Mexico Elderly Care Products Market Size, Share, Trends and Forecast by Product, Usage, End User, and Region, 2025-2033

Mexico Elderly Care Products Market Overview:

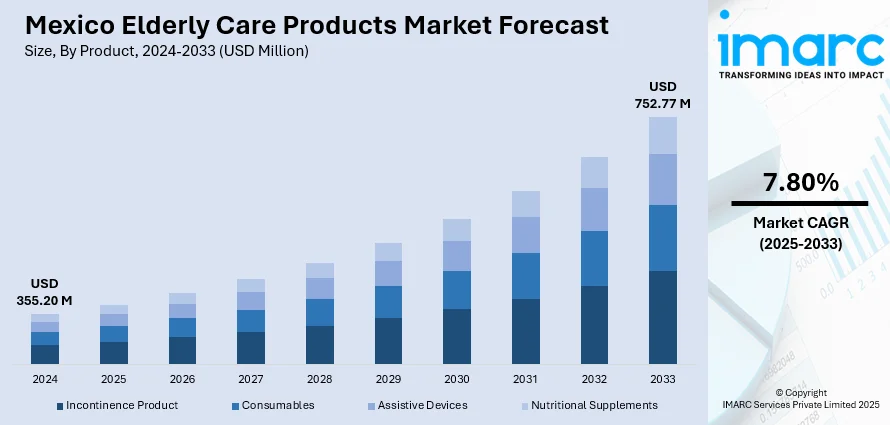

The Mexico elderly care products market size reached USD 355.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 752.77 Million by 2033, exhibiting a growth rate (CAGR) of 7.80% during 2025-2033. The market is experiencing robust expansion based on growing geriatric population, home care preference, and expanding use of assistive and intelligent health technologies. Demand is accelerating for comfort-focused daily aids, remote monitoring devices, and in-home medical devices. The trend indicates social movements toward independent, dignified aging and enhancing the quality of life among senior citizens. Sustained innovation and accessibility are also driving growth in Mexico elderly care products market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 355.20 Million |

| Market Forecast in 2033 | USD 752.77 Million |

| Market Growth Rate 2025-2033 | 7.80% |

Mexico Elderly Care Products Market Trends:

Growing Demand for Home-Based Assistive Devices

In Mexico, more and more geriatric patients would rather stay in their own homes than move into institutions, leading to an unprecedented increase in the demand for assistive devices in the home. Adjustable beds, grab bars, anti-slip floors, mobility devices, and equipment for personal hygiene are fast becoming an integral feature of homes with elderly occupants. It is fueled by both utilitarian requirements and cultural norms that focus on family-based care. Families are aggressively investing in technology that allows their aging relatives to stay at home without constant supervision. Further contributing to the movement are the government's continued enhancements in healthcare access and public health literacy. Manufacturers are also meeting this movement halfway through ergonomically shaped, convenient products specific to home settings. Mexico elderly care products market growth is being spurred in part by this general movement toward supportive living at home, the result of a greater societal dedication to aging independently and with dignity.

Integration of Smart Health Monitoring Technologies

The use of intelligent health monitoring technologies by elderly populations in Mexico is developing very quickly. Wearable monitors for tracking vital signs, automated medication dispensers, and AI-based emergency alert systems have become indispensable tools for elderly care. These technologies offer vital information that facilitates early medical intervention, improves compliance with treatment, and encourages peace of mind for caregivers and family members. As the digital health ecosystem of the country grows, aged people are now more integrating these tools into daily practices. However, government aid for digital literacy and telemedicine has also contributed toward greater accessibility. Apart from this, these innovations are also reducing avoidable hospital visits by allowing remote monitoring and instant intervention for health irregularities. Mexico elderly care products growth is directly supported by this technological change, where more households and providers embrace intelligent solutions that provide real-time assistance and enhance the overall quality of life for aged individuals. For instance, in September 2023, IMMUSE™ was launched by Kyowa Hakko USA in Mexico, bringing improved immune support for the elderly and fueling the expansion of the Mexico market for elderly care products with effective, science-based supplements.

