Mexico Eco Friendly Cleaning Solutions Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, Form, and Region, 2026-2034

Mexico Eco Friendly Cleaning Solutions Market Summary:

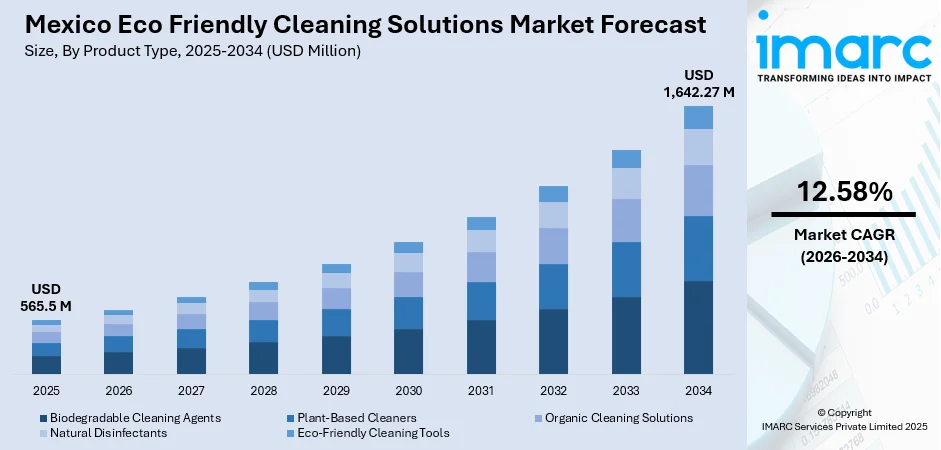

The Mexico eco friendly cleaning solutions market size was valued at USD 565.5 Million in 2025 and is projected to reach USD 1,642.27 Million by 2034, growing at a compound annual growth rate of 12.58% from 2026-2034.

Mexico's eco-friendly cleaning solutions market reflects growing environmental consciousness among people who increasingly prioritize sustainable alternatives that minimize ecological impact while maintaining effective cleaning performance. Urban households and commercial establishments actively seek biodegradable formulations that align with health awareness and responsible consumption patterns. Traditional retail channels maintain dominance while digital platforms emerge as convenient alternatives for environmentally conscious shoppers seeking transparency in product ingredients and sustainable packaging option, thereby expanding the Mexico eco friendly cleaning solutions market share.

Key Takeaways and Insights:

- By Product Type: Biodegradable cleaning agents dominate the market with a share of 28% in 2025, driven by consumer demand for formulations that break down naturally without leaving harmful residues.

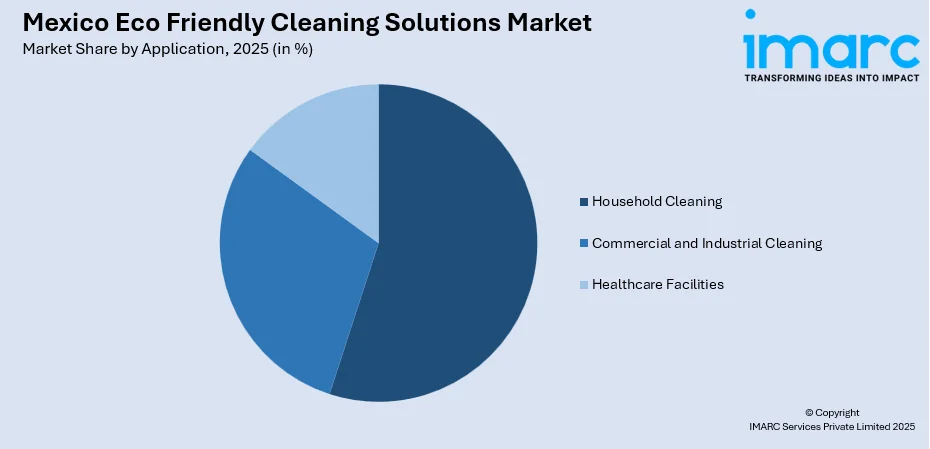

- By Application: Household cleaning leads the market with a share of 55% in 2025, driven by consumer demand for formulations that break down naturally without leaving harmful residues.

