Mexico Dust Control Solutions Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2026-2034

Mexico Dust Control Solutions Market Summary:

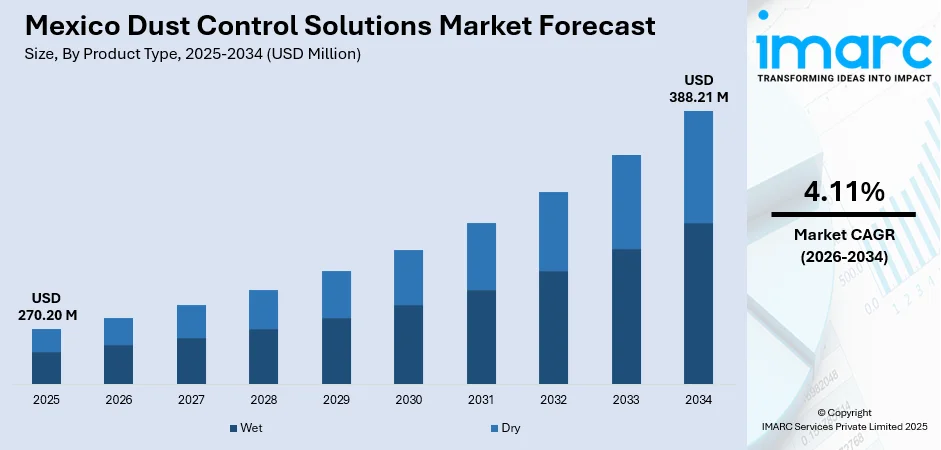

The Mexico dust control solutions market size was valued at USD 270.20 Million in 2025 and is projected to reach USD 388.21 Million by 2034, growing at a compound annual growth rate of 4.11% from 2026-2034.

The Mexico dust control solutions market is driven by rising industrial activity, stricter environmental regulations, and the growing attention to worker safety across sectors, such as mining, construction, and manufacturing. Companies are adopting advanced suppression and filtration systems to reduce airborne particulates, meet compliance requirements, and maintain operational efficiency. Increasing urban development and infrastructure expansion also drive the need for effective dust management, supporting steady demand for technologies that minimize emissions and protect surrounding communities.

Key Takeaways and Insights:

- By Product Type: Wet dominates the market with a share of 65% in 2025, driven by superior effectiveness in capturing fine particulates, versatility across industrial applications, and enhanced compliance capabilities with environmental regulations governing air quality standards.

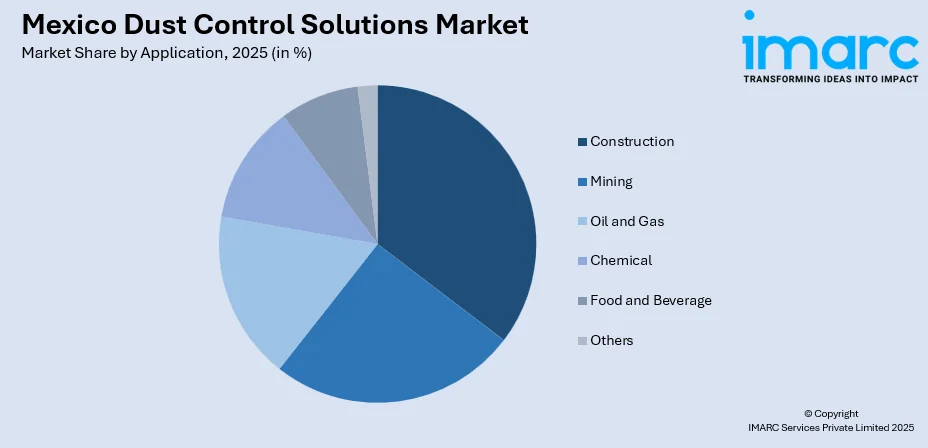

- By Application: Construction leads the market with a share of 30% in 2025, supported by substantial infrastructure investments, nearshoring-driven industrial park development, and increasing regulatory enforcement of dust emission controls on construction sites.

- Key Players: The Mexico dust control solutions market exhibits moderate competitive intensity, with multinational equipment manufacturers and chemical suppliers competing alongside regional distributors across product segments and industrial applications.

To get more information on this market Request Sample

The Mexico dust control solutions market is driven by rising industrial activity, expanding construction operations, and stricter environmental regulations aimed at reducing particulate emissions. The growing awareness about workplace safety and occupational health standards is encouraging companies to adopt effective dust suppression systems to protect workers and surrounding communities. Industries like mining, manufacturing, cement production, and logistics rely on solutions that limit airborne particles, improve air quality, and support regulatory compliance. The significant contribution of urban development and large-scale transportation projects to higher dust generation is directly addressed by Mexico's 2025 unveiling of a comprehensive National Infrastructure and Transport Plan, which includes an investment of MXN 126.6 billion in airport rehabilitation and measures to strengthen logistics. Such projects that generate high levels of dust, reinforcing the need for reliable mitigation technologies. Moreover, companies seek to reduce equipment wear, enhance operational efficiency, and prevent environmental fines by implementing advanced containment and treatment methods.

