Mexico E-Bike Battery Market Size, Share, Trends and Forecast by Battery Type, Battery Pack Position Type, and Region, 2026-2034

Mexico E-Bike Battery Market Size and Share:

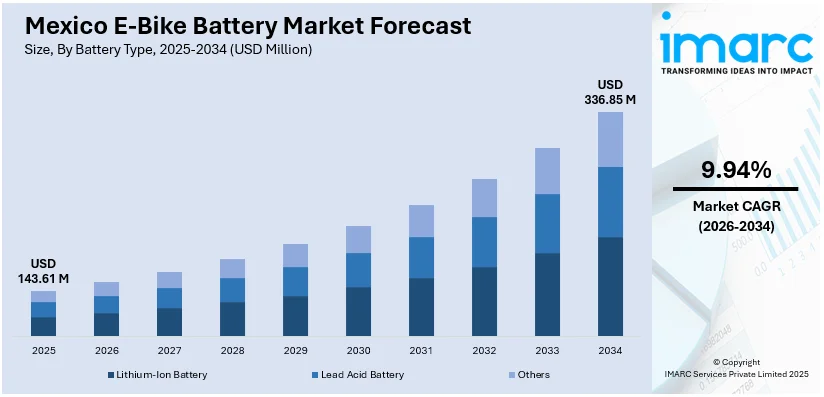

The Mexico E-bike battery market size was valued at USD 143.61 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 336.85 Million by 2034, exhibiting a CAGR of 9.94% from 2026-2034. The market is driven by rapid urbanization, environmental awareness, and government initiatives through support policies for sustainable transportation. The market involves various types of batteries and configurations that are aimed at different consumer demands for different categories of e-bikes. Moreover, increasing infrastructure and easy access to solutions for electric mobility have transformed the way people travel within cities. The lithium-ion segment accounts for the largest share due to its superior performance characteristics. The strategic positioning preference reflects various aspects of rider ergonomics and vehicle design issues that together affect market Mexico e-bike battery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 143.61 Million |

| Market Forecast in 2034 | USD 336.85 Million |

| Market Growth Rate 2026-2034 | 9.94% |

Access the full market insights report Request Sample

Rapid urbanization, combined with visibly deteriorating air quality in major metropolitan areas, accelerates the shift toward electric mobility solutions. Compact electric bicycles are a popular alternative to conventional vehicles due to the increasing traffic congestion and lack of parking available in densely populated cities. The municipal authorities continue to invest heavily in the infrastructure of cycling lanes and charging stations, thereby improving the prospects of electric two-wheelers as daily commuters. Consumers are increasingly considering affordable means of transportation that come with minimal operational costs, given rising motor fuel prices and ownership expenses. Moreover, the younger population is showing a strong trend toward eco-friendly lifestyle preferences, preferring electric bicycles as a practical tool for minimizing carbon footprints while sustaining the independence that comes with mobility. The demographic shift coupled with superior battery technology that delivers longer range and reduced charging times is essentially altering urban transportation patterns and driving continuous demand for advanced systems.

To get more information on this market Request Sample

Government policies, aimed at cutting down greenhouse gas emissions and the adoption of clean energy, are creating favorable conditions for electric mobility expansion. Incentive schemes for purchases of electric vehicles, in the form of subsidies or tax benefits, reduce entry barriers for consumers who would like to try an electric bicycle. Favorable regulatory frameworks that encourage the establishment of sustainable transportation infrastructure are facilitating market penetration across urban and suburban regions. International automotive players and technology companies are establishing local operations in the country, bringing along advanced battery manufacturing capabilities and efficient supply chains into the domestic market. In July 2025, HPQ Silicon Inc. launched HPQ Endura, its first commercial lithium-ion battery brand using GEN3 silicon-anode technology, targeting high-performance applications across Canada, the U.S., and Mexico. Moreover, this industrial development contributes to creating jobs while reducing imports of critical components. Furthermore, a rising awareness of health and fitness benefits related to cycling, linked with electric drives that make longer distances achievable, also extends the addressable market beyond traditional cycling enthusiasts to include commuters, delivery services, and recreational users who seek versatile transportation that balances physical activity with convenience.

Mexico E-Bike Battery Market Trends:

Smart Battery Management Systems Integration

Advanced technologies in battery management, including real-time monitoring, predictive maintenance, and connectivity, are becoming commonplace in modern electric bicycle applications. These intelligent systems optimize charging cycles, balance cell performance, and update users about detailed insights into battery health, remaining range, and usage patterns via mobile apps. The use of IoT capabilities can be further extended to diagnostics, firmware updates, and anti-theft features that contribute to improving the overall user experience and extending product life. Manufacturers are developing sophisticated algorithms that adapt power delivery based on terrain, rider input, and environmental conditions, maximizing efficiency and extending operational range. Cloud-connected platforms allow fleet operators to monitor multiple vehicles simultaneously, thus optimizing logistics and maintenance schedules. With consumer expectations shifting toward connected mobility experiences, the trends in Mexico's e-bike battery market are increasingly oriented toward seamless integration between hardware and software components, thus creating differentiated value propositions beyond basic energy storage functionality.

