Mexico Education Computing Devices Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2025-2033

Mexico Education Computing Devices Market Overview:

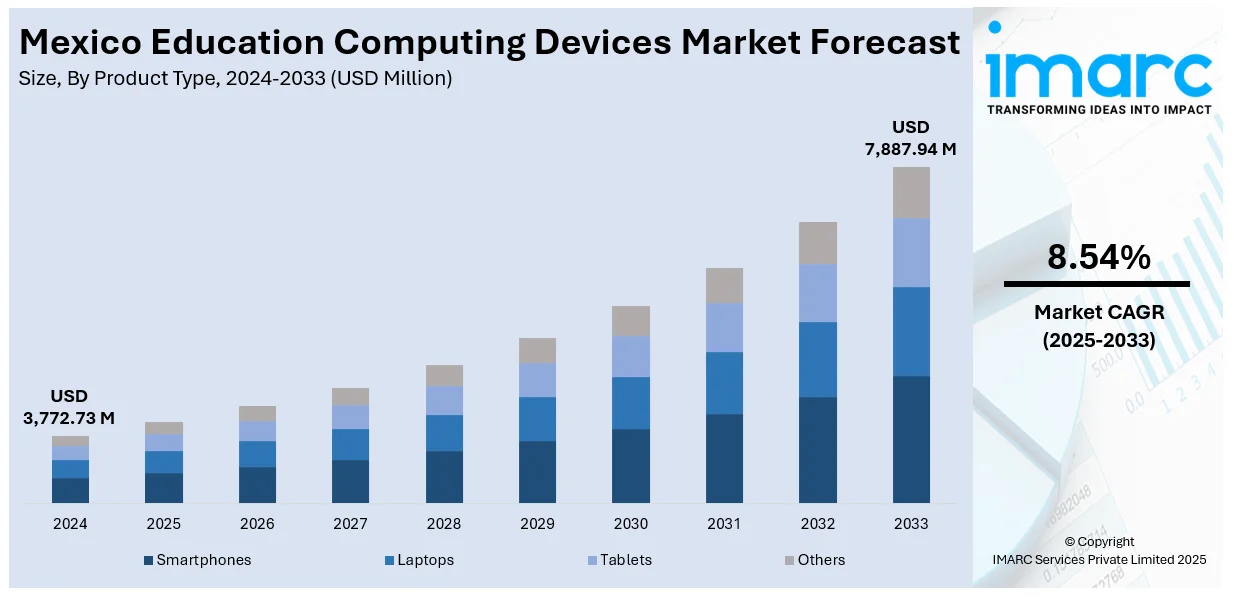

The Mexico education computing devices market size reached USD 3,772.73 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 7,887.94 Million by 2033, exhibiting a growth rate (CAGR) of 8.54% during 2025-2033. The market is witnessing steady growth driven by digital learning initiatives, rising student enrollment, and increasing government focus on edtech integration. Demand for laptops, tablets, and hybrid devices in schools and universities continues to rise as institutions modernize classrooms and enhance remote learning capabilities, thereby strengthening the overall Mexico education computing devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,772.73 Million |

| Market Forecast in 2033 | USD 7,887.94 Million |

| Market Growth Rate 2025-2033 | 8.54% |

Mexico Education Computing Devices Market Trends:

Increasing Student Enrollment and Urbanization

Rising enrollment rates across primary, secondary, and higher education levels are driving the need for scalable digital infrastructure in Mexico. Urbanization is also concentrating students in cities where schools are more likely to adopt digital technologies. As educational institutions look to accommodate growing class sizes and diverse learning needs, computing devices such as Chromebooks and tablets become essential tools. The adoption of learning management systems (LMS) and virtual classrooms further accelerates this trend. With the student population growing annually, demand for accessible, durable, and affordable computing devices continues to rise, supporting sustained market growth in both public and private education sectors.

Growth of E-learning and Hybrid Education Models

Post-pandemic education strategies in Mexico increasingly rely on hybrid and remote learning models. These formats require reliable access to education computing devices, both in classrooms and at home. E-learning platforms, virtual tutoring, and digital assessments have become mainstream, driving schools to provide students with suitable devices. The flexibility of online education is especially appealing in rural and underserved areas where traditional schooling options may be limited. Moreover, educational content providers and tech companies are collaborating to bundle hardware with software, making devices more useful and cost-effective. This shift toward digital-first learning significantly boosts demand across all levels of the education system.