- By Distribution Channel: Offline represents the largest segment with a market share of 60% in 2025, owing to established trust relationships with traditional retailers including supermarkets, abarrotes stores, and pharmacies.

- By Form: Liquid cleaners lead the market with a share of 50% in 2025, owing to their versatility across multiple cleaning applications, ease of dilution for cost-effectiveness.

- Key Players: The Mexico eco friendly cleaning solutions market exhibits moderate competitive intensity with international personal care corporations and regional manufacturers competing across multiple price segments through product innovation and distribution expansion.

To get more information on this market Request Sample

The Mexico eco-friendly cleaning solutions market expands through environmental awareness initiatives that reshape consumer purchasing decisions toward sustainable alternatives. Urban population growth concentrates demand in metropolitan areas where concerns about indoor air quality and water pollution drive adoption of biodegradable formulations. Regulatory frameworks promoting environmental protection and sustainable manufacturing practices encourage producers to reformulate products with plant-based ingredients. Rising middle-class incomes enable households to prioritize quality and sustainability over price considerations alone. Between 2020 and 2024, household incomes grew consistently, leading to a notable decrease in income inequality, according to reports from Mexico’s National Institute of Statistics and Geography (INEGI).

Mexico Eco Friendly Cleaning Solutions Market Trends:

Concentrated Formulations Gaining Consumer Acceptance

People in Mexico increasingly embrace concentrated cleaning formulations that require smaller packaging and reduce transportation environmental impact. These products deliver equivalent cleaning power through higher active ingredient concentrations while minimizing plastic usage and storage space requirements. User education emphasizes proper dilution ratios and cost savings through extended product longevity. Moreover, the government is investing in urban developments, thereby changing the preferences of people. Urban households particularly value space-efficient storage in compact living environments prevalent across major metropolitan areas. Between 2020 and 2024, household incomes grew consistently, leading to a notable decrease in income inequality, according to reports from Mexico’s National Institute of Statistics and Geography (INEGI).

Refillable and Reusable Packaging Systems Emerging

Refillable packaging initiatives address plastic waste concerns while providing economic incentives for environmentally conscious users. Retail establishments introduce refill stations where customers replenish containers with concentrated solutions, reducing single-use plastic consumption. This approach resonates with traditional Mexican consumer practices of reusing containers and aligns with circular economy principles gaining traction across Latin American markets. Early adoption occurs primarily in environmentally progressive urban communities. These activities are further encouraging brands to manufacture a wide range of sustainable packaging solutions. In 2024, Nefab, an international frontrunner in eco-friendly packaging and logistics, announced that PolyFlex, a division of Nefab Group, is inaugurating its facility in León, Mexico, and enhancing its manufacturing capacities to boost internal production of heavy gauge thermoformed packaging. Nefab’s thermoformed products are fully recyclable, offering an eco-friendlier option compared to conventional packaging materials.

Multi-Purpose Cleaners Addressing Time Constraints

Busy urban lifestyles drive demand for eco-friendly multi-purpose cleaning solutions that eliminate the need for specialized products. Consumers seek formulations effective across various surfaces and applications without compromising environmental credentials. These versatile products simplify cleaning routines while reducing household chemical inventory. Market offerings increasingly combine natural disinfection properties with general cleaning capabilities to meet comprehensive household hygiene requirements through single sustainable product solutions. In 2024, Nouryon revealed a strategic distribution pact with Brenntag Specialties, a global leader in the distribution of chemicals and ingredients, for Nouryon’s cleaning products line in Mexico. This partnership allowed Nouryon to utilize Brenntag Specialties’ extensive regional network, broaden its market presence, and enhance customer accessibility nationwide.

Market Outlook 2026-2034:

The Mexico eco-friendly cleaning solutions market demonstrates robust expansion potential as environmental consciousness permeates mainstream consumer behavior across diverse demographic segments. The market generated a revenue of USD 565.5 Million in 2025 and is projected to reach a revenue of USD 1,642.27 Million by 2034, growing at a compound annual growth rate of 12.58% from 2026-2034.

