Mexico E-Wallet Market Size, Share, Trends and Forecast by Type, Ownership, Technology, Vertical, and Region, 2025-2033

Mexico E-Wallet Market Overview:

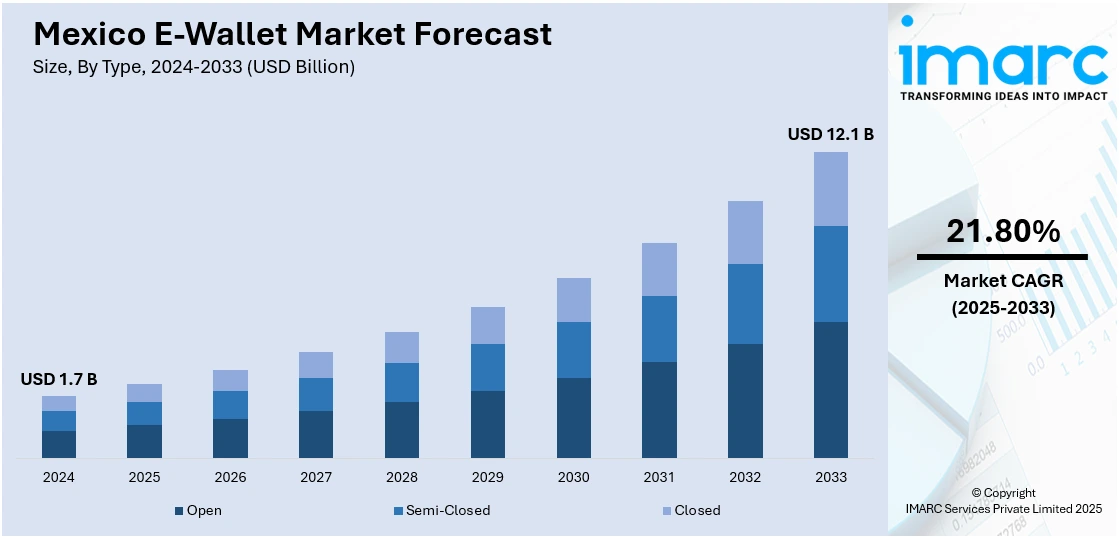

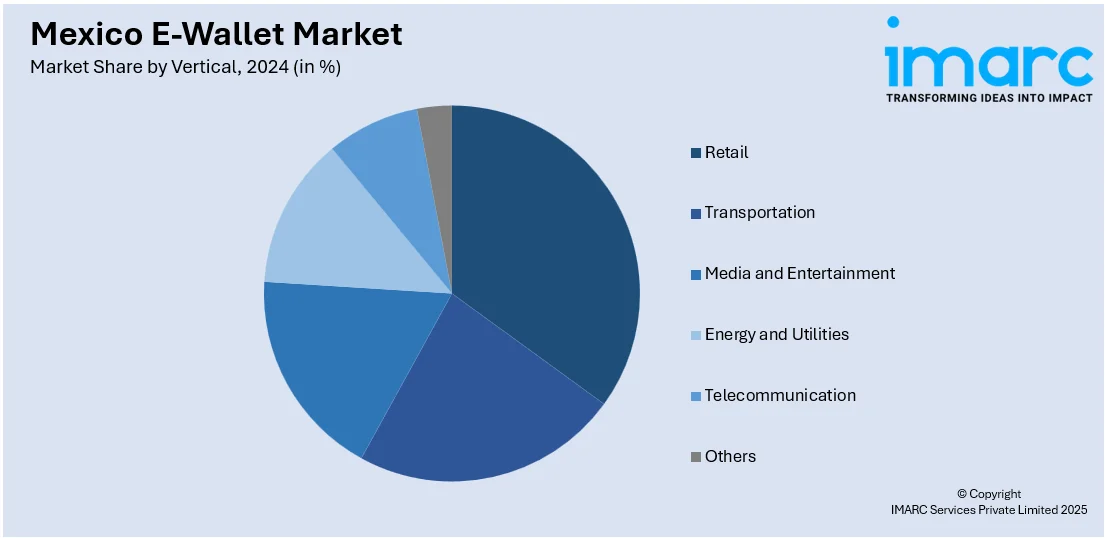

The Mexico e-wallet market size reached USD 1.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 12.1 Billion by 2033, exhibiting a growth rate (CAGR) of 21.80% during 2025-2033. The market is witnessing significant growth driven by increasing adoption across various sectors such as retail, transportation, and telecommunications. Moreover, digital payment growth, integration with new technologies, and the expansion of e-wallet services across multiple regions and ownership types, are also contributing positively to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.7 Billion |

| Market Forecast in 2033 | USD 12.1 Billion |

| Market Growth Rate 2025-2033 | 21.80% |

Mexico E-Wallet Market Trends:

Growth in E-commerce and Online Shopping

The rise of e-commerce in Mexico has significantly accelerated the adoption of e-wallets for online purchases making digital wallets essential for consumers. The growing preference for online shopping is driving the Mexico e-wallet market growth as more consumers seek convenient, fast, and secure payment options. According to industry reports, e-commerce in Mexico grew to 15% of retail sales totaling $74 billion in 2023 and projected to reach $100 billion in 2024 and $176.8 billion by 2026. E-wallets enable customers to store multiple payment methods in one place making checkout convenient and faster which is particularly appealing for busy online shoppers. With increasing availability of mobile payments and expansion of e-commerce websites usage of e-wallets is turning out to be the most favored payment mode across various product categories. From apparels to electronics customers are increasingly using e-wallets for small and large purchases. As digital payments continue to rise and mobile shopping becomes more widespread, the Mexico e-wallet market outlook remains positive, with strong future growth anticipated.

Integration with Cryptocurrency and Blockchain Technologies

In Mexico, some e-wallets are integrating cryptocurrency wallets allowing users to store and transact with both digital currencies and traditional fiat money. This shift is driven by the increasing popularity of cryptocurrencies such as Bitcoin and stablecoins which offer benefits like faster transactions and lower fees compared to traditional banking systems. By incorporating digital currencies e-wallet providers are catering to a broader range of consumers including those who seek alternatives to traditional payment systems. For instance, in August 2024, CoinFlip officially expanded its services to Mexico marking its eighth international market. The US-based company offers cryptocurrency kiosks throughout Mexico City enabling secure buying and selling of digital currency. This expansion follows the successful launch in Canada and is aimed at meeting the growing demand for cryptocurrency in Latin America. This integration also facilitates access to decentralized finance (DeFi) services where users can engage in activities like lending and staking. As adoption grows, this feature is expected to attract both crypto enthusiasts and users in underbanked regions expanding the e-wallet user base. The ongoing development of cryptocurrency solutions within e-wallets is driving the Mexico e-wallet market share, positioning the country as a growing hub for digital finance.

Mexico E-Wallet Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, ownership, technology, and vertical.

Type Insights:

- Open

- Semi-Closed

- Closed

The report has provided a detailed breakup and analysis of the market based on the type. This includes open, semi-closed, and closed.

Ownership Insights:

- Banks

- Telecom Companies

- Device Manufacturers

- Tech Companies

A detailed breakup and analysis of the market based on the ownership have also been provided in the report. This includes banks, telecom companies, device manufacturers, and tech companies.

Technology Insights:

- Near Field Communication

- Optical/QR Code

- Digital Only

- Text-Based

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes near field communication, optical/QR code, digital only, and text-based.

Vertical Insights:

- Retail

- Transportation

- Media and Entertainment

- Energy and Utilities

- Telecommunication

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes retail, transportation, media and entertainment, energy and utilities, telecommunication, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico E-Wallet Market News:

- In October 2024, Kuady expanded its digital wallet services into Mexico, following successful launches in Peru, Chile, and Argentina. This initiative aims to enhance financial inclusion and streamline cross-border transactions. CEO Lorenzo Pellegrino emphasized the move as a milestone in creating an interconnected financial ecosystem across Latin America.

- In September 2024, Mexican fintech Clip, known for mobile POS terminals, raised $100 million to launch a digital wallet and upgrade POS systems for larger businesses.

Mexico E-Wallet Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Open, Semi-Closed, Closed |

| Ownerships Covered | Banks, Telecom Companies, Device Manufacturers, Tech Companies |

| Technologies Covered | Near Field Communication, Optical/QR Code, Digital Only, Text-Based |

| Verticals Covered | Retail, Transportation, Media and Entertainment, Energy and Utilities, Telecommunication, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico e-wallet market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico e-wallet market on the basis of type?

- What is the breakup of the Mexico e-wallet market on the basis of ownership?

- What is the breakup of the Mexico e-wallet market on the basis of technology?

- What is the breakup of the Mexico e-wallet market on the basis of vertical?

- What is the breakup of the Mexico e-wallet market on the basis of region?

- What are the various stages in the value chain of the Mexico e-wallet market?

- What are the key driving factors and challenges in the Mexico e-wallet market?

- What is the structure of the Mexico e-wallet market and who are the key players?

- What is the degree of competition in the Mexico e-wallet market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico e-wallet market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico e-wallet market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico e-wallet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)