Mexico Earthquake Resistant Building Materials Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Mexico Earthquake Resistant Building Materials Market Overview:

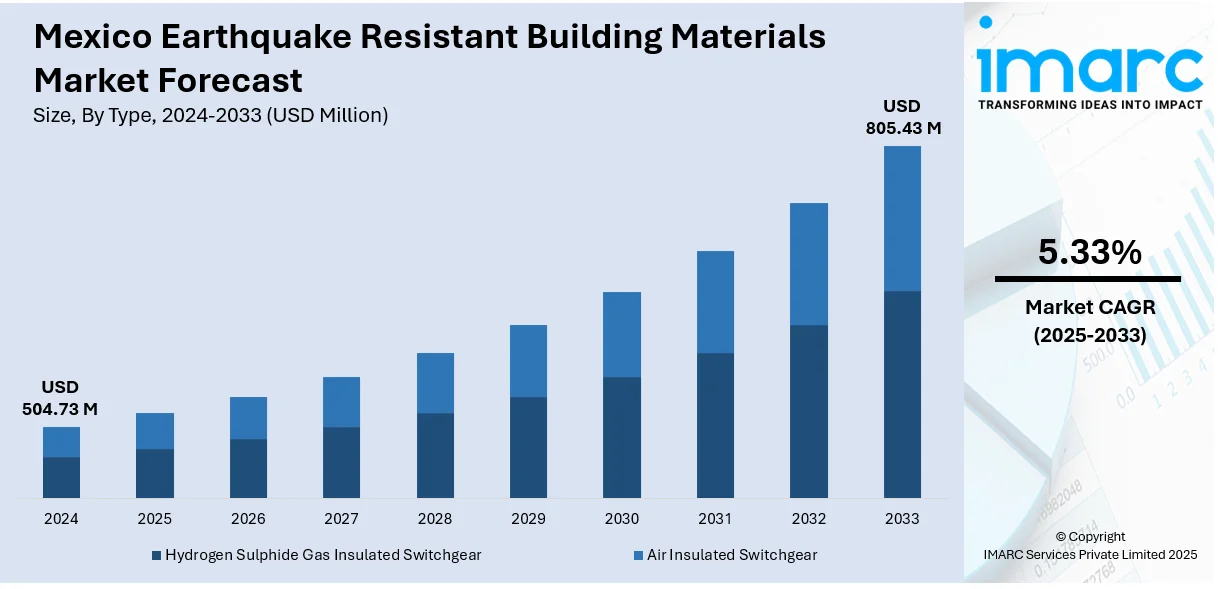

The Mexico earthquake resistant building materials market size reached USD 504.73 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 805.43 Million by 2033, exhibiting a growth rate (CAGR) of 5.33% during 2025-2033. At present, as people are becoming more informed about the dangers posed by seismic activity, there is a rising demand for building solutions that offer protection and resilience. Besides this, the broadening of urban centers, highways, hospitals, and schools is contributing to the expansion of the Mexico earthquake resistant building materials market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 504.73 Million |

| Market Forecast in 2033 | USD 805.43 Million |

| Market Growth Rate 2025-2033 | 5.33% |

Mexico Earthquake Resistant Building Materials Market Trends:

Rising awareness about seismic risks

Increasing awareness about seismic risks is positively influencing the market. The country is experiencing a high incidence of earthquakes due to its location along active tectonic plate boundaries, making earthquake preparedness a national priority. As per industry reports, in 2024, Mexico witnessed 1,971 earthquakes, with a magnitude over 4.0. As people are becoming more informed about the dangers posed by seismic activity, there is a growing demand for building solutions that enhance safety and resilience. Businesses and government authorities are willing to invest in materials like reinforced concrete, steel bracing systems, and shock-absorbing foundations that help minimize structural damage during earthquakes. Public education campaigns, media coverage, and disaster preparedness initiatives are further spreading awareness about the importance of using proper materials. Building regulations are also evolving to reflect this shift, requiring the utilization of certified earthquake-resistant materials in new projects. Insurance companies often offer better terms for structures built with such materials, encouraging wider adoption. Additionally, reconstruction efforts after past quakes highlight the long-term value of wagering on quality materials. This awareness is resulting in more responsible building practices across Mexico, steadily driving the demand in the market.