Mexico Eco Friendly Cleaning Solutions Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Biodegradable Cleaning Agents | 28% |

| Application | Household Cleaning | 55% |

| Distribution Channel | Offline | 60% |

| Form | Liquid Cleaners | 50% |

Product Type Insights:

- Biodegradable Cleaning Agents

- Plant-Based Cleaners

- Organic Cleaning Solutions

- Natural Disinfectants

- Eco-Friendly Cleaning Tools

Biodegradable cleaning agents dominate with a market share of 28% of the total Mexico eco friendly cleaning solutions market in 2025.

Biodegradable cleaning agents lead market adoption through formulations incorporating rapidly degrading surfactants derived from renewable plant sources including coconut oil, corn, and palm that achieve complete biodegradation within prescribed timeframes established by international standards organizations. These products address consumer concerns about aquatic toxicity and wastewater contamination while delivering effective cleaning performance across multiple household surfaces without leaving harmful residues that affect food preparation areas or contact with children's toys.

Plant-based cleaners leverage botanical ingredients and essential oils to provide cleaning solutions free from petroleum-derived chemicals, synthetic fragrances, and artificial colorants that appeal to health-conscious consumers seeking transparent ingredient disclosure. Organic cleaning solutions emphasize certified organic ingredient sourcing that meets stringent purity standards while prohibiting synthetic pesticides, offering premium positioning for environmentally committed individuals willing to invest in verifiably sustainable products. Natural disinfectants utilize plant-derived antimicrobial compounds including thymol from thyme oil and citric acid that effectively eliminate household pathogens while avoiding harsh chemical disinfectants associated with respiratory irritation.

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Household Cleaning

- Commercial and Industrial Cleaning

- Healthcare Facilities

Household cleaning leads with a share of 55% of the total Mexico eco friendly cleaning solutions market in 2025.

Household cleaning applications drive majority market demand as residential consumers prioritize family health and safety by selecting non-toxic formulations that eliminate exposure risks from volatile organic compounds, chlorine bleach, and ammonia-based cleaners prevalent in traditional products. Mexican households increasingly recognize that conventional cleaning chemicals contribute to indoor air pollution and potential respiratory problems, particularly affecting children, elderly family members, and individuals with existing sensitivities or chronic conditions like asthma.

The segment benefits from extensive product variety spanning kitchen degreasers, bathroom disinfectants, floor cleaners, and multi-surface solutions that address comprehensive household maintenance requirements while maintaining competitive pricing relative to premium conventional alternatives through concentrated formulas that reduce packaging costs and extend product longevity per purchase unit. The total households in Mexico hit 36.7 million by 2025, as reported by the National Statistical Office. This is 1.05% higher than last year. This is further expected to increase the need for proper eco-friendly cleaners.

Distribution Channel Insights:

- Online

- Offline

Offline exhibits a clear dominance with a 60% share of the total Mexico eco friendly cleaning solutions market in 2025.

Offline distribution through supermarkets, hypermarkets, specialty stores, and traditional retail outlets maintains dominant market position reflecting Mexican consumer preferences for physical product evaluation before purchase, particularly when selecting new eco-friendly brands requiring trust establishment regarding cleaning performance and value proposition. Major retail chains including Walmart Mexico, Soriana, and Chedraui allocate expanding shelf space to sustainable cleaning product categories responding to consumer demand while leveraging their extensive nationwide store networks that provide convenient access across metropolitan areas, secondary cities, and provincial markets.

Although e-commerce is preferred by few people in Mexico owing to convenient payment and delivery choices, a large portion of consumers continues to favor conventional shopping practices. Zebra Technologies' recent research, “Connecting with the Modern Latin American Consumer,” states that 86% of Mexican shoppers still frequent brick-and-mortar stores for their purchases, while 55% opt for online shopping. The inclination towards in-person shopping in Mexico is largely influenced by product availability, mentioned by 17% of participants, discounts and promotions (12%), and the chance to engage with the product (12%).

Form Insights:

- Liquid Cleaners

- Powder Cleaners

- Spray Cleaners

Liquid cleaners lead with a share of 50% of the total Mexico eco friendly cleaning solutions market in 2025.

Liquid cleaner formulations capture the largest market share through versatility across diverse cleaning applications and consumer familiarity with traditional liquid product formats. These formulations offer advantages in dilution flexibility, enabling cost-effective usage through concentration adjustments based on cleaning intensity requirements. Liquid formats integrate seamlessly with existing spray bottles and application tools common in Mexican households and commercial establishments. User preference reflects established usage patterns and perceived effectiveness compared to alternative formats. Manufacturers leverage liquid format dominance through innovation in concentrated formulations and sustainable packaging while maintaining cleaning performance standards.

