Mexico E-Cigarette Market Size, Share, Trends and Forecast by Product, Flavor, Mode of Operation, Distribution Channel, and Region, 2025-2033

Mexico E-Cigarette Market Overview:

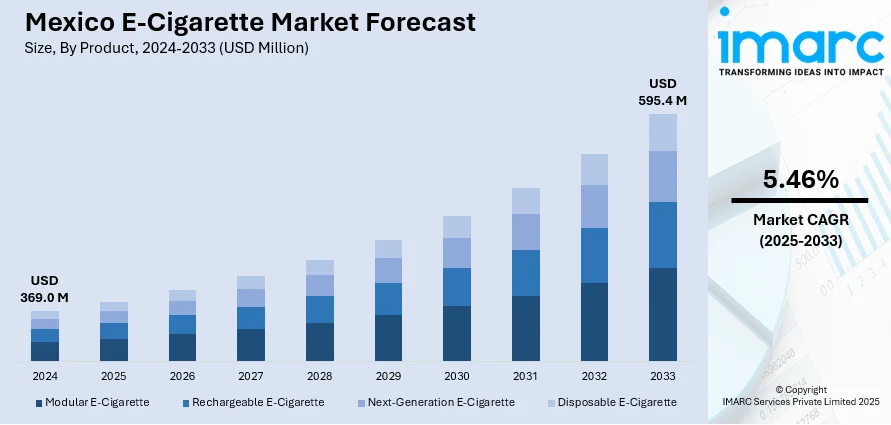

The Mexico e-cigarette market size reached USD 369.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 595.4 Million by 2033, exhibiting a growth rate (CAGR) of 5.46% during 2025-2033. The market is driven by rising health awareness, shifting preferences from traditional smoking, and increasing youth adoption. Moreover, regulatory support, product innovations, online retail expansion, and aggressive marketing by global brands further boost the Mexico e-cigarette market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 369.0 Million |

| Market Forecast in 2033 | USD 595.4 Million |

| Market Growth Rate 2025-2033 | 5.46% |

Mexico E-Cigarette Market Trends:

Rising Health Awareness and Shift from Traditional Smoking

The e-cigarette market in Mexico continues to grow as more people become aware of how traditional smoking harms their health. More people recognizing the importance of their health status now actively search for substitute products to traditional tobacco products. The negative perception of e-cigarettes arose from their missing tar content along with their diminished toxic chemical presence, leading to widespread market acceptance. Multiple smokers employ e-cigarettes either to lessen their tobacco consumption or eliminate it. This growing demand for harm-reduction alternatives is expected to fuel the Mexico e-cigarette market share.

Youth Adoption and Changing Consumer Preferences

Young adults, together with teenagers, have significantly contributed to market expansion through their increasing interest in e-cigarettes. The combination of fashionable designs with tasty flavors and social media engagement made electronic cigarettes appeal to consumers as a stylish choice. Young consumers choose electronic cigarettes instead of conventional smoking because they view vaping as trendy, and they can personalize their vaping experience. The market success for young customers has been fueled by flavored nicotine products that include fruity along with menthol and dessert tastes. Consequently, the growing adoption among younger consumers continues to drive demand for e-cigarettes in the country, which is expected to create a positive impact on the Mexico e-cigarette market outlook.

Technological Advancements and Product Innovations

Continuous innovation in e-cigarette technology has enhanced user experience, driving market growth in Mexico. The development of advanced vaping devices with improved battery life, temperature control, and customizable nicotine levels has increased their appeal. Additionally, manufacturers are investing in new flavors and nicotine salt formulations to cater to different consumer preferences. The emergence of disposable and pod-based e-cigarettes has also made vaping more accessible and convenient. These advancements, coupled with aggressive marketing strategies by global and local brands, have strengthened the e-cigarette market, attracting both new users and existing smokers looking for innovative alternatives.

Mexico E-Cigarette Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product, flavor, mode of operation, and distribution channel.

Product Insights:

- Modular E-Cigarette

- Rechargeable E-Cigarette

- Next-Generation E-Cigarette

- Disposable E-Cigarette

The report has provided a detailed breakup and analysis of the market based on the product. This includes modular e-cigarette, rechargeable e-cigarette, next-generation e-cigarette, and disposable e-cigarette.

Flavor Insights:

- Tobacco

- Botanical

- Fruit

- Sweet

- Beverage

- Others

A detailed breakup and analysis of the market based on the flavor have also been provided in the report. This includes tobacco, botanical, fruit, sweet, beverage, and others.

Mode of Operation Insights:

- Automatic E-Cigarette

- Manual E-Cigarette

A detailed breakup and analysis of the market based on the mode of operation have also been provided in the report. This includes automatic e-cigarette and manual e-cigarette.

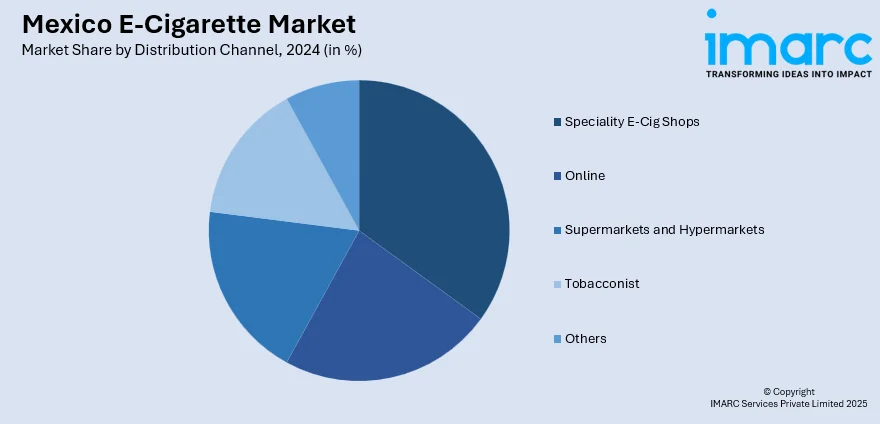

Distribution Channel Insights:

- Speciality E-Cig Shops

- Online

- Supermarkets and Hypermarkets

- Tobacconist

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes speciality e-cig shops, online, supermarkets and hypermarkets, tobacconist, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico E-Cigarette Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Modular E-Cigarette, Rechargeable E-Cigarette, Next-Generation E-Cigarette, Disposable E-Cigarette |

| Flavors Covered | Tobacco, Botanical, Fruit, Sweet, Beverage, Others |

| Mode of Operations Covered | Automatic E-Cigarette, Manual E-Cigarette |

| Distribution Channels Covered | Speciality E-Cig Shops, Online, Supermarkets and Hypermarkets, Tobacconist, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico e-cigarette market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico e-cigarette market on the basis of product?

- What is the breakup of the Mexico e-cigarette market on the basis of flavor?

- What is the breakup of the Mexico e-cigarette market on the basis of mode of operation?

- What is the breakup of the Mexico e-cigarette market on the basis of distribution channel?

- What is the breakup of the Mexico e-cigarette market on the basis of region?

- What are the various stages in the value chain of the Mexico e-cigarette market?

- What are the key driving factors and challenges in the Mexico e-cigarette market?

- What is the structure of the Mexico e-cigarette market and who are the key players?

- What is the degree of competition in the Mexico e-cigarette market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico e-cigarette market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico e-cigarette market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico e-cigarette industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)