Mexico Electric Actuators Market Size, Share, Trends and Forecast by Type, End-User, and Region, 2025-2033

Mexico Electric Actuators Market Overview:

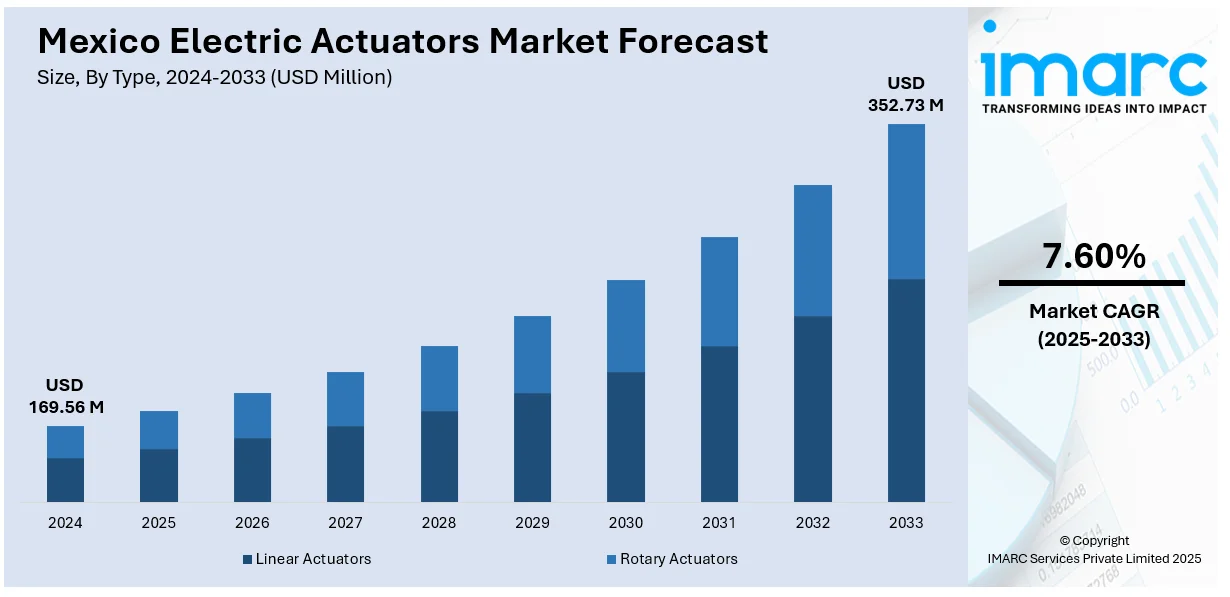

The Mexico electric actuators market size reached USD 169.56 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 352.73 Million by 2033, exhibiting a growth rate (CAGR) of 7.60% during 2025-2033. Rising adoption of industrial automation, strong growth in automotive manufacturing, and expansion of the oil and gas sector are supporting the market growth. Moreover, increasing demand for water and wastewater treatment solutions, growing investments in renewable energy projects, and need for precise motion and process control are stimulating the market growth. Apart from this, the burgeoning use of electric vehicles (EVs), integration of heating, ventilation, and air conditioning (HVAC) systems, ongoing infrastructure development, implementation of energy efficiency initiatives, expansion of smart manufacturing facilities, and supportive government policies are providing a thrust to the Mexico electric actuators market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 169.56 Million |

| Market Forecast in 2033 | USD 352.73 Million |

| Market Growth Rate 2025-2033 | 7.60% |

Mexico Electric Actuators Market Trends:

Industrial Automation Adoption

The growing focus on industrial automation is one of the key factors fostering the Mexico electric actuators market growth. Manufacturers across sectors such as automotive, food processing, packaging, and electronics are increasingly shifting toward automated systems to reduce manual intervention, lower operating costs, and improve overall productivity. Electric actuators offer precise control, efficient motion, and lower maintenance compared to their pneumatic or hydraulic counterparts, making them a preferred choice for automation upgrades. With government policies supporting Industry 4.0 adoption and the private sector actively investing in smart technologies, companies are equipping their production lines with advanced components, including actuators. This shift is especially notable in Tier 2 and Tier 3 manufacturing hubs in central and northern Mexico, where automation is helping companies stay competitive in export-driven supply chains. The trend is expected to continue as global OEMs and local firms look for reliable, scalable solutions that support efficient, flexible, and safe operations.

Automotive Industry Growth

Mexico’s position as a key automotive manufacturing hub in North America significantly drives the electric actuators market. With major global players such as General Motors, Volkswagen, and Ford operating large-scale production facilities in the country, demand for automated assembly and material handling systems has risen steadily. Electric actuators are used extensively in robotic arms, welding stations, paint shops, and conveyor systems within automotive plants, helping ensure consistency, repeatability, and precision. Additionally, the growing shift toward electric vehicles (EVs) and hybrid models is creating new actuator applications within battery assembly, cooling systems, and vehicle component testing. In 2024, Tesla announced plans to expand its Gigafactory in Nuevo León, Mexico, to increase EV production capacity, which is expected to further boost demand for precision automation solutions like electric actuators. Local automotive suppliers and tier vendors are also investing in smart factory upgrades, increasing the use of programmable actuators for control and feedback.

Expansion of Oil and Gas Operations

Mexico's expansion in its oil and gas market, particularly in offshore drilling and downstream refineries, is a leading force behind electric actuators. For instance, in 2024, Pemex increased crude oil exports to Cuba to 20,100 barrels per day on average, up from 16,800 bpd in 2023. The move is in response to Cuba's energy needs amid recurring fuel shortages, bolstering bilateral relations and Pemex's role in regional energy cooperation. Actuators play a key role in valve regulation, flow control, and safety systems in oilfields, pipelines, and refining plants. While pneumatic and hydraulic systems are still dominant, electric actuators are now gaining popularity due to their energy efficiency, lower maintenance requirements, and simplicity of connection to remote monitoring systems. Further, overseas companies running energy exploration operations through redesigned contracts are also adopting automation-friendly alternatives, including electric actuators, in order to improve efficiency and comply with safety regulations.

Mexico Electric Actuators Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end-user.

Type Insights:

- Linear Actuators

- Rotary Actuators

The report has provided a detailed breakup and analysis of the market based on the type. This includes linear actuators and rotary actuators.

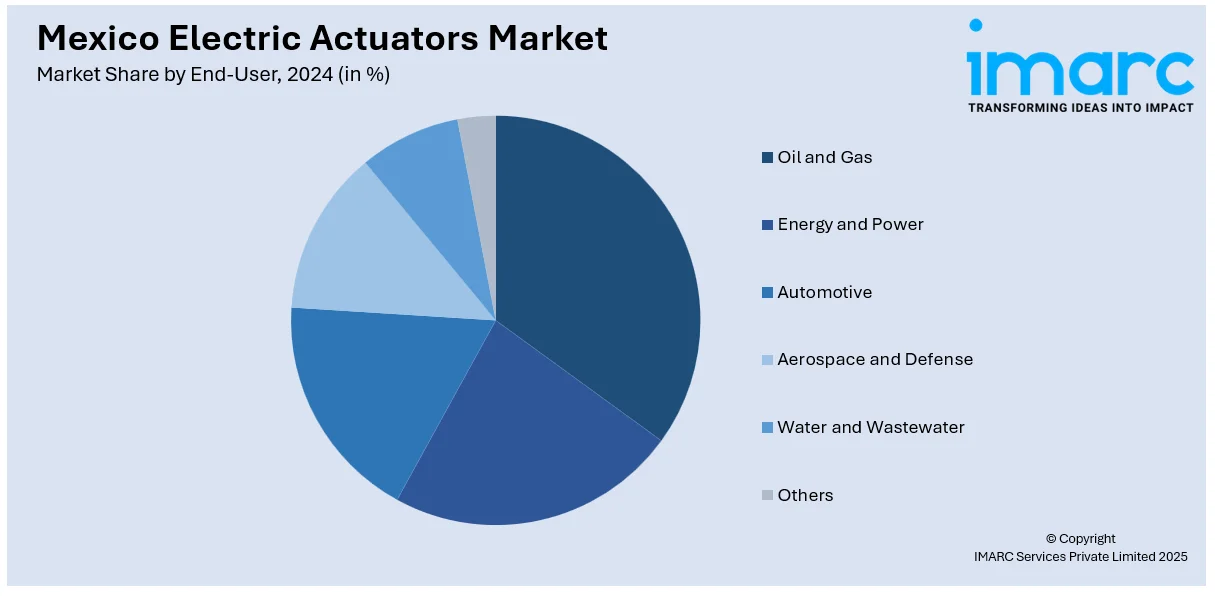

End-User Insights:

- Oil and Gas

- Energy and Power

- Automotive

- Aerospace and Defense

- Water and Wastewater

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes oil and gas, energy and power, automotive, aerospace and defense, water and wastewater, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Electric Actuators Market News:

- In 2024, Valeo committed to investing more than USD 500 million in Mexico, including the inauguration of the Valeo Mobility Tech Center in Querétaro. This center focuses on developing advanced technologies and aims to double Valeo's sales in Mexico from USD 3 billion in 2023 to USD 5.5 billion by 2030.

- In 2024, Magna International announced a USD 166 million investment in Coahuila, Mexico, to enhance its electric mobility capabilities. This investment underscores Magna's strategic vision for growth and its commitment to supporting the automotive industry's transition to electrification.

Mexico Electric Actuators Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Linear Actuators, Rotary Actuators |

| End-Users Covered | Oil and Gas, Energy and Power, Automotive, Aerospace and Defense, Water and Wastewater, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico electric actuators market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico electric actuators market on the basis of type?

- What is the breakup of the Mexico electric actuators market on the basis of end user?

- What is the breakup of the Mexico electric actuators market on the basis of region?

- What are the various stages in the value chain of the Mexico electric actuators market?

- What are the key driving factors and challenges in the Mexico electric actuators market?

- What is the structure of the Mexico electric actuators market and who are the key players?

- What is the degree of competition in the Mexico electric actuators market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico electric actuators market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico electric actuators market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico electric actuators industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)