Mexico Ecommerce Warehousing Market Size, Share, Trends and Forecast by Product, Business Type, Component, and Region, 2025-2033

Mexico Ecommerce Warehousing Market Overview:

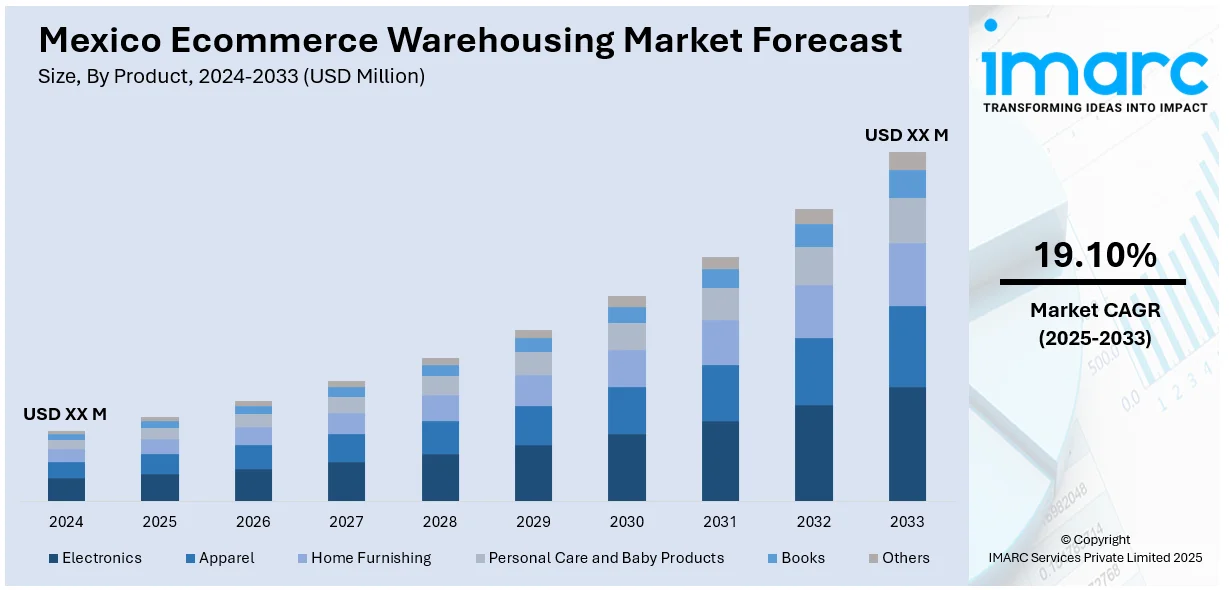

The Mexico ecommerce warehousing market size is projected to exhibit a growth rate (CAGR) of 19.10% during 2025-2033. The market growth is driven by its strategic location near the U.S., making it ideal for nearshoring and cross-border trade. Rising online shopping demand pushes the need for faster fulfillment, encouraging automation and smart warehouse technologies. Companies seek greater supply chain resilience, leading to investment in flexible, decentralized warehousing models. Sustainability pressures also drive greener facility designs. Together, these factors are reshaping warehousing as a critical backbone of Mexico’s expanding e-commerce and logistics landscape, boosting Mexico Ecommerce Warehousing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 19.10% |

Mexico Ecommerce Warehousing Market Trends:

Nearshoring and Cross-Border Infrastructure Expansion

Mexico’s proximity to the U.S. has positioned it as a strategic hub for nearshoring, attracting global companies seeking to relocate manufacturing and logistics closer to North America. This shift aims to shorten delivery times and avoid the disruptions associated with long-haul global supply chains. As a result, demand for modern warehousing near border cities like Tijuana and Ciudad Juárez is surging. The influence of nearshoring is demonstrated by the fact that by November 2024, the eight major manufacturing and logistics centers in northern Mexico accounted for 40% of all industrial warehouse rental activity nationwide. Investments in cross-border infrastructure, such as rail and trucking enhancements, are facilitating smoother trade flows and faster movement of goods. These developments support a more resilient and responsive regional supply chain. Mexico’s growing role as a logistics partner continues to attract investment in strategically located, technologically advanced warehousing that meets the needs of today’s fast-moving e-commerce and industrial sectors.

Automation and Smart Warehousing Adoption

Mexico Ecommerce Warehousing market growth is driving a major revolution in the country’s warehousing sector as companies rapidly adopt automation to keep pace with the fast-expanding e-commerce market. The focus is shifting from old-fashioned manual systems to more effective, technology-driven systems. Smart warehousing involves automated storage systems, data-tracking sensors, and robots that facilitate faster, more accurate processing of orders. These technologies reduce errors, speed up shipping, and maximize space and labor usage. Logistics providers are integrating digital platforms to track inventory in real time, offering greater visibility and responsiveness throughout the supply chain. This transition to smarter operations not only responds to growing consumer demands for speed and accuracy but also positions Mexican warehousing as a modern, responsive solution for global retailers seeking reliability and efficiency in their logistics operations.

Sustainability and Resilient Logistics Networks

Sustainability has become a central focus in the development of warehousing across Mexico. Companies are designing warehouses that use renewable energy sources and environmentally friendly materials to reduce their impact on the planet. This includes using natural lighting, improved insulation, and alternative energy solutions to cut down on emissions. At the same time, building a resilient logistics network is a priority. Businesses are creating flexible warehouse systems and micro-distribution hubs that can adapt quickly to disruptions such as supply chain delays or shifts in consumer demand. These efforts improve reliability while aligning with global environmental goals. In urban areas, smaller fulfillment centers are being used to reduce transportation time and environmental strain, especially during last-mile delivery. Together, these strategies reflect a commitment to future-proofing warehousing infrastructure through sustainability and resilience.

Mexico Ecommerce Warehousing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, business type, and component.

Product Insights:

- Electronics

- Apparel

- Home Furnishing

- Personal Care and Baby Products

- Books

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes electronics, apparel, home furnishing, personal care and baby products, books, and others.

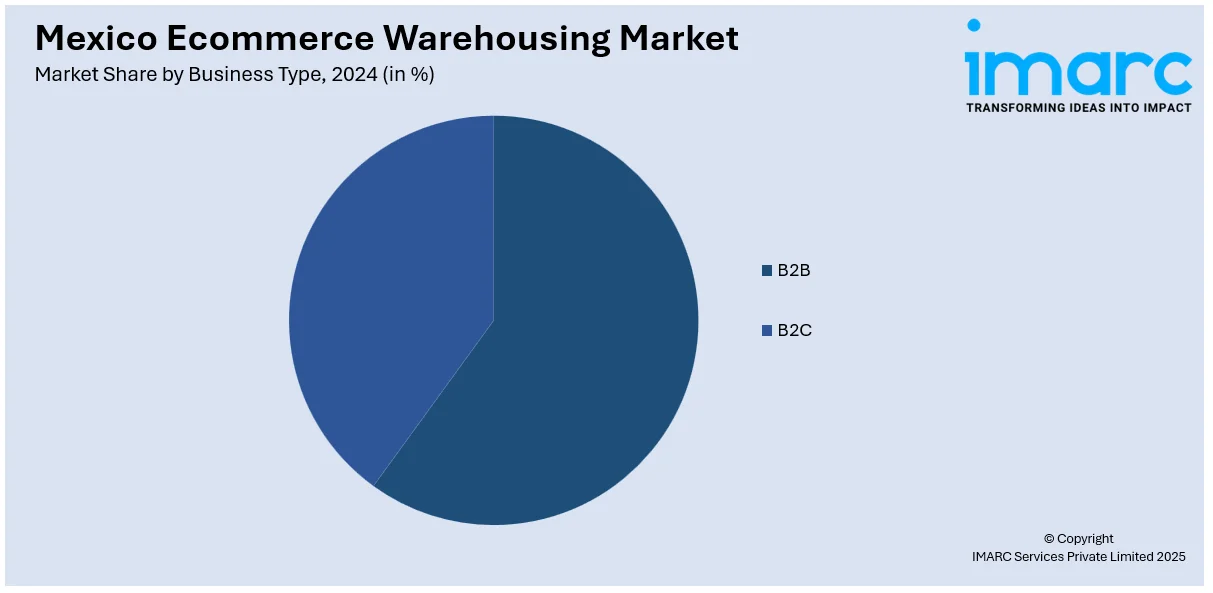

Business Type Insights:

- B2B

- B2C

The report has provided a detailed breakup and analysis of the market based on the business type. This includes B2B and B2C.

Component Insights:

- Hardware Equipment

- Software

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware equipment and software.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Ecommerce Warehousing Market News:

- In February 2025, Alibaba Cloud launched its first cloud region in Mexico, enhancing digital transformation and innovation across Latin America. The new region offers secure, scalable services tailored to key sectors like e-commerce, logistics, fintech, and telecom. Backed by global infrastructure, it supports local startups and businesses with low-latency, resilient cloud solutions. This move strengthens Mexico’s role as a regional tech hub and reflects Alibaba Cloud’s commitment to fostering sustainable digital growth.

- In June 2024, COSCO SHIPPING upgraded its cross-border logistics with new e-commerce warehousing in Savannah and US-Mexico transportation services. The 75,000-square-foot warehouse supports real-time order sharing for e-commerce clients, while a fleet of 53-foot Dry Vans in Laredo, TX enhances cross-border efficiency and cargo security. These initiatives reflect COSCO’s push to deliver integrated, digital supply chain solutions across North America, strengthening US-Mexico logistics capabilities.

Mexico Ecommerce Warehousing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Electronics, Apparel, Home Furnishing, Personal Care and Baby, Products, Books, Others |

| Business Types Covered | B2B, B2C |

| Components Covered | Hardware Equipment, Software |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico ecommerce warehousing market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico ecommerce warehousing market on the basis of product?

- What is the breakup of the Mexico ecommerce warehousing market on the basis of business type?

- What is the breakup of the Mexico ecommerce warehousing market on the basis of component?

- What is the breakup of the Mexico ecommerce warehousing market on the basis of region?

- What are the various stages in the value chain of the Mexico ecommerce warehousing market?

- What are the key driving factors and challenges in the Mexico ecommerce warehousing market?

- What is the structure of the Mexico ecommerce warehousing market and who are the key players?

- What is the degree of competition in the Mexico ecommerce warehousing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico ecommerce warehousing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico ecommerce warehousing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico ecommerce warehousing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)