Liquid cleaner formulations dominate market preferences through versatile application methods enabling dilution customization for different cleaning intensities, surface types, and specific household tasks ranging from gentle wood floor maintenance to heavy-duty kitchen grease removal. User familiarity with liquid formats reduces adoption barriers when transitioning from conventional to eco-friendly alternatives, while innovations including concentrated liquid formulas and water-soluble sheet technologies address packaging waste concerns without sacrificing the convenience and performance characteristics associated with traditional liquid cleaning products.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents high-potential markets driven by elevated per-capita income levels and proximity to United States border fostering cross-border environmental influence. Major metropolitan areas including Monterrey demonstrate GDP per capita reaching approximately thirty-two thousand dollars, significantly exceeding national averages and supporting premium eco-friendly product adoption among affluent consumers. Nuevo León state captures seventy-two percent of nearshoring investment driving economic growth and attracting skilled workforce with higher disposable incomes.

Central Mexico including Mexico City metropolitan area, State of Mexico, Guadalajara, and Puebla dominates market concentration accounting for largest consumer population and highest eco-friendly product penetration. Mexico City produces approximately sixteen percent of national GDP with per-capita purchasing power significantly above national averages, creating attractive markets for premium natural cleaning solutions. The region benefits from extensive retail infrastructure including major supermarket chains, specialty organic stores, and robust e-commerce platforms supporting product accessibility.

Southern Mexico comprising Chiapas, Guerrero, and Oaxaca presents emerging opportunities constrained by lower income levels and higher poverty rates averaging sixty-six percent compared to national average of thirty percent. The region demonstrates significant disparities with indigenous populations experiencing restricted access to modern retail channels. Economic development historically lagged due to challenging mountainous topography isolating communities and limited foreign direct investment accounting for only two-point-five percent of cumulative national totals.

Others including coastal resort destinations Quintana Roo and Baja California Sur demonstrate specialized characteristics driven by tourism industry requirements and expatriate communities. These regions benefit from hospitality sector demand for eco-friendly cleaning products supporting green hotel certifications while serving affluent international visitors preferring sustainable amenities.

Market Dynamics:

Growth Drivers:

Why is the Mexico Eco Friendly Cleaning Solutions Market Growing?

Heightened Environmental Awareness Among Mexicans

Mexicans demonstrate increasing environmental consciousness shaped by educational initiatives, media coverage of pollution impacts, and growing recognition of individual responsibility in environmental protection. Urban populations particularly embrace sustainable consumption patterns that reduce ecological footprints through daily purchasing decisions. Social media platforms amplify awareness of environmental issues while facilitating community discussions about sustainable alternatives. The Ministry of Environment and Natural Resources of Mexico issued in the Federal Official Gazette the Sectoral Program for Environment and Natural Resources 2025-2030. This program shows the environmental policy significances and strategic lines that will handle federal actions over the next five years.

Regulatory Framework Supporting Sustainable Manufacturing

Mexico's regulatory environment increasingly incentivizes sustainable manufacturing through policies promoting biodegradable formulations and reduced environmental impact. The National Clean Production Agreement provides framework for sustainable manufacturing practices across industries including cleaning product sector. State and municipal regulations addressing plastic waste and environmental protection create market conditions favoring eco-friendly alternatives. Compliance requirements drive innovation in sustainable product development while establishing competitive advantages for environmentally responsible manufacturers. As per IMARC Group’s predictions, Mexico waste plastic recycling market is projected to attain USD 1,088.5 Million by 2033.

E-Commerce Platform Expansion Facilitating Market Access

Rapid e-commerce growth provides eco-friendly cleaning product manufacturers with expanded distribution channels reaching consumers across Mexico's diverse geographic regions. According to OECD, 33.2% Mexicans made online purchases and data from Mexico’s National Survey on Availability and Use of Information Technologies in Households (ENDUTIH) mentioned that 35.8% of internet users made online purchases in the country. Online platforms enable specialized sustainable brands to reach environmentally conscious consumers without requiring extensive traditional retail presence. Digital marketing facilitates consumer education about product benefits, ingredient transparency, and environmental credentials.