Mexico Dust Control Solutions Market Trends:

Expansion of Construction and Infrastructure Development

Mexico’s expanding construction and development activities produce substantial dust from excavation, demolition, and large-scale earthworks, increasing the need for dependable suppression systems to maintain safety and minimize complaints. This requirement grows as new projects accelerate nationwide, including housing initiatives such as the Housing for Well-Being program, which planned 6,401 homes for delivery in 2025. With 4,871 units across 58 developments announced under INFONAVIT. This rising construction volume is catalyzing the demand for dust control technologies that support clearer visibility, safer worksites, and smoother project execution across varied development environments.

Growth of Logistics, Warehousing, and Bulk Material Handling

The rise of warehousing, freight routes, and distribution hubs is increasing dust generation from loading, unloading, and bulk material handling, encouraging logistics operators to adopt reliable suppression systems that support safe and efficient operations. This need is reinforced by expanding facilities such as the 40,000 m² JD Logistics warehouse launched in Mexico City in 2025, designed to support rapid fulfillment. As truck movement and storage activity intensify within expanding supply chain networks, demand rises for dust control technologies that protect goods, reduce disruptions, and maintain orderly material handling across high-traffic logistics environments.

Increasing Demand in Mining

Mining activities produce substantial dust during drilling, blasting, hauling, and material processing, creating risks for worker health, visibility, equipment performance, and surrounding land quality. Effective suppression systems are essential for maintaining safer operations, reducing delays, and supporting compliance. This need grows as new developments progress nationwide, including several projects scheduled for launch in 2024 from companies such as Torex Gold, Minera Alamos, and Endeavor Silver. With expanding extraction and processing activity, mines increasingly depend on dust control technologies to protect machinery, stabilize working conditions, ensure accurate sensor performance, and maintain stronger relations with nearby communities.

Market Outlook 2026-2034:

The Mexico dust control solutions market shows growth prospects, supported by continued industrial development and stricter regulations related to air quality and workplace safety. Rising activity in mining, construction, and manufacturing is leading to the adoption of technologies that reduce particulate emissions and improve operational compliance. The market generated a revenue of USD 270.20 Million in 2025 and is projected to reach a revenue of USD 388.21 Million by 2034, growing at a compound annual growth rate of 4.11% from 2026-2034.

Mexico Dust Control Solutions Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Wet | 65% |

| Application | Construction | 30% |

Product Type Insights:

- Wet

- Wet Scrubbers

- Wet Electrostatic Precipitators (WEPS)

- Dry

- Bag Dust Collectors

- Cyclone Dust Collectors

- Electrostatic Dust Collectors

- Vacuum Dust Collectors

- Others

Wet dominates with a market share of 65% of the total Mexico dust control solutions market in 2025.

Wet [wet scrubbers and wet electrostatic precipitators (WEPS)] leads the market owing to its ability to effectively suppress airborne particles in high-dust environments, particularly in mining and construction. Its capacity to reduce emissions at the source makes it a preferred choice for operations facing stricter compliance requirements.

Its popularity is also supported by ease of application, lower equipment complexity, and strong performance across large material-handling sites. Wet segment helps to maintain safer working conditions, reduce visibility hazards, and support continuous operations, reinforcing their widespread use across industrial settings.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Construction

- Mining

- Oil and Gas

- Chemical

- Food and Beverage

- Others

Construction leads with a market share of 30% of the total Mexico dust control solutions market in 2025.

Construction dominates the market due to large-scale urban development, infrastructure projects, and roadwork activities generate significant particulate emissions. For instance, in 2025, Mexico unveiled a USD16 billion plan to modernize six key ports, including Ensenada, Manzanillo, and Veracruz, to enhance the country's maritime competitiveness, infrastructure, and logistics capacity. These sites require continuous dust suppression to maintain safety, minimize air pollution, and comply with regulatory standards, driving strong demand for reliable control systems.

Its leading position is further supported by frequent material handling, excavation, and demolition activities that elevate dust levels. Construction firms increasingly rely on suppression technologies to protect workers, reduce community impact, and maintain project continuity, reinforcing the sector’s central role in overall market demand.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico generates strong demand for dust control solutions due to extensive mining activity, large material-handling operations, and frequent construction projects. High particulate levels across extraction sites and logistics corridors drive the need for reliable suppression technologies.

Central Mexico market is shaped by major construction works, expanding industrial zones, and active transportation corridors. Frequent earthmoving, infrastructure development, and bulk-material movement require effective dust management to maintain safety and meet environmental expectations.

Southern Mexico sees rising adoption of dust control systems as resource development, road construction, and agricultural operations expand. Increased particulate generation across project sites necessitates dependable suppression methods to protect workers and surrounding communities.

Others contribute to market demand through localized construction, quarrying, and logistics activities. Smaller industrial clusters and developing infrastructure still require adaptable dust control solutions to maintain operational efficiency and reduce airborne emissions.