Modular and Swappable Battery Architectures

Among these, flexible battery configurations for quick replacement and capacity customization have gained favor as consumers look for ease of use and operational flexibility. Standardization of the battery-pack interface and modular design let users carry extra packs for extended trips or simply swap out depleted batteries at special stations, without having to spend hours recharging. This is especially applicable in commercial applications, such as food delivery and courier services, where vehicle utilization directly translates into revenue generation. Service providers also establish a battery-as-a-service model in which users pay subscription fees to access fully charged batteries, rather than owning individual packs, which considerably reduces the upfront cost of entry and eliminates fears over degradation and replacement costs in the future. Interoperability across different vehicle models and manufacturers drives industry-wide standardization efforts, which could give way to network effects that accelerate adoption further. Such modular architecture designs make recycling and component recovery at the end of life much easier, which addresses circular economy and environmental sustainability goals.

Development of Lightweight High-Capacity Cells

Continuous improvements in cell chemistry and in manufacturing processes result in batteries with higher energy density while maintaining or reducing overall weight. Advanced electrode materials, better electrolyte formulas, and improved production methods all combine to allow manufacturers to pack more energy into smaller, lighter packages-which directly enhances the performance and handling characteristics of the vehicle. This reduction in weight is much more critical for electric bicycles than for cars because extra mass affects acceleration and climbing ability as well as overall riding dynamics. Newer silicon-based anode and high-nickel cathode cell architectures are now entering commercial production, providing substantial capacity increases over traditional designs. These advances are basically enabling longer riding ranges without proportionate increases in the size or weight of the battery, or of the vehicle, and address one of the major concerns consumers have towards adopting electric mobility. In parallel, improvements in thermal management and safety mechanisms enable reliable operation across a wide variety of environmental conditions, which further builds consumer confidence and opens up more use cases.

Mexico E-Bike Battery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Mexico E-bike battery market, along with forecast at the regional, and country levels from 2026-2034. The market has been categorized based on battery type and battery pack position type.

Analysis by Battery Type:

- Lithium-Ion Battery

- Lead Acid Battery

- Others

Lithium-ion technology commands the dominant position in the Mexico E-bike battery market growth, with 85% share, due to superior energy density, extended cycle life, and declining cost structures. They give consistent power output, regardless of the discharge rates, and hence keep the performance of the vehicles relatively constant during the charge depletion cycle, translating into predictable riding experiences for users. The maturity of the technology has had the effect of robust supply chains, standardized manufacturing processes, and wide dispersion of technical know-how among service providers, reducing the complexity and cost of ownership. Lithium-ion cells have favorable weight-to-capacity ratios compared to alternative chemistries, critical in applications where vehicle mass directly impacts efficiency and handling. Further, lithium-ion batteries support fast charging protocol capabilities that allow for the rapid replenishment of energy, aligning with modern consumer demands for convenience. The established recycling infrastructure and improving second-life applications for degraded packs further enhance the environmental profile, addressing sustainability concerns and creating extra value streams beyond primary use.

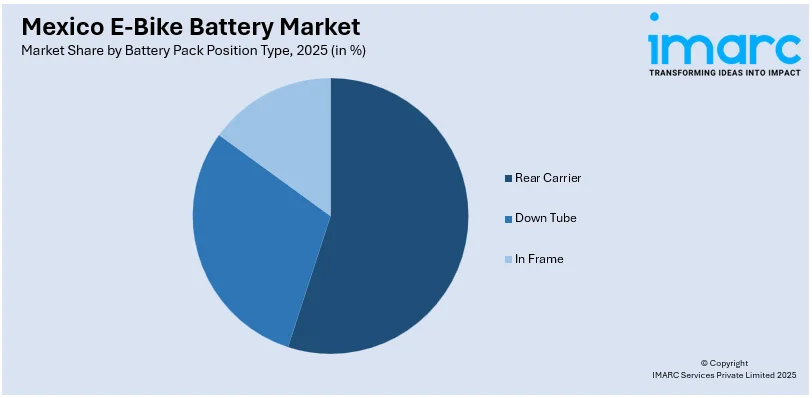

Analysis by Battery Pack Position Type:

To get detailed segment analysis of this market Request Sample

- Rear Carrier

- Down Tube

- In Frame

Down tube mounting configuration reflects the preferred installation location, with 65% of market share adoption due to optimal weight distribution, aesthetic integration, and accessibility concerns. This places the CG of the battery low and centered within the frame geometry, which enhances stability and handling characteristics during cornering and acceleration. The down tube mounting position shields the battery pack from road debris, water spray, and impact damage while it remains easily accessible for removal and charging without requiring unique tools or awkward positioning. Battery casings may also be seamlessly integrated by frame manufacturers into tube structures, preserving the bike's profile and maintaining aerodynamic efficiency. This mounting position also allows larger capacity packs compared to other mounting locations, a factor that directly extends operational range without compromising structural integrity or rider ergonomics. Standardization around this mounting position has developed economies of scale within frame design and battery housing production, reducing production costs and simplifying compatibility within aftermarkets across different vehicle models and price segments.

Regional Analysis:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The Northern Mexico e-bike battery market outlook is driven by growing urbanization, rising disposable income, and increasing adoption of electric mobility solutions; key industrial hubs and improved charging infrastructure are accelerating demand, while government incentives and rising environmental awareness further support the region’s expansion in e-bike battery applications.

The Central Mexico e-bike battery market is witnessing growth due to high population density, increasing e-commerce delivery fleets, and rising consumer interest in sustainable transportation; expansion of retail networks, government subsidies, and investments in battery technology are contributing to enhanced adoption and market penetration in urban and suburban areas.

The Southern Mexico e-bike battery market is developing steadily, supported by tourism, local commuting needs, and small-scale logistics operations; rising interest in eco-friendly transport and regional infrastructure projects, along with targeted promotional activities by manufacturers, are helping to increase adoption of e-bike battery solutions.

The other regions of Mexico e-bike battery market encompass rural and emerging markets where adoption is gradually increasing; factors such as improving road networks, renewable energy initiatives, and local government support are driving awareness and adoption, offering opportunities for manufacturers to expand their market footprint beyond primary urban centers.

Competitive Landscape:

The competitive environment comprises a diverse set of participants, from specialized battery manufacturers to integrated e-bike producers developing proprietary power solutions. Market dynamics are continuous, with heavy investments by competitors in research and development to achieve differentiation by way of performance improvement, charging speed enhancement, and longevity extension. Strategic partnerships between cell manufacturers and vehicle assemblers are increasingly common, creating vertically integrated supply chains that enhance quality control and cost efficiency. Entry barriers remain high on account of the capital needs for manufacturing facilities, demands of technical expertise, and regulatory compliance obligations. Nevertheless, this growing market is attracting fresh entrants that leverage recent advances in adjacent industries, particularly the consumer electronics and automotive sectors. Price competition is increasing due to rising scale economies and maturing manufacturing processes; however, upscale segments continue to remunerate innovation and proven reliability. There is likely to be industry consolidation, with successful players expanding capacity and smaller participants seeking partnerships or exits that will shape the trajectory of the Mexico e-bike battery market forecast.

The report provides a comprehensive analysis of the competitive landscape in the Mexico E-bike battery market with detailed profiles of all major companies.

Latest News and Developments:

- September 2024: Yadea launched its premium intelligent electric motorcycle Kemper in Mexico at the SIMM Exhibition, showcasing advanced features including CATL battery technology with 80% charge in 10 minutes, high acceleration, and smart connectivity. The launch strengthens Yadea’s presence and promotes sustainable, high-performance electric mobility in Mexico.

- August 2025: Fly-E Group, Inc. opened its first retail store in Mexico City and entered a strategic partnership with local e-bike brand TECHNOLOGIES E-SOLOMO. The collaboration aims to accelerate market penetration, provide advanced electric mobility solutions, and establish after-sales services, marking a significant milestone in Fly-E’s South American expansion.

Mexico E-Bike Battery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Battery Types Covered | Lithium-Ion Battery, Lead Acid Battery, Others |

| Battery Pack Position Types Covered | Rear Carrier, Down Tube, In Frame |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico e-bike battery market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico e-bike battery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico e-bike battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The E-bike market in Mexico was valued at USD 143.61 Million in 2025.

The E-bike battery market in Mexico is projected to exhibit a CAGR of 9.94% during 2026-2034, reaching a value of USD 336.85 Million by 2034.

The main drivers are fast urbanization with a need for efficient transportation, government incentives in favor of electric mobility, lower costs of batteries for affordability, and environmental awareness among consumers. It becomes economically viable with infrastructure development to support cycling and charging, increasing fuel prices, extended range due to technological developments, and reduced charging time that has overcome traditional barriers to adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)