Private Sector and NGO Involvement in EdTech Expansion

Private companies and non-governmental organizations (NGOs) are playing an increasingly significant role in Mexico’s educational technology landscape, which is driving the Mexico education computing devices market growth. These entities are offering device donations, low-cost leasing programs, and edtech solutions to bridge gaps in public education. Major tech firms are also partnering with educational institutions to introduce devices customized for learning, often with local-language support and tailored content. NGOs focused on child education and digital literacy are helping deploy computing devices in rural and low-income communities, complementing governmental efforts. This collective involvement enhances market penetration, promotes digital inclusion, and encourages innovation in device features tailored specifically for educational use in Mexico. For instance, in December 2023, the SpinQ Gemini Mini Pro, one of SpinQ's two educational-grade quantum computers, traveled across 14 time zones to reach the National Autonomous University of Mexico (UNAM) in Latin America. In addition to making UNAM the first Latin American institution to acquire quantum computing equipment, this successful delivery signifies SpinQ's entry into the worldwide market and contributes to the growth and acceptance of quantum computing education in the region.

Mexico Education Computing Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and end user.

Product Type Insights:

- Smartphones

- Laptops

- Tablets

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes smartphones, laptops, tablets, and others.

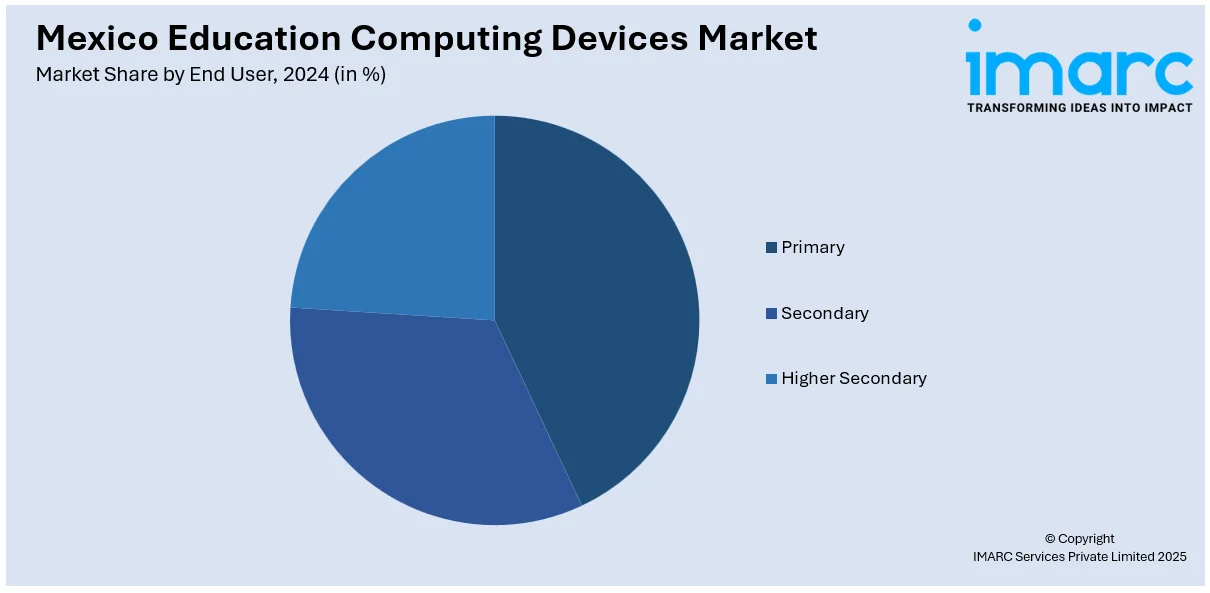

End User Insights:

- Primary

- Secondary

- Higher Secondary

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes primary, secondary, and higher secondary.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Education Computing Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Smartphones, Laptops, Tablets, Others |

| End Users Covered | Primary, Secondary, Higher Secondary |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico education computing devices market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico education computing devices market on the basis of product type?

- What is the breakup of the Mexico education computing devices market on the basis of end user?

- What is the breakup of the Mexico education computing devices market on the basis of region?

- What are the various stages in the value chain of the Mexico education computing devices market?

- What are the key driving factors and challenges in the Mexico education computing devices market?

- What is the structure of the Mexico education computing devices market and who are the key players?

- What is the degree of competition in the Mexico education computing devices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico education computing devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico education computing devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico education computing devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)