Market Dynamics:

Growth Drivers:

Why is the Mexico Dust Control Solutions Market Growing?

Rising Demand in Power Generation

Power generation facilities that handle coal, biomass, and other solid fuels produce dust during unloading, crushing, conveying, and storage, creating risks such as equipment clogging, fire hazards, and respiratory exposure for workers. Effective suppression systems, extraction units, and protective enclosures are essential for maintaining cleaner operating zones around boilers, fuel yards, and conveyor lines. The need for reliable dust control is intensifying as national capacity expands. For instance, Mexico’s 2025–2030 National Electric System plan aims to add nearly 23 GW across 51 new projects. As activity increases, plants depend on dust management to ensure stable combustion, reduce contamination, and maintain predictable maintenance cycles.

Rising Importance of Dust Control in Textile Sector

Textile mills release substantial dust and fibers during spinning, carding, weaving, and finishing, which can accumulate on machinery, impair air quality, and increase the likelihood of equipment malfunctions. To maintain safe and efficient operations, facilities use extraction fans, filtration systems, and targeted suction points to control airborne fibers. The need for effective suppression is becoming more pronounced as the sector grows. Mexico announced over $5 billion in planned textile investments for 2025, following a 2024 GDP contribution of 488 billion pesos reported by INEGI. Improved dust control enhances product quality, reduces defects, and supports stable performance of high-speed equipment.

Growing Dust Control Needs in Metals Processing Facilities

Metals processing involves cutting, grinding, smelting, and casting, all of which generate fine airborne particles that compromise air quality, reduce equipment accuracy, and pose health risks for workers. To address these challenges, facilities rely on filtration units, extraction systems, and localized suppression methods that capture dust at the source. The relevance of such controls continues to grow alongside the sector’s expansion, the Mexico metal casting market reached USD 2.1 Billion in 2024, reflecting heightened activity. Effective dust management supports cleaner operations, protects machinery, prevents heat-system buildup, and ensures more consistent production outcomes in demanding manufacturing environments.

Market Restraints:

What Challenges the Mexico Dust Control Solutions Market is Facing?

High Cost of Advanced Suppression Technologies

Many operators face difficulty adopting modern dust control systems due to high upfront equipment costs, installation expenses, and continuous maintenance requirements. Budget limitations often delay upgrades, especially for small and mid-sized firms. Price sensitivity reduces the pace at which newer technologies are introduced, restricting broader adoption. This financial burden limits access to efficient solutions and slows overall market growth, despite rising concerns related to air quality and workplace conditions.

Limited Technical Awareness Among Small Operators

Smaller firms often lack adequate knowledge about effective dust management practices, leading to reliance on outdated methods that offer limited efficiency. Insufficient understanding of system capabilities, performance metrics, and proper application weakens the impact of control efforts. This gap in awareness slows modernization and reduces demand for advanced solutions. Without broader training and clearer operational guidance, many users struggle to select suitable systems that match their site conditions.

Operational Challenges in Harsh Work Environments

Frequent outdoor activities, heavy machinery use, and continuous material movement create conditions where dust control systems must withstand demanding environments. Equipment often faces accelerated wear, performance decline, and higher upkeep requirements. Maintaining efficiency under these conditions becomes challenging, particularly when operations run long hours. This increases operational complexity and reduces the lifespan of systems, making reliable dust suppression difficult to sustain without frequent servicing and technical support.

Competitive Landscape:

The Mexico dust control solutions market exhibits moderate competitive intensity characterized by the presence of multinational equipment manufacturers alongside regional distributors and service providers competing across product segments and industrial applications. Market dynamics reflect strategic positioning ranging from premium, technology-driven offerings emphasizing IoT-enabled monitoring and advanced filtration to value-oriented products targeting cost-conscious operators. The competitive landscape is increasingly shaped by digitalization initiatives, water efficiency innovations, and service capabilities that extend beyond equipment sales to comprehensive dust management programs. Strategic partnerships with industrial park developers and mining operators are enabling leading providers to establish recurring revenue streams while expanding market presence across Mexico's growing industrial base.

Mexico Dust Control Solutions Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Construction, Mining, Oil and Gas, Chemical, Food and Beverage, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico dust control solutions market size was valued at USD 270.20 Million in 2025.

The Mexico dust control solutions market is expected to grow at a compound annual growth rate of 4.11% from 2026-2034 to reach USD 388.21 Million by 2034.

Wet dominates the market with 65% revenue share in 2025, driven by superior particulate capture effectiveness, versatility across industrial applications, and enhanced environmental compliance capabilities.

Key factors driving the Mexico dust control solutions market include rising construction activity, with 6,401 homes planned for 2025 under the Housing for Well-Being program and 4,871 units across 58 INFONAVIT developments, driving the need for reliable suppression systems to ensure safer, clearer worksites.

Major challenges include high costs, limited technical awareness, and demanding work environments. Expense-related barriers delay upgrades, knowledge gaps reduce system effectiveness, and harsh operating conditions increase wear, making consistent performance difficult without frequent maintenance and specialized support.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)