Market Restraints:

What Challenges the Mexico Eco Friendly Cleaning Solutions Market is Facing?

Premium Pricing Limiting Mass Market Adoption

Eco-friendly cleaning products typically command premium pricing compared to conventional alternatives, creating accessibility barriers for price-sensitive Mexican consumers particularly in lower-income segments. Higher production costs associated with sustainable ingredients and specialized manufacturing processes limit manufacturer ability to achieve price competitiveness with established conventional brands. User willingness to pay premium prices varies significantly across socioeconomic segments, restricting market penetration beyond affluent urban households and environmentally committed consumers.

Limited Consumer Awareness in Semi-Urban and Rural Areas

Environmental consciousness concentrates in urban centers while semi-urban and rural populations maintain limited awareness of eco-friendly alternatives and their benefits. Geographic disparities in environmental education access create uneven market development across Mexican regions. Traditional cleaning practices persist in areas lacking exposure to sustainable product messaging. Limited retail presence of eco-friendly brands in smaller communities reduces product visibility and trial opportunities for potential users beyond major metropolitan markets.

Performance Perception Concerns Among Conservative Consumers

Some users harbor skepticism regarding eco-friendly product cleaning effectiveness compared to established conventional brands, particularly for heavy-duty cleaning applications. Traditional cleaning product associations with strong chemical formulations create perception barriers that plant-based alternatives must overcome through consumer education and demonstration. Product performance concerns particularly affect commercial and industrial segments requiring verified cleaning efficacy. Conservative user segments resist switching from familiar conventional products without compelling evidence of comparable performance.

Competitive Landscape:

The Mexico eco-friendly cleaning solutions market exhibits moderate competitive intensity characterized by established multinational consumer goods corporations competing alongside emerging sustainable brands and regional manufacturers. Market participants pursue differentiated strategies emphasizing product innovation, ingredient transparency, and environmental credentials to capture environmentally conscious consumer segments. Distribution channel partnerships with major retail chains provide market access while direct-to-consumer online channels enable specialized sustainable brands to reach target audiences without extensive traditional retail presence. Product portfolio diversification across multiple cleaning applications and format innovations addresses diverse consumer preferences and usage occasions. Sustainability certification and third-party environmental endorsements serve as competitive differentiation tools influencing purchasing decisions among informed consumers. Regional manufacturers leverage local market knowledge and flexible production capabilities to address specific Mexican consumer preferences.

Mexico Eco Friendly Cleaning Solutions Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Biodegradable Cleaning Agents, Plant-Based Cleaners, Organic Cleaning Solutions, Natural Disinfectants, Eco-Friendly Cleaning Tools |

| Applications Covered | Household Cleaning, Commercial and Industrial Cleaning, Healthcare Facilities |

| Distribution Channels Covered | Online, Offline |

| Forms Covered | Liquid Cleaners, Powder Cleaners, Spray Cleaners |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico eco friendly cleaning solutions market size was valued at USD 565.5 Million in 2025.

The Mexico eco friendly cleaning solutions market is expected to grow at a compound annual growth rate of 12.58% from 2026-2034 to reach USD 1,642.27 Million by 2034.

The biodegradable cleaning agents segment commanded the largest market share through consumer preference for formulations that decompose naturally without environmental persistence, driven by water resource protection awareness and regulatory incentives supporting sustainable product adoption across Mexican municipalities and urban centers.

Key factors driving the Mexico eco friendly cleaning solutions market include heightened environmental awareness among Mexican consumers shaped by educational initiatives and media coverage, regulatory framework supporting sustainable manufacturing and National Clean Production Agreement incentives, and e-commerce platform expansion facilitating market access across diverse geographic regions while enabling specialized sustainable brands to reach environmentally conscious consumers through digital channels

Major challenges include premium pricing that limits mass market adoption particularly among price-sensitive consumer segments in lower-income brackets, limited user awareness in semi-urban and rural areas where environmental education access remains restricted and traditional cleaning practices persist, and performance perception concerns among conservative consumers who harbor skepticism regarding eco-friendly product cleaning effectiveness compared to conventional chemical formulations for heavy-duty applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)