Mexico Driver Assistance Systems Market Size, Share, Trends and Forecast by Type, Technology, Vehicle Type, and Region, 2025-2033

Mexico Driver Assistance Systems Market Overview:

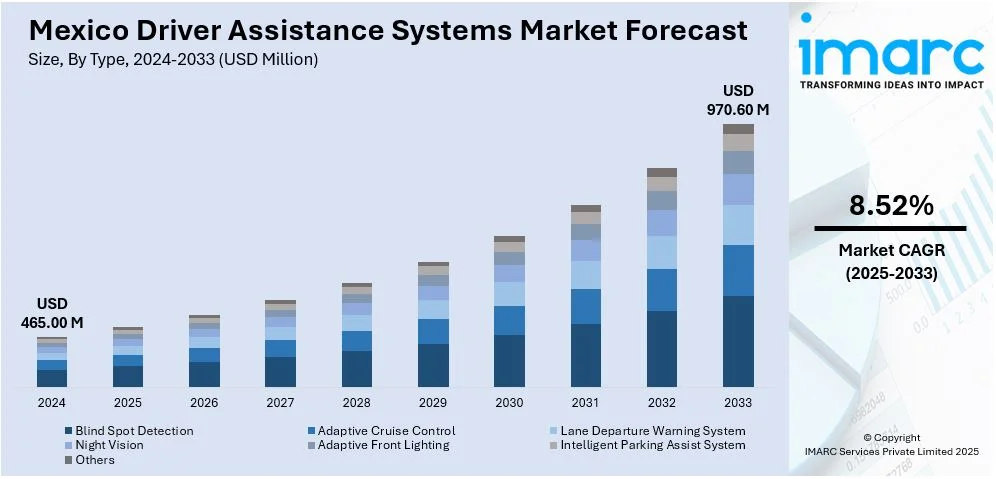

The Mexico driver assistance systems market size reached USD 465.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 970.60 Million by 2033, exhibiting a growth rate (CAGR) of 8.52% during 2025-2033. Mexico's growing automotive sector, driven by original equipment manufacturers (OEMs) and Tier 1 suppliers, is catalyzing the demand for advanced driver assistance systems. The increasing popularity of electric vehicles (EVs), which are built on next-gen platforms, further promotes the integration of safety technologies. This trend is contributing to the expansion of the Mexico driver assistance systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 465.00 Million |

| Market Forecast in 2033 | USD 970.60 Million |

| Market Growth Rate 2025-2033 | 8.52% |

Mexico Driver Assistance Systems Market Trends:

Growth of the Mexican Automotive Manufacturing Sector

Mexico's role as a major automotive manufacturing center is influencing the expansion of the driver assistance systems market. Due to a significant presence of global OEMs and Tier 1 suppliers, the nation enjoys substantial production levels and access to cutting-edge automotive technologies. These production plants frequently serve both local and international markets, encouraging the integration of advanced safety systems to satisfy various consumer needs. The Mexican Automotive Industry Association (AMIA) predicts that by the end of 2025, Mexico will rank as the fifth-largest vehicle producer worldwide. In 2024, overall automobile production hit 3,989,403 units, showing a 5.56% rise compared to 2023, with a further 2.7% growth anticipated for 2025. This increase in production is driving the need for high-value, technologically sophisticated vehicles, encouraging local innovation in automotive electronics, including driver assistance systems. The existing manufacturing framework also facilitates economical production and quicker incorporation of advanced features, such as driver assistance technologies. This industrial expansion also facilitates technology transfer and enhances the abilities of local suppliers, placing Mexico not merely as a user but as a significant participant in driver assistance systems design and execution. With this strong manufacturing environment, Mexico is set to stay at the leading edge of automotive technology innovation, guaranteeing ongoing progress in driver assistance systems as a component of the nation's growing position in the worldwide automotive supply chain.

Rise of Electrification and Next-Generation Vehicle Platforms

The growing shift toward electric vehicles (EVs) in Mexico is closely tied to the advancement of driver assistance technologies. Numerous EVs are constructed on advanced vehicle platforms that feature integrated software and modular architecture, which inherently enhances their compatibility with driver assistance systems. With international and domestic manufacturers investing in electrification, these platforms frequently come pre-equipped or can be readily upgraded with advanced assistance features, addressing a tech-savvy clientele. EV purchasers often embrace new technologies and are generally more willing to invest in advanced safety and automation features. The National Institute of Statistics and Geography (INEGI) indicated that between January and November 2024, 108,943 hybrid, plug-in hybrid, and EVs were sold in Mexico, marking a 70.2% rise when compared to the sales figures from the same timeframe in 2023. This significant rise in EV sales indicates an increasing user demand for eco-friendly and high-tech vehicles. As EV infrastructure develops and use increases, the need for smart vehicles, linked and centered on safety, also escalates. Driver assistance systems are emerging as a vital element in the wider transition toward sustainable and smart mobility options in Mexico, improving the appeal of EVs and aiding in the overall Mexico driver assistance systems market growth.