Increase in Demand for Comfort-Focused Daily Living Aids

Comfort-oriented daily living aids are becoming increasingly popular in Mexico's geriatric care environment, a reflection of societal priorities on quality of life and physical health. Products including orthopedic chairs, ergonomic utensils, soft-grip walking sticks, and memory foam pillows are specifically developed to minimize stress and maximize ease in daily activities. These aids work particularly well for those coping with conditions like arthritis, mobility limitations, or chronic exhaustion. Their increasing adoption reflects a movement away from strictly utilitarian to comfort-promoting solutions in geriatric care. Older people are increasingly looking for products that provide support and convenience, fostering increased independence and emotional well-being. Families are more involved in finding and buying such products for their older family members as well. Mexico elderly care products growth is being supported by this trend, as the market responds to address changing consumer demands that value not only safety and function, but comfort and dignity of daily living as well.

Mexico Elderly Care Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, usage, and end user.

Product Insights:

- Incontinence Product

- Consumables

- Assistive Devices

- Nutritional Supplements

The report has provided a detailed breakup and analysis of the market based on the product. This includes Incontinence product, consumables, assistive devices, and nutritional supplements.

Usage Insights:

- Home Care

- Chronic Illness Care

A detailed breakup and analysis of the market based on the usage have also been provided in the report. This includes home care and chronic illness care.

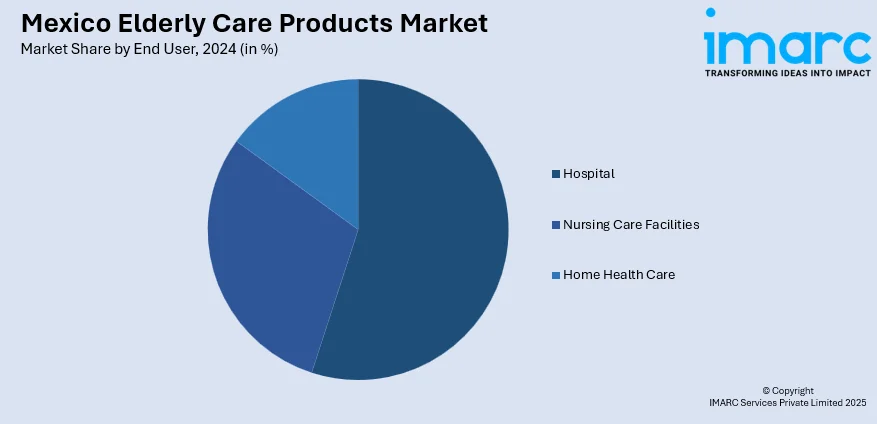

End User Insights:

- Hospital

- Nursing Care Facilities

- Home Health Care

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospital, nursing care facilities, and home health care.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Elderly Care Products Market News:

- In 2024, President Claudia Sheinbaum introduced the Women's Wellbeing Pension, offering financial assistance to women aged 60 to 64, and the House to House Health program, delivering medical care directly to the elderly and disabled.

Mexico Elderly Care Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Incontinence Product, Consumables, Assistive devices, Nutritional Supplements |

| Usages Covered | Home Care, Chronic Illness Care |

| End Users Covered | Hospital, Nursing Care Facilities, Home Health Care |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico elderly care products market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico elderly care products market on the basis of product?

- What is the breakup of the Mexico elderly care products market on the basis of usage?

- What is the breakup of the Mexico elderly care products market on the basis of end user?

- What is the breakup of the Mexico elderly care products market on the basis of region?

- What are the various stages in the value chain of the Mexico elderly care products market?

- What are the key driving factors and challenges in the Mexico elderly care products?

- What is the structure of the Mexico elderly care products market and who are the key players?

- What is the degree of competition in the Mexico elderly care products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico elderly care products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico elderly care products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico elderly care products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)