Growing infrastructure development

Rising infrastructure development is impelling the Mexico earthquake resistant building materials market growth. As the country is investing in residential, commercial, and public infrastructure projects, there is a rising need for construction materials that ensure structural safety and durability. Mexico’s frequent exposure to seismic activity makes earthquake resilience a key consideration in urban planning and development. Government agencies and private developers are prioritizing materials that can withstand tremors, such as reinforced concrete, flexible steel frameworks, and base isolation systems. These materials help reduce the risk of collapse and ensure long-term safety for occupants. The expansion of urban centers, highways, hospitals, and schools is further driving the demand for compliant and reliable building materials. Rising government investments in smart cities and transportation networks are also creating opportunities for using advanced seismic-resistant technologies. Contractors and builders are adopting these materials to meet building codes and enhance the safety of their projects. Moreover, consciousness among citizens and investors about earthquake risks is encouraging safer construction practices. As the construction industry is thriving in the country, the market is set to expand in Mexico. As per industry reports, the construction sector in Mexico was projected to grow by 4.1% in 2024.

Mexico Earthquake Resistant Building Materials Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Hydrogen Sulfide Gas Insulated Switchgear

- Air Insulated Switchgear

The report has provided a detailed breakup and analysis of the market based on the type. This includes hydrogen sulfide gas insulated switchgear and air insulated switchgear.

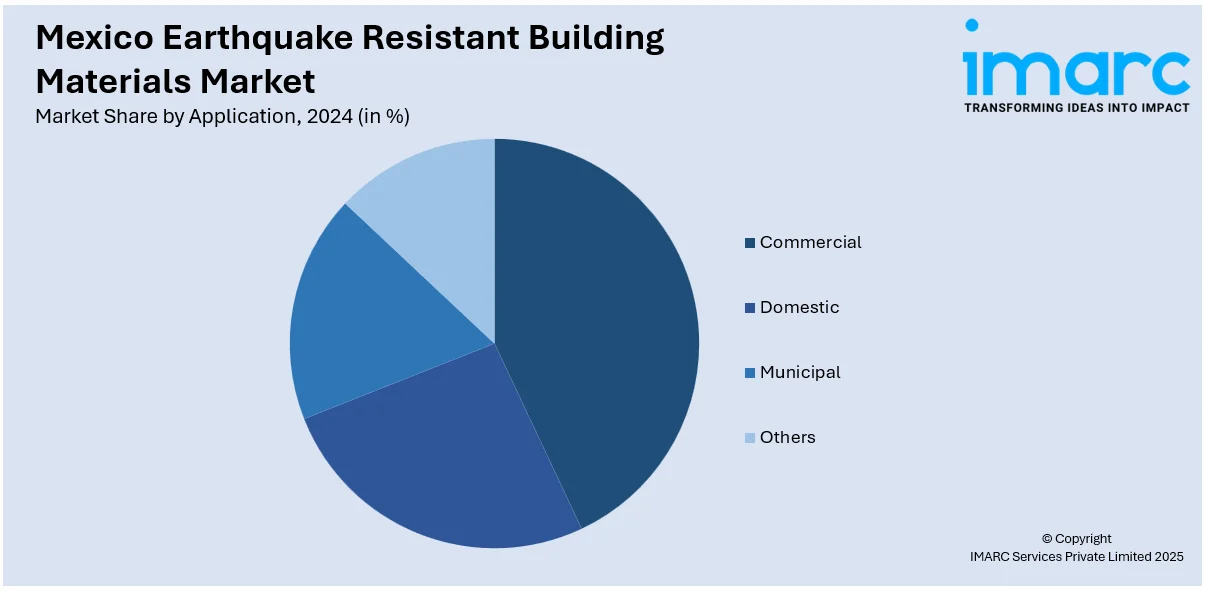

Application Insights:

- Commercial

- Domestic

- Municipal

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial, domestic, municipal, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Earthquake Resistant Building Materials Market News:

- In March 2024, an engineer in electrical and mechanical fields from Mexico, Ramón Martín Espinosa Solís, created a novel building material known as Eco Plastico Ambiental, which enabled the construction of homes that could withstand seismic activity from the earth. He developed an eco-friendly material derived from recycled plastics that was highly resistant to seismic activity because of its flexibility. It could serve to construct homes, classrooms, offices, and small lodges.

Mexico Earthquake Resistant Building Materials Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hydrogen Sulfide Gas Insulated Switchgear, Air Insulated Switchgear |

| Applications Covered | Commercial, Domestic, Municipal, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico earthquake resistant building materials market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico earthquake resistant building materials market on the basis of type?

- What is the breakup of the Mexico earthquake resistant building materials market on the basis of application?

- What is the breakup of the Mexico earthquake resistant building materials market on the basis of region?

- What are the various stages in the value chain of the Mexico earthquake resistant building materials market?

- What are the key driving factors and challenges in the Mexico earthquake resistant building materials market?

- What is the structure of the Mexico earthquake resistant building materials market and who are the key players?

- What is the degree of competition in the Mexico earthquake resistant building materials market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico earthquake resistant building materials market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico earthquake resistant building materials market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico earthquake resistant building materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)