Mexico Driver Assistance Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, technology, and vehicle type.

Type Insights:

- Blind Spot Detection

- Adaptive Cruise Control

- Lane Departure Warning System

- Night Vision

- Adaptive Front Lighting

- Intelligent Parking Assist System

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes blind spot detection, adaptive cruise control, lane departure warning system, night vision, adaptive front lighting, intelligent parking assist system, and others.

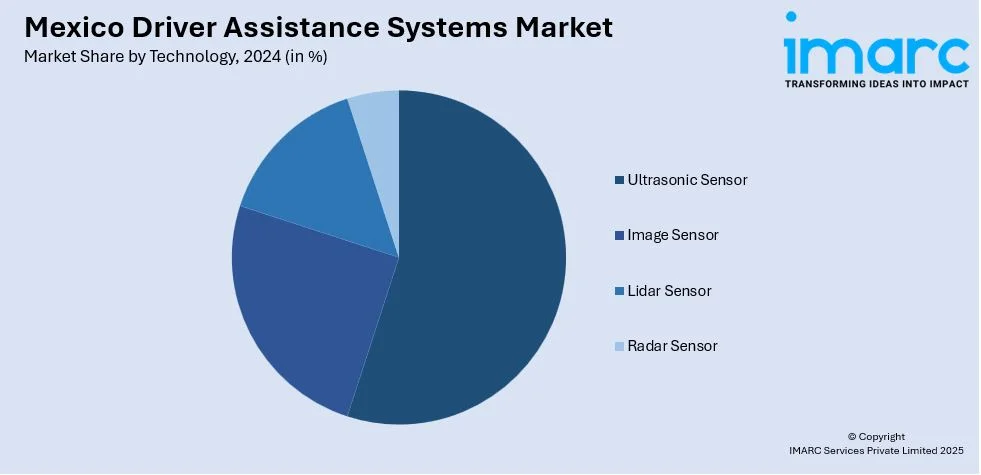

Technology Insights:

- Ultrasonic Sensor

- Image Sensor

- Lidar Sensor

- Radar Sensor

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes ultrasonic sensor, image sensor, Lidar sensor, and radar sensor.

Vehicle Type Insights:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars, light commercial vehicles, and heavy commercial vehicles.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Driver Assistance Systems Market News:

- In February 2025, Motive launched AI-powered Drowsiness Detection and Forward Collision Warning in Mexico to combat distracted and drowsy driving. The system uses dual-facing AI dashcams to issue real-time alerts and notify safety managers. These features aim to enhance fleet safety by preventing fatigue-related and rear-end collisions.

- In February 2025, Tesla launched its Full Self-Driving (FSD) v13.2.6 in Mexico, marking its first expansion outside the US and Canada. The system, designed for AI4 hardware, offers advanced driver-assistance features like autonomous lane changes, city street navigation, and traffic light recognition. Tesla chose Mexico over China and Europe likely due to simpler regulatory approval, allowing quicker deployment and real-world testing.

Mexico Driver Assistance Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blind Spot Detection, Adaptive Cruise Control, Lane Departure Warning System, Night Vision, Adaptive Front Lighting, Intelligent Parking Assist System, Others |

| Technologies Covered | Ultrasonic Sensor, Image Sensor, Lidar Sensor, Radar Sensor |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico driver assistance systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico driver assistance systems market on the basis of type?

- What is the breakup of the Mexico driver assistance systems market on the basis of technology?

- What is the breakup of the Mexico driver assistance systems market on the basis of vehicle type?

- What is the breakup of the Mexico driver assistance systems market on the basis of region?

- What are the various stages in the value chain of the Mexico driver assistance systems market?

- What are the key driving factors and challenges in the Mexico driver assistance systems market?

- What is the structure of the Mexico driver assistance systems market and who are the key players?

- What is the degree of competition in the Mexico driver assistance systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico driver assistance systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico driver assistance systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico driver assistance systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)