billion by 2034, growing at a compound annual growth rate of 5.42% from 2026-2034.

The Mexico doors market is experiencing growth driven by the expanding residential and commercial construction activities and rising user demand for aesthetically appealing and energy-efficient door solutions. Government-backed housing programs, increased foreign direct investment (FDI) in hospitality and industrial infrastructure, and the growing adoption of smart home technologies are reshaping purchasing patterns. These dynamics, combined with heightened focus on fire safety compliance and sustainable building materials, are strengthening the Mexico doors market growth across residential, commercial, and industrial applications.

Key Takeaways and Insights:

- By Type: Interior doors dominate the market with a share of 58% in 2025, driven by consistent demand from residential construction projects requiring multiple interior access points per dwelling unit and renovation activities focused on modernizing indoor living spaces.

- By Material: Wood leads the market with a share of 46% in 2025, owing to its timeless aesthetic appeal, natural insulation properties, and strong user preference for traditional craftsmanship in both residential and premium commercial applications.

- By Mechanism: Swinging represents the largest segment with a market share of 52% in 2025, reflecting their universal applicability across residential and commercial settings, cost-effectiveness, and straightforward installation and maintenance requirements.

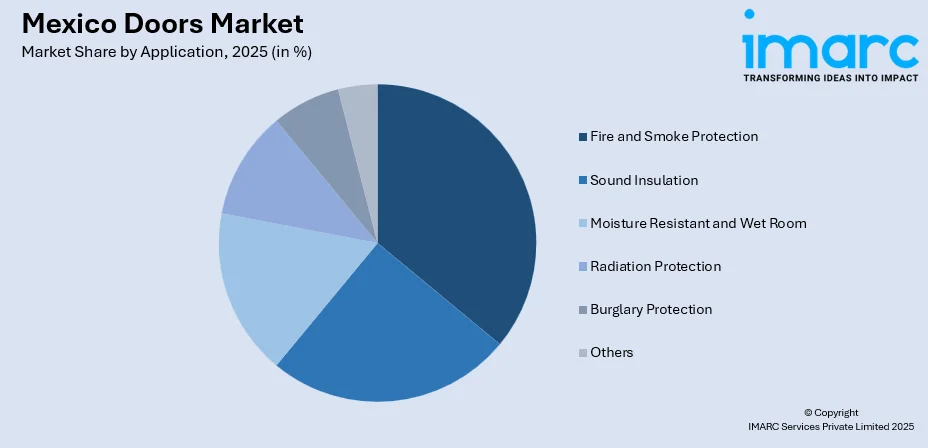

- By Application: Fire and smoke protection hold the biggest market share of 26% in 2025, influenced by stringent building safety regulations under local government standards and increasing emphasis on occupant safety in commercial and industrial facilities.

- By End User: Residential dominates the market with a share of 63% in 2025, supported by government housing initiatives, the growing middle-class purchasing power, and sustained demand for both new construction and home renovation projects.

- Key Players: The Mexico doors market exhibits moderately fragmented competition, with multinational manufacturers leveraging technological innovation and distribution networks while regional producers compete on customization capabilities and localized service offerings.

To get more information on this market Request Sample

The Mexico doors market is propelled by robust expansion in construction across residential, commercial, hospitality, and public infrastructure sectors. This robust expansion in construction across all sectors is particularly evident in the residential market, where the nationwide house price index continued to rise strongly by 9.64% in Q1 2024, according to the Sociedad Hipotecaria Federal (SHF), following steady double-digit growth in the previous quarters. Moreover, rising disposable incomes fuel home renovations and remodeling, emphasizing energy-efficient, stylish, and functional door solutions. Businesses establishing operations demand specialized doors for high-traffic, secure, and climate-controlled environments, prioritizing sustainability and compliance. Large-scale government projects for schools, hospitals, and facilities necessitate fire-rated, soundproof, and high-security options to adhere to stringent regulations. Besides this, innovation in durable, eco-friendly materials and designs is contributing to the market growth, supported by increasing security concerns and modern lifestyle preferences.

Mexico Doors Market Trends:

Rising Demand for Residential Construction

With a steadily increasing population and urban expansion, both new housing developments and renovations require a variety of door solutions. Homeowners seek doors that offer aesthetics, functionality, and security, contributing to a broad market for interior and exterior doors. This growing number of new housing developments is exemplified by the completion of the Pedre housing complex in Mexico City in 2024 by Mexican studios JSa and Mta+v, which featured a curving design with three volumes around a central spiral staircase and rooftop garden. Furthermore, as disposable income rises, people are investing in high-quality materials and innovative door designs to enhance the value of their properties. This trend is particularly evident in the construction of multi-family residential complexes and upscale housing projects, which significantly drive the demand for durable and stylish doors.

Government Investments in Infrastructure and Public Works

Large-scale infrastructure projects like schools, hospitals, and government buildings require installation of specialized doors, including fire-rated, soundproof, and high-security types, to meet stringent safety and functional standards. In 2025, the Mexican government initiated the Comprehensive Program for the Eastern State of Mexico, targeting the creation of over 10,000 new educational facilities, exemplifying significant public investment in infrastructure. Such initiatives are catalyzing the demand for doors that comply with regulatory safety requirements. As a result, these projects create ongoing opportunities for both domestic and international door manufacturers to supply tailored solutions that address operational and security needs in public infrastructure development.

Expansion of Commercial Real Estate

As businesses establish and expand operations, the demand for commercial properties, such as office buildings, retail spaces, and industrial facilities increases, necessitating specialized door solutions tailored to diverse requirements. In 2025, Industrial Realty Group (IRG), through its subsidiary Industrial Realty Mexico (IRM), acquired a 121,608 square foot property in Hermosillo, Mexico. The site, formerly a Lowe’s retail store, will be repositioned for retail or industrial use, with significant developable land included. These solutions must accommodate high-traffic usage, security needs, and climate control while emphasizing energy efficiency and sustainability through enhanced insulation and eco-friendly materials. This sector drives innovation, encouraging manufacturers to prioritize durability, design, and adherence to commercial building standards, thereby contributing to the market growth in Mexico.

Market Outlook 2026-2034:

The Mexico doors market is poised for growth throughout the forecast period, driven by key demographic trends and significant investments in infrastructure. With a rising urban population and increased demand for both residential and commercial construction, the market shows strong potential for expansion. The market generated a revenue of USD 2.33 Billion in 2025 and is projected to reach a revenue of USD 3.76 Billion by 2034, growing at a compound annual growth rate of 5.42% from 2026-2034. This growth is underpinned by rising construction activity and increasing user demand for innovative door solutions in both new developments and renovation projects.

Mexico Doors Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Interior Doors | 58% |

| Material | Wood | 46% |

| Mechanism | Swinging | 52% |

| Application | Fire and Smoke Protection | 26% |

| End User | Residential | 63% |

Type Insights:

- Interior Doors

- Exterior Doors

Interior doors exhibit a clear dominance with a 58% share of the total Mexico doors market in 2025.

Interior doors lead the market due to their essential role in residential and commercial spaces. As demand for home and office improvements rises, interior doors provide aesthetic appeal, functionality, and privacy, making them a key component in construction and renovation projects.

Additionally, the increasing trend of interior design customization further drives the demand for diverse styles and finishes in interior doors. With preferences for modern, sleek designs and energy-efficient materials, interior doors cater to evolving user tastes, reinforcing their dominance in the market.

Material Insights:

- Wood

- Glass

- Metal

- Plastic

- Others

Wood dominates the market with a 46% share of the total Mexico doors market in 2025.

Wood represents the largest segment owing to its aesthetic appeal, versatility, and natural insulating properties. Wood door is highly preferred for residential and commercial applications, as it offers a combination of durability, design flexibility, and warmth, which align with user preferences.

Moreover, wood is a sustainable material that can be sourced responsibly, appealing to environmentally-conscious individuals. The material’s ability to be easily customized, stained, or painted further contributes to its popularity, allowing wood door to cater to various architectural styles and interior designs in the market.

Mechanism Insights:

- Swinging

- Sliding

- Folding

- Revolving

- Others

Swinging represents the largest market with a 52% share of the total Mexico doors market in 2025.

Swinging holds the biggest market share, driven by its simplicity, ease of use, and wide applicability in both residential and commercial settings. Its traditional design, which allows for smooth operation, is well-suited for high-traffic areas such as homes, offices, and retail spaces.

The market dominance of swinging door design is complemented by the consistent expansion of commercial and residential infrastructure, as demonstrated by Salesforce's 2025 announcement of a USD1 billion investment in Mexico over five years to boost economic growth and open a new office in Mexico City. Furthermore, swinging door is cost-effective and require minimal maintenance compared to more complex mechanisms.

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Sound Insulation

- Fire and Smoke Protection

- Moisture Resistant and Wet Room

- Radiation Protection

- Burglary Protection

- Others

Fire and smoke protection dominates the market with a 26% share of the total Mexico doors market in 2025.

Fire and smoke protection doors hold the biggest market share owing to stringent building codes and safety regulations. These doors are essential in commercial, industrial, and residential buildings to prevent the spread of fire and smoke, safeguarding lives and property during emergencies.

With heightened awareness about fire safety, builders and developers are prioritizing fire and smoke protection doors to comply with safety standards, further contributing to their dominance in the market. This increased prioritization of fire and smoke protection doors to comply with safety standards is being formalized at the municipal level, as evidenced by Mexico City's adoption of 11 ULSE standards in 2025 to enhance fire safety and emergency systems in construction, which specifically include fire door tests.

End User Insights:

- Residential

- Non-residential

Residential exhibit a clear dominance with a 63% share of the total Mexico doors market in 2025.

Residential represents the largest segment because of the increasing demand for home construction and renovations. As the population grows and urbanization expands, more homeowners are investing in high-quality, aesthetically pleasing doors for both functional and decorative purposes.

This dominance of the residential segment, driven by high demand for home construction and renovations, is being significantly supported by government initiatives, such as the Mexican government's 2024 launch of the Housing Improvement Program for Well-Being in the State of Mexico, which aimed to provide 100,000 support grants and is part of the broader National Housing Plan targeting 1 million new homes.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico plays a crucial role in the doors market due to its strong industrial base. The demand for doors is driven by commercial construction, urban development, and cross-border trade, creating a robust market.

Central Mexico, particularly Mexico City, is a crucial segment in the market with significant construction activity. The demand for residential and commercial doors is driven by ongoing development in both the private and public sectors, including infrastructure projects and residential complexes.

Southern Mexico is experiencing higher adoption of doors due to an increasing focus on infrastructure development and residential construction. Government initiatives and private investments in housing projects are driving the demand for durable, cost-effective doors in both urban and rural areas.

Others, including regions like the Yucatán Peninsula, is witnessing steady growth in the doors market. Investments in tourism, commercial real estate, and residential development are driving the need for high-quality, aesthetically appealing doors in these expanding regions.

Market Dynamics:

Growth Drivers:

Why is the Mexico Doors Market Growing?

Growing Renovation and Remodeling Activities

In Mexico, the increasing trend of home renovation and remodeling is driving the demand for doors, as homeowners invest in upgrading properties with modern, energy-efficient, and aesthetically pleasing doors. This trend is influenced by increased disposable income, with the National Institute of Statistics and Geography (Inegi) reporting an average monthly household income of 25,955 pesos in 2024, reflecting the growing financial capacity for home improvements. Renovations that enhance interior design and functionality create steady demand for diverse door styles, ranging from contemporary to traditional finishes.

Growth of Tourism and Hospitality Sector

As Mexico remains a premier destination for international tourists, the construction of hotels, resorts, and recreational facilities is catalyzing the demand for durable, stylish doors that ensure security, soundproofing, and fire resistance while enhancing aesthetic appeal to elevate guest experiences. Mexico’s National Statistics Institute (Inegi) reported that the country welcomed 45.04 million international tourists in 2024, reflecting a 7.4% year-over-year increase, which underscores the tourism sector's robust momentum. This expansion, propelled by foreign investments and local initiatives, continues to generate substantial opportunities for specialized doors in Mexico's robust hospitality infrastructure.

Increasing Industry Events

The rising number of industry-specific events, including trade shows and expos, serves as a major factor bolstering the growth of the market in Mexico by providing structured platforms for professional interaction, technological demonstration, and strategic collaboration. These gatherings enable manufacturers, suppliers, and buyers to exchange knowledge, assess emerging trends, and explore advanced solutions that drive competitive development. For example, the Glasstech Mexico Doors & Windows Expo Aluminum 2024, held from July 9 to 11 at Expo Guadalajara, brought together leading companies and specialists from the glass, window, and door industries, reinforcing its role as a key venue supporting market advancement across Latin America.

Market Restraints:

What Challenges the Mexico Doors Market is Facing?

Rising Raw Material Costs

The Mexico doors market faces challenges due to the rising cost of raw materials, such as wood, aluminum, and steel. Fluctuations in the price of these materials impact manufacturing costs, forcing door manufacturers to either absorb the higher costs or pass them onto end users. This can create pricing pressures in the market, making it difficult for manufacturers to remain competitive while maintaining profitability, and affecting overall market growth.

Stringent Regulatory Compliance

The Mexico doors market is grappling with increasingly stringent regulatory requirements related to building codes, safety standards, and environmental regulations. Compliance with these regulations, such as fire ratings, energy efficiency standards, and sustainability practices, requires continuous investment in research and development (R&D) and modifications to existing products. The complexity and cost of adhering to these regulations can strain resources, particularly for smaller manufacturers, potentially leading to delays, higher costs, and reduced market competitiveness.

Increasing Competition from Imported Products

The influx of imported doors, especially from countries with lower production costs, is creating intense competition in the market. Imported products, often priced more competitively, challenge local manufacturers who struggle to compete on price without sacrificing quality. This situation forces domestic companies to innovate in design, improve operational efficiency, and focus on offering superior customer service to differentiate themselves, which can increase operating costs and impact profit margins.

Competitive Landscape:

The Mexico doors market exhibits moderately fragmented competitive dynamics characterized by multinational building products corporations operating alongside established regional manufacturers and specialized local producers. Market participants compete across price segments through product differentiation strategies emphasizing material quality, design innovation, safety certifications, and customization capabilities. Technology integration is emerging as a key differentiator as players adopt sensor-based automation and Internet of Things (IoT)-enabled access control features. Distribution channel development, including e-commerce expansion and retail partnerships, influences market positioning. Strategic acquisitions and partnerships are reshaping the competitive landscape as global players seek to strengthen specialized capabilities and regional market access.

Recent Developments:

- In October 2025, Best Access Doors has expanded its operations to Mexico, launching a new e-commerce platform, Puertas de Acceso, offering access doors and panels for the construction sector. The platform aims to streamline product ordering and technical support for local professionals. It will also be featured at Expo CIHAC 2025 in Mexico City.

Mexico Doors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Interior Doors, Exterior Doors |

| Materials Covered | Wood, Glass, Metal, Plastic, Others |

| Mechanisms Covered | Swinging, Sliding, Folding, Revolving, Others |

| Applications Covered | Sound Insulation, Fire and Smoke Protection, Moisture Resistant and Wet Room, Radiation Protection, Burglary Protection, Others |

| End Users Covered | Residential, Non-residential |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico doors market size was valued at USD 2.33 Billion in 2025.

The Mexico doors market is expected to grow at a compound annual growth rate of 5.42% from 2026-2034 to reach USD 3.76 Billion by 2034.

Interior doors hold the largest type segment share at 58% in 2025, driven by consistent demand from residential construction requiring multiple access points per dwelling and renovation activities modernizing indoor spaces.

Key factors driving the Mexico doors market include large-scale infrastructure projects like schools, hospitals, and government buildings. In 2025, the Mexican government launched the Comprehensive Program for the Eastern State of Mexico, aiming to create over 10,000 new educational facilities. These initiatives drive the demand for compliant doors, offering ongoing opportunities for domestic and international manufacturers

Major challenges include the rising material costs, stricter regulations, and the growing competition from low-cost imports. These factors increase production expenses, strain compliance resources, challenge domestic competitiveness, and force manufacturers to innovate while managing tighter margins